What is a Home Improvement Loan?

A home improvement loan is a way for homeowners to borrow money for fixing or upgrading their houses. Typically, these loans are unsecured personal loans, meaning they don’t require collateral and are based on your creditworthiness

These loans are great for all sorts of home changes, big or small, from necessary repairs to making your home look nicer.

But, there’s also another type of home improvement loan that you can get, which is secured. This means you use the value of your house as a guarantee for the loan.

However, it’s really important to know that if you go for this kind and can’t pay back the loan, you could risk losing your house. We’re going to talk more about the differences between these two and what they mean for you a bit later on.

What Types of Home Improvement Loans Are Available?

As mentioned earlier, there are two main kinds of home improvement loans: secured and unsecured. Here’s a breakdown of the two kinds:

Secured Loans

Secured loans are a good match for big renovation projects. With these loans, you’re using your house as a safety net for the lender.

It means if you can’t pay back the loan, there’s a risk you might lose your house. They’re great for when you need a lot of money for things like adding extensions or major structural changes.

The amount you can borrow with a secured loan usually starts from about £10,000 and can go up quite high, depending on how much your house is worth and your financial situation.

However, the interest rates on these loans can change over time, which can make planning your budget a bit tricky.

Unsecured Loans

On the other hand, unsecured loans are more suited for smaller home improvements. These could be things like getting a new bathroom fitted, updating your kitchen, or other projects that don’t cost as much.

The best part about these loans is that you don’t have to use your home as security. This means there’s no risk of losing your house if you face problems in paying back the loan.

Typically, with unsecured loans, you can borrow amounts starting from around £1,000 up to £25,000.

But, since these loans are not secured against your property, they might come with higher interest rates compared to secured loans. This is the lender’s way of balancing the risk of lending money without any collateral.

How To Choose the Ideal Home Improvement Loan?

When trying to decide which loan to go for, think about how big your renovation project is and how much it’ll cost.

Also, look at how much you can afford to pay back every month. You want to pick a loan that fits your project but doesn’t put too much strain on your wallet.

It’s a good idea to talk to a financial advisor, especially if you’re thinking about getting a secured loan. They can help you understand how each type of loan fits into your overall money plan. They can look at your situation and give you advice that’s just right for you.

You can also check our secured loans guide and other alternatives before getting a home improvement loan.

Who Qualifies for Home Improvement Loans?

Before you apply, it’s important to know the requirements to make sure you get the best deal that fits your situation. Generally, lenders look at several factors:

- Credit History. A good credit score increases your chances of being approved. Lenders use this to assess your reliability in repaying loans.

- Income and Employment. Steady income and stable employment are important. Lenders need to know you have a regular income to make repayments.

- Equity in Your Home. For secured loans, having equity in your home can be a key factor. This means part of your home must be paid off and worth more than the remaining mortgage.

- Debt-to-Income Ratio. Lenders will look at your existing debts compared to your income. A lower ratio generally means a better chance of approval.

- Project Feasibility. Some lenders might also consider the specifics of your renovation project and its potential impact on your home’s value.

Remember, each lender has different criteria, so it’s worth shopping around and checking the eligibility requirements of various lenders.

How To Get Home Improvement Loans?

The process of obtaining a home improvement loan typically involves several key steps:

- Loan Research and Comparison. Start by exploring different loan options. Each loan comes with unique terms, interest rates, and eligibility requirements.

- Application Process. Applications require personal and financial documentation, along with a credit check. Lenders’ response times can vary.

- Fund Disbursement. Once approved, the loan amount is transferred to your account, usually within a few working days, allowing you to start your project promptly.

- Project Implementation. Use the loan to finance your home improvement plans.

- Repayment. Loans are repaid in monthly instalments. Some lenders offer flexible repayment options, including early repayment or deferral, though additional fees may apply.

Pros and Cons of Home Improvement Loans

Deciding if a home improvement loan is the right choice for you involves looking at both the positives and negatives.

It’s crucial to weigh these up before making a decision. Let’s explore what you might want to consider:

Pros of Home Improvement Loans

– Freedom of Use. You get to decide how to use the loan money, whether it’s for a new kitchen, a bathroom makeover, or any other home improvement.

– Potential Increase in Home Value. Investing in home improvements can be a smart move. Often, these changes can boost the value of your property.

– Quick Access to Funds. Once your loan is approved, you usually get the money within a few days, letting you start your project without much delay.

– Budget-Friendly for Big Projects. Loans can be a practical way to manage the costs for big projects that you can’t pay for all at once.

Cons of Home Renovation Loans

– Risks with Secured Loans. If your loan is secured against an asset like your home, there’s a risk. You could lose your home if you can’t keep up with repayments.

– Penalties for Repayment Issues. Struggling with repayments might lead to extra charges.

