- Secured Loans: A Quick Overview

- How Do Secured Loans Work?

- Why Choose a Secured Loan?

- How Long Does It Take to Get a Secured Loan?

- What Exactly is a Secured Loan Broker?

- Why Consider a Broker for Loans

- Do Secured Loan Brokers Have Fees?

- How to Find the Right Secured Loans Broker

- Should I use a secured loan broker?

- Tips for Working with a Broker for Loans

- The Bottom Line

How To Find the Best Secured Loans Broker

Secured loans can be a great way to get the money you need for a variety of purposes, from consolidating debt to home improvements.

But with so many different lenders and loan options available, it can be difficult to know where to start.

That’s where a secured loan broker can help.

A broker can assess your financial situation and match you with the best possible loan for your needs. They can also help you with the application process and negotiate on your behalf.

In this article, we’ll discuss everything you need to know about secured loan brokers, including how they work, how to choose the right broker, and what to expect during the application process.

Secured Loans: A Quick Overview

Secured loans mean you promise one of your properties as a guarantee when making a deal with the lender.

If you can’t pay back the loan, the lender can take and sell this property to get back the money you owe, plus any extra charges.

It’s a big decision to use your home, or another valuable asset, as a guarantee. If you can’t make the necessary payments, you might lose your home just like failing to pay a mortgage.

How Do Secured Loans Work?

Secured loans can be of different types. Some are backed by cars, others by homes or property equity. Certain loans are meant for specific things like paying off other debts or making home improvements.

Most of them give you a big amount of money that you pay back in monthly instalments over a set time. You can pay off the loan early but might have to pay extra charges if you do.

If you can’t make the payments and don’t arrange a new plan with the lender, they can take and sell your property to recover their money. This means you could lose your home if you stop making payments.

Why Choose a Secured Loan?

A big reason people pick secured loans over unsecured ones is that you can borrow more money.

While unsecured loans usually stop at £15,000 to £25,000, a secured loan can offer more than £100,000, depending on the kind of loan you get.

Another reason might be a lower interest rate, although this isn’t always sure and depends on your personal situation, including your credit history and current score.

How Long Does It Take to Get a Secured Loan?

Normally, getting a secured loan takes a bit longer than an unsecured one. The lender might want to check the value of your property before deciding the loan amount.

This procedure can take a while, usually between 3 to 6 weeks. Once you get the nod, you can expect the funds in your account in a few days.

What Exactly is a Secured Loan Broker?

A secured loan broker is either a person or a firm that takes time to understand your credit needs and evaluates if a secured loan suits you.

If it seems like a good match, they will explore the market for you to spot the best opportunities.

In case you decide to go ahead with one of the suggested options, the broker can guide you through the application process.

This service isn’t free – they usually charge a fee, and might even get a commission from the loan company.

However, it’s worth noting that not all brokers operate the same way.

Some skip the personal conversation at the beginning and operate fully online, sending your application to various potential lenders.

>> More about The Best Online Mortgage Brokers in 2023 [UK]

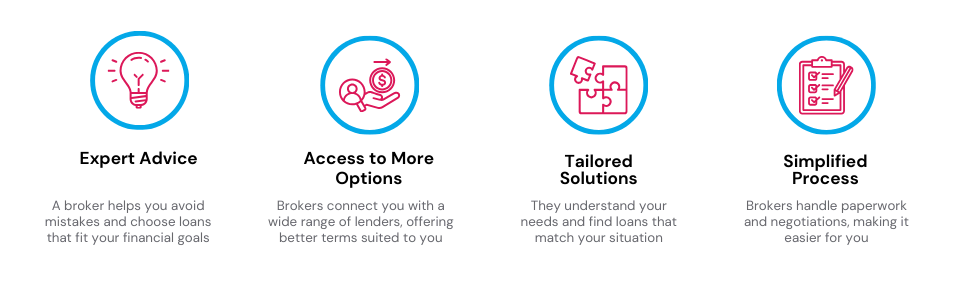

Why Consider a Broker for Loans

Working with a loan broker can significantly simplify your experience when securing a loan.

They come equipped with a vast knowledge base and can provide sound advice to help you make decisions that align with your financial goals.

This guidance can help you avoid common mistakes and make the loan process smooth and manageable.

With a secured loan broker by your side, you have access to a wider range of lenders, giving you the chance to explore more loan options than you might find on your own.

This vast network can potentially secure better terms and interest rates, customising a loan package that perfectly suits your financial situation.

Loan brokers excel at understanding your specific needs and can find loan options that are tailored to your circumstances.

They diligently work to craft loan solutions that are a great fit for you, increasing the likelihood of securing a loan that meets your needs precisely.

When you work with a secured loan broker, the loan application process becomes much easier.

They take care of the details, from completing paperwork to negotiating terms with lenders, saving you time and reducing stress.

Do Secured Loan Brokers Have Fees?

Yes, working with a secured loan broker isn’t a free service as their goal is to earn a profit. The way they charge can vary greatly between brokers.

Some might ask for a fee when they start looking for a loan for you, while others only ask for payment if you accept one of the loans they suggest.

There are also brokers who won’t charge you directly but will receive a commission from the loan company.

