- What is a Second Home?

- How Much Deposit Will You Need?

- Understand Affordability Criteria

- Be Aware of Higher Interest Rates

- Understand the Additional Financial Commitments

- Choose Between Residential or Buy-to-Let

- How to Apply for a Second Home Mortgage

- 7 Tips to Successfully Secure a Second Home Mortgage

- Can You Remortgage to Buy a Second Home?

- Can You Secure a Second Mortgage with Bad Credit?

- Alternative Options for Second Home Finance

- The Bottom Line

Second Home Mortgage Rules and Requirements in the UK

Purchasing a second home can be an exciting milestone.

Perhaps you want a holiday getaway, maybe you’re looking to invest in property, or you simply need more space for a growing family.

Whatever your reasons, a second home mortgage opens doors to new possibilities. But, second home mortgages have unique rules and requirements you must consider.

Lenders view second properties as higher risk, so you’ll likely need a larger deposit and face stricter affordability checks.

But armed with the right information, you can successfully secure finance for your next home.

This comprehensive guide examines everything you need to know about second home mortgages in the UK.

Let’s get started.

What is a Second Home?

Before applying for finance, you must establish what classifies a property as a second home.

According to UK tax law, a second home is a property you own in addition to your main residence.

This includes:

- Holiday homes and weekend cottages

- City crash pads used for work

- Homes owned for dependents like children or parents

- Part-ownership of a shared family holiday home

Properties you fully rent out are classified as buy-to-let investments, not second homes. We’ll explore the key differences shortly.

How Much Deposit Will You Need?

Unlike first-time buyers who can access 5% deposit mortgages through government schemes, second home buyers typically require a minimum 15-20% deposit.

Some lenders may accept 10%, but this usually incurs higher interest rates.

The more deposit you can pay, the better mortgage rates and lower loan-to-value (LTV) you’ll secure.

For example, putting down a 40% deposit provides a preferable 60% LTV over a 15% deposit and 85% LTV.

If your current home has equity, consider remortgaging or securing a second charge to unlock funds for your deposit. But, think carefully, as this will increase your overall debt.

Understand Affordability Criteria

Meeting affordability criteria is arguably the biggest hurdle to clear when applying for a second home mortgage.

Lenders calculate affordability based on your current obligations. This includes:

- Income and existing mortgage payments

- Outstanding loans and credit card balances

- Essential living costs

- Any child maintenance or alimony payments

They’ll review your payslips, bank statements, credit report and completed application to assess if you can afford another mortgage commitment.

To strengthen affordability, reduce existing debts where possible and avoid new credit applications in the run-up to your application. A higher household income also helps.

Some lenders may take into account your rental income from your second home when calculating whether you can afford to borrow money. However, don’t rely on this entirely, as different lenders have different criteria.

Be Aware of Higher Interest Rates

Expect to pay a higher interest rate on a second home mortgage. As lenders view second properties as riskier, they offset this with higher rates.

However, strong credit scores, sizable deposits and lower LTVs can help secure more competitive deals. Shopping around and using a broker will also give you access to second home mortgage exclusives.

Fixed-rate terms of 2-5 years are common for second homes. Make sure you’re comfortable with payments after any initial deal expires.

Understand the Additional Financial Commitments

When planning to buy a second home in the UK, it’s essential to account for expenses beyond the mortgage. Being well-informed can help you budget effectively and avoid surprises:

Increased Stamp Duty Costs

Purchasing any additional property over £40,000 in England and Northern Ireland means paying an extra 5% surcharge on the standard stamp duty rates.

This is a significant cost and should be factored into your initial budget.

| Property Price | Standard Rate | Rate for Second Homes |

|---|---|---|

| Up to £250,000 | 0% | 5% |

| £250,001 – £925,000 | 5% | 10% |

| £925,001 – £1,500,000 | 10% | 15% |

| Over £1,500,001 | 12% | 17% |

For more detailed information, visit the UK government’s official website on stamp duty.

Specialist Insurance Requirements

Unlike your main residence, standard home insurance won’t cover your second home.

Expect higher premiums for a second home insurance policy, which may also include specific conditions, particularly concerning periods of inoccupancy.

Council Tax Implications

Owning a furnished second home does not entitle you to the single-person discount on council tax. However, some local councils may offer a reduced rate for properties used as holiday homes.

For instance, if you purchase a holiday home in a specific area, it’s important to check the local council’s policy, as this can significantly affect your annual expenses.

Learn more about council tax on second homes at the UK government’s council tax information page.

Capital Gains Tax (CGT)

Any profit from selling your second home is subject to CGT.

