- What Exactly is Remortgaging?

- Do You Qualify?

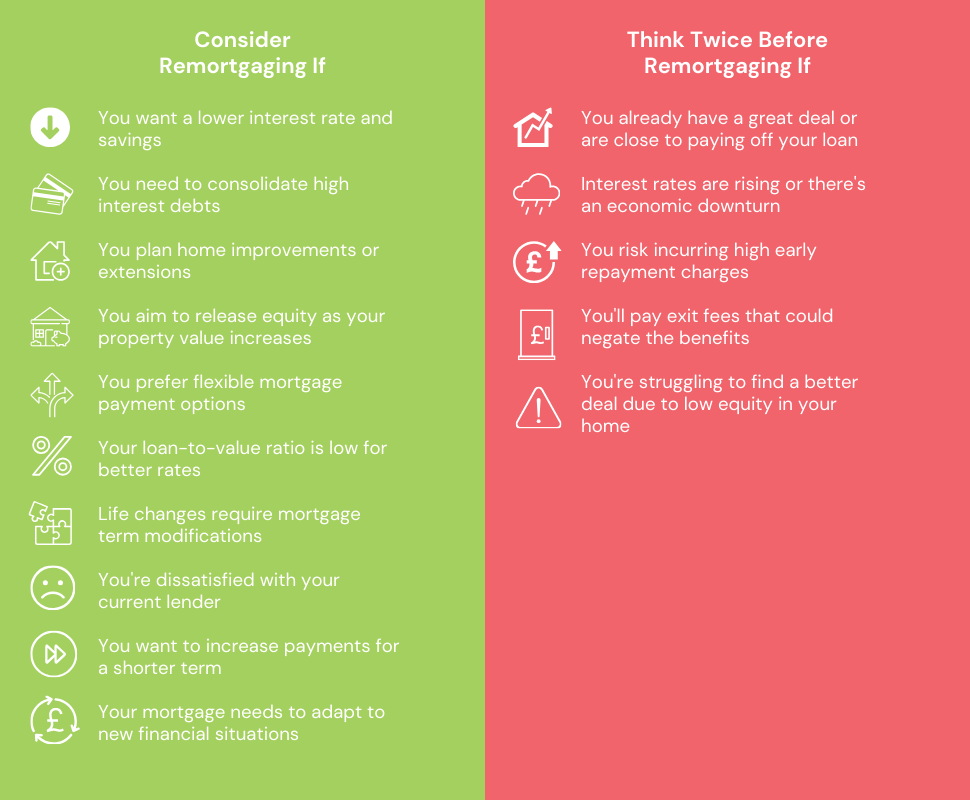

- Is Remortgaging Right For You?

- Don’t Ignore These 3 Crucial Checksâ¦

- Loan-To-Value, Equity, and Property Value Explained

- How Much Could You Save By Remortgaging?

- Costs and Fees of Remortgaging

- Which Remortgage Type Best Suits Your Goals?

- Should You Stay With Your Current Lender or Switch?

- Which Mortgage Type Fits You?

- Get Your Facts Straight Before Remortgaging

- Ready To Remortgage? Hereâs Howâ¦

- Planning The Future

- Tips To Boost Your Chances of Remortgaging

- The Bottom Line

The Ultimate Remortgage Guide for Smart Homeowners in 2024

Life doesn’t always go as planned. And sometimes that means taking a second look at big choices, like your mortgage.

With so many deals in the UK, it’s tough to know what’s right for you.

You might have found a great deal but then hit a wall with strict lending rules or confusing terms. Or maybe you’re dealing with changing interest rates and feel lost in the maze of options.

If you’re in this boat, wanting to switch your mortgage for a lower rate to save MORE money.

Then, this guide is for YOU.

Ready?

What Exactly is Remortgaging?

Remortgaging is the act of replacing your existing mortgage with a new deal. You can do this with your current lender or a new one, all while staying in your cosy home.

Many choose to remortgage for a variety of reasons, yet the primary aim is to save money.

Since a mortgage is usually the biggest thing you’ll pay for, it makes sense to find a way to make it cheaper.

This is especially true when your fixed mortgage deal ends and you move to the Standard Variable Rate (SVR), which often costs more.

Do You Qualify?

To see if you’re fit for a remortgage, tick off these points:

- You have an existing mortgage.

- Your current deal is expiring in six months or less. (You can remortgage before this, but it often doesn’t make sense due to early repayment charges)

- Your income can comfortably handle the new repayments.

- You owe less than 90% of your home’s worth – a solid position for a new deal.

- You have a good credit score. (This means lenders can trust you with a new mortgage and possibly better rates.)

Is Remortgaging Right For You?

Remortgaging is popular when interest rates are low and you can snatch up a more affordable deal. Because mortgage rates track the Bank of England rate, when it rises, so do your mortgage payments.

Even when interest rates are on the higher end (like they currently are now), remortgaging to a lower fixed deal rate often still makes a lot more sense than staying on your bank’s standard variable rate (SVR). Those rates are often the highest you can find.

There are plenty of reasons why a homeowner would want to remortgage.

Let’s look at those first.

Remortgaging could be a good choice in these situations:

- When you’re on the Standard Variable Rate. This rate can be competitive but… The bank has the power to move it up or down whenever it pleases. So it can be a little unpredictable. Remortgaging could better position you for long-term savings if you move over to a lower & more affordable rate.

- You want to consolidate high-interest debts like personal loans, council tax, credit cards, and bank overdrafts into one lower-interest payment.

- You want to borrow more money (often called “further advance”) for home improvements such as adding an extension, installing a brand new kitchen or updating the bathrooms…

- When you have a lower loan to value you can qualify for a better interest rate. That can mean big savings!

- To release equity when your home’s value goes up

- You want to adjust the terms or buy out your joint mortgage partner due to their financial difficulties or a relationship change…

- Your lenders are a pain in the neck (to put it nicely). Don’t enjoy working with them. Think they’re out to fatten their wallet rather than help you? Then maybe it’s time to switch.

- You want to make extra payments to your mortgage so you can pay it off in 10 years and not 30 BUT… your current mortgage deal won’t let you do it. Probably time to switch.

- Your financial or life situation changed. Maybe you got a promotion, struck oil in your backyard or the kids finally moved out of your basement. If so, you may want to move into your dream home or get a smaller home and travel the world posting photos on Instagram for all your friends to get jealous. In these cases, remortgaging might be a penny saver.

Now hold on a sec…

Remortgaging isn’t for everyone. Here’s why you may want to hold off.

- You’re already on a great deal. If you’ve already got an awesome rate, it might not make sense to switch.

- You’re almost done with payments. If you’re close to paying off your mortgage and your mortgage balance is low, switching might cost you more in fees than you’d save.

- Bad Timing. If interest rates are rising, your income has dropped, or your credit score has taken a hit, it’s wise to wait.

- Your early repayment penalties are sky-high. If these charges are through the roof, hanging tight until they drop (usually when your deal’s about to end) can save you a bundle.

- Sometimes there are exit fees. Even small fees like £75-£300 can add up, so consider waiting until your current deal nears its end.

- You’ve got little equity in your home – homeowners in this situation can have a tough time finding a better deal.

Don’t Ignore These 3 Crucial Checks…

Before you leap into remortgaging, it’s vital to get your numbers right with your current deal. This will show you whether it’s truly better to switch or if staying put is the smarter move.

In short, this step ensures you remortgage without regrets!

Here are three things to check before making the move:

1. Confirm Any Exit Fees

An exit fee is the money your lender charges you for processing the end of your mortgage. If your paperwork wasn’t clear about these fees, it’s your right to question them.

