- How Does Debt Consolidation Work?

- What Do You Need to Know About Mortgages in the UK?

- Different Types of Mortgages Available

- What Lenders Evaluate

- Does Debt Consolidation Affect Getting a Mortgage?

- The Pros and Cons of Debt Consolidation When Applying for a Mortgage

- What Are Other Ways to Manage Debt for Mortgage Applicants?

- How Can You Prepare for Future Mortgage Success?

- Key Takeaways

- The Bottom Line

Does Debt Consolidation Make Getting A Mortgage Harder?

With UK household debt at record levels, many Brits are turning to debt consolidation loans and credit cards to try and regain control of their finances.

But could consolidating your debts make it harder to get a mortgage in the future?

In this article, we’ll explore how debt consolidation works, look at the impact it can have on your credit score, and explain what mortgage lenders will be looking for if you’ve consolidated debt recently.

How Does Debt Consolidation Work?

Debt consolidation works by merging various debts into a single loan.

If you have numerous debts, such as credit card bills and personal loans, each with its interest rate and monthly due date, consolidation can simplify these into one payment.

Often, this new loan has a lower overall interest rate than the combined rates of your previous debts.

The result is a more manageable financial situation with one consistent monthly payment. This makes budgeting easier, as you only need to keep track of one payment, and it also reduces the total interest paid over time.

There are several ways to consolidate debt, including:

- Debt Consolidation Loans. These are typically offered by banks or other financial institutions to pay off your multiple debts.

- Balance Transfer Credit Cards. Here, you move your existing debts to a new credit card, often with a lower interest rate.

- Home Equity Loans. Sometimes, people use the equity in their homes to pay off debts, but this comes with its risks.

What Do You Need to Know About Mortgages in the UK?

A mortgage in the UK is a special loan for buying a house or land. It’s usually a big commitment, often lasting for 25 years or more, though sometimes it can be for a shorter or longer time.

When you get a mortgage, the house or land you’re buying is used as a kind of safety promise.

This means if you can’t pay back the money, the lender might take your home. Mortgages are a common way for people to buy their own home, spreading the cost over many years.

Different Types of Mortgages Available

Here are the different types of mortgages you might come across once you’ve started to shop around:

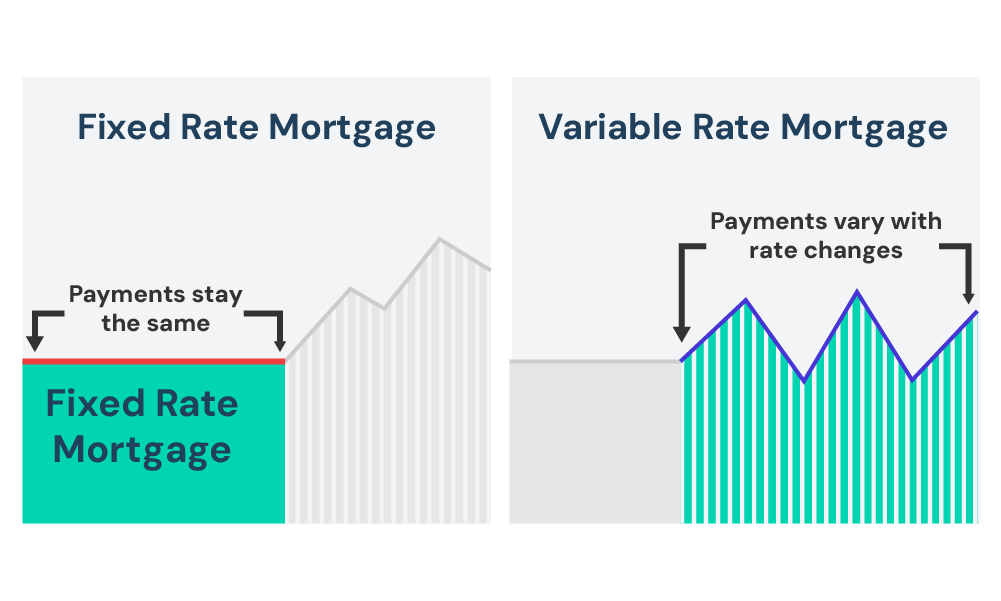

- Fixed-Rate Mortgages. In this type, the interest rate remains constant for a specific period, ensuring predictable repayments.