For instance, if you buy a second home for £350,000 and sell it for £450,000, your taxable gain after the CGT allowance could lead to a significant tax liability, especially if you’re a higher-rate taxpayer.

For further details, visit HM Revenue & Customs’ guide on CGT.

Inheritance Tax Considerations

If a single person inherits a second home, it can be received tax-free. In contrast, for married couples, the inheritance of a second home might incur taxes if it’s above the threshold.

Comprehensive information can be found on the UK government’s inheritance tax page.

Remember, these additional expenses are a significant part of your buying decision. It’s not just the purchase price; the ongoing financial commitments of owning a second home are crucial to consider for effective long-term planning.

Choose Between Residential or Buy-to-Let

Lenders offer two main mortgage types for second homes:

- Residential Mortgages – These are good if you want a second home just for yourself or your family. For example, for holidays or living in. Remember, you can’t rent out the home with this kind of mortgage. It’s only for your own use.

- Buy-to-Let Mortgages – Choose this if you want to rent out the property to others as an investment. You’ll need at least 25% of the property’s price as a deposit to get this mortgage. It’s different from a regular home loan because it has its tax benefits and rules.

Think carefully about what you want to do with the property before you pick a mortgage. The way you plan to use the second home really matters in choosing the right mortgage.

Also, some lenders might let you rent out the home for a short time with a residential mortgage.

But if you want to rent it out often, especially for holidays, you might need a special kind of mortgage called a holiday let mortgage.

Knowing the difference between these mortgages helps you make a better choice that fits your plans for the second home.

How to Apply for a Second Home Mortgage

Applying for a second home mortgage follows the usual process:

- Deposit – Start by saving at least 15% of the home’s price for your deposit. This is the minimum amount you’ll need.

- Proof of Income – Gather documents like your pay slips, self-employment records, or company accounts to show how much you earn.

- Identification Documents – You’ll need to provide identification, such as a passport or driving licence, along with proof of your current address.

- Affordability Check – Share details about your income, any debts you have, and other financial obligations. This helps the lender understand if you can afford the mortgage.

- Credit Check – The lender will carry out a thorough credit check. This involves reviewing your credit history to assess your financial reliability.

- Property Valuation – A surveyor, appointed by the lender, will evaluate the property’s value to ensure it’s worth the mortgage amount.

- Mortgage Offer – If the lender approves your application, they’ll send you a mortgage offer. This document outlines the terms of your mortgage.

- Solicitor Engagement – You will need to appoint a solicitor. They handle all the legal work, including paperwork and property searches.

- Exchange of Contracts – At this stage, you’ll sign the contracts and pay your deposit to the seller.

- Completion – This is the final step. The remaining funds are transferred to the seller, and you get the keys to your new second home!

To ensure a smooth application process, it’s wise to get all your documents organised well in advance.

Consider seeking guidance from an experienced mortgage broker who can offer valuable advice and assistance throughout the process.

7 Tips to Successfully Secure a Second Home Mortgage

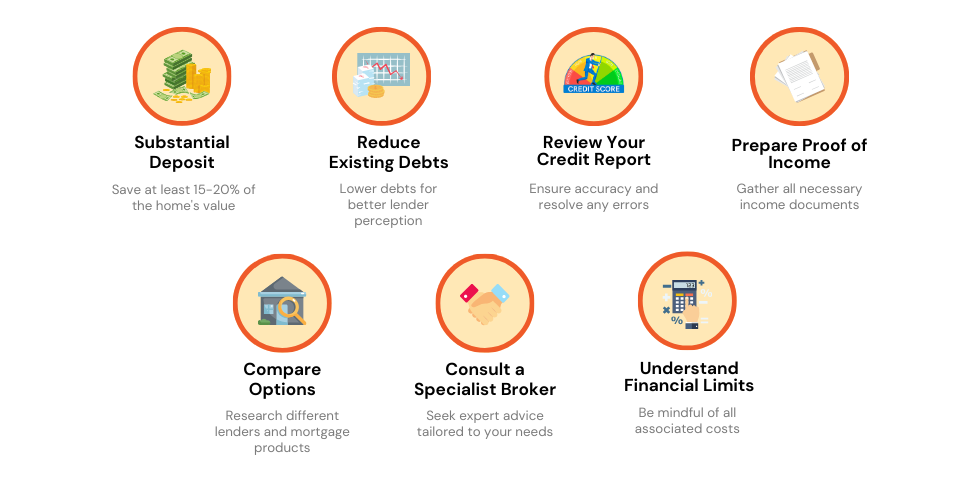

Follow these tips when seeking a second home mortgage:

- Save a Substantial Deposit – Aim to save at least 15-20% of the property’s value. A larger deposit often means access to better mortgage rates and a wider choice of products.