Ask your lender for clarity and, if the fees weren’t mentioned upfront, request their cancellation. It’s all about ensuring you have fair warning of all charges.

2. Check the Early Repayment Charges (ERC)

These are fees you pay if you end your mortgage during a certain period. Lenders charge them to cover the costs they face when you leave your deal early.

When remortgaging, it’s a good idea to confirm if this applies. Then, ask your current lender these 2 questions:

- How much is it?

- Until when is this fee applicable?

Knowing this helps you figure out if it’s better to stay put for a bit longer or if you’re good to go ahead with a new deal without losing money.

3. Compare How Much You Owe versus Your Home’s Value.

Don’t play a guessing game with how much you owe compared to your home’s worth. Get the precise numbers.

If your estimated debt is off, you might end up borrowing more than necessary or missing out on the best remortgage deals.

Understanding your loan-to-value ratio (the comparison of your debt to your home’s value) is crucial. It can significantly impact the deals you’re eligible for and ensure you’re making a move that genuinely benefits you.

Loan-To-Value, Equity, and Property Value Explained

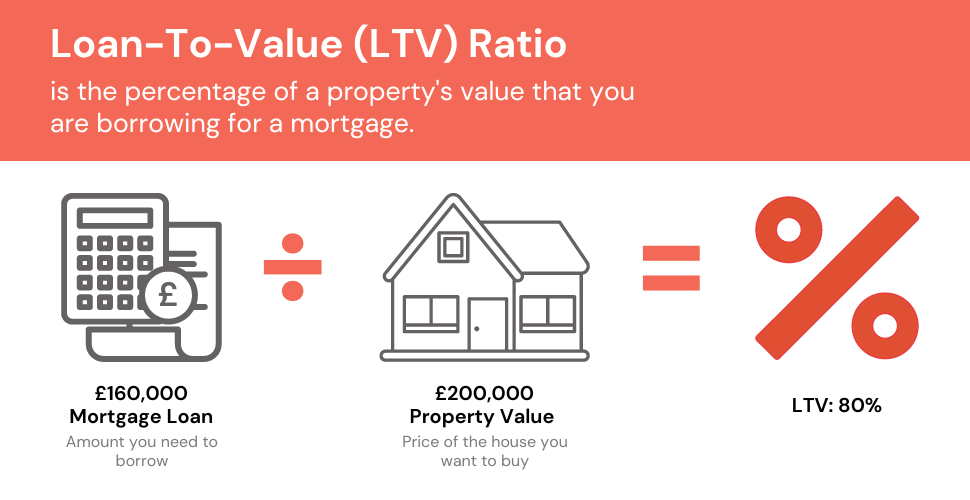

What is Loan-To-Value?

Loan to Value (LTV) measures the proportion of your property’s value that’s covered by your mortgage

It’s crucial because it influences the interest rate lenders will offer you.

A lower LTV signals to lenders that you’re a safer bet, often leading to more appealing mortgage rates.

The formula is simple: LTV = (Mortgage Amount ÷ Property Value) × 100. So, if your home is worth £200,000 and you owe £160,000, your LTV is 80%.

But there’s more to it.

LTV isn’t just about what you owe; it’s a measure of the lender’s risk. If you’re borrowing 80% of your home’s value, the lender has a 20% buffer.

This buffer protects them if property values dip and make them more willing to offer you sweet deals.

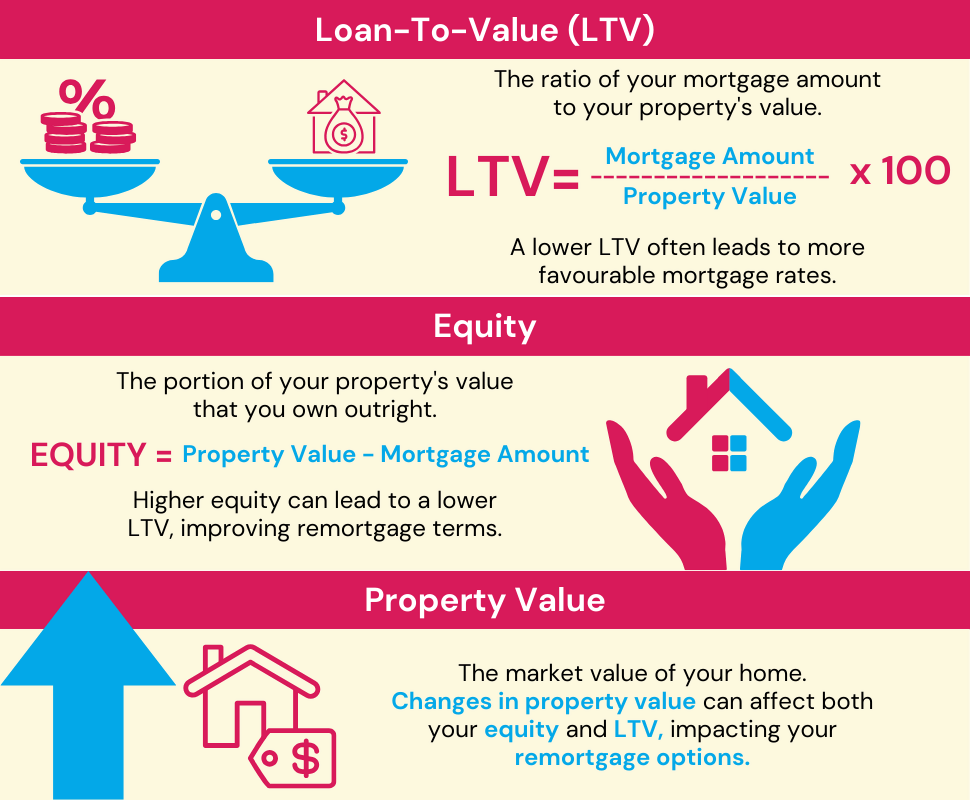

Of course, LTV doesn’t just sit in isolation; it’s closely tied to your home’s equity and value.

Here’s how:

The Role of Equity in LTV

Equity is the portion of your home that you truly own, the value beyond your mortgage. It’s a star player when you’re looking to remortgage.

Here’s a simple example: say your home is worth £180,000 and you owe £140,000 on your mortgage. Your equity is £40,000.

This number is a powerful part of your financial picture because it directly influences your Loan to Value (LTV) ratio.

In simple terms, more equity usually means a lower LTV, which can get you better remortgaging rates.

Ideally, you should aim for at least 5% equity to start. However, to get the most attractive rates, aim for around 20% or even 40%.

The golden rule is simple: more equity equals better rates and lower monthly repayments.

It’s important to remember that your equity and LTV can change over time. They vary as you pay off more of your mortgage and as your home’s market value fluctuates.

If your home’s value increases, your equity goes up. But if the value falls, your equity decreases.

This dance between your equity and your property’s value is why getting a spot-on valuation is so important.

Your existing equity in your home acts as your deposit when you remortgage.

This means you typically won’t need to pay additional cash upfront to your new lender, unless you have specific financial goals in mind, like lowering your mortgage payment or getting a better rate.

Property Value’s Impact on LTV and Equity

The value of your property is really important. It influences your Loan to Value (LTV) ratio and how much equity you have. Lenders look at this to decide how risky your loan is and what terms they can offer.

If your property is worth more than you thought, that’s great news! It means you have more equity and a lower LTV, which could give you better options for remortgaging. But if it’s worth less, your LTV goes up, which might make remortgaging less beneficial.

