- What is a Secured Loan for a Self-Employed Individual?

- How Do Secured Loans Work for the Self-Employed?

- Who Can Get a Self-Employed Secured Loan?

- What Can You Use a Self-Employed Loan For?

- How Much Can You Borrow?

- Should You Get a Secured Loan if You’re Self-Employed?

- What Interest Rates Can You Expect?

- Are There Additional Costs to Keep in Mind?

- What About Early Repayment Charges?

- How Does the Application Process Work?

- What Type of Self-Employed Loans Are Out There?

- What Do You Need to Apply for a Self-Employed Loan?

- The Bottom Line

How To Get a Secured Loan If You’re Self Employed

Starting a business takes courage, hard work, and, let’s be honest, money.

Whether you want to launch a new product, buy better tools, or make your workspace bigger, a secured loan could help you make it happen.

Finding a loan when you don’t have a regular job can feel tricky.

But here’s the good news: more and more lenders are now open to helping self-employed people like you, so there are better options than ever before.

In this guide, you’ll learn how to find the right loan for your business, what lenders want from you, and how to make the whole process easier.

Let’s get started!

What is a Secured Loan for a Self-Employed Individual?

A secured loan is money you borrow that’s backed by something valuable you own, like your house. You’ll need to pay it back every month, along with some extra money called interest.

Here’s how it compares to an unsecured loan:

- For a secured loan, you offer an asset, like your home, as a guarantee.

- These loans let you borrow larger amounts, often more than £25,000.

- Interest rates are usually lower for secured loans.

- If you’re self-employed, getting a secured loan can often be easier for you.

Lenders might see self-employed people as risky because their income isn’t always steady.

With a secured loan, you take on more responsibility because your property or other asset is at stake if you don’t repay the loan.

How Do Secured Loans Work for the Self-Employed?

A secured loan works like other types of borrowing—you pay back the money in small chunks each month, plus interest, until it’s fully paid off.

Here’s how the process works:

- The lender checks how much your asset, like your house, is worth.

- The amount you can borrow depends on this value and whether you owe money on it already.

If you don’t keep up with the repayments, you could lose the asset you used as a guarantee.

For example, if your house is used as security and you can’t pay, the lender could take you to court and sell your house to get their money back.

So, if you’re self-employed, think carefully before taking out a secured loan. Make sure your income is steady enough to handle the repayments without putting your finances at risk.

Who Can Get a Self-Employed Secured Loan?

If you’ve been self-employed for at least six months, you’re off to a good start. Some lenders, though, might prefer if you’ve been running your business for two or three years.

But don’t worry—how long you’ve been self-employed isn’t the only thing they look at.

Lenders usually consider a few key things:

- Your credit score – This shows how well you’ve handled borrowing money in the past.

- Your business finances – They’ll want to see if your business is stable and making money.

- Your income and expenses – Lenders check how much you earn and spend each month to see if you can afford repayments.

- The value of your assets – For secured loans, they’ll assess the value of what you’re offering as collateral, like your house.

If you’re unsure about where to start, working with an FCA-approved broker can make a big difference.

They’ll guide you through the process and help improve your chances of getting approved. Being prepared with all the right info makes applying much easier!

What Can You Use a Self-Employed Loan For?

A self-employed loan can be used for all kinds of things. Here are some examples:

- Buying business supplies, equipment, or even a vehicle for work.

- Renovating your home, like getting a new kitchen or adding an extra room.

- Buying a car or bike.

- Paying for a dream wedding.

- Taking the family on a holiday.

- Combining all your debts into one payment to make life simpler.

These loans are pretty flexible, so you can use them to meet your personal or business needs.

How Much Can You Borrow?

