- How Do Debt Consolidation Mortgages Work?

- Mortgage Types for Debt Consolidation

- What Should You Look For In a Provider?

- Top UK Lenders For Debt Consolidation Mortgages

- Getting Started with the Right Lender

- What Are the Benefits of Debt Consolidation Mortgages?

- What Are the Risks of Remortgaging to Consolidate?

- Can First-Time Buyers Consolidate Debt into Their Mortgage?

- When Might a Mortgage Lender Repossess a Home?

- Are You Considering a Debt Consolidation Mortgage?Â

- Key Takeaways

- The Bottom Line

Top UK Debt Consolidation Mortgage Providers: A Full Review

Are you a homeowner struggling under multiple debts and considering consolidation? While rolling everything into one mortgage can help, choosing the right debt consolidation mortgage provider is key.

This guide examines some of the top lenders and products available for streamlining your finances through remortgaging.

How Do Debt Consolidation Mortgages Work?

Before exploring providers, let’s recap how these mortgages work:

- You remortgage and switch lenders, often borrowing more than your current mortgage balance.

- The new lender assesses your property’s value and available equity.

- Based on your situation, they calculate how much extra you can borrow—typically 85-90% of the home’s value.

- This lump sum is then used to repay your existing credit card, loan and other debts.

- You are left with one manageable monthly repayment on your mortgage over an agreed term.

Consolidating through your mortgage combines all debts into one place, making monthly budgeting easier.

Mortgage Types for Debt Consolidation

If you decide to consolidate, what mortgage types should you consider? Here are some of the main options:

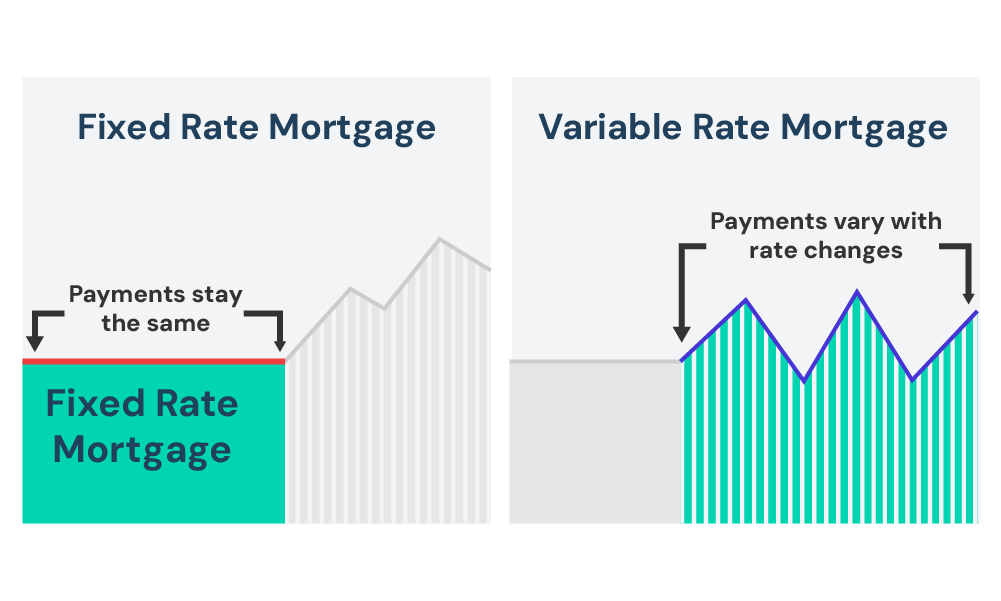

- Tracker rate. Interest moves with the Bank of England base rate. Carries the risk of increasing costs but offers potential savings.

- Offset. Your savings with the lender offset interest calculations on your debt. Can help pay the mortgage down faster.

- Fixed-rate Your interest is fixed for 1-5 years typically. Offers payment certainty but limits flexibility.

- Variable rate. Interest can fluctuate but there are usually no early repayment charges. Gives flexibility.

Consider which suits your plans. Seek advice on the right product for your needs.

What Should You Look For In a Provider?

With so many mortgage lenders in the UK, we know how hard it is to pick the best one for your debt consolidation needs. So how do you do it? Here are some practical tips to consider:

- Look for Lenders with a Wide Range of Mortgage Choices. Some lenders offer different types of mortgages, like fixed-rate, tracker, variable, or offset mortgages. The more options available, the better your chances of finding one that matches your financial needs.

- Go with Lenders Who Know Debt Consolidation. It’s helpful to choose a lender that specialises in debt consolidation. They understand the challenges of managing multiple debts and can offer advice and products designed to make the process easier for you.