- Variable-Rate Mortgages. These mortgages have fluctuating interest rates. They include ‘tracker’ mortgages, which align with the Bank of England’s base rate, and ‘standard variable rate’ mortgages, where rates vary.

- Interest-Only Mortgages. With these mortgages, you pay only the interest each month, leaving the loan amount unchanged.

What Lenders Evaluate

After picking the right mortgage type, you might be curious about how lenders decide if you’re a good fit. Have a look at several key things before applying:

- Income and Employment. They assess your earnings and job security to determine your repayment capability.

- Credit History. Your past management of debts is a critical factor in their evaluation.

- Deposit Size. A larger deposit typically secures a more advantageous mortgage deal.

- Age and Health. These aspects can influence the repayment term, based on your ability to repay over time.

Does Debt Consolidation Affect Getting a Mortgage?

Yes, debt consolidation does affect getting a mortgage.

When you consolidate your debts, it can have both immediate and long-term effects on your mortgage application. Let’s break down how this works:

Short-Term Credit Score Impact

Initially, debt consolidation can lower your credit score. This happens because you’re opening a new line of credit, which often leads to a temporary dip. Lenders might see this as a risk in the short term.

Long-Term Credit Improvement

Over time, if you manage your consolidated debt responsibly and make regular payments, your credit score can improve.

This shows lenders that you’re good at managing your finances. A better credit score can increase your chances of getting a mortgage with favourable terms.

Consolidating your debts can positively affect your debt-to-income ratio (DTI).

A lower DTI is attractive to lenders because it suggests you’re less of a financial risk and more likely to manage mortgage repayments effectively.

To check where you currently stand, feel free to use our DTI ratio calculator.

Lender Perception

Lenders look favourably at borrowers who take steps to manage their debts. Successfully managing a consolidated debt can portray you as a responsible borrower, positively influencing your mortgage application.

Future Borrowing Opportunities

Once your credit score improves, you may have access to better mortgage deals. This means potentially lower interest rates and better terms, making your dream home more affordable in the long run.

In summary, while debt consolidation can initially impact your credit score and mortgage application negatively, responsible management of consolidated debt can improve your financial standing and enhance your chances of securing a mortgage with better terms.

The Pros and Cons of Debt Consolidation When Applying for a Mortgage

Here’s a breakdown of the pros and cons of debt consolidation when you’re planning to apply for a mortgage.

Pros:

- Simplified Debt Management. Consolidating multiple debts into one loan simplifies your financial management, making it easier to keep track of payments and deadlines.

- Potential Lower Interest Rates. Debt consolidation can lead to lower interest rates compared to the combined rates of your existing debts, reducing the amount you pay over time.

- Improved Credit Score Over Time. Regular payments on a consolidated loan can boost your credit score in the long run, enhancing your eligibility for a mortgage.

- Lower Monthly Payments. By consolidating, you might be able to negotiate lower monthly payments, which can ease your financial burden and improve your debt-to-income ratio, a key factor for mortgage approval.

Cons:

- Initial Credit Score Impact. Applying for a debt consolidation loan can temporarily lower your credit score due to the credit check and opening a new account.

- Higher Long-Term Costs. Lower monthly payments might extend the loan term, potentially increasing the total amount of interest paid over the life of the loan.

- Qualification Challenges. Obtaining a debt consolidation loan can be difficult with a poor credit history, and you may not get favourable interest rates or terms.

- Risk of Accumulating More Debt. There’s a danger of falling into further debt if you use the credit freed up by consolidation irresponsibly, which can jeopardize future mortgage applications.

In considering debt consolidation, it’s important to weigh these pros and cons carefully, especially in how they relate to your long-term goal of applying for a mortgage.

Effective debt management through consolidation can set a positive foundation for a mortgage application, but it requires careful planning and discipline to avoid potential pitfalls.

What Are Other Ways to Manage Debt for Mortgage Applicants?

Debt consolidation isn’t your only option when you’re looking to manage your debts before applying for a mortgage. Here’s a look at some alternatives:

Debt Management Plans (DMPs). These are agreements with creditors to pay off your debt over time. Unlike consolidation, you don’t take out a new loan. DMPs can help reduce interest rates and monthly payments.