How Much Could You Save By Remortgaging?

On average, UK homeowners save at least £294 each month, adding up to £3,258 a year. However, savings vary based on different situations. Your potential savings depend on factors such as:

- Your household income

- Level of current debt (personal loans, credit cards, bank overdrafts, etc.)

- The amount of time you’ll borrow for.

Costs and Fees of Remortgaging

To work out potential savings, you also need to consider the increasing fees which add to your mortgage cost.

Here’s what you need to watch out for:

Early Repayment Charges

As discussed earlier, these are fees your current lender might charge you if you’re keen to break free early. It’s their way of saying ‘not so fast’.

These charges can vary, but they’re usually a slice of your outstanding loan.

- Typical Cost: Varies, often around 1% and 5% of the outstanding loan.

- Paid To: Current lender.

- Do You Always Need To Pay This Fee? Yes, if you’re jumping ship early.

- How Do You Pay It? Usually at the time of remortgaging.

Exit Fee

Also known as a mortgage discharge fee, this is what you pay your current lender to cover the administrative costs of closing your mortgage account when you remortgage.

- Typical Cost: £75-£300

- Paid To: Current lender.

- Do You Always Need To Pay This Fee? Generally, yes, when you close your current mortgage.

- How Do You Pay It? At the time of remortgaging or included in the final balance.

Mortgage Arrangement Fee

This is a fee that lenders charge for setting up your mortgage. It’s one of the most significant charges in the mortgage process.

It’s important to consider this fee as part of the total cost of the mortgage, as it can substantially impact the overall affordability of the deal.

- Typical Cost: £0 to £2,500, or 1.5% to 2% of the loan for large mortgages

- Paid To: New Lender

- Do You Always Need To Pay This Fee? Not always, as it varies by lender and mortgage product.

- How Do You Pay It? Upfront or add it to your mortgage

Booking or Reservation Fee

Some lenders charge this fee to secure a particular mortgage deal, like a fixed-rate or tracker mortgage. This fee is typically for the lender’s assurance that you’re committed to the deal.

- Typical Cost: Varies, but can range from £100 to £2,000.

- Paid To: New lender.

- Do You Always Need To Pay This Fee? Not with all mortgage products.

- How Do You Pay It? Always upfront and non-refundable.

Valuation Fee

This fee covers the cost of assessing the value of your property. Lenders require this to ensure the property offers sufficient security against the mortgage loan.

- Typical Cost: Around £300 or more.

- Paid To: New lender or a valuation company.

- Do You Always Need To Pay This Fee? Not always. Some lenders are willing to pay for you.

- How Do You Pay It? Always upfront.

Legal Fees

These fees cover the legal work involved in remortgaging your property. This can include checking the title, drafting the mortgage deed, and managing the funds transfer.

- Typical Cost: £800 and £1,500.

- Paid To: Your solicitor or conveyancer.

- Do You Always Need To Pay This Fee? Often required. Some lenders might pay for you.

- How Do You Pay It? Always paid upfront.

Broker Fees

The mortgage maze can be tricky, and a good broker can be your guide. But even guides need their dues.

If you’re considering a broker, ask about their fees straight away. And a word to the wise – if they want their fee upfront, tread carefully; you don’t want to lose your money if you decide to take a different path.

- Typical Cost: Typically between £0 and £500, though it can vary.

- Paid To: Your broker.

- Do You Always Need To Pay This Fee? Not necessarily. Some brokers don’t charge a fee as they receive a commission from the lender.

- How Do You Pay It? Usually upfront, but practices can vary.

After knowing the potential fees when remortgaging, it’s time to crunch the numbers!

Use the calculator to see what remortgage options could be within your reach. If you’re planning to cash out some equity, include that amount; otherwise, feel free to leave that field empty.

This estimate helps you plan your finances better. But keep in mind, it’s just an estimate. Extra fees like legal costs, surveys, or early repayment charges can change the picture.

So, where to go from here? For precise costs and the best deal, a reliable mortgage broker is your best bet. They can give you advice that fits just right for you.

Simply, drop your details into this form, and we’ll pair you with a good remortgage broker.

Which Remortgage Type Best Suits Your Goals?

There’s no magic “one size fits all” in remortgages. The perfect one depends on your reason for remortgaging.

Ask yourself: what do I want to achieve with this new loan? That will help you figure out what your new loan needs to do.

To spark some ideas, here are some of the most popular types of remortgages:

Buy To Let Remortgages

This type of remortgage is for people who want a better rate on a second home they rent out.

It’s a good way to save money each month, raise money for home improvements, or expand their portfolio by purchasing more properties.

Debt-Consolidation Remortgages

This type of remortgage lets you borrow extra money to clear high-interest debts such as credit card bills, council tax, car loans, or overdrafts.

It’s a second chance to hop in the driver’s seat of your finances and prove you can handle it.

Debt consolidation remortgages help in TWO ways:

- They combine all your payments into one monthly mortgage, removing the hassle of multiple due dates, and

- They usually offer lower rates than high-interest debts like credit cards, reducing your monthly outgoings significantly.

Let’s face it, credit card debt is expensive (an average of 23.57%** in the UK) so the sooner you can pay it off, the better.

Before you jump in, though, remember: consolidating debts means stretching short-term loans over the longer life of a mortgage.

It’s crucial to balance the immediate relief with the long-term cost. Make sure this move fits snugly into your overall financial plan.

**Average interest rate on credit cards as of August 2023.

Home Improvement Remortgages

Remortgaging for home improvements is quite common. Homeowners will use it as a way to raise money to make improvements to their homes.

Things like adding an extension, renovating a bathroom or putting in a new kitchen.

In any case, the lender takes the same issues into consideration…

How much equity you have in your home and can you afford to keep up with the payments. As well as the type of property, cost of the home improvement, your credit history and financial circumstances.

Product Transfer Mortgages

In the UK, a lot of folks are choosing to switch their mortgage deal with their current lender, known as a product transfer.

In fact, UK Finance reports that 84% of remortgagers went for this option in the second quarter of 2023. It’s a popular choice because it’s easy, often cheaper, and you don’t have to go through the hassle of finding a new lender.

This approach also dodges extra fees from remortgaging with a new lender and makes the whole process quicker and less paperwork-heavy.

But, it’s worth thinking about whether you could find a better deal or cheaper rates with other lenders.

While sticking with your existing lender is convenient, sometimes shopping around can land you an even sweeter deal that aligns perfectly with your current financial situation or life changes. So, it’s a good shout to weigh up your options before making the switch.

Remortgage to Release Equity

Switching your mortgage to free up equity can be a smart move for homeowners wanting to tap into the value they’ve built up in their home.

Basically, you get a new mortgage that’s larger than your current one, and the extra money is handed to you in cash.

You can use this extra cash for things like home improvements, buying a new car, or paying off other debts.

It’s a good option, especially if you’ve built up a lot of equity in your home. But remember, doing this means your total mortgage debt goes up. It’s important to make sure you can manage the bigger repayments as part of your budget.

Should You Stay With Your Current Lender or Switch?

Remortgaging can be a head-scratcher, especially when it comes to choosing a lender.

Staying with your current lender can be easier. They might offer a new deal without a full remortgage, called a product transfer. It’s faster, simpler, and you might not need a lawyer.

However, switching to a different lender has its perks too. Many of them try to tempt you with offers like free legal services or cashback. Plus, they might have lower interest rates than what you’re currently paying.

For the best outcome, it’s a good idea to chat with a mortgage broker. They’ve got the inside scoop on deals that you might not find on your own.