This scenario means a portion of your loan repayments will be given to the broker, potentially making your loan a bit more expensive.

Moreover, if a broker only takes a commission from the loan company, it could mean they aren’t exploring all the available options in the market but only those from companies they have agreements with.

This could possibly limit your chances of finding a better loan deal somewhere else.

How to Find the Right Secured Loans Broker

To find a reliable secured loan broker, pay attention to their expertise, reputation, and the quality of service they provide.

Make sure they are licensed and have good reviews or testimonials from previous clients. Their transparency about fees and commissions is also a critical factor to consider.

Before you hire a broker, inquire about their experience in the field, their methods for finding the best loans, and the fees involved.

Asking about their network of lenders and how they manage potential conflicts of interest will give you a clear picture of their reliability and trustworthiness.

Understanding the broker’s fees and commissions is vital.

Some brokers might charge a flat fee, while others work on a commission basis. Clear knowledge of this will prevent surprises down the line.

To get started easily and quickly, simply send an enquiry. We will do the legwork and connect you with the right broker to get you the best deal.

>> More about How To Find the Right Broker

Should I use a secured loan broker?

If you’re considering a secured loan in the UK, you may be wondering if using a broker is a good idea. Here are some of the pros and cons to consider:

Pros:

- Professional guidance. Secured loan brokers can offer expert advice to help you choose the right loan for your needs and circumstances, especially if you have a low credit score.

- An extensive network of lenders. Brokers often have relationships with a variety of lenders, which can give you access to loan terms and interest rates that you might not be able to find on your own.

- Customised loan options. Brokers can sift through different loan options to find one that’s perfectly tailored to your financial situation, saving you time and stress.

- Simplified application process. Brokers can handle the paperwork and other administrative tasks involved in applying for a loan, so you can focus on other things.

Cons:

- Additional costs. Brokers typically charge fees for their services.

- Potential conflicts of interest. Brokers may receive commissions from lenders, which could influence the loan options they present to you.

- Restricted lender options. Brokers may not have relationships with all lenders in the market, so your choices may be limited.

- Reliance on the broker’s expertise. The quality of the loan options you receive from a broker will depend on their experience and knowledge.

Ultimately, the decision of whether or not to use a secured loan broker is up to you. Weigh the pros and cons carefully to decide what’s best for your situation.

Pro Tip

Not sure if a secured loan broker is for you? Well, they can’t guarantee a better deal.

But if the idea of finding a loan on your own feels daunting, especially if you have a low credit score, a broker might be worth the cost.

If you choose to hire one, make sure they are approved by the Financial Conduct Authority.

Tips for Working with a Broker for Loans

- Preparing Necessary Documents. Ensure a smooth collaboration with your broker by having all required documents ready. These may include proof of income, identification, and details of your credit history. Your broker will guide you on what is needed to speed up the process.

- Discussing Your Financial Goals. Open discussion about your financial goals is crucial when working with a broker. It assists them in identifying the best possible loan options that align with your goals, ensuring a more successful outcome.

- Keeping an Open Line of Communication. Maintaining open and frequent communication with your broker throughout the loan process allows for a smoother transition between stages and helps in addressing any concerns or questions promptly.

The Bottom Line

Secured loan brokers play a crucial role in helping you find the most suitable loan options based on a comprehensive analysis of your financial situation. Here are some of the things they can do for you once you use a broker:

- Review your credit score, income, debts, and assets to assess your eligibility.

- Simplify the application process by providing assistance with documentation and form completion.

- Work closely with lenders to ensure a smooth and timely approval process.

- Serve as a communication bridge between you and lenders.

- Clarify terms, negotiate conditions, and ensure that everyone is on the same page.

Get in touch with us to easily find the right secured loan broker. We’ll connect you with a broker who will listen to your situation and create the best possible solution.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Who is qualified for a secured loan?

If you own something valuable, like a house or a car, you might be in the right position to get a secured loan. But, there are other conditions you need to meet, including being the right age according to the lender’s rules.

When you apply, the lender will look at how much money you make every month and the debts you’re already paying. They do this to figure out if you can afford to take on another payment.

If the loan seems too heavy for your budget, considering other important expenses, they might say no to giving you the loan.

Also, your credit history plays a big part in this decision. If your credit score isn’t good, getting a loan could be tough.

Are secured loans a bad choice?

Some people argue that secured loans are risky because you could lose your assets if things go south financially. It’s true that it’s a risk – you might lose your home.

But, by borrowing a smaller amount or saving up before taking the loan, you can lessen the risk. Plus, many people get a secured loan without any problems, enjoying the benefits of higher credit amounts at competitive interest rates.

How to identify legitimate secured loan lenders?

If you find it hard to spot a legitimate lender, you can try searching for approved lenders on the FCA website. If unsure, you can always ask a debt charity to help you figure out if the lender is legit.

Which UK banks offer secured loans?

In the UK, most banks have a variety of secured loans to choose from. They offer personal loans, loans backed by home equity, debt consolidation loans, home improvement loans, car loans, and more.

Where to find the best secured loan?

There isn’t a one-size-fits-all answer to where you can find the best secured loan. Banks, mortgage providers, and online creditors all might have what you’re looking for, with competitive rates. It all depends on your personal situation.