How To Find Your Ideal Mortgage Broker In The UK

Buying a home is likely one of the biggest purchases you’ll ever make. The process can seem daunting, especially when it comes to securing the right mortgage.

Should you tackle it alone or get some help?

This is where having an experienced mortgage broker guide you can make all the difference.

Finding the ideal broker tailored to your needs takes the stress out of financing and sets you up for mortgage success. But not all brokers are created equal.

You need one who deeply understands your situation and works tirelessly to get you the best deal.

This comprehensive guide shares insider tips to equip you with the knowledge to find the perfect UK mortgage broker.

We’ll explain exactly what brokers do, key qualifications to look for, smart ways to research brokers, and how to select the right fit.

And if the process still feels overwhelming, we’re here to help match you with a top broker at no cost, so you can focus on the exciting parts of homebuying.

What is a Mortgage Broker?

A mortgage broker serves as a middleman between you, the borrower, and potential lenders.

They are experts in the mortgage industry with access to a broad range of mortgage products from various lending institutions.

Mortgage brokers work on your behalf to find the most suitable mortgage option based on your specific financial situation and home buying goals.

Rather than directly approaching a bank or building society alone, you can enlist the services of a broker to compare mortgage deals for you.

A knowledgeable mortgage broker can offer you greater choice, secure a more competitive interest rate, and minimise paperwork hassles.

Why Use a Mortgage Broker?

Here are some of the top benefits of utilising a mortgage broker:

- Access to Exclusive Deals – Brokers have special partnerships with lenders and access to mortgage options not directly advertised to the public. This inside access allows them to connect you with unique savings.

- Wide Lender Choice – Brokers collaborate with multiple lenders and have an expansive view of the market. This makes it simpler for them to identify the most appropriate lender and mortgage product for you.

- Mortgage Expertise – With intricate knowledge of various mortgage options, brokers can pinpoint the optimal loan type based on your financial circumstances.

- Convenience – The broker manages the application and approval process for you, saving you time and paperwork.

- Potentially Better Rates – With the ability to shop multiple lenders, brokers can assist you in landing a highly competitive interest rate.

- Help for Challenging Cases – For unique borrowing needs, a broker’s specialised expertise can prove invaluable in getting you financing. This includes for self-employed applicants or those with credit difficulties.

>> More about Benefits of a Mortgage Broker

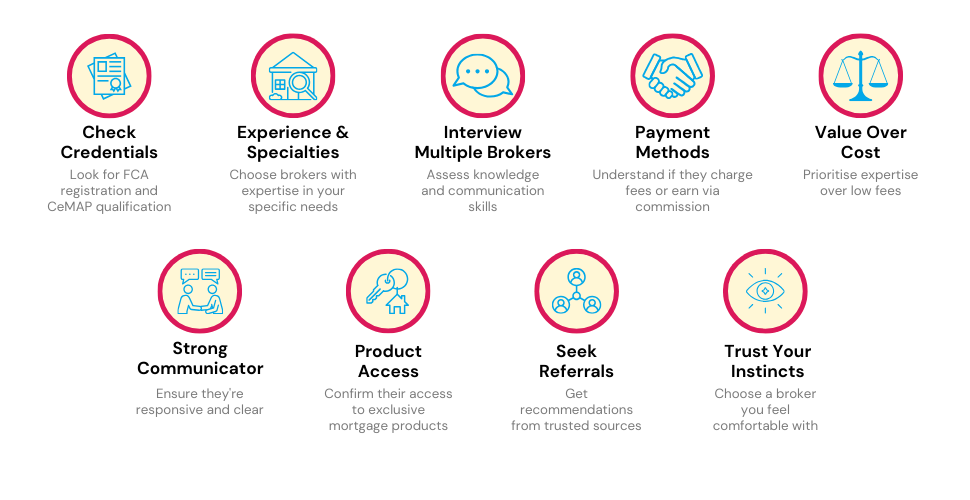

What to Look for in a UK Mortgage Broker

To legally provide services, UK mortgage brokers must meet authorisation requirements:

- FCA Registration – The Financial Conduct Authority regulates brokers. All brokers must appear on the FCA register.

- CeMAP Certification – While not mandatory, the CeMAP (Certificate in Mortgage Advice and Practice) administered by the Chartered Insurance Institute is a widely recognised qualification demonstrating core mortgage advice competencies. Ideally, most brokers will hold this certification to signify their commitment to providing competent advice, although it is not a legal requirement for FCA approval.