Individual Voluntary Arrangements (IVAs). This is a formal agreement where you pay back a portion of your debts over a set period. It’s legally binding and can write off some debt at the end.

Budgeting and Repayment Strategy. Sometimes, just revising your budget and focusing on repaying debts starting with the highest interest rate (avalanche method) or smallest debt (snowball method) can be effective.

Comparing these with debt consolidation, each method has its strengths. Consolidation simplifies payments but may extend the repayment period.

DMPs and IVAs provide structured plans without new loans, and budgeting strategies depend heavily on your discipline and financial circumstances.

How Can You Prepare for Future Mortgage Success?

The mortgage industry is always evolving, and so are strategies for managing debt.

Here’s what to expect and how to prepare:

- Future Trends. Digital technology will likely streamline mortgage applications and debt management. Expect more online tools for better mortgage comparison and debt consolidation options.

- Interest Rates and Market Changes. Keep an eye on how economic trends affect mortgage rates. A slight rate change can impact your repayments significantly.

Long-Term Financial Planning Tips:

- Build a Strong Credit Profile. Regularly check your credit score and work on improving it.

- Save for a Larger Deposit. The more you save, the less you have to borrow, reducing your mortgage costs.

- Stay Informed. Keep up with financial news and trends. Understanding the market can help you make smarter decisions about when and how to apply for a mortgage.

- Manage Your Debts Wisely. If you have debts, think about how you can manage them better. This shows lenders you’re good with money.

- Review Your Money Plans Regularly. Now and then, take a look at how you’re doing with your budget and savings. This helps you stay on track for getting a mortgage.

- Get Advice if You Need It. If you’re not sure about something, talking to a good mortgage expert can be really helpful. They can give you advice that’s just right for your situation.

Key Takeaways

- Debt consolidation means combining all your debts into one loan so you only have one payment to worry about, often with less interest to pay. You can do this by getting a debt consolidation loan, balance transfer credit cards, or using your home’s value to pay off debts.

- Your credit score might drop a little when you consolidate, but paying on time can help it go back up and even improve.

- Having fewer payments to make and a lower debt compared to your income can make it easier for banks to trust you when you want a home loan.

- If debt consolidation isn’t the best fit, you can try other ways like debt management plans, individual voluntary arrangements, or setting a smart budget to pay what you owe faster.

The Bottom Line

Taking out a debt consolidation loan doesn’t necessarily stop you from getting a mortgage. In fact, it can sometimes make it easier.

By consolidating your debts, you’re simplifying your finances and can potentially improve your credit score over time. This shows mortgage lenders that you’re serious about managing your money.

However, it’s important to remember that consolidation can initially lower your credit score, and if not managed well, it can make getting a mortgage harder. The key is to consolidate wisely and keep up with your repayments.

So, while debt consolidation can be a helpful step towards getting a mortgage, it needs careful planning and responsible financial management to really work in your favour.

A good mortgage broker can help make things easier for you. They can provide you with the insights and support needed to make your home ownership dreams a reality.

You can choose to go solo or take an easier path. Reach out to get connected to the right mortgage broker for expert guidance. They will assess your needs and guide you to the right solution.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How long should I wait to apply for a mortgage after consolidating my debts?

After consolidating your debts, it’s wise to wait until you’ve made several consistent payments on the new loan. This waiting period can vary, but typically a few months to a year is advisable. This shows lenders that you’re managing your new consolidated debt responsibly.

Can debt consolidation improve my chances of getting a better mortgage rate?

Yes, effectively managing debt consolidation can improve your credit score over time, which in turn can qualify you for better mortgage rates. Lenders view a higher credit score as a sign of financial reliability, which can lead to more favourable interest rates.

Are there risks to using home equity for debt consolidation when planning to apply for a mortgage?

Using home equity to consolidate debt does come with risks. It puts your home at increased risk of foreclosure if you’re unable to meet the new payment terms. It’s crucial to consider this option carefully, especially if you plan to apply for a new mortgage in the future.

How does debt consolidation impact my debt-to-income ratio when applying for a mortgage?

Debt consolidation can positively impact your debt-to-income ratio by reducing your monthly debt payments. A lower debt-to-income ratio is appealing to mortgage lenders as it indicates a balanced financial situation and the ability to comfortably manage additional loan repayments.