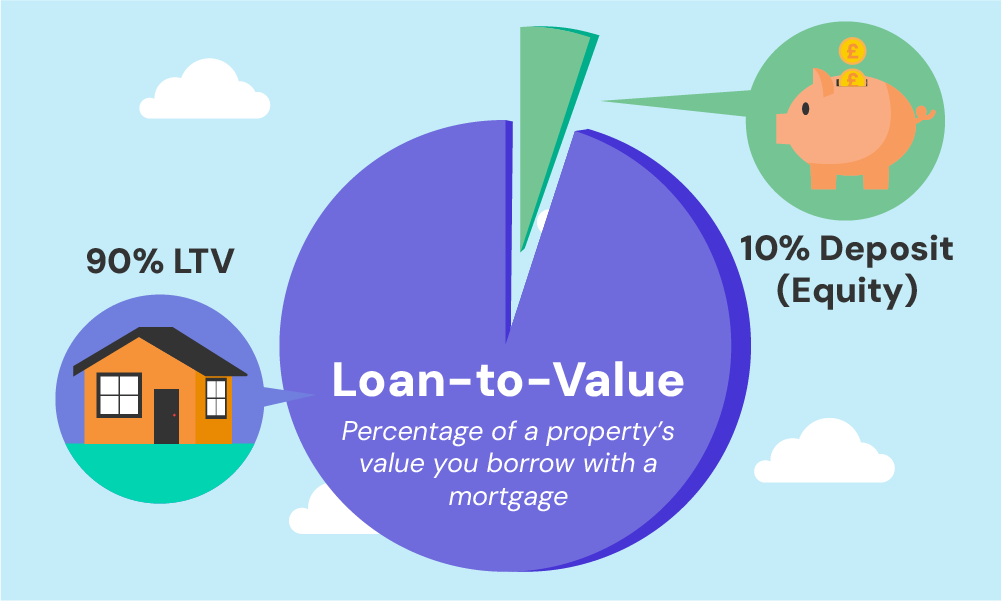

How much you can borrow depends on the value of what you’re offering as collateral, like your house.

Most lenders let you borrow around 80% of your equity, and some might go up to 95%.

If you’re using the property for buy-to-let purposes, the amount you can borrow (called Loan-to-Value or LTV) might be a bit lower.

Want to get an idea of what your monthly payments could look like? Try using the secured loan calculator below.

Keep in mind, the calculator gives you a rough estimate. For a full picture, including hidden costs or fees, it’s a good idea to talk to a loan advisor. They can help you figure out the best option for your situation.

Should You Get a Secured Loan if You’re Self-Employed?

Secured loans can be a good choice for self-employed people, but there are pros and cons to think about before deciding. Here’s a quick look at both sides:

Pros:

- Lower interest rates – These loans usually have lower rates, which means you’ll pay less in the long run.

- Borrow more – Since you’re offering collateral, lenders might give you a larger loan.

- Longer repayment periods – You could get more time to pay it back, which can make monthly payments easier to manage.

- Bad credit? No problem – Even with poor credit, good collateral might help you get approved.

- Tax benefits – If the loan is for your business, you might be able to claim the interest as a tax deduction.

Cons:

- Risk of losing your asset – If you don’t pay back the loan, the lender can take what you offered as collateral, like your house.

- Complicated process – Secured loans might need more paperwork, like property appraisals and legal checks.

- Extra costs – You might have to pay for things like valuations, legal fees, or other charges.

- Less flexible – If your income changes month to month, the strict repayment terms could be harder to manage.

- Debt danger – Since you can borrow more with a secured loan, it’s easy to take on more than you can handle, which might lead to more debt.

Extra Tips

- Only borrow what you truly need, and be sure you can afford the monthly payments.

- Shop around and compare offers from different lenders to get the best deal.

- Read the loan agreement carefully so you understand all the terms and conditions.

- Make your payments on time to avoid trouble, like losing your collateral.

Taking out a secured loan can help you manage your finances or grow your business, but it’s important to make the right choice for your situation.

What Interest Rates Can You Expect?

Secured loans usually come with lower interest rates than unsecured ones, which can help you save money.

But the rate you get isn’t guaranteed—it depends on a few things, like your finances, the lender’s rules, and the state of the market.

The Bank of England’s base rate also plays a role in setting these rates.

Right now, the average interest rate for a self-employed secured loan is about 7% per year. But keep in mind, this is just an estimate.

Your rate could be higher or lower depending on factors like your credit score, how much you want to borrow, the value of what you’re offering as collateral, and how the lender views your application.

To get the best deal, it’s smart to shop around and speak to a broker or advisor. They can help you understand your options and find a loan that works best for you.

Are There Additional Costs to Keep in Mind?

Yes, there are a few extra costs you’ll need to budget for besides the interest rate:

- Setup fees – These are charges from the lender to arrange your loan.