Beyond this, the most qualified brokers pursue additional credentials like:

- CII Certificates – Respected certificates issued by the Chartered Insurance Institute focused on mortgage advice and UK financial regulations.

- LIBF Diploma – This advanced mortgage qualification from the London Institute of Banking & Finance signals deep expertise.

- Specialist Training – Ongoing learning like accredited comprehensive training programs display up-to-date broker knowledge.

The ideal broker combines proper licensing with premium qualifications, training, experience and proven expertise.

This demonstrates comprehensive capabilities to advise you.

How to Find the Best Mortgage Broker for You

Start with Solid Research

Every savvy financial choice begins with doing your homework:

- Seek Personal Referrals – Chat with family and friends who’ve recently navigated the mortgage process. Did they like their broker? Was the broker insightful and responsive?

- Get Professional Recommendations – Your real estate agent knows the local market and can suggest skilled mortgage brokers with a track record of success.

- Dig into Reviews – Online feedback, like Google or Yelp reviews, can reveal a lot about a broker’s ability to handle challenges, their communication style, and their problem-solving skills.

Remember, verifying a broker’s credentials is crucial. Check if they’re licensed with the Financial Conduct Authority in the UK.

Compare Your Options

Just like you compare prices when shopping for a mortgage, you should compare brokers too. Once you’ve done your research, pick out at least three brokers and consider the following:

1. What range of loan products can you offer?

It’s important to find out if they have a broad selection of mortgage options on hand, and crucially, if they offer the loan you have your eye on.

This will help you to be sure you’re not missing out on a product better suited to your financial situation.

2. How extensive are your lender relationships?

A broker’s network can greatly influence the kind of deals they can snag for you. Ask about the array of lenders they’re in touch with.

This is especially pertinent if you’re aiming for a deal with a particular lender in mind.

3. Can you clearly outline your fee structure?

Transparency in fees is a non-negotiable aspect. Mortgage brokers typically charge between 1% to 2% of the loan amount.

Ask them to specify how they’re compensated—whether it’s by the lenders, by you, or both. Clarity here will help you avoid any hidden costs down the line.

Lastly, don’t hesitate to discuss your financial circumstances.

Whether you have certain credit challenges or need a particular type of loan, understanding the broker’s expertise in handling similar situations can be a deciding factor.

Let Us Simplify Your Search

Instead of searching all over for a broker, let us do it.

We know what makes a broker great, and we’ll find you one that fits just right, at no cost to you.

Here’s How We Help:

We find out what you need:

- How much you want to borrow

- Your deposit amount and where it’s from

- Your age and credit history

- What you’re buying and its value

- Your job, salary, and other spending

Then, we match you with a broker who:

- Knows the whole market

- Specialises in helping people like you

- Has the right qualifications and training

- Works with various lenders

- Agrees to our fair-fee policy

You don’t need to dig through loads of info to find a top-notch mortgage broker. We’ve done the legwork and only partner with the best.

So, with a quick chat, we can connect you to the right expert for your mortgage needs.

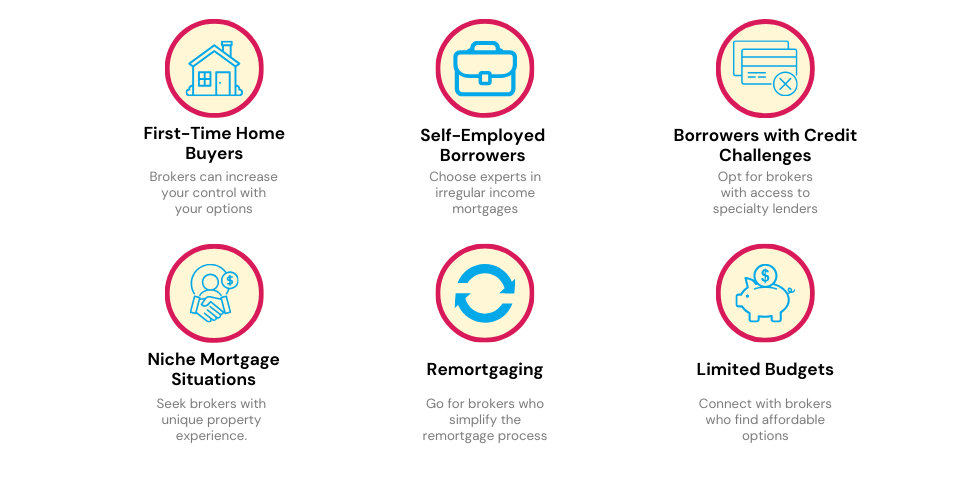

Choosing the Right Mortgage Broker for Your Situation

With so many broker options available, it’s essential to find one well-matched to your circumstances.