– Interest Costs. Remember, you’ll end up paying back more than you borrowed due to interest.

– Credit History Matters. The best loan rates are typically only available if you have a good credit history.

– No Guaranteed Property Value Increase. While home improvements can increase your home’s value, it’s not always a guarantee.

Other Factors to Consider When Applying for a Home Improvement Loan

Before deciding on a home improvement loan, it’s wise to think about a few key things:

- Interest Rate. This will determine how much extra you’ll be paying on top of the borrowed amount. The rate you get will depend on several factors, including your credit history.

- Your Credit Rating. A better credit history means access to better rates. If your credit rating isn’t great, you might find that other options are more suitable.

- Borrowing Amount. If your project is small, other borrowing options, like a 0% interest credit card, might be more cost-effective. Just make sure you can use the card for the expenses you have in mind.

- Repayment Terms. Consider whether the monthly payments are manageable for you in the long term. What would happen if your circumstances changed? Also, note that shorter loan terms generally mean paying less interest overall.

Can I use my mortgage to finance home renovations?

Yes, using your mortgage for home improvements is a possibility. This is known as remortgaging. By remortgaging, you might be able to get extra funds for your renovations.

But, it’s not always straightforward. Different lenders have their own rules on how you can use the extra money from remortgaging, and sometimes this might not include home improvements.

Before you decide to remortgage for this purpose, it’s a good idea to have a chat with your lender. They can explain their specific policies and restrictions.

Want more insights on how remortgaging works? Check out our detailed guide on the topic.

Can I Get a Home Improvement Loan If I Have Bad Credit?

The answer is yes, but it might be a bit more challenging. With a lower credit score, you might find that your options for loans are limited.

Also, the interest rates offered to you could be higher than average. This is because lenders might see lending money to you as a higher risk.

Before applying for a loan, it’s sensible to check your credit history. Using an eligibility calculator can also give you a better idea of what kind of loan products you might qualify for.

If improving your home isn’t urgent, you might consider alternative funding methods or spend some time working on improving your credit score before applying for a loan.

Remember, if you have a county court judgement against you, getting a loan could be more difficult. However, there are steps you can take to rebuild your credit score over time.

What Are the Alternatives for Home Improvement Loans?

If a home improvement loan isn’t quite right for you, there are other options to consider:

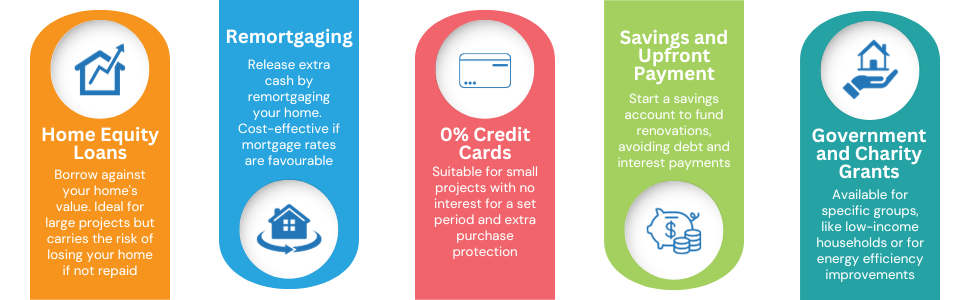

Home Equity Loans

These are secured loans where you borrow against the increased value of your home. They can be a good choice for larger projects. Make sure you understand the risks, as failing to repay can mean losing your home.

Another option is to remortgage your home, releasing extra cash for your renovations. This can be a cost-effective approach, especially if current mortgage rates are favourable.

0% Credit Cards

For smaller projects, a 0% credit card can be a smart choice. You won’t pay any interest for a set period, sometimes up to two years. Plus, you get extra protection under Section 75. However, ensure that you can use the card for your intended expenses.

Savings and Upfront Payment

Starting a savings account to fund your renovations can be a wise move, especially for smaller projects. This way, you avoid debt and interest payments.

Government and Charity Grants

Depending on your circumstances, you might be eligible for government or charity grants. These are often available for low-income households, individuals with disabilities needing home modifications, or those aiming to improve their home’s energy efficiency.

The Bottom Line

Home improvement loans make it possible to finance home renovations that might otherwise seem out of reach. However, they come with a hefty interest rate, strict repayment terms, and potential collateral consequences.

Before taking the plunge, carefully weigh the convenience of borrowing against the loss of affordability and potential risks to determine if it’s the best long-term solution for your home and wallet. Borrow wisely, manage your finances prudently, and reap the exciting rewards of a transformed home!

If all of this sounds like too much to handle, don’t go it alone. Getting advice from an expert can make all the difference. They can give you tailored advice that best fits your financial situation, guide you throughout the process, and manage the paperwork.

To skip the hassle of finding the right advisor, simply get in touch. We’ll connect you with the perfect advisor for your needs.