In the end, whether you decide to stay put or make a switch, it’s all about what works best for you. And remember, the right choice now could save you a tidy sum over time.

Which Mortgage Type Fits You?

Picking the right mortgage is as important as choosing your home – it has to fit your life and your budget.

When it comes to remortgaging, repayment mortgages often lead the way. They’re straightforward and widely used.

However, for those seeking flexibility or with a solid exit plan, an interest-only mortgage might be a good option. It’s important to note, though, that these days, interest-only options are rare.

Understanding these two types can help you make better mortgage decisions.

Let’s go deeper to help you pick what works for you…

Repayment vs. Interest-Only

Repayment Mortgages

In a repayment mortgage, your monthly payments are divided into two parts: one part goes towards paying the interest on the loan, and the other part reduces the principal amount you borrowed.

Over time, as you keep making payments, the amount you owe decreases, and the equity in your home increases.

Pros

- You own the property outright at the end of the mortgage term.

- Each payment increases your equity in the property.

- Over time, you’ll pay less in interest compared to interest-only options.

Cons

- Your monthly payments will be more than those for interest-only mortgages, which could stretch your budget.

- You might need to put down a larger deposit upfront.

Interest-Only Mortgages

With an interest-only mortgage, your monthly payments only cover the interest on the loan.

The principal, or the original amount borrowed, remains the same throughout the mortgage term. You are expected to repay the principal in a lump sum at the end of the mortgage term, using a separate investment, savings, or other means.

Pros

- You’re only paying the interest each month, so your payments are smaller.

- The lower payments free up cash for other investments or expenses.

- You might get away with a smaller deposit compared to repayment mortgages.

Cons

- You’ll need a solid plan to pay off the entire loan at the end of the mortgage.

- Depending on investments or property value increases to pay off the loan can be uncertain.

- You might end up paying more in interest over time than with a repayment mortgage.

- Your payments don’t increase your ownership of the property, which is risky if property values don’t rise.

Remortgage Fact:

Switching to a different mortgage type does not mean you’re starting from scratch. Your lender will count ALL your past payments towards your financial health.

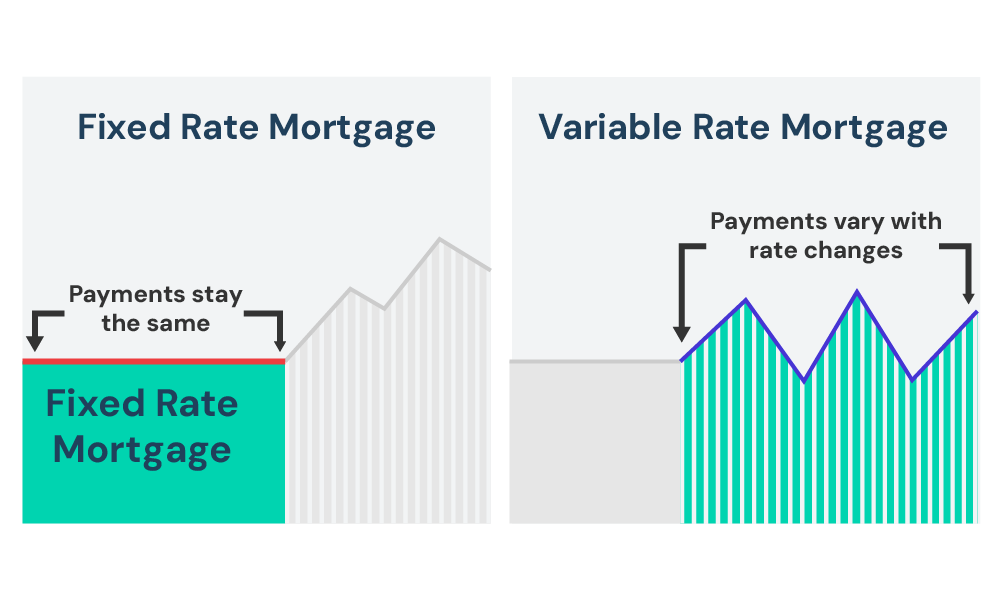

Fixed-Rate Mortgages

A fixed-rate mortgage locks your interest rate for a set period. Whether it’s for two, five, or even ten years, your monthly payments stay the same throughout this time.

Pros

- Protection against interest rate rises that affect variable rates.

- Predictable monthly payments make budgeting easier.

- Peace of mind knowing your rate won’t change during the fixed period.

Cons

- Typically higher rates than variable options at the start.

- Less benefit if interest rates fall.

- Early repayment charges may apply if you switch before the end of the fixed term.

Variable Rate Mortgages

Variable rate mortgages can change at any time. This means your monthly payments can go up or down based on the lender’s interest rate, which is often influenced by the Bank of England’s base rate.

This base rate shifts with the UK’s economic rhythm. When the economy is booming and prices rise (inflation), the base rate often goes up.

This makes saving more appealing and borrowing pricier, nudging you to spend less.

On the flip side, during a downturn or recession, the base rate usually drops. Borrowing then gets cheaper to push people to spend and help the economy.

Now we’ve seen the big picture of variable rates, let’s dive into the four main categories.

Standard variable rate mortgage (SVR)

After your introductory mortgage deal ends, lenders typically move you onto their SVR. This rate can fluctuate based on the market, and it’s up to your lender when and how they adjust it.

For instance, if your lender’s SVR is 4% and market conditions push them to increase it, your rate might jump to 4.25%.

Pros

- Flexibility to overpay or switch deals without facing early repayment charges.

- You might benefit from rate reductions if your lender decides to lower their SVR.

Cons

- Generally more expensive than other mortgage types.

- Unpredictable rate changes can make budgeting difficult.

- It’s wise to consider switching deals as your introductory period ends to avoid higher SVR rates.

- Lenders may not pass on the full benefits of rate decreases, and you might face rate hikes at their discretion.

Discount Rate Mortgages

This is the same as your lender’s standard variable rate but with a discount. The discount is for a specific period and a set percentage (usually 2 or 5 years).

For example, if the lender’s SVR is 4% and the discount is 1%, you’ll pay a rate of 3%. However, if the SVR increases to 4.5%, your rate would also rise to 3.5%.

Pros

- Initially lower rates, offering short-term affordability.

- Similar flexibility in payments as other variable rate mortgages.

Cons

- Payments can rise if the lender’s SVR increases.

- The discount period is temporary, with rates typically reverting to the higher SVR afterwards.

- You might not fully benefit from rate decreases, as you’re still subject to the lender’s discretion in setting the SVR.

Tracker Rate Mortgages

Tracker mortgages move directly in line with the Bank of England’s base rate. For instance, if the base rate is 1% and your tracker mortgage is set at base rate plus 1%, your mortgage rate would be 2%.

Pros

- Transparency in rate changes, as they directly track the base rate.

- Potential for lower payments if the base rate drops.

Cons

- Your payments can increase if the base rate rises.

- Less predictability in monthly payments compared to fixed-rate mortgages.

Capped Rate Mortgages (Hybrid Option)

Capped rate mortgages are a less common option these days. They offer a variable rate, which could be a tracker or a discounted deal, but with a safety net.

There’s a ceiling on how high your interest rate can go, protecting you from drastic rate increases.

For instance, if your mortgage has a capped rate of 5% and the lender’s rate increases to 6%, you would still only pay up to 5%.

Pros

- The cap ensures your payments won’t exceed a certain level, offering some security.

- You can benefit from savings if the rates drop below the cap.

Cons

- Rates and payments can fluctuate up to the capped level.