If your credit history is limited and savings are scarce, brokers familiar with getting initial approvals for new borrowers can increase your odds of success.

Their understanding of lenders willing to work with first-timers is key.

Look for brokers well-versed in securing mortgages for those with irregular income sources. Gaps in employment history make lender requirements challenging to meet.

Specific experience overcoming this is invaluable.

Borrowers with Credit Challenges

Brokers familiar with specialty lenders offering financing to riskier borrowers with past credit difficulties open more options. This knowledge is critical to approval.

Niche Mortgage Situations

In unique cases like vacation homes, investment properties, or unusual constructions, only specialised brokers will suffice. Identify ones possessing specific related experience.

Select a broker intensely familiar with streamlined refinancing procedures and facilitating hassle-free service transfers between old and new lenders. Avoid headaches.

Brokers skilled at securing financing for lower-income borrowers on restricted budgets can make homeownership possible. Connect with ones able to identify the right programs.

Vetting brokers thoroughly helps you form relationships with exceptional professionals who can provide you the very best mortgage terms along with personalised guidance.

Trusting the proper broker vastly simplifies your home buying journey.

Getting Ready Before Finding a Mortgage Broker

Before you dive into the search for a mortgage broker, taking certain steps can pave the way for a smooth and fruitful interaction:

Check Your Credit

Your credit score is really important when you want to get a mortgage. You can get a free credit report every year to see where you stand.

This will help you and your broker know what kind of loans you might get.

>> More about checking your credit report

Learn About Different Loans

It’s good to have a basic idea of the different types of home loans. Some loans need smaller down payments, and others have different requirements. Knowing a bit about these can help you talk to your broker about what you need.

Figure Out How Much You Can Spend

Use an online calculator to get an idea of how much you might be able to spend on a house. It looks at your income and your debts to help you estimate.

Get Your Papers Together

You’ll need to show your mortgage broker some paperwork, like your ID, your bank statements, and your tax information. Collecting these documents early can speed things up later.

Choosing a Good Broker

Once you have all your information ready, a good broker can help you find the right lender for your situation.

They’ll look at what you can afford and your financial background to give you choices that fit your needs. A smart choice here can save you money over the life of your mortgage.

The Bottom Line: Match with a Perfect Broker for Free

Finding the right mortgage broker doesn’t have to be a chore. Leave the hard work to us and we’ll quickly connect you with the ideal advisor for your needs – and it won’t cost you a penny!

Get in touch for a straightforward way to locate your perfect broker.

After we receive your details, we’ll organise a free, no-obligation consultation with a qualified mortgage broker who fits just right with what you’re looking for.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What's the difference between a mortgage broker and financial advisor?

Mortgage brokers specifically advise on home loans and arrange financing. Financial advisors handle wider services like investments, insurance, and pensions along with mortgages. Some specialise in both.

How are mortgage brokers paid?

Most brokers earn 1-2% of the mortgage amount, either paid upfront or added to the loan. Fees are negotiable. Better terms brokers secure can offset their costs.

>> More about How Mortgage Brokers Get Paid

Should I use my bank's mortgage broker?

Bank brokers are limited to that bank’s products. Independent brokers provide whole-of-market choice. Wider access often results in better deals.

Will a broker hurt my credit scoring mortgage shopping?

When first shopping rates, brokers only conduct soft inquiries which don’t impact your score. Only the final application causes a hard credit check.

Should I work with the broker provided by my estate agent?

To make sure you’re seeing the best mortgage deals out there, it’s smart to consult an independent broker with full market access. Estate agent-affiliated brokers might not have this extensive access, and their expertise may not be the best fit for your mortgage needs.

What does a private mortgage broker do?

A private mortgage broker caters to individuals with high net worth, focusing on clients looking for mortgages of £1 million or more. These brokers work with private lenders adept at meeting the unique needs of such borrowers, offering tailored mortgage solutions that align with their financial stature.