What is a Buy To Let Secured Loan?

Buy-to-let secured loans (BTL mortgages) allow borrowers to obtain loans by using rental properties as security. These loans are specifically designed for landlords and property investors looking to expand their portfolios.

Moreover, these loans are sometimes called “second-charge mortgages” because they sit behind your first mortgage in terms of priority. If you default on both loans and your home is sold, the first mortgage will be repaid first, followed by the secured loan.

Here are some defining features:

– Secured loans. Getting a loan secured against your property can offer lower interest rates but comes with the big responsibility of possibly losing your home if you can’t repay the loan.

– Investment purpose. These loans are primarily used to purchase properties for renting out, which can generate a steady stream of rental income.

– Loan-to-value (LTV) ratio. Lenders typically offer a lower LTV ratio for BTL mortgages than for residential mortgages. This means that investors need to make a larger initial deposit.

As an investor, it’s key to consider several factors that affect your borrowing capacity. These include the EQUITY in your property, current RENTAL INCOME and projections, and ANY other financial commitments you have.

With sufficient equity and manageable repayments, it is possible to obtain third or even fourth-charge mortgages on a buy-to-let property.

Can I Get A Secured Loan On A Buy To Let Property?

Yes, you can get a loan on your buy-to-let property. But remember, specific rules apply, and we will explain them in a bit.

Types of Buy to Let Secured Loan

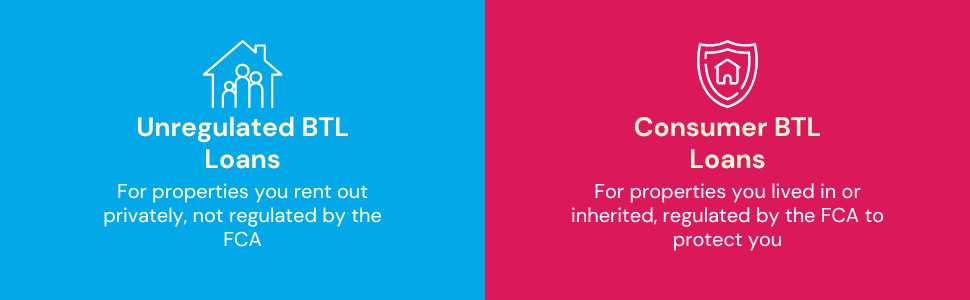

Buy-to-let secured loans fall into two categories:

Unregulated BTL loans – These are for properties you bought to rent out privately. The Financial Conduct Authority (FCA) does not regulate these loans.

Consumer BTL loans – These loans are for properties you lived in before or inherited. The FCA regulates these loans, offering you protection including coverage under the Financial Services Compensation Scheme (FSCS). This regulation helps protect you from misguidance, mis-selling, and other potential problems.

By understanding these differences, you can make an informed decision and choose the loan type that best suits your needs and circumstances.

Eligibility Criteria

To get this loan, your credit score isn’t the only thing that matters. While a higher score can help get better interest rates, lenders mainly look at whether YOU can afford the loan.

A key factor for lenders is the rental income your property generates. Typically, they look for a rental yield that’s at least 25% higher than your total loan repayments.

In numerical terms, if your loan and mortgage repayments amount to £800 monthly, lenders would like to see a rental income of at least £1,000 per month to consider you for the loan.

To qualify, you also need to:

- Have at least 20% equity of the property’s total value.

- Get permission from your mortgage lender, if any, since this loan affects their asset too.

- Be aware that some lenders have age limits, generally not working with individuals under 21 years.

The Pros and Cons of Buy to Let Secured Loans

Choosing a buy-to-let secured loan comes with its distinct set of advantages:

– Larger Borrowing Amount. You have the opportunity to borrow a more substantial sum, often with lower interest rates and flexible repayment periods.

– Protect Your Main Residence. These loans allow you to access funds without risking your primary home, as the loan is secured against your rental property.

– Credit Score Boost. By consolidating various unsecured debts, you can potentially improve your credit score.

– Increase Rental Income. You can use the loan to make improvements to your property, potentially increasing your rental yield.

– Tax Benefits. Utilizing the loan correctly can assist in reducing your property tax bill, by balancing increased rental gains with the interest payments on the loan.

– Flexible Eligibility Criteria. These loans often come with more flexible eligibility requirements, facilitating access for a broader range of borrowers.