- Compare Interest Rates to Save Money. The main reason to consolidate debt is to save money. Look for a lender with a lower interest rate than what you’re paying on your current debts. Compare rates from different lenders to find the most affordable one.

- Pay Attention to the Fees. Check the costs involved, like arrangement, valuation, and legal fees. Some lenders may include these in their mortgage deals, which can save you money. Also, check for early repayment fees, especially if you think you might pay off your loan faster than planned.

- Choose a Lender with Flexible Terms. Life can be unpredictable, so it’s good to pick a lender that offers flexibility. For example, they might let you adjust the length of the loan or extend it into retirement if needed. This makes it easier to keep your mortgage manageable over time.

- Check for Good Customer Service. Dealing with a mortgage can be stressful, so good customer service is a must. Look at reviews or ask others about their experiences with the lender. You’ll want a provider that explains things clearly and is easy to reach when you have questions.

Pro Tip: Keep Some Wiggle Room in Your Budget

When consolidating debts, make sure you leave some extra room in your budget for unexpected expenses. This way, you can manage your payments comfortably and avoid running into financial stress again.

Top UK Lenders For Debt Consolidation Mortgages

In the UK, if you’re looking to merge your debts into a mortgage, there are several places you can turn to. Here’s a list of some key players who might be able to help:

- Halifax

- Lloyds

- Barclays

- Santander

- HSBC

- Virgin Money

- TSB

- Metrobank

- Royal Bank of Scotland

- First Direct

- Coventry Building Society

- Kensington

- Atom Bank

- Nationwide

- Accord Mortgages

- Principality

- Post Office

- Co-Operative

Each of these institutions may offer debt consolidation mortgages, but the specifics of their products, such as interest rates, terms, and eligibility criteria, can vary.

Before making a decision, it’s advisable to compare offers from multiple providers and, if possible, consult with a mortgage advisor to find the best solution for your financial situation.

Remember, the suitability of a debt consolidation mortgage depends on circumstances, including your current debts, financial stability, and long-term financial goals.

Getting Started with the Right Lender

If you decide to apply for a debt consolidation mortgage, make sure you:

- Speak to a qualified independent mortgage broker who can access the whole market

- Get proposals from multiple lenders to compare rates and products

- Check for any early repayment charges to exit your current mortgage

- Understand all fees including arrangement, valuation and legal

- Evaluate fixed, tracker and offset products to suit your future budget

The right debt consolidation mortgage provider for you will offer the most competitive rates whilst also giving expert support. Taking time to explore your options is key to making the smartest decision.

What Are the Benefits of Debt Consolidation Mortgages?

When used strategically, consolidating debts through your mortgage can offer homeowners several benefits:

- Lower interest rate. Mortgages often have lower rates than things like credit cards and personal loans, so your interest costs are reduced.

- One single payment. Consolidating multiple debts into your mortgage simplifies budgeting and monthly outgoings.

- Pay off debts faster. Some borrowers take a longer mortgage term so they have lower payments, allowing them to overpay and clear debts sooner.

- Access equity. Remortgaging allows homeowners to unlock some of the equity tied up in their property.

- Improve credit score. Managing one monthly payment can help improve your credit rating over time.

What Are the Risks of Remortgaging to Consolidate?

While they offer advantages, debt consolidation mortgages also carry risks that must be considered:

- Debt remains secured. If you default, your home is at risk.

- Higher lifetime costs. You’ll likely repay more interest over the longer term of a new mortgage.

- Early repayment charges. Existing lenders may charge you fees to exit your current mortgage.

- Missed payment penalties. Some mortgages impose higher penalties than other debts.

- Credit score impact. Applying for a new mortgage can damage your rating short term.

- Reduced equity. Less equity remains in your home for future borrowing.

- Debt habits continue. Root overspending issues need addressing or debt can spiral again.

Can First-Time Buyers Consolidate Debt into Their Mortgage?

Yes, they can. If you’re buying your first home, you might be able to include your existing debts in your mortgage.

This depends on factors like:

- Your loan-to-value ratio

- How much deposit you have

- If you use some deposit to overpay debts

- Your credit rating and existing debts

- Whether you can afford higher monthly payments

However, every situation is different, so getting advice from a mortgage expert is a smart move.

When Might a Mortgage Lender Repossess a Home?

Lenders will only consider repossession as a last resort. They must first try other options like changing your mortgage type, extending it, or adding missed payments to the debt.

Generally, missing one or two payments won’t lead to repossession; lenders prefer to work out a reasonable solution. If you’re selling your home, the lender can’t take legal action to repossess it.

Are You Considering a Debt Consolidation Mortgage?