- Capped rates are usually higher than standard variable rates to account for the cap feature.

Special Features of a Mortgage

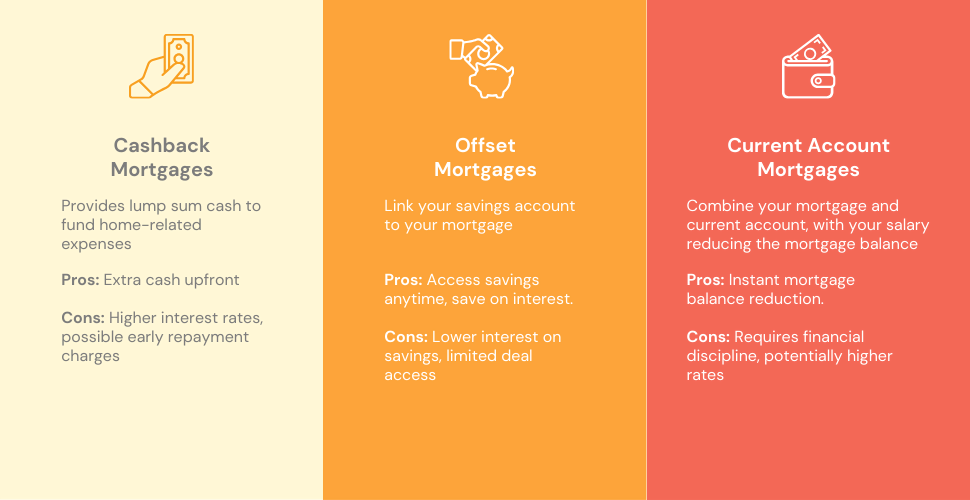

Cashback Mortgages

This provides you with a lump sum of cash when you take out your mortgage. This can be particularly helpful if you’re remortgaging and need some extra funds to cover the costs associated with moving or improving your home.

Pros

- You get extra cash upfront, and cover home-related expenses.

- This can be helpful if you’re saving for a deposit.

Cons

- Often come with higher interest rates compared to other mortgage types.

- Early repayment charges may apply if you decide to pay off your mortgage early.

Offset Mortgages

Offset mortgages link your savings account to your mortgage. Essentially, the money in your savings account is ‘offset’ against your mortgage, meaning you only pay interest on the mortgage amount minus your savings.

For example, if you have a mortgage of £170,000 and savings of £15,000, you only pay interest on £155,000.

This can be a smart way to use your savings to reduce the cost of your mortgage while still having access to your funds.

However, be mindful that withdrawing your savings reduces the offset effect on your mortgage.

Also, while you save on mortgage interest, offset mortgages might come with higher rates than standard mortgages, so it’s important to assess if the benefits outweigh the costs.

Pros

- Access your savings anytime without penalty.

- Save on mortgage interest payments and potentially pay off your mortgage faster.

Cons

- Your savings might not earn as much interest as they would in a separate account.

- You might not have access to certain discounted rate deals.

Current Account Mortgages

A particular type of offset mortgage is the Current Account Mortgage. Here, your mortgage and current account are combined.

When your salary lands in the account, it automatically reduces your mortgage balance.

For instance, if you have £5,000 in your current account and a mortgage of £90,000, you effectively owe £85,000. Any deposit you make, such as your salary, instantly reduces your mortgage balance.

It’s a unique way to manage your money, but it requires careful financial planning. And while you’re saving on mortgage interest, it’s worth noting that offset mortgages might carry higher rates than standard ones. So, do the maths and ensure the savings on interest really do tip the scales in your favour.

Important Note

These mortgages are best suited for those who are financially disciplined. You’ll need a consistent income or a healthy savings pot to benefit from this mortgage type.

It’s crucial to keep a close eye on your spending, as it’s easy to lose track when your mortgage and current account are intertwined.

Flexible Mortgage Options

Overpayment Options

Overpayment allows you to pay more than your regular mortgage payment. This means you could pay off your mortgage faster and save on interest. Many lenders allow you to overpay up to 10% of your mortgage balance each year without a penalty.

However, it’s crucial to understand the specifics of your mortgage agreement, as paying off your mortgage before the term ends can sometimes lead to early repayment fees.

Pros

- Reduces the total amount of interest you pay.

- Gives you the flexibility to clear your mortgage earlier.

Cons

- There might be limits on how much you can overpay.

- Not all mortgages offer this feature without penalties.

Payment Holiday Options

Sometimes life throws a curveball, and you might need a temporary break from your mortgage payments. This is where payment holidays come in.

You can pause your payments for a short period, usually a few months, giving you breathing space when you need it most.

To access this option, you’ll need to check your mortgage agreement and get in touch with your lender to apply for a payment holiday.

Pros

- Offers temporary relief during financial hardships.

- Helps you manage unexpected expenses.

Cons

- Interest continues to accrue during the holiday, increasing the total amount you owe.

- Not all lenders offer this, and there may be conditions to meet.

That’s quite a bit to take in, isn’t it?

You might be brimming with questions or feeling a tad overwhelmed right now.

If that’s the case, having a chat with a reliable mortgage advisor could be your best bet. They’ll offer you bespoke advice and help you pinpoint the deal that suits you perfectly.

Get Your Facts Straight Before Remortgaging

The better your prep, the smoother the step.

Being well-informed and ready helps you make smart choices for your family, home, and finances.

While the whole process, including the legal aspects, usually last from 4 to 8 weeks, it is best to start planning at least 3 months before your current deal ends.

So, don’t delay!

Here are steps you can take to prepare for your remortgage:

Obtain Your Credit Report…

To begin, we recommend taking our Free Financial Health Check Here.

After that, you can do what lenders do to find out your credit. Head over to Experian, Equifax, and TransUnion.

They’re the big three credit reference agencies and you can find out your score from them for FREE!

- Most lenders will check your credit history, especially if you’re borrowing more money, or changing the type of mortgage or length of contract.

- Expect to have your credit report looked at. It’s how a lender decides if you’re a good person to loan to.

Popular question: Can I Remortgage With Bad Credit?

The short answer is probably!

Of course, lenders like to see there’s little risk in lending to you and that you’ve paid up debts or aren’t behind on any financial commitments, but…

Some lenders will consider working with you despite a low credit score.

>> More about Remortgaging with a Bad Credit

Figure Out Your Home’s Value…

- Getting a professional valuation is key to knowing how much money you can borrow and how much equity you’ve built up.

- Prices of homes go up and down. Knowing its value gives you the upper hand when trying to negotiate a fair deal.

- More equity = better mortgage rate

- You’ll also need to calculate how much you owe your current lender.

And finally…

Here’s A List Of All The Paperwork You’ll Need:

Employees need:

- Personal bank statements for the last 3 months

- Payslips for the last 3 months

- Your P60 (the most recent)

- Do you receive any benefits like child support, spousal support or child tax credits? You’ll have to provide proof.

- 2 utility bills (mobile phone bill doesn’t count) with your current address

- Driver’s licence or passport

Self-employed need:

- Personal bank statements for the last 3 months

- Do you receive any benefits like child support, spousal support or child tax credits? You’ll have to provide proof.

- 2 utility bills (mobile phone bill doesn’t count) with your current address

- Driver’s licence or passport

- Own a limited company? You’ll need 2 years’ worth of audited accounts

- Contractor? Proof of your last 12 months of contracts and all your current contracts (signed by every party)

- Business bank statements for the last 3 months (all your business bank accounts)

- Tax Year Overview (past 3 years) and your last three SA302’s (Tax Calculation)

(Not all lenders will ask for all of these documents, but it’s better to have them and not need them.)

