- What Is a Mortgage With a Guarantor?

- Who Can Be a Guarantor on a Mortgage?

- Can Parents Guarantee a Mortgage?

- How To Qualify As a Mortgage Guarantor?

- Can You Be a Guarantor With Poor Credit?

- How Being a Guarantor Impacts Your Credit

- Lenders Still Run Stringent Checks on Guarantors

- Minimum Income Requirements for Guarantors

- Benefits of Being a Mortgage Guarantor

- Risks of Being a Mortgage Guarantor

- The Bottom Line: Speak to an Expert Mortgage Broker

Who Can Be A Guarantor For Your Mortgage?

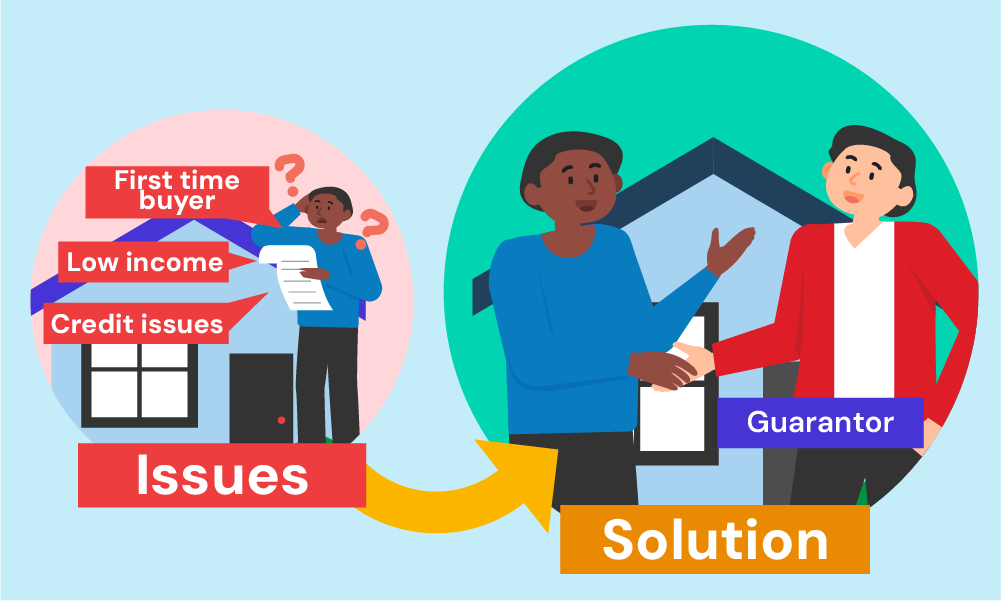

Buying property can be challenging if you don’t have a long credit history or high income. Maybe you’re young and just starting out, new to the UK, or a freelancer whose income varies.

Whatever your reasons–one thing is true: you’re struggling to secure a mortgage. In this case, a guarantor mortgage can help.

But, what is a guarantor mortgage, and who exactly can act as a guarantor on a mortgage? 🤔

This guide takes a closer look.

What Is a Mortgage With a Guarantor?

A guarantor mortgage allows you to have someone else–usually a close family member–act as a guarantor on your mortgage.

The guarantor promises to cover the mortgage repayments if you CAN’T make them yourself. This gives lenders more confidence to approve mortgages for borrowers who may struggle due to issues like:

- Being a first-time buyer with no credit history

- Having a low income

- Having impaired credit like CCJs, defaults or bankruptcy

- Being self-employed with variable income

In essence, the guarantor is taking on liability for your mortgage – so understandably lenders want to be sure they are financially secure.

Who Can Be a Guarantor on a Mortgage?

Most mortgage lenders will only accept certain people as guarantors for a home loan.