However, it’s essential to be aware of the possible downsides of this loan type:

– Risk of Property Repossession. Since the loan is secured against your property, failing to keep up with repayments can lead to the property being repossessed.

– Potential for Higher Debts. While it’s tempting to borrow larger amounts due to the lower interest rates, this can potentially lead to higher levels of debt if not managed wisely.

– Complex Approval Process. Sometimes, the approval process for these loans can be more complex and time-consuming compared to unsecured loans.

– Potential Additional Costs. There might be additional costs and fees involved, including valuation fees, broker fees, or early repayment charges, which can add to the total cost of the loan.

Remember to thoroughly assess your financial situation and consult with a financial advisor if necessary before deciding to take out a buy-to-let secured loan. This will help ensure that this financial route is aligned with your investment strategy and financial goals.

How Much Can You Borrow with a Buy-to-Let Secured Loan?

The amount you can borrow through a rental property loan is determined by various factors, influenced by different lenders and your situation. Here are some of the factors that lenders consider:

- The balance between the rental income you generate and your property’s mortgage payments.

- Your additional sources of income.

- Your credit score.

- The existing equity in your rental property.

Lenders typically cap the loan amount at 75% of the property’s total value, but some lenders may offer up to 100% of the value, depending on your circumstances.

If you’re considering a buy-to-let secured loan, try to use the calculator below to get an idea of what your monthly repayments might be.

[Embedded Secured Loans Calculator]

While these figures provide an estimate, it’s wise to consult with a mortgage advisor who can help you grasp the full picture, inclusive of all potential fees and costs. This way, you can make an informed decision that aligns well with your financial goals and circumstances.

Interest Rates to Expect

When you decide to get a second-charge mortgage, it’s essential to know that the interest rates might be a bit higher than the ones for a first mortgage.

This is because, if you can’t pay back your loan, your new lender gets paid only after your first lender, putting them at a bit more risk.

As of recent times, you might see rates ranging from 6.5% to 12%, but keep in mind, that these can fluctuate due to the changing market conditions.

The exact rates that you might encounter depend on several aspects. A big factor is how much you want to borrow compared to the real value of your home, or the equity you have in it.

Here’s a tip: the LOWER your Loan-to-Value (LTV) ratio, the BETTER the rates you can GET. This makes you an attractive borrower for many lenders.

But, be cautious –having a bad credit history could bump up the rates on a second-charge mortgage since fewer lenders might be willing to think about giving you more loans.

Other Options to Think About

While securing a second-charge mortgage can be a great method to acquire extra funds, there might be other options that suit your needs better, based on your specific situation. Here are a few to consider:

Remortgage to Free Up Equity

Instead of securing another loan on your property, you might choose to remortgage. This way, you can free up more equity and manage just one bigger mortgage.

Remortgaging can have its perks, but be cautious. You might find that the new mortgage rates don’t match up to your current ones, or you might face charges for paying off your mortgage early, which can increase the overall cost.

This option tends to work best when you’re not in a fixed-rate period and can secure a deal as good as or better than your current one. A broker can help you figure out the best path.

Unsecured Loan

If you only need a small sum of money, an unsecured loan might be your best bet. This option is quicker to set up since it doesn’t require detailed checks or property evaluation.

You can generally borrow up to £25,000, or possibly even £50,000 if you go through your current bank.

Keep in mind that the rates on unsecured loans are usually higher than secured loans because you aren’t using any assets to guarantee your borrowing.

Bridging Loan

A bridging loan might be just what you need if you only need extra money for a short time, such as for a down payment on a new house while you’re waiting for your current property to sell.

These loans are faster to get than mortgages and offer more flexibility. However, they can also be quite costly, so discuss all potential expenses with your broker before choosing this option.

The Bottom Line

Getting a secured loan on a buy-to-let property is possible, and the RIGHT broker can help you smoothly navigate the process. Here’s how a broker can support you:

- Assess YOUR financial situation, including your credit score, outstanding debts, and rental income, to determine your eligibility.

- Simplify the application process, helping you with paperwork and ensuring you meet all requirements.

- Work with lenders to FAST-track a successful approval process, increasing your chances of getting a favourable loan.

- Serve as a RELIABLE intermediary between you and the lenders, facilitating clear and open communication.

- Help clarify the loan terms, negotiate better conditions, and ensure that all parties are informed and in agreement.

If you want to find the right broker without hassle, get in touch with us. We’ll connect you with a broker who will listen to your situation and create the best possible solution.