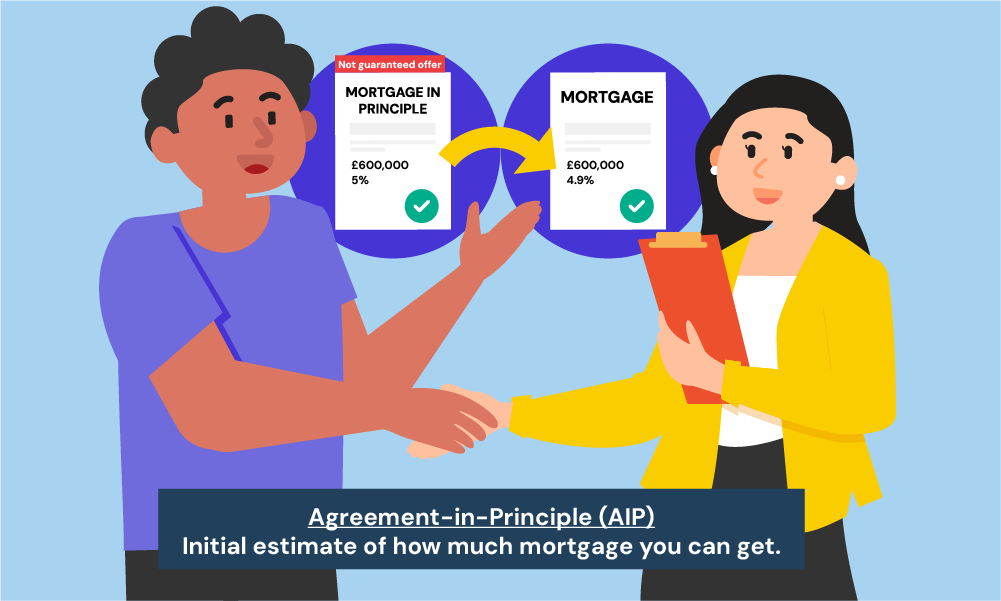

Do I Need an AIP To Remortgage?

It’s not usually necessary if you’re sticking with your current lender, as they already know your financial situation.

However, if you’re looking to switch lenders, getting an AIP can be helpful. It gives you and the new lender a clear idea of how much you could borrow.

The process is similar to what you might have gone through with your first mortgage.

Just remember, an AIP isn’t a final offer, but it can guide your remortgaging decisions and show lenders you’re serious.

Ready To Remortgage? Here’s How…

Right now, you’re deep into the process, and it’s time to get your ducks in a row for the big remortgage move.

Before you leap into the wide world of mortgage deals, start where you are: your current lender.

They’ve been your financial partner so far, and they might just have the perfect deal to keep you on board.

You can reach out and see what remortgage options or ‘product transfers‘ they offer. These deals can save you money on fees, especially if you’re not borrowing more money.

However, these deals aren’t always advertised, so you may need to ask about them specifically.

Next, consult with your bank too. They may have special offers available, especially for existing customers. Don’t expect the best deal right away, but it’s worth asking as you might save money compared to other lenders.

With those offers in hand, it’s time to play the field. The market is full of options, and you have two main ways to go about it.

Getting The Deal – On Your Own Or With An Advisor?

It’s totally understandable if you’re thinking, “I’ve got this, I can sort my own remortgage.”

And you’re not wrong to feel that way.

Going it alone means diving into websites to compare deals, crunching numbers, and understanding all the nitty-gritty details.

It’s like solving a big puzzle – it demands your time and effort, but it can be rewarding to figure it all out on your own.

However, while it’s great to do your research, remortgaging isn’t always a walk in the park. It can be a hassle, especially with all the legal and financial terms to get your head around.

That’s why it’s a good idea to complement your search with a trustworthy advisor.

A good mortgage advisor will take the time to understand your situation and look for mortgage terms that benefit you, not their own pockets. They’ll also be able to do most of the heavy lifting so you don’t have to do it all on your own.

But before you go off and choose an advisor, read this next part carefully…

Understanding Different Types Of Brokers/Advisors

There are different types of mortgage brokers or advisors. Some offer free services (or say they do) to get you in the door.

First, make sure they’re licensed (the most common qualification is called CeMAP). It sounds silly, but you don’t want to take advice from someone who doesn’t have the proper qualifications.

Then interview them! Ask each advisor the following list of questions before taking the next step.

- Is there a fee for your services? While they may not charge any fees up front, they may charge one when the deal goes through. Other times the lenders pay the mortgage broker a finder’s fee for introducing you to them. Whatever the case may be, you want to know so you can plan accordingly.

- How many lenders does the broker work with? The more options, the better your chances of landing a good rate. Sometimes these lenders have deals available only through the broker.

- What types of mortgage terms do you offer? Be sure to ask about APR and interest rates. No mortgage is better than another. It all depends on your situation.

- What credit qualifications do I need?

- How does the mortgage approval process work?

- What type of mortgage should I go for?

- Is there any way to save on interest?

- Does this deal allow for larger payments without being penalised?

- Is there a penalty for early repayments?

- What are the closing costs I need to plan for?

- Is it possible to remortgage with this new deal?

- Do I need to take out mortgage insurance?

Once you know your financial situation and have picked an advisor, here’s what you can expect in the remortgaging process:

- Apply for your new mortgage

- Get your property valued

- Prepare for legal checks (Conveyancing)

- Receive and review the mortgage offer

- Settle your old mortgage

- Completion

1. Apply for your new mortgage

Your advisor will guide you through the formal application for your new mortgage. This means gathering paperwork like payslips, ID, bank statements, and details of your current mortgage.

Accuracy is key, and your advisor will double-check everything to avoid any delays later. They can also negotiate with lenders on your behalf to secure the best possible terms for your financial situation.

2. Get your property valued

Next, to ensure they’re lending you the right amount, your lender will arrange for a professional valuer to assess your property’s value. This step is important as it affects your mortgage terms, like the loan amount and interest rate.

While your advisor doesn’t directly handle this, they’ll explain its importance and how it affects your mortgage.

3. Prepare for legal checks (Conveyancing)

Conveyancing solicitors handle the legal side of things. They’ll make sure there are no legal issues with your property and that all the paperwork for switching from your old mortgage to the new one is in order.

This process involves documents related to property titles, land registration, and ensuring the property’s legal compliance.

4. Receive and review the mortgage offer

Once everything’s lined up, the lender sends you a formal mortgage offer outlining the loan amount, interest rate, and repayment period.

Your advisor will thoroughly review it with you, making sure you understand the terms and whether it fits your financial goals and circumstances.

5. Settle your old mortgage

If you accept the mortgage offer, your new lender will take care of settling your old mortgage. This means they’ll pay off the remaining balance to your old lender.

Your advisor can guide you through this process, which might involve exit fees or early repayment charges depending on your old mortgage terms.

6. Completion

Once the old mortgage is settled, congratulations, you’re officially remortgaged! Your new terms kick in, and you’ll start making payments as agreed.

During this phase, your advisor will confirm everything’s in order. They will ensure you understand your new payment schedule and any other obligations. They will also oversee the signing of an updated mortgage agreement along with any other relevant documents to finalise the process.

Beyond the Finish Line…

Your advisor remains your mortgage ally even after completion. They’ll ensure you have all the necessary documents, understand your next steps, and can guide you on making overpayments or handling any future financial challenges.