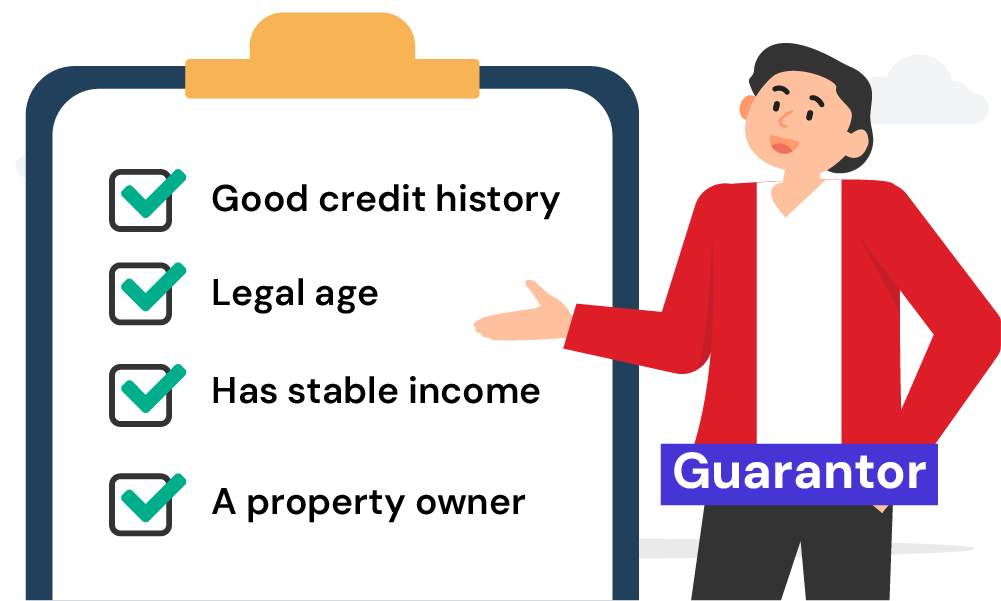

There are typically some basic requirements:

- Must be over 21 years old

- Have a good credit history with no severe negative issues

- Be able to prove their income and ability to afford the repayments

- Often they must be a property owner themselves

Essentially, the lender wants to be sure that the guarantor is financially secure and would be able to maintain mortgage payments on your behalf if required.

In the majority of cases, parents are by far the MOST common type of guarantor used for mortgages. Lenders feel parents have the closest vested interest in helping their children GET on the property ladder.

However, it is usually possible to have other close family members act as guarantors. This could include:

- Spouse/Partner

- Siblings

- Grandparents

- Aunts & Uncles

Some mortgages may even accept a close friend being the guarantor if you can demonstrate you have a well-established relationship. However, this is quite rare.

The most important factor is that the guarantor has sufficient income and assets to credibly take on the mortgage payments. Lenders are unlikely to accept guarantors who are financially insecure themselves.

Can Parents Guarantee a Mortgage?

As we’ve talked about, parents are the most common guarantors for mortgages, and lenders approve them readily. This is because lenders understand parents want to help their children buy a home.

Here’s why parents are ideal guarantors:

- They likely own a home with equity already.

- They often have a long history of steady income.

- They share your goal of homeownership, so their interests align with yours.

As long as parent guarantors meet the lender’s income, credit and age criteria then they should be accepted on most guarantor and family mortgages.

The big drawback? If you can’t make repayments, your parents’ property could be at risk. So, it’s KEY they only guarantee a mortgage they could truly afford if needed.

How To Qualify As a Mortgage Guarantor?

While the exact criteria can vary between mortgage lenders, guarantors generally need to meet the following requirements:

- Aged 21 or Over – Most lenders have a minimum age of 21 for guarantors to ensure they are financially mature and independent.

- Good Credit Score – A guarantor needs a strong credit rating with no major adverse issues like bankruptcies, CCJs or mortgage arrears.

- Stable Employment – Most prefer guarantors in full-time permanent employment, though some income from investments or self-employment could be accepted.

- Provable Income – You’ll need to evidence your income, usually with payslips, accounts or tax returns over the last 2-3 years.

- Property Owner – Owning their own home and having equity provides extra security, though it may not always be essential.

- Able to Afford Payments – You must prove you could comfortably take on the mortgage repayments on top of your current outgoings.

The mortgage lender will closely scrutinise your finances during the application to be confident you would be a suitable guarantor.

Having an impaired credit history or insufficient income/assets makes it highly UNLIKELY you’ll be accepted.