While combining debts into your mortgage is a move that might suit some, it’s important to think about it carefully. Here are a few questions to ask yourself:

- Will Combining Debts Lower Your Monthly Costs? Check if the interest rate on your mortgage will save you a decent amount each month compared to what you’re paying now on your debts.

- Can You Handle the Bigger Mortgage Payments? Remember, your mortgage payments will likely go up. Make sure you’re comfortable with this increase in the long run.

- Are You Okay with Using Your Home as Security? When you consolidate your debts into your mortgage, your home becomes the guarantee for these debts. It’s a big decision because if things go south, it could put your home at risk.

- Have You Sorted Out Your Spending Habits? It’s crucial to tackle any overspending habits that led to the debt in the first place. Otherwise, you might find yourself back in the same boat down the line.

- Is Your Credit Score Up to Scratch? To get a good deal on a remortgage for debt consolidation, you need a decent credit rating. If your credit score isn’t great, this might not be the best option for you.

- How Much Equity Do You Have in Your Property? Consider the amount of equity in your home, as this will affect your eligibility and the terms of the remortgage.

- Have You Compared Different Lenders and Rates? Research and compare rates from various lenders to find the most suitable option.

- Are You Prepared for a Longer Repayment Period? Understand that consolidating debts might extend the repayment period, potentially increasing the total interest paid.

- Have You Considered the Associated Costs and Fees? Factor in the costs and fees of remortgaging, including valuation, legal, and arrangement fees.

- Have You Sought Professional Advice? Consult with a mortgage advisor for personalised guidance and to understand all aspects of the remortgage process.

For some folks, consolidating debts into a mortgage can be too risky. There are other ways to manage debt, like getting professional advice or using balance transfer credit cards. These might be safer bets. So, take a good, hard look at your situation before deciding.

Key Takeaways

- Debt consolidation mortgages let you combine all your debts into one mortgage payment, making it easier to manage your finances.

- These mortgages usually have lower interest rates compared to credit cards and personal loans, which can save you money over time.

- You can choose from various mortgage types, like fixed-rate, tracker, offset, or variable rate, based on your financial situation and goals.

- Using your home as security for consolidated debts is a big decision—if payments are missed, you risk losing your home.

The Bottom Line

Conduct thorough research to find the debt consolidation mortgage provider in the UK. Look for one that aligns perfectly with your specific needs, offering the ideal rates and products.

Remember, consolidating debts into your mortgage could lessen your financial strain, but it’s not a universal solution. Each financial journey is unique.

To ensure this step fits your long-term financial plan, professional guidance is invaluable.

Ready to take the next step? Contact us. We’ll match you with your ideal mortgage broker who will help you understand your options and find the right lender.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What should I look for in a debt consolidation mortgage provider?

Pick a provider that follows the rules of the Financial Conduct Authority (FCA) in the UK. This means they’re trustworthy and fair. Also, go for lenders with good experience in helping people with debt consolidation and positive reviews from their customers.

Are interest rates for debt consolidation mortgages higher than regular mortgages?

Sometimes, yes. Debt consolidation mortgages can have higher interest rates because lenders see them as a bit riskier. But rates can vary a lot between lenders, so it’s a good idea to compare deals to find the best one.

Can I combine all my debts into a mortgage?

You can usually include unsecured debts like credit cards, personal loans, or store cards. But some debts, like student loans, might not be allowed. Check with your lender to see what’s included.

Is there a limit to how much debt I can combine into my mortgage?

Yes, the limit depends on how much your home is worth and how much you can afford to repay. Lenders often let you borrow up to 80-85% of your home’s value.

How long does it take to remortgage for debt consolidation?

It usually takes about two months. While you wait, you’ll still need to pay your current debts. If there are delays or your debts grow during this time, your new mortgage might not cover everything.

Can I pay off my new mortgage early?

Yes, you can. Just make sure you pick a mortgage that allows early repayment. Check with your lender if there are extra fees for paying it off ahead of schedule.

What happens if I can’t keep up with payments on a debt consolidation mortgage?

Missing payments is serious because your home is used as security. If you can’t pay, the lender could take your home. Always talk to your lender if you’re having trouble—they might be able to help.

Are there other ways to consolidate debt without using a mortgage?

Yes, you could try personal loans, balance transfer credit cards, or debt management plans. Each option works differently, so pick one that fits your financial situation best.

What should I do if my money situation changes after I combine my debts?

If things change and you’re struggling to keep up with payments, talk to your mortgage lender right away. They might help by offering things like a break from payments (payment holiday) or letting you pay over a longer time. The sooner you let them know, the more options you’ll have.

Can self-employed people get a debt consolidation mortgage?

Yes, they can. If you’re self-employed, you’ll need to show proof of steady income, like your business accounts or tax returns. This helps the lender see that you can manage the payments.