What is Remortgaging?

Remortgaging is when you get a new mortgage to replace the one you already have. It’s something a lot of people in the UK do to help them get a better deal, especially when the first set rate of their mortgage is over.

But first, let’s understand why someone might want to remortgage. Sometimes, after the fixed rate period of your mortgage ends, you might have to deal with a standard variable rate (SVR).

This rate can change and might make your monthly payments go up and down, which can be a bit tricky to manage.

So, how can remortgaging help?

Well, if life throws some surprises your way, like sudden expenses or changes in how much money you make, remortgaging gives you a chance to make your financial plans fit BETTER with your current life. It can even be a smart way to handle and reduce debts.

Here’s how:

– Lower Monthly Payments. By finding a better interest rate, you can pay less each month. This means you might have some extra money to take care of other debts.

– Changing Your Rate. You can switch from a changing rate to a fixed rate, or the other way around, to make your payments more predictable.

– Using Your Home’s Value. Remortgaging can let you use some of the money your home is worth for important things like fixing up your house or bringing existing debts into one place.

– Finishing Your Mortgage Sooner. If you are in a better place financially, you might choose to pay off your mortgage quicker, which can also save you money in the long run.

In the UK, remortgaging is a popular way to bring different debts together into ONE easier payment each month.

In the next parts of this article, we will look more closely at how remortgaging can be a good plan to settle debts, especially for people in the UK.

Can I Remortgage to Pay Off Debt?

Yes, you can. It is possible to remortgage to pay off debt, and it is a common reason why people in the UK remortgage.

To do this, you need to have enough equity in your home and meet the lender’s requirements.

Most lenders in the UK (around 90%) are willing to allow this type of remortgage. Remortgaging to pay off debt can simplify your finances by consolidating multiple payments into one monthly payment. This can reduce stress and help you avoid missed payments.

However, it’s important to be aware that this option can also have drawbacks.

When you consolidate short-term debt into your mortgage, you are essentially extending the repayment period, which can lead to HIGHER overall interest payments. This means that even though your monthly payments may be lower, you could end up paying MORE in total over the life of the loan.

It’s key to weigh the pros and cons of remortgaging to pay off debt before making a decision. You may also want to seek financial advice to ensure that this is the best option for your circumstances.

Should I Remortgage to Pay Off My Debts?

As mentioned earlier, remortgaging to pay off debt is a BIG decision that should not be taken lightly. There are both pros and cons to consider, here’s a breakdown to help you make a wise decision:

Pros

– Streamline your finances. By consolidating all of your debts into one monthly payment, you can simplify your finances and reduce the stress of managing multiple payments.

– Lower monthly payments. Spreading your debt over a longer period can lead to lower monthly payments, which may make your finances more manageable.

– Utilise the value of your home. Your home typically appreciates over time, which can help to offset the additional interest you may pay.

Cons

– Risk of repossession. If you are unable to make your monthly payments, you could lose your home, as it secures the mortgage.

– Higher long-term interest. Although mortgages often have lower interest rates than other debts, you could end up paying more interest over the extended period of the loan.

– Potential for large fees. Exiting your current mortgage agreement early may incur hefty fees, especially if done before the end of a specific fixed-term period.

Ultimately, the decision of whether or not to remortgage to pay off debt is a personal one. There is no right or wrong answer, and the BEST decision for you will depend on your circumstances.

How to Remortgage to Pay Off Debt?

An easy and informed way to begin remortgaging to pay off debts is to start a conversation with a good mortgage broker. They can guide you in understanding the BEST deals available and ASSIST you throughout the following steps to secure a beneficial agreement:

- Understand Your Current Mortgage. Get familiar with the specifics of your existing mortgage. Know your current rate and the terms to identify what you would prefer in a new deal.

- Determine Your Home’s Value. It’s important to know how much your home is worth. It’s best to hire a surveyor for this. They can give you a more exact value than estate agents, who might say your home is worth more than it is.

- Calculate Your Home Equity. Find out the amount of equity in your home. This is the difference between your home’s current value and the remaining mortgage balance. Your broker can help you work this out.

- Choose Your Lender Wisely. Don’t restrict yourself to your current lender. A broker can facilitate connections with a plethora of lenders, helping you find the best deal that suits your financial circumstances.

- Gather Necessary Documents. After choosing a lender, gather all necessary documents to prepare for the application process. This usually involves proof of income, identity verification, and property valuation among other things. Make sure all the details are accurate to avoid delays in the process.

How Much Can I Borrow?

The amount you can borrow when remortgaging depends on the lender’s lending criteria.

Most lenders will lend up to 75% to 80% of the value of your home, but some may lend up to 85% or more. The pool of lenders willing to lend up to 85% is smaller.

Your credit score will also be a factor in how much you can borrow. Lenders will look at your repayment history to assess your ability to repay the loan. If you have a low credit score, you may only be able to borrow a lower amount.

It is important to check your credit score before you start the remortgaging process. You can do this by getting a free credit report from the credit reference agency.

If your credit score is low, there are steps you can take to improve it, such as paying off debts and making on-time payments.

A good credit score will increase your chances of getting a remortgage approved and getting the best possible interest rate.

Use the remortgage calculator below to see what remortgage options are within your reach. If you are planning to cash out some equity, include that amount. Otherwise, you can leave that field empty.

[Embedded Remortgage Calculator]

This estimate can help you plan your money better. However, it is just an estimate. The actual figures may vary depending on additional costs you may incur, such as legal fees, valuation fees, or early repayment penalties from your current lender.

What should you do next? If you want to know the exact amount and the best offer, talk to a mortgage broker. They can give you tailored advice. Simply fill in this form and we will match you with a mortgage broker who is an expert in remortgaging.