Note that the same process applies if you prefer going solo. The only difference is that you’ll be doing all the legwork and negotiations yourself, which will naturally require more time and effort.

On the other hand, if you choose a product transfer, you’ll need to talk to your current lender first. They’ll explain the details of their offer, including the terms, rates, and any fees.

If you’re happy with everything, you’ll need to fill out some paperwork to start the transfer.

Once that’s done, your lender will confirm the switch and make sure you understand the new terms and payment schedule.

Planning The Future

Moving with a Mortgage? Here’s What You Need to Know

If you’re planning to move and have an existing mortgage, you face a decision: should you transfer your current mortgage to the new property, or is it time for a new mortgage deal?

Portable mortgages allow you to move your current mortgage to your new home. You can check this by reviewing your agreement or contacting your lender.

If it is portable, you might be able to transfer your existing deal to your new home.

However, this is not guaranteed. Your lender will take time to reassess your financial situation and the new property’s value. They need to ensure it’s a sound decision for them too.

If your new home is more expensive, and you need to borrow more, you might face limitations.

Lenders often allow you to port only the amount you currently owe, and any additional funds needed may be subject to a different mortgage product or the lender’s standard variable rate.

Also, be mindful that while portability offers convenience, the rates for portable mortgages can sometimes be higher, adding to the overall cost.

On the flip side, if porting your mortgage is impossible or doesn’t align with your needs, consider a new ‘home mover’ mortgage.

This involves settling your current mortgage, usually with the sale proceeds of your old home, and securing a new mortgage for your new property.

This process is similar to getting a first-time buyer’s mortgage and might be beneficial if current market rates are more favourable than your existing deal.

In both scenarios, it’s best to plan and talk to an advisor before you get a portable mortgage or move to a new home.

The numbers are important so you’ll want to double or even triple-check you’re making a good decision before it’s too late and you find yourself in a sticky situation.

And finally…

How To Protect Your Home With The Right Mortgage Insurance

Taking out mortgage insurance is a great choice, especially if your family or household relies on only one income. If you were to get sick, have an accident and not be able to work would you be able to keep up with payments?

For many people relying on one income, the answer is “no”.

Having mortgage insurance means if you found yourself in a situation like the above your insurance would cover the cost of your mortgage payments until you can return to work.

As you look for mortgage insurance, these factors comes into play:

- How much it costs every month, which depends on your salary.

- The type of policy that suits your needs.

- The size of your mortgage payments.

- How soon you want the policy to pay.

In addition, you will find lenders and brokers offering you different types of insurance, like Mortgage Payment Protection Insurance (MPPI), life cover, or building insurance.

Let’s break these down:

Mortgage Payment Protection Insurance (MPPI)

MPPI is designed to cover your mortgage payments if you’re unable to work due to illness, or injury, or if you lose your job.

While it sounds like a good safety net, it’s important to be cautious. Make sure the policy is suitable for you, especially if you have health issues, are self-employed, or there’s a chance your job might not last.

Read everything carefully – know what the policy covers, how long you have to wait before it starts paying, and how long it will pay out for.

And remember, a broker offering you MPPI might not always have the cheapest option, so doing a bit of homework yourself is a good idea.

Life Cover

This is an insurance policy that pays out a lump sum to your loved ones if you pass away. It’s designed to provide financial support and peace of mind.

Your lender might offer you life cover as part of your mortgage package. While it’s convenient, it’s worth shopping around.

The deal from your lender might not always be the best on the market. So, take a step back, compare offers, and you could end up saving significantly.

Buildings and Contents Insurance

Buildings insurance covers the structure of your home, and contents insurance covers your belongings inside it.

Lenders usually require you to have building insurance, but be cautious if they try to bundle their insurance with your mortgage. These bundles aren’t always competitively priced.

Compare their offer with what you already have or can get elsewhere. Keep in mind that some lenders may charge a fee if you choose to arrange your insurance instead of taking theirs.

In short, while getting mortgage insurance is important, be smart about the other insurance products linked to your mortgage.

Take your time, research, and ensure you’re getting the best for your needs. Your home is a big investment, and protecting it properly is crucial.

Tips To Boost Your Chances of Remortgaging

Get on the Electoral Roll

Being on the electoral roll is free and gives your credit score a surprising bump. It helps lenders confirm your address and stability.

Registering takes minutes at www.gov.uk/register-to-vote.

If you’re not eligible due to residency status (for foreign nationals), you can add a note to your credit file to provide alternative proof of residency.

Check Your Credit File First

Before any lender checks your credit, check it yourself! You can get free credit reports from Equifax, Experian, and TransUnion.

Look for errors and fix them directly with the agency. Make sure your address and personal details are correct on all your accounts.

It’s like tidying up your financial house before the guests arrive.

Keep Your Address Updated

Make sure your address is updated on all active accounts. Even that old mobile contract you barely use could cause a stir if it’s registered at an old address.

Lenders love consistency.

Cut Ties with Old Finances

If you once shared accounts with flatmates or exes, their credit history might still be clinging to yours. Free yourself by writing to credit agencies and requesting a “disassociation.”

Use Credit Cards Wisely

If your score needs a boost, consider getting a credit card. Use it for everyday purchases, but always pay it off in full each month.

This shows lenders you’re responsible with credit, like a financial superhero with a budget cape!

Let Time Heal

Got some bumps on your credit report, like missed payments or overdue debts? The good news is that these marks can fade after a few years, usually around six.

So, waiting a little longer before applying for your remortgage can show lenders a cleaner and more appealing record.

It’s also worth noting that even credit card applications can impact your score, though they only stay on your file for a year.

If you’ve applied for a lot of credit cards in a short period, it might be wise to wait until those inquiries drop off too. These inquiries can signal to lenders that you’re seeking additional credit, which could raise some flags.

By giving yourself some time to space out your applications, you can present a more stable picture of your financial situation.

Avoid Credit Card Cash Withdrawals

Don’t raid your credit card for cash withdrawals. Lenders see that as a red flag like you’re living beyond your means.

Show Me the Money

Lenders care about more than just how much you earn, they want to see how you manage it. Show them your recent payslips and bank statements. Be honest and upfront, even if things haven’t been perfect.

If you face hiccups like furloughs, explain them openly. Prove you’re back on track and ready to handle a mortgage responsibly. Remember, transparency is your friend!

Keep an Eye on Your Expenditures

Your bank statements are a storybook of your spending habits. Lenders will read it closely.

Frequent overdrafts or unexplained outgoings can raise eyebrows. Make sure your financial narrative is one of prudence and foresight.

Have Your Story Ready

Sometimes, our bank statements tell unusual stories – maybe a regular payment to a family member or an odd large purchase.

Be ready to narrate these tales convincingly. Lenders appreciate honesty paired with a reasonable explanation.

Understand Your Disposable Income

Knowing how much you save is just as crucial as your earnings. It’s all about what’s left in your wallet after you’ve settled your bills. This remaining sum is known as your disposable income, and it holds significant importance for lenders, much like your salary.

The bigger your savings pot, the more relaxed lenders feel. It directly mirrors your capability to handle a mortgage.

Financial Makeover

Consider this as tidying up your finances. Cut down on your monthly expenses by getting rid of unnecessary subscriptions and negotiating better deals on your bills. A more streamlined and efficient list of expenses is appealing to lenders.

Stress-Test Your Finances

Ask yourself, ‘Can I manage my mortgage if interest rates go up?‘ Lenders will assess your ability to make payments at higher rates.

You can use mortgage calculators to anticipate these scenarios. Being prepared for the worst gives you the best chance at approval.