- Property valuations – If you’re using your home as collateral, it might need to be valued, and you’ll have to pay for that.

- Broker fees – If you’re using a broker to find a loan, they might charge a flat fee or take a percentage of the loan amount.

These extra costs add to the total amount you’ll need to pay back, so it’s worth factoring them in.

What About Early Repayment Charges?

If your business does really well and you want to pay off your loan early, watch out for early repayment charges. These are fees you might have to pay for settling the loan before the agreed time.

The fee could be a few months’ worth of interest or a percentage of what’s left on the loan.

If you’re still early in your repayment term, this can be a big cost, so it’s something to check before signing up.

How Does the Application Process Work?

Applying for a secured loan is usually quicker and simpler than applying for a mortgage. It often takes just one to three weeks to complete. Here’s how it works:

- Check Your Situation – Decide if a secured loan is the right choice for what you need.

- Talk to a Broker – Speak to a loan expert about how much money you want to borrow and how long you’d like to pay it back.

- Market Research – Your broker will look around to find the best loan options for you.

- Financial Check – Agree to a detailed check of your finances by the lender and provide any documents they need.

- Stay on Top of Things – Answer lender questions quickly to avoid delays.

- Property Valuation – If you’re using your home as collateral, the lender will check how much it’s worth.

- Draft Contract – You’ll get a draft contract. Read it carefully, especially the total cost after fees, before signing and sending it back.

Once everything’s signed, the money is usually sent to you within 48 hours. Your first loan payment will be due next month.

What Type of Self-Employed Loans Are Out There?

If you’re self-employed in the UK, there are a few loan options to choose from:

- Personal Loans – Use these for personal expenses like fixing up your house, getting a new car, or paying off other debts.

- Business Loans – Perfect for growing your business, whether it’s upgrading your workspace, buying new equipment, or boosting your marketing.

- Secured Loans – These require you to offer something valuable, like your house, as collateral. It’s easier to get approved for a larger amount this way.

- Unsecured Loans – These don’t need collateral, but they can be harder to get, especially if you’re self-employed.

What Do You Need to Apply for a Self-Employed Loan?

When applying for a secured loan, you’ll need to provide certain documents. Here’s what most lenders will ask for:

- ID Proof – A passport or driving licence to confirm your identity.

- Proof of Address – A utility bill works. If you’ve lived at your address for less than three years, you might need proof of your old address too.

- Business Details – Documents like incorporation papers and accountant-verified accounts to show you run a business.

- Tax Returns – Up to three years of tax returns (SA302 forms) related to your self-employment.

- Bank Statements – At least three months’ worth of statements showing your income and expenses.

The lender might ask for more paperwork, so be ready. The quicker you provide the documents, the faster your loan can be processed.

The Bottom Line

When it comes to loans, everyone’s situation is different, and brokers get that.

A good broker can give you insider tips and show you what’s worked for people like you. They can also look at all the lenders out there—not just the big high-street ones—to find you the best deals.

Before you decide, it’s a smart idea to get some advice from a financial expert. Understanding the loan terms fully will help you avoid surprises later on.

Remember, if you don’t keep up with payments on a secured loan, you could lose the asset you put up, like your house.

Want to make the process easier? Fill out this quick form, and we’ll connect you with a friendly loan advisor. They’ll guide you, take care of the paperwork, and help you find the right loan for your needs.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What are repayment options like?

Your broker and lender will work together to set up a repayment plan that suits your budget and what you can afford. Secured loans often let you spread the payments over a long time—sometimes as much as 30 years.

This has its good and bad sides. Longer repayment periods mean smaller monthly payments and sometimes lower interest rates. But, the longer it takes to pay off, the more you’ll spend overall.

For example, paying a loan back over 25 years at 4% interest will cost you more in the end than paying it off in 15 years at 5.5%.

Can I get a loan if I have bad credit?

Yes, you can. Some lenders specialise in helping people with bad credit, even if you’ve had CCJs (County Court Judgements) or missed payments in the past.

The interest rates on these loans might be a bit higher than usual, but they’re often cheaper than unsecured loans for people with bad credit.

Secured loans can still be a good option if you’re trying to improve your financial situation.