- What Exactly Are Home Improvement Loans?

- Secured Home Improvement Loans

- Unsecured Home Improvement Loans

- Can You Get a Home Improvement Loan with Bad Credit?

- What Can You Do with a Home Improvement Loan?

- Who Can Get a Home Improvement Loan?

- What Credit Score Do You Need for a Home Improvement Loan?

- How To Get a Home Improvement Loan with Bad Credit?

- Which Lenders Offer Bad Credit Home Improvement Loan?

- Factors to Consider When Comparing Home Improvement Loans

- Getting Help With Bad Credit

- How Can You Improve Your Credit Score in the UK?

- Alternatives To Home Improvement Loans

- Key Takeaways

- The Bottom Line

How To Get a Home Improvement Loan with Bad Credit

In the UK, making your home more comfortable and practical is a smart choice. Maybe you’ve thought about making your workspace better, updating your kitchen, or giving your bathroom a fresh, modern look.

It’s not just about how your home looks—it’s about creating a space that fits the way you live and what matters to you.

You might also think about making your home more energy-efficient. This can help the environment and even save you money in the long run.

So, how do you get started with these changes? Check out our guide on home improvement loans to see how you can make your home work better for you.

What Exactly Are Home Improvement Loans?

A home improvement loan is money you borrow to fix or upgrade your home. It’s like loans you might use to buy a car or pay off other debts, but this one is meant to improve where you live.

You get all the money at once and then pay it back in monthly chunks with extra fees called interest. There are two main types of home improvement loans: secured and unsecured.

Secured Home Improvement Loans

A secured loan means you use something valuable, like your house or car, as a backup for the lender. This way, if you can’t pay them back, they can take that item to recover their money.

Sometimes, this could mean losing your house if the loan is linked to your home’s value. It sounds a bit risky, but the upside is that lenders might let you borrow more or charge less interest because they feel safer with the deal.

Unsecured Home Improvement Loans

An unsecured home improvement loan doesn’t require you to offer your house or car as backup. If you can’t pay it back, the lender can’t take your things.

But be careful—missing payments can still get you into trouble. The lender might take you to court, send bailiffs, or even get a charging order, which could still risk your property.

Can You Get a Home Improvement Loan with Bad Credit?

Yes, you can still get a home improvement loan even if your credit score isn’t great. These are sometimes called “bad credit home improvement loans.”

But keep in mind, this isn’t guaranteed. Whether you can get a loan depends on your financial situation, whether you meet the lender’s criteria, and what’s available in the market.

Lenders may charge more interest and let you borrow less money if you have bad credit since they see it as a bigger risk.

It’s worth thinking carefully about the good and bad sides of this before applying. If you’re unsure, speaking to a financial advisor can help.

Tips for Getting a Loan with Bad Credit:

- Compare lenders to find the best deal.

- Be honest about your finances and don’t borrow more than you can repay.

- Use an asset, like your house, to secure the loan. This makes it less risky for the lender and might help you get approved.