Top Up Your Deposit

Every bit you add to your deposit helps.

For instance, say your home’s worth is £150,000, and you started with a 10% deposit (£15,000). Bumping that up to 15% (£22,500) shrinks your loan-to-value (LTV) ratio from 90% to 85%.

This not only makes you more attractive to lenders, but it could also snag you a sweeter interest rate, saving you money on both your monthly payments and the overall mortgage cost.

Keep Clear of Your Overdraft

Regularly using your overdraft can signal financial instability. If you often find yourself overdrawn, transferring your overdraft to a 0% interest money transfer card can be a smart move.

This lets you clear your overdraft without racking up extra charges, showing lenders you’re actively managing your finances and reducing your liabilities before remortgaging.

Say No to Payday Loans

These can be credit score killers, screaming “high risk” to lenders. If you’ve leaned on payday loans in the past, focus on building your own mini-emergency fund.

Socking away a manageable amount, like £20 a month, not only gives you a financial buffer, but also shows lenders you’re committed to responsible money management and building stability.

Trim Your Unused Credit

Having a bunch of unused credit lying around can raise eyebrows about potential future debts. Take a look at your credit lines and consider closing any unused accounts, especially those with high limits.

But be careful!

Closing old accounts with a good history can temporarily affect your credit score, so weigh the long-term benefits before taking action.

Put Your Savings To Work

Your savings can do more than just sit there. They can actively improve your remortgage terms.

For example, slashing £3,000 off a £100,000 mortgage takes your LTV from 75% to 72%.

This small decrease could qualify you for a lower interest rate, potentially saving you hundreds of pounds a month and thousands over the entire mortgage term.

The Bottom Line

For a quick reference, here’s a handy recap:

Check If You Qualify – If you have an existing mortgage, your current deal ends in six months or less, you have sufficient income, your debt is below 90% of your home’s value, and you have a good credit score, chances are you qualify!

Evaluate if it’s the Right Choice – There are many reasons to remortgage, but the main one is usually to save money. To make sure it’s the best decision for you, follow the 3Cs with your existing lender: (1) Confirm any exit fees; (2) Check the ERCs; and (3) Compare your current mortgage against your home’s value.

Crunch the Numbers (Savings and Fees) – Before you bite the bullet, calculate how much you might save or spend with a new loan. This’ll answer the big question: “Should I remortgage at all?” We’ve got a handy remortgage calculator if you want a rough idea of the numbers.

Define Your Remortgage Goals – Your research will show you different types of remortgages available in the UK, like buy-to-let, debt consolidation, home improvement, product transfer, and equity release. To choose the right one, be clear about your financial goals and what you want to achieve with your remortgage.

Choose Your Mortgage Terms – Now you’ve picked your remortgage option, it’s time to decide how you’ll handle repayments. Will it be all principal and interest, or interest-only? And what features do you need? Fixed or variable rate? Extras like cashback, offsetting, or flexibility? The key is to find what fits your budget and keeps you comfortable.

Gather More Information – The key to a smooth remortgage is being well-prepared. Start by getting a free Financial Health Check to understand your financial standing. Then, download your credit reports for free from credit agencies’ websites. Check your property value, gather any necessary paperwork, and consider getting an Agreement in Principle (AIP) before diving into the remortgage process.

Remortgage Time! – You’ve cracked the code for a smooth remortgage, and it’s time to cross the finish line. But hold your horses! Check in with your current lender or bank first. They might have sweeter deals under the radar, so asking directly can save you money. Once that’s done, decide how you want to roll: do it yourself or use a good mortgage broker? For a stress-free experience, we recommend using a reputable mortgage broker.

Plan Your Mortgage Move & Protect Your Home – If you’re moving house while you’re still paying off a mortgage, check if it’s portable with your current lender. If not, consider a new “home mover” mortgage. You can also explore mortgage protection options like life cover or MPPI to safeguard your home, family, and future in case of unexpected events.

That’s a lot to digest, so here’s what we recommend…

First, take the Money Saving Guru FREE 30-second assessment here.

Then, we’ll:

✅ Compare the leading UK lenders to uncover the best rate for YOU…

✅ Save you hours of trying to do it all on your own…

✅ Access exclusive deals not available on the high street, so you save big…

✅ Provide free, no-obligation quotes

✅ And introduce you to our vetted mortgage advisors so they can hold your hand throughout the whole process.

One last tip: Mortgage trends are always changing. To avoid overpaying, keep an eye on the market, especially in the 3-6 months before your fixed rate ends.

Remember, time is irreplaceable. Stay ahead of the curve by subscribing to Money Saving Guru’s newsletters. You’ll get exclusive mortgage updates and money-saving tips straight to your inbox.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What determines if a lender will finance my property?

Lenders carefully assess properties before lending. They consider your property’s value, construction, and location. Issues like proximity to businesses, need for significant renovations, or certain building materials can be red flags.

Lenders vary in their criteria, so a rejection from one doesn’t mean all will say no. Being transparent about your property’s details and using a good broker can streamline the process and improve your chances of approval.

How long should my remortgage last?

Typically, a mortgage starts with a 25-year term. If you’re looking to clear your mortgage sooner, it’s wise not to extend this term during remortgaging.

However, if your current payments are a stretch, you might consider increasing the term to reduce your monthly outgoings.

But be cautious – a longer term means more interest paid over time. Also, think about your age at the end of the term. Many lenders are reluctant to extend mortgages into your retirement years.

If your mortgage permits, maintaining a longer term for flexibility and making overpayments can be a smart move. This way, you enjoy lower monthly payments and clear your debt faster without committing to a shorter term right off the bat.

Can I remortgage after my current one ends?

Yes, you can definitely remortgage when your current deal runs out! In fact, it’s often a good idea as most lenders move you to their Standard Variable Rate (SVR) after that, which can be higher than other deals available.

That said, not all SVRs are bad, so it’s worth checking yours before switching. Start looking at new options a few months before your current deal ends. Even a small drop in your interest rate, say 1%, can save you quite a bit each month.

Just be aware of any “exit fees” your current lender might charge if you leave early, even after your deal ends. These aren’t common, but it’s worth checking to avoid surprises.

So, in short, remortgaging after your current deal ends is usually a good option, but do your research first and look out for any potential fees.

Is it possible to rent out my mortgaged property?

Yes, but you’ll need your lender’s ‘consent to let’ before renting out your property. Lenders’ responses vary; some might simply give permission, while others could require a switch to a buy-to-let mortgage or adjust your interest rate, usually leading to higher costs.

It’s crucial to discuss this with your lender beforehand to understand the implications, potential extra costs, and to ensure you’re proceeding correctly.

How often can I remortgage?

You can remortgage as many times as you want, as long as it’s financially wise for you. People often opt to remortgage when their fixed-rate term ends, to see if a better deal is out there.

Can I remortgage a government-scheme home?

Yes, you can. When you want to remortgage, the new lender will look into your financial situation. Be prepared to share details like your job, how much you earn and spend, your current mortgage info, and your credit score.

Are there alternatives to remortgaging?

Alternatives to remortgage in the UK can include equity release (Over 55+), securing a second-charge mortgage, bridging loans, or negotiating a product transfer with your current lender. Personal loans or credit cards can also be options. Consulting with a mortgage advisor is recommended before making a choice.

What to do if my remortgage application gets denied?

Don’t panic if this happens. Resist the urge to apply with other lenders right away. Instead, find out why you were rejected. A good mortgage broker can help you fix the issue and guide you to lenders who can meet your specific needs.