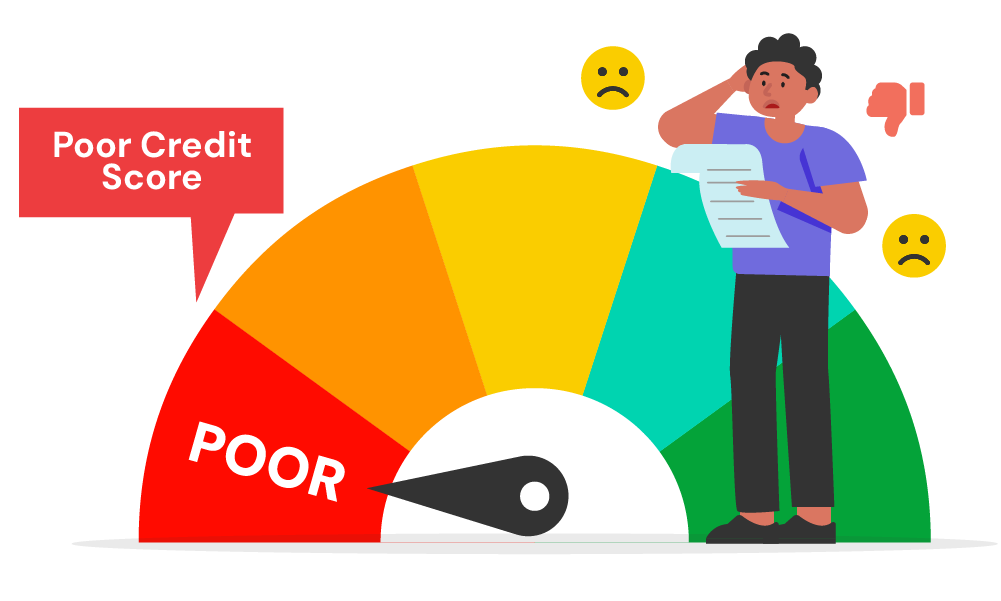

Can You Be a Guarantor With Poor Credit?

Most lenders will reject you if you have a poor credit history, including things like bankruptcy, court judgements, missed payments or falling behind on a mortgage.

There’s no one perfect credit score to guarantee approval, but generally the higher the better.

Lenders want to know you can afford the mortgage payments on top of your bills. That’s why they prefer homeowners with full-time jobs and stable income.

If your credit score isn’t great, try to improve it before agreeing to be a guarantor. Even a few problems could mean you get rejected.

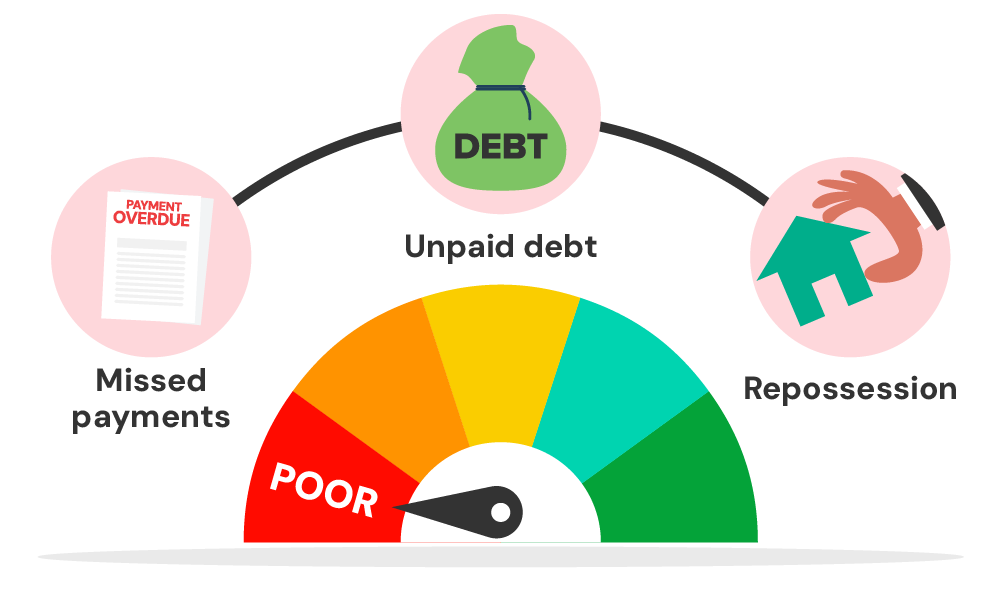

How Being a Guarantor Impacts Your Credit

Being a guarantor won’t hurt your credit score straight away. Lenders do a soft credit check that doesn’t leave a mark.

However, if the borrower misses payments, your credit score can be seriously damaged.

Here’s how it can hurt your credit:

- Missed payments you have to cover get reported in your credit file.

- County Court Judgments (CCJs) for unpaid debt can appear.

- Repossession might happen if you can’t keep up with payments.

