- What is a Debt Consolidation Mortgage?

- How Do Debt Consolidation Mortgages Work?

- What Debts Can You Consolidate Through Remortgaging?

- Who is Eligible for a Debt Consolidation Mortgage?

- Example of Debt Consolidation Mortgage

- What Are the Benefits of Debt Consolidation Mortgages?

- What Are the Potential Drawbacks?

- What Debt Consolidation Options Do You Have in the UK?

- How Do You Apply for a Debt Consolidation Mortgage?

- Tips for Getting the Best Debt Consolidation Mortgage

- The Bottom Line

Debt Consolidation Mortgages Explained

Debt can creep up on even the most financially responsible person. Between mortgages, credit cards, personal loans, and other expenses, many homeowners find themselves struggling under the weight of high-interest debt.

If you feel overwhelmed by monthly payments and high interest rates, you may benefit from consolidating your debts into a single mortgage loan.

Here is everything UK homeowners need to know about debt consolidation mortgages.

What is a Debt Consolidation Mortgage?

A Debt Consolidation Mortgage gives your finances a fresh start by tidying up multiple debts. You replace various debts, such as credit card bills and personal loans, with a single mortgage.

This can save you money since mortgage interest rates are often lower than those on unsecured debts. The simplicity of managing one monthly payment instead of several is another significant advantage.

How Do Debt Consolidation Mortgages Work?

Let’s look at how this process unfolds:

- Start by calculating the total of your existing debts. This includes everything from credit card bills to personal loans.

- Next, you apply for a new mortgage or adjust your current one. The aim is to ensure it’s large enough to cover both your existing mortgage and these additional debts.

- Once this new mortgage is approved, you use it to clear off all those smaller debts.

- This consolidation leaves you with a single, more manageable monthly mortgage payment.

Just a heads-up, though.

While it simplifies things, you might end up paying more interest in the long run because you’re spreading your debt over a longer period.

It’s also worth checking for early repayment fees on your old debts. And, as always, it’s a smart move to talk to a mortgage advisor before diving in. They can help you figure out if this is the right step for you.

Remember, debt consolidation is not just about streamlining your repayments. It’s also about saving money.

To make the most of it, aim for a lower interest rate than what you’re currently paying on your existing debts.

This is how you can truly benefit from consolidation. However, it’s crucial to understand that consolidation alone doesn’t solve the root causes of financial challenges.

Keeping up with your new loan repayments is essential to avoid further issues. Think of it as a strategic move to manage your debts better, not as a magic fix for financial problems.

What Debts Can You Consolidate Through Remortgaging?

Most types of unsecured debt can be consolidated into a mortgage, including:

- Credit cards

- Personal loans

- Payday loans

- Store cards

- Overdrafts

- Car loans

Additionally, while it’s possible to consolidate some secured debts, such as second mortgages, this depends on various factors like your property’s equity, your credit history, and the lender’s policies.

It’s not a guarantee for every situation, so it’s important to consult with your remortgage lender to understand if a specific secured debt qualifies for consolidation.

Who is Eligible for a Debt Consolidation Mortgage?

To qualify for debt consolidation through remortgaging, you must:

- Be a current homeowner

- Have sufficient equity in your home

- Have a good credit score and history

- Show you can afford your new monthly payments

- Meet your lender’s specific eligibility criteria

If you’ve had credit issues in the past, don’t lose hope. Some specialist lenders consider applications even from those with a less-than-perfect credit history.

They assess applications on a case-by-case basis, considering your current financial situation and how you’ve managed debts recently.

Example of Debt Consolidation Mortgage

Before looking at the benefits and drawbacks, here’s an illustrative example of how consolidating debts into a mortgage could affect monthly payments.

The figures used are for demonstration purposes only.

Your interest rates, repayment amounts, and terms will depend on your financial circumstances, credit rating, lender criteria, and any associated fees.

Scenario:

A homeowner has the following debts:

- Mortgage: £150,000 at 3% interest over 25 years

- Credit Card Debt: £10,000 at 18% APR

- Car Loan: £15,000 at 7% APR over 5 years

They consider consolidating these into a new £175,000 mortgage at 3.5% interest over 25 years.

Debt Consolidation Breakdown:

| Debt Type | Amount | Interest Rate | Monthly Payment Before | Monthly Payment After |

|---|---|---|---|---|

| Mortgage | £150,000 | 3% | £711.32 | – |

| Credit Card | £10,000 | 18% | £150.00 | – |

| Car Loan | £15,000 | 7% | £297.02 | – |

| New Consolidated Mortgage | £175,000 | 3.50% | £1,158 (total across debts) | £876 |

⚠ While consolidating debt into a mortgage can lower monthly repayments, extending the repayment term may result in paying more interest over time.

Consider the total cost before making a decision.

What Are the Benefits of Debt Consolidation Mortgages?

Consolidating debts into your mortgage offers several potential advantages:

- Simplified Payment Schedule. Combining multiple debts into a single mortgage loan streamlines your payment schedule, making it easier to manage your finances.