- Reduce Your Existing Debts – Lowering your current debts can make you appear more financially stable to lenders, thereby improving your chances of approval.

- Review Your Credit Report – Before you apply, check your credit file for accuracy and ensure there are no errors.

- Prepare Proof of Income – Have all your income evidence ready, including payslips and, if you’re self-employed, your business accounts.

- Compare Options – Don’t settle for the first offer. Look around to compare interest rates and lending criteria from different lenders and brokers.

- Consult a Specialist Broker – A broker who specialises in second home mortgages can help you find the best deals tailored to your situation.

- Understand Your Financial Limits – Be aware of all the costs involved, including stamp duty, legal fees, and the expenses of furnishing your second home.

Can You Remortgage to Buy a Second Home?

Yes, remortgaging is a practical option if you have substantial equity in your first home or if it’s already paid off.

This method allows you to use the value tied up in your primary residence to generate the deposit needed for a second property.

It’s crucial, though, to ensure you can comfortably afford the additional mortgage repayments.

While this strategy can unlock necessary funds, be aware that lenders will conduct thorough affordability checks, which can be more stringent than for a single mortgage.

Can You Secure a Second Mortgage with Bad Credit?

Yes, securing a second mortgage with bad credit is possible. The process is similar to obtaining a mortgage for a primary residence, even with a less-than-ideal credit history.

Lenders will consider the type and severity of any bad credit incidents on your record, as well as how recent they are.

Be mindful that having bad credit may limit your choice of lenders and affect the terms of your mortgage, typically leading to higher interest rates or the need for a larger deposit to offset the perceived risk.

Alternative Options for Second Home Finance

If you fail to secure a mortgage, consider alternative finance options:

- Secured Loans – Use the equity in your existing property as collateral to borrow additional funds.

- Bridging Loans – Ideal for short-term needs, particularly if you’re renovating or purchasing properties at auction.

- Joint Borrower Sole Proprietor Agreements – Team up with a family member to co-buy the property. This can improve your borrowing potential.

- Guarantor Mortgages – Have a third party, such as a family member, guarantee a portion of your mortgage, enhancing your eligibility.

- Offset Mortgages with Savings – Connect your mortgage to your savings account. This can help reduce the interest you pay on your mortgage.

It’s important to explore all available options if a standard mortgage isn’t feasible. Just ensure that whichever route you choose aligns with your financial situation and long-term plans for the property.

The Bottom Line

We hope this guide equips you with everything required to apply for a second home mortgage in the UK.

Remember to research lenders, check affordability early and target lower LTVs for the best chance of approval. Paying a higher deposit gives you access to better interest rates too.

If you’re looking for personalised advice, we can connect you with specialist mortgage advisers experienced in second home mortgages. They are equipped to offer solutions perfectly tailored to your unique financial circumstances.

Contact us today to get started on securing your ideal second home with expert guidance.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I use a second home mortgage for any type of property?

Second home mortgages are typically for properties you intend to use personally, like holiday homes or residences for family members. They’re not suitable for properties you plan to rent out full-time.

Are interest rates higher for second home mortgages compared to first-home mortgages?

Yes, generally, interest rates for second home mortgages are slightly higher. This is due to the perceived higher risk by lenders for second properties.

Is it possible to switch from a second home mortgage to a buy-to-let mortgage later?

Yes, you can switch your mortgage type, but it requires applying for a new mortgage and meeting the specific criteria for a buy-to-let mortgage.

How challenging is it to secure a mortgage for a second home?

Obtaining a mortgage for a second property can be more demanding due to extra affordability checks.

With adequate disposable income, a substantial deposit, and a solid credit score, it’s achievable, though the process may be more rigorous compared to a first home mortgage.

Can I obtain a second mortgage if I have a County Court Judgment (CCJ)?

Getting a second mortgage with a CCJ is possible, but much depends on the specifics of the CCJ.

For instance, a small CCJ (under £100) that is older than three years might have less impact on your application than a larger, more recent CCJ. The lender will consider the amount and the age of the CCJ in their decision-making process.

Is it possible to use my second home as a holiday rental?

Yes, you might be able to rent out your second home as a holiday let. This depends on your mortgage terms; some residential mortgages allow short-term rentals for a limited period each year.

For more frequent or longer-term holiday lets, you’ll likely need a specific holiday let mortgage, which has different requirements and implications.