These defaults would damage your credit score and make it harder to get credit or remortgage your own home in the future.

Being a guarantor creates a financial link to the borrower’s mortgage, but this isn’t a problem as long as they keep up with payments. Only if they default does your creditworthiness suffer.

Lenders Still Run Stringent Checks on Guarantors

Lenders will thoroughly check your finances before approving you as a guarantor. Even if your credit score isn’t affected right away, they’ll dive deep to see if YOU can afford the mortgage if needed.

Here’s what they’ll likely look at:

- Proof of income for the past 3+ years (payslips, bank accounts, tax returns).

- Bank statements for the past 3+ months showing your spending.

- Details of any existing debts, loans or financial obligations.

- Proof of your assets and savings balances.

Basically, they need to be sure you can handle the mortgage payments without hurting your own finances. So, a stable job, high income and low spending are essential.

Some lenders might even reject guarantors with low income, those who are retired, or relying solely on pensions or benefits.

Minimum Income Requirements for Guarantors

There’s NO single income requirement to be a guarantor in the UK. Each lender sets their own risk tolerance.

Some lenders might want your income to be 1.5 or 2 times more than the yearly mortgage cost. Others might use similar income multiples as for regular mortgage applicants.

They’ll consider your whole financial picture:

- Job type and security

- Other income and savings (investments, house value)

- Your spending habits, debts and other financial commitments

Focus on having strong, reliable income that covers the mortgage on top of your bills. This could be a steady job or solid investments.

If unsure, talk to a mortgage broker. They can advise if your finances meet lender requirements for guarantors.

Benefits of Being a Mortgage Guarantor

Being a guarantor isn’t all bad news! There are some potential upsides:

- Help someone you care about – Give a close friend or family member a leg up on buying a home.

- Stay involved (if you want) – You might feel more comfortable knowing you can keep an eye on things as a guarantor.

- Shorter commitment – Some guarantor mortgages only last a fixed time, like 5 years, until the borrower builds equity.

- Build trust – Helping someone responsibly shows you believe in their ability to manage money.

But remember, only agree to be a guarantor if you’re sure the borrower can afford the mortgage and you’re comfortable with the risks.

Risks of Being a Mortgage Guarantor

Being a guarantor comes with big risks:

- You’re on the hook for the entire mortgage if the borrower can’t pay – that could be a huge sum.

- Your credit score could suffer if the borrower misses payments. This could make it harder to borrow money yourself in the future.

- Your own home could be repossessed if you can’t keep up with the repayments as guarantor.

- Guaranteeing a mortgage can cause tension with the borrower, especially if there are money problems.

- Some mortgages require guarantors to pay a deposit upfront which you could lose if the borrower defaults.

Think carefully before agreeing to be a guarantor, especially if the borrower has a poor financial history.

The Bottom Line: Speak to an Expert Mortgage Broker

Talk to a mortgage broker before agreeing to be a guarantor. Guarantor mortgages are complex and a broker can explain the pros and cons for both you and the borrower.

A good broker will:

- Check your situation and recommend suitable lenders.

- Explain the risks involved.

- Make sure you meet the lender’s requirements.

- Help the application run smoothly and boost your chances of approval.

Looking for the right broker? Reach out to us. We’ll set up a quick, free, and no-obligation consultation with a qualified broker to help you with your mortgage.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Who is the best person to be a guarantor?

The best person to be a guarantor is usually a close family member or friend who has a stable income, a good credit history, and sufficient assets to provide security if needed.

Ideally, this person should understand the responsibilities involved and be financially comfortable enough to cover the loan if you cannot make the payments.

Can I use anyone as a guarantor?

While you can choose many people to be your guarantor, not everyone will qualify. Guarantors need to meet specific criteria set by the lender, which typically include a good credit score, stable income, and sometimes homeownership. It’s important they fully understand the risks and commitments.

What happens if you are someone's guarantor?

If you are a guarantor, you agree to repay the borrower’s debt if they default on their payments. This responsibility can impact your credit rating and financial standing.

It’s a serious commitment that should not be taken lightly, as it could involve repaying a significant amount of money.

Can a guarantor sue a borrower?

Yes, a guarantor can sue a borrower to recover any money they’ve had to pay on the borrower’s behalf, if the agreement between the guarantor and the borrower includes this provision.

However, this is usually a last resort and can be both financially and relationally taxing. It’s important to have a clear understanding and agreement before entering into such an arrangement.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.