- Lower Interest Rates. Mortgage loans typically offer lower interest rates compared to other forms of debt, leading to significant savings over time.

- Fixed Repayment Timeline. Replacing open-ended debts like credit card balances with a mortgage provides a clear payoff date, aiding in budgeting and financial planning.

- Potential Tax Deductions. Transferring debt to a mortgage may open up possibilities for tax deductions on mortgage interest, which are not available for general consumer debts.

- Improved Credit Score. Consolidating debts can lower your credit utilisation ratio, gradually improving your credit score and potentially leading to better financial opportunities.

What Are the Potential Drawbacks?

While useful for many, debt consolidation mortgages also come with some risks:

- Extended Debt Duration. Refinancing might result in a longer period of indebtedness, especially if the new mortgage has a longer term than the original.

- Qualification Challenges. Securing favourable refinancing terms often requires a strong credit history and a low debt-to-income ratio, which might be difficult with high existing debts.

- Increased Risk of Foreclosure. Failing to meet mortgage repayments increases the risk of losing your home, particularly with larger refinanced amounts.

- Additional Refinancing Costs. The mortgage refinancing process involves various fees, adding to the overall expense.

- Higher Total Interest Costs. While initial monthly payments might be lower, extending the loan term could result in higher total interest costs over the life of the loan.

Before deciding, carefully consider these benefits and drawbacks in light of your unique financial situation.

What may be an advantage for one person could be a disadvantage for another, depending on factors like financial stability, long-term financial goals, and current debt levels.

For personalised guidance, consult a financial advisor or mortgage broker. They can help you determine if debt consolidation through a mortgage aligns with your financial objectives and circumstances.

What Debt Consolidation Options Do You Have in the UK?

Debt consolidation can be a strategic way to manage and reduce your debt burden. In the UK, homeowners have several options to consolidate their debts, each with its unique features and considerations.

Here’s a detailed look at the main options:

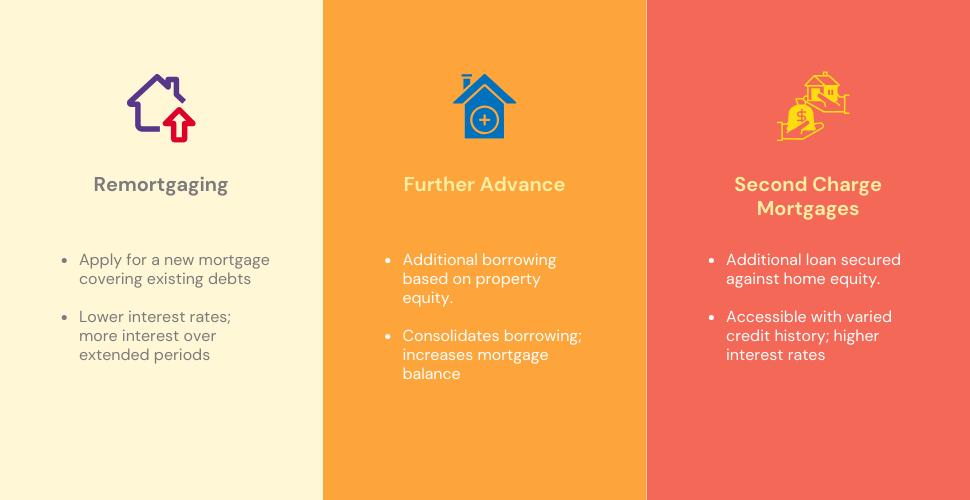

1. Remortgaging for Debt Consolidation

Remortgaging means replacing your existing mortgage with a new one that also covers your other debts. Here’s how it can be beneficial for you:

- Process – Apply for a new mortgage that pays off your current one and provides extra funds to clear your other debts.

- Benefits – Usually, the interest rates are lower compared to personal loans or credit cards, which can save you money.

- Considerations – Extending your mortgage period might result in more interest paid over time. Also, be aware of any fees for early repayment of your original mortgage.

2. Further Advance on Your Mortgage

A further advance involves asking your current mortgage lender for additional borrowing. This is an option if you’ve built up significant equity in your home.

- Process – Request more borrowing from your lender based on your property’s equity.

- Benefits – Often comes with lower interest rates compared to other debts and keeps your borrowing under one roof.

- Considerations – Increases your overall mortgage balance, potentially leading to more interest over the long haul. The new loan might have different terms and interest rates.

3. Second Charge Mortgages

This is an additional loan, secured against the equity in your home, alongside your primary mortgage. It’s a viable option if remortgaging isn’t suitable for you.

- Process – Secure a new loan against your property, in addition to your main mortgage.

- Benefits – More accessible if you have a less-than-perfect credit history, and might offer more flexible repayment terms.

- Considerations – Your home is at risk if you can’t make the repayments. The interest rates for these loans are usually higher than for a primary mortgage.

How Do You Apply for a Debt Consolidation Mortgage?

Applying for a debt consolidation mortgage might seem daunting, but it’s a straightforward process when broken down. Here’s what you need to know:

- Assessment of Your Financial Situation – Start by assessing your financial health. Look at your debts, income, and monthly expenses. This will give you a clear picture of where you stand and how much you might be able to borrow.