Which Lenders Allows You to Remortgage to Pay Off Debt?

If you are considering remortgaging to pay off debt, it’s great to know that many lenders are ready to assist you. Different lenders have varied terms, and it’s vital to choose one that suits your needs best. Let’s look at some of the popular lenders and what they offer:

- West Brom – This lender also has a threshold of 80% of your property’s value for remortgaging. However, you can only allocate up to £15,000 of it for debt repayment.

- HSBC – At HSBC, you can remortgage up to 80% of your property’s worth. But, they restrict the debt repayment amount to a maximum of £50,000.

- TSB – This lender permits you to remortgage up to 85% of your home’s value. However, they keep a limit on the amount you can use for paying off debts. It can’t be more than 20% of your home’s value. And remember, your credit score matters.

- Santander – Like TSB, Santander also lets you remortgage up to 85% of the value of your home. When it comes to settling debts, they have set a cap of £50,000.

- Harpenden Building Society – Harpenden allows remortgaging up to 80% of the property value as well. But the amount you can use for debt settlement is confined to £30,000, and you need to have a good repayment history.

Note that the policies of lenders can change. Sometimes they update their requirements, especially during times when the economy is shaky. So, the conditions can vary from what is mentioned here.

Always make sure to check the latest updates before making a decision. It helps to keep you informed and make choices that suit your financial status best.

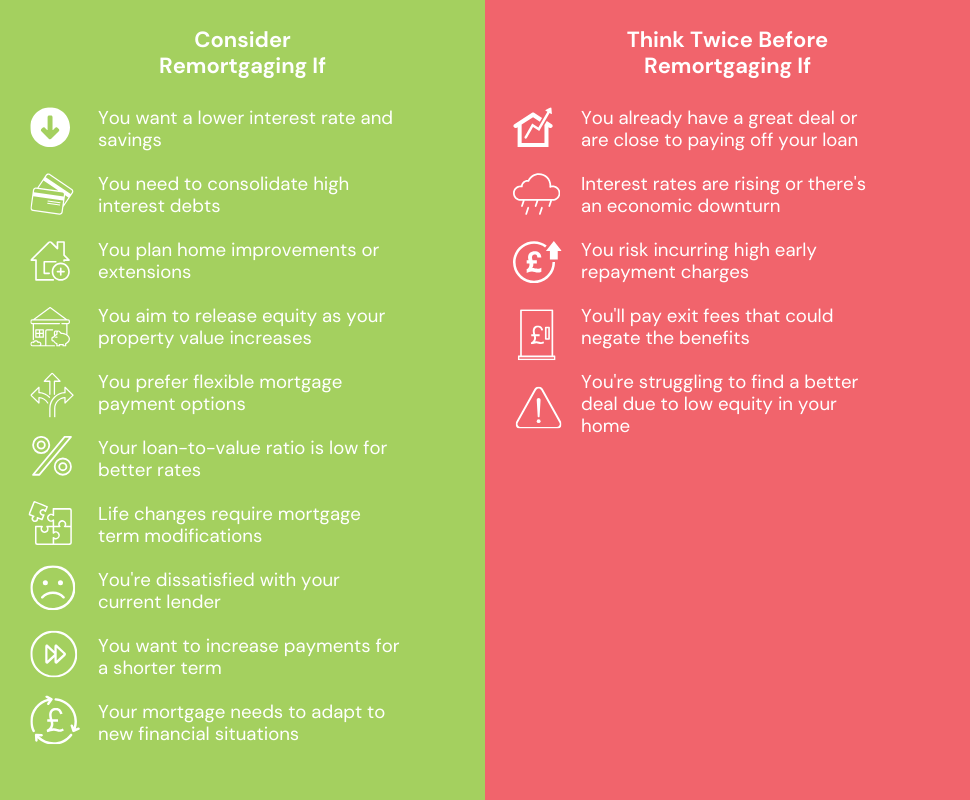

How to Decide Whether or Not to Remortgage to Pay Off Debt

Remortgaging to consolidate debts can be a breath of fresh air for many, making it simpler to manage their finances. But it isn’t a one-size-fits-all solution.

Different people, with varied financial situations, will find this choice either a boon or a bane.

Let’s delve into who should consider this option and who might want to explore other avenues.

Who Should Consider Remortgaging to Pay Off Debt?

- You have debts with steep interest rates. Bundling them into your mortgage could save you money in the long run.

- You have a steady income. This will make it easier to manage your finances if you have all of your debts in one place.

- You are juggling multiple debts and find it stressful. Bundling them into your mortgage could simplify your finances and reduce your stress levels.

Who Should Think Twice Before Remortgaging?

- You are about to clear a loan in a few months. Adding it to your mortgage could mean paying more interest over time.

- Your existing debts are minor or have low interest rates. Mixing them with your mortgage might not be cost-effective.

- You have an unpredictable income. A higher mortgage repayment might not be the best fit for you, as it could add to your financial stress.

Should I Use a Remortgage Broker or Go Solo?

Stepping into the mortgage market can feel a bit tricky, especially with its constant shifts and changes. It can be quite a puzzle, even for those who know a thing or two about finances.

But remember, you don’t have to figure it out all by yourself. Remortgage brokers are here to lend a hand. They know the ins and outs of the market, helping you spot the best deals out there.

Plus, they can increase your chances of getting approved. Using their deep knowledge and expertise, they can find a deal that fits right with your situation.

If you need more advice about successful remortgaging to pay off your debts, don’t hesitate to reach out. We will connect you with a remortgage broker who can make the whole process easier and more effective.