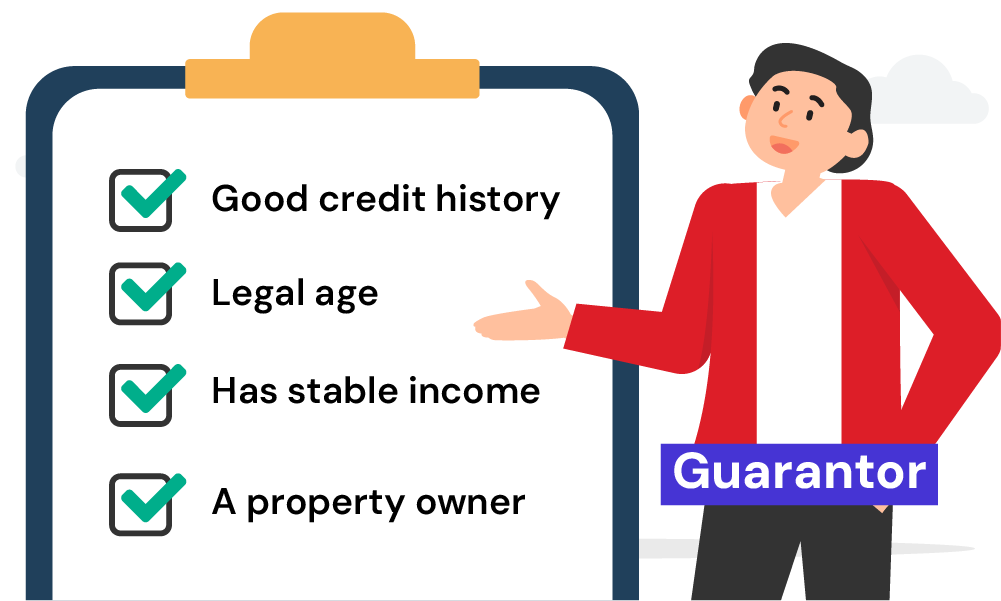

- Find a guarantor—someone who promises to pay if you can’t.

What Can You Do with a Home Improvement Loan?

You can use this type of loan to pay for lots of home projects, from small changes to big renovations. For example:

- Redecorating rooms

- Getting a new kitchen or bathroom

- Adding a conservatory or an extension

- Turning your loft into a living space

- Improving energy efficiency with insulation or double glazing

- Fixing your roof or other parts of the house

- Adding outdoor features like a patio or driveway

Home improvements can make your house more comfortable and even increase its value. This is useful if you plan to sell it later.

Who Can Get a Home Improvement Loan?

Different lenders have their own rules for who can apply for a home improvement loan. But they’ll usually check things like:

- Your age (you often need to be at least 18 or 21).

- Whether you own a home, with or without a mortgage.

- How much money you make and how much debt you already have.

- Your credit score, which shows how well you’ve managed money and debt before.

The lender will use all this information to decide if you can get the loan.

What Credit Score Do You Need for a Home Improvement Loan?

There isn’t one specific credit score that guarantees approval for a home improvement loan. Lenders look at other factors too. But having a score between 650 and 700 might give you a better chance.

If your score is lower, don’t lose hope. You might still get approved if you can offer something valuable, like your home, as security for the loan. This makes the lender feel safer about lending you money.

How To Get a Home Improvement Loan with Bad Credit?

Getting a home improvement loan when you have bad credit can be tricky, but it’s not impossible. Here are some tips to improve your chances:

- Look for loans made for people with bad credit, but check the APR (the cost of borrowing) carefully.

- Save up some money before applying so you don’t need to borrow as much.

- Try to improve your credit score. Simple steps like paying bills on time can help.

- Avoid applying for lots of loans at once. This can make your credit score worse.

Working with a good broker can make things much easier. They know how the market works and can help you find lenders offering the best deals for your situation.

A broker can save you time, stress, and even money. If you’re ready to start, send us an enquiry. We’ll connect you with a broker who can help you get the best deal for your needs.

Which Lenders Offer Bad Credit Home Improvement Loan?

Specialist lenders are more likely to offer bad credit home improvement loans than traditional banks and building societies. Here are a few examples, but availability may change:

- Ocean Finance

- Likely Loans

- Pegasus Personal Finance

- Norton Finance

- Upgrade

- One Main Financial

- Net Credit

- Avant

- Lending Point

Please note that these are just examples, and you should explore all available options before making a decision.

Factors to Consider When Comparing Home Improvement Loans

Before you compare loans, make sure that the lenders you’re considering are authorised and regulated by the Financial Conduct Authority (FCA). You should only borrow money from legal lenders.

One of the most important things to consider is the interest rate. This is the amount of money you’ll pay in interest on the loan.

Loans usually have a representative APR (annual percentage rate), which is the rate that at least 51% of borrowers get. This will give you an idea of how much interest you’ll pay, based on the amount you want to borrow.

Other factors to consider include:

- The loan term (how long you have to repay the loan)

- The repayment amount (how much you’ll have to repay each month)

- Any fees associated with the loan

Use a secured loans calculator to get an idea of what your monthly repayments might be.