- Check Your Credit Score – Your credit score is a key factor in mortgage applications. Check your score beforehand to understand your chances of approval and potentially improve it before applying.

- Determine Your Home Equity – Calculate the equity you have in your home. This is the difference between the market value of your property and the amount you still owe on your mortgage.

- Explore Your Options – Research different lenders and their debt consolidation mortgage products. Compare interest rates, terms, and any additional fees.

- Contact a Mortgage Broker – A broker can help simplify the process. They can provide advice, help you find the best deals, and assist with paperwork.

- Gather Necessary Documents – Prepare the necessary documents. This typically includes proof of income, bank statements, current mortgage details, and information about your debts.

- Application Submission – Apply through your chosen lender or via a broker. Be honest and thorough in your application to avoid any delays.

- Property Valuation – The lender may require a valuation of your property to confirm its market value and the available equity.

- Approval Process – Once you submit your application, the lender will review it along with your financial details. They’ll assess your ability to repay the new mortgage.

- Agreeing to Terms and Completing the Process – If approved, you’ll receive an offer. Review the terms carefully. If you agree, accept the offer, and the lender will proceed with setting up the new mortgage, which will pay off your existing debts.

- Closing the Deal – There will be some paperwork to finalise the deal. Once completed, your existing debts will be paid off, leaving you with just the new mortgage to manage.

Remember, every lender has different processes and requirements, so the exact steps can vary. However, this guide provides a general roadmap for what to expect when applying for a debt consolidation mortgage.

Tips for Getting the Best Debt Consolidation Mortgage

Follow these tips to maximise benefits and get the right debt consolidation deal:

- Shop Around – Compare mortgage rates and features from multiple lenders to find the best fit for your situation. Brokers can help access the most suitable products.

- Calculate Total Costs – Factor in all fees to determine if consolidation will save you money in the long run.

- Choose the Right Term – Opt for the shortest term you can afford to minimise interest costs over the life of the loan.

- Take Payment Holidays Sparingly – Payment holidays may provide temporary relief but increase costs over the full mortgage term.

- Overpay When Possible – Making even small overpayments when possible will reduce your mortgage faster and save on interest.

- Improve Your Credit Rating – Work on improving your credit before applying to access better mortgage rates.

- Seek Professional Advice – Consulting a qualified mortgage broker or financial adviser can help you make the right decision.

The Bottom Line

If debt is starting to feel unmanageable, consolidating through remortgaging could provide an affordable solution. It’s important to compare different mortgage options to find the best route for reducing your debt costs.

Remember, considering both the benefits and risks is key before you decide on a debt consolidation mortgage. Here’s where a broker can help:

- They find deals that match your financial situation.

- Brokers have deep market knowledge for tailored advice.

- You get access to special rates and products.

- They simplify the complex mortgage process.

- Brokers save you time by handling the research and comparison.

Thinking about debt consolidation? Get in touch with us. We’ll connect you with a skilled broker who’ll assess your needs and guide you to the right solution.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What’s the difference between debt consolidation and debt management?

Debt consolidation involves combining multiple debts into a single loan, typically with a lower interest rate. This simplifies repayment and can reduce overall interest costs.

Debt management, on the other hand, is a structured plan to pay off existing debts individually, often with the help of a credit counselling agency. It doesn’t consolidate debts but may negotiate lower interest rates or payments with creditors.

Can I get a debt consolidation mortgage with bad credit?

Yes, specialist lenders offer debt consolidation mortgages even if you have a poor credit history. You will likely pay higher interest rates and fees.

Can debt consolidation affect my mortgage terms?

Yes, consolidating debts into your mortgage can affect its terms. This may include changes to the interest rate, monthly payment amount, and the duration of the loan.

It’s crucial to compare these changes with your current terms to ensure the consolidation is beneficial in the long term.

How long does the process of debt consolidation take?

The process duration varies, but it generally takes several weeks to a few months. This includes time for application, approval, property valuation (if required), and completion of the consolidation process. The exact timeline depends on the lender and the complexity of the borrower’s financial situation.

Can I still use my credit cards after consolidating their balances?

Yes, you can still use your credit cards after balance consolidation. However, it’s important to manage them responsibly to avoid accumulating new debt.

Consider using them for small, manageable purchases and pay off the balances in full each month to avoid falling back into high-interest debt.

How much equity do I need to consolidate debt through remortgaging?

Most lenders want you to have at least 10% equity after consolidating debts. The more equity you have, the better mortgage rates you can access.

What happens if I sell my home after consolidating my debts?

If you sell your home after consolidating debts into your mortgage, you must pay off the consolidated mortgage balance from the sale proceeds.

Any remaining funds after paying off the mortgage are yours. It’s important to consider if the home sale will cover the entire consolidated debt.

Are there any tax implications of debt consolidation?

In the UK, there are typically no direct tax implications for consolidating personal debts. However, if debt consolidation leads to significant changes in your financial situation, it could indirectly affect your tax liabilities. It’s advisable to consult a tax professional for personalised advice.