These numbers are just estimates. It’s a good idea to speak to a loan advisor, so you know about all the fees and costs involved. This will help you choose a loan that fits your financial plans.

Getting Help With Bad Credit

If your bad credit is stopping you from getting loans, you can get free advice from a debt charity. They can help you figure out how to handle your money and improve your credit.

Here’s what they can do:

- Help you understand your debt and how to manage it.

- Create a budget to organise your money.

- Talk to creditors to find better repayment terms.

- Suggest solutions like consolidation loans or debt management plans.

If you’re finding it hard to manage debt, don’t wait. Debt charities can guide you, so you can get back on track and start improving your credit score.

How Can You Improve Your Credit Score in the UK?

Improving your credit score can make it easier to borrow money when you need it. Here are some simple steps you can take:

- Register to vote. Being on the electoral roll helps credit agencies confirm who you are and can give your score a small boost.

- Check your credit report for mistakes. Lots of people have errors on their credit reports that can lower their score. Look through your report regularly and fix anything that’s wrong.

- Wait for defaults to disappear. If you’ve missed payments in the past, these defaults will be removed from your record after six years. If you’re close to this time, it might be worth waiting before applying for a loan.

- Use less of your credit. Keep your credit card balance well below your limit. Lenders like to see that you’re not using all the credit available to you.

Alternatives To Home Improvement Loans

If a home improvement loan isn’t right for you, there are other ways to pay for your project. Here are some options:

Extend your current mortgage

You could ask your lender to increase your mortgage amount. This might come with a lower interest rate than other loans.

It can be helpful for big projects like adding solar panels or getting a new boiler. But keep in mind, lenders will still check your credit and affordability, and there may be extra fees.

Remortgage

Switching to a new lender and borrowing more than you currently owe is another option. It spreads the cost over a longer time, which might make monthly payments smaller.

But you’ll likely pay more interest overall, and there could be early repayment charges or application fees.

Use an overdraft or credit card

For smaller projects, using an overdraft or credit card could work. If you pay off the balance quickly, you can avoid high interest.

If you have bad credit, a credit builder card might be an option. These cards often have higher interest rates, but using them carefully can help improve your credit score.

Borrow from friends or family

If you can’t borrow from a bank, asking friends or family for help might be an option. It’s a way to avoid high-interest rates and skip credit checks.

Just make sure to agree on clear repayment terms and put them in writing to avoid misunderstandings.

Key Takeaways

- A home improvement loan is money you borrow to fix or upgrade your home. Some loans need you to offer something valuable, like your house, while others don’t.

- If your credit score isn’t great, you can still apply for a loan, but it depends on your money situation and what the lender allows.

- You can improve your credit score by doing things like signing up to vote or not using too much of your credit card limit.

- If a loan isn’t right for you, other options include asking your bank to add to your mortgage, switching lenders, using a credit card, or borrowing from family or friends.

- Always check the interest rates and fees before picking a loan, and asking a loan expert for help can make things easier.

The Bottom Line

Home improvement loans can be a helpful way to fund changes to your home, whether you’re tackling big projects or small upgrades. Even if your credit isn’t great, there are options to suit different circumstances.

A loan broker can make the process easier by finding the best match for your needs.

Ready to get started? Reach out to us, and we’ll connect you with a trusted broker who can help you make the right choice.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What is a guarantor home improvement loan?

If you don’t have any assets or home equity, you may want to consider a guarantor loan. This is a type of loan where someone else, such as a family member who owns their home, agrees to repay the loan if you can’t. This can make it easier to get a loan if you have bad credit or a low income.

Can I get multiple home improvement loans?

Yes, you can get multiple home improvement loans, but it may be difficult if you already have a bad credit home improvement loan. Lenders will assess your ability to manage additional debt responsibly, based on your existing financial obligations.

When you apply for another loan, it is important to disclose all of your current loans and debts. Lenders will check your credit history during the application process.