- Can I Get a Mortgage After Bankruptcy?

- When Is the Best Time to Apply for a Mortgage After Bankruptcy?

- How Much Deposit Will I Need After Bankruptcy?

- Mortgage Options After Bankruptcy

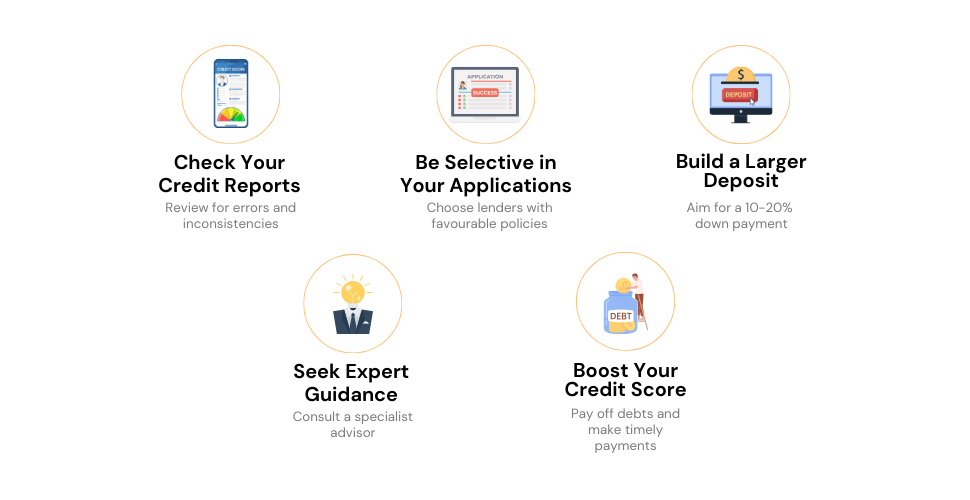

- How Can I Boost My Chances for a Mortgage After Bankruptcy?

- What Happens to My Credit After Bankruptcy?

- Buy-to-Let Mortgage After Bankruptcy

- Key Takeaways

- The Bottom Line

How To Get a Mortgage after Bankruptcy? A Detailed Guide

Life sometimes serves us bitter lemons, and bankruptcy can be one of those sour moments.

It can make you feel like your dream of owning a home is vanishing into thin air.

But, don’t let this dampen your spirits. Yes, acquiring a mortgage after bankruptcy might seem like trying to thread a moving needle, but it’s not a lost cause.

There’s a diverse type of lenders out there. Some may tighten their purse strings, viewing bankruptcy as a severe financial hiccup.

Yet, others are willing to extend a helping hand, looking beyond the numbers and understanding the individual stories behind the bankruptcy.

This article will provide a roadmap to those of you feeling overwhelmed by the process of securing a mortgage after bankruptcy.

We’ll cover the important factors such as the best time to apply, how your deposit can influence the situation, and the importance of professional advice.

So, if you’re worried that bankruptcy has stolen your dream of owning a home, let’s dispel that fear.

There’s a way forward, and we’re here to guide you through it.

Can I Get a Mortgage After Bankruptcy?

It may be possible to get a mortgage after bankruptcy. But, we won’t sugarcoat it – it does introduce certain complexities.

This includes:

- A lower credit score, which could make lenders hesitant to approve your application.

- Higher interest rates, as lenders may see you as a higher risk.

- Fewer lender options, as some lenders may not accept applications from individuals with a history of bankruptcy.

- Stricter lending criteria, such as needing a larger deposit or proof of long-term financial stability.

- The bankruptcy record remains on your credit file for several years, making it harder to build trust with lenders.

- Mandatory waiting periods, as many lenders require a set amount of time to pass before considering your application.

These challenges can make getting a mortgage after bankruptcy harder, but rebuilding your finances can help improve your chances.

Focus on steps like boosting your credit score, saving for a bigger deposit, and showing that your finances are stable.

A specialist broker who knows about bankruptcy cases can also be a big help. They can point you toward lenders who might consider your application and give advice that fits your situation.

While it’s never a sure thing, careful planning and the right support can make owning a home possible again.

When Is the Best Time to Apply for a Mortgage After Bankruptcy?

It’s important to understand the ideal timing for a mortgage application after bankruptcy.

You can’t apply for a mortgage until you’ve been discharged from bankruptcy.This typically happens around 12 months after bankruptcy, but it can be sooner in some cases.

Applying immediately after discharge might seem tempting, but it’s essential to be cautious. Lenders have strict guidelines, so approval at this stage can be challenging.

But, it’s not completely off the table. If the rest of your application is strong and you approach a lender who is open to considering your circumstances, you might still be approved.

It’s essential to present a strong application and choose a suitable lender.

If you’ve been discharged from bankruptcy recently (within one year), lenders might require a large deposit from you and charge higher-than-average rates.

It’s a careful balancing act, one that you don’t have to navigate alone. Specialist advisors can help you craft a winning strategy, ensuring that your application is in the best possible shape.

How Much Deposit Will I Need After Bankruptcy?

The length of time since your discharge from bankruptcy heavily influences your required deposit amount.

Let’s look at an estimated guideline:

| Timeline After Bankruptcy | Deposit Requirement in % of Home Value |

|---|---|

| Less than a year | 40% |

| 1 year | 25% – 30% |

| 2 years | 15 – 20% |

| 3 years or more | 5% (given you’ve maintained good credit since bankruptcy) |

Bear in mind, this table only provides a general overview. Other factors can influence your deposit amount, such as your current income, your credit score, and your property value.

Each situation is unique, and an advisor can provide a more accurate deposit estimate tailored to your circumstances.

Mortgage Options After Bankruptcy

Let’s examine your mortgage possibilities after bankruptcy.

First, you can pursue a traditional mortgage. Typically, these lenders would require a minimum deposit from you, often around 5% of the property value.

Your deposit amount can be a vital factor in securing approval, so it’s worth saving as much as possible.

For those interested in property investment, a buy-to-let mortgage might be the way forward. These mortgages are specifically designed for properties that are rented out.

Some lenders offer this type of mortgage to discharged bankrupts, adding another layer to your range of options.

Remortgaging is also an alternative worth considering.

If you already own a property and have been discharged from bankruptcy, remortgaging might help you secure better interest rates, consolidate debts, or release some equity.

In all these cases, it’s essential to seek advice from experts who are well-versed in dealing with bankruptcy mortgage scenarios. They can guide you towards the best solution tailored to your situation.

How Can I Boost My Chances for a Mortgage After Bankruptcy?

Here are five tips to help you navigate this situation effectively:

Check Your Credit Reports

Your credit report is a crucial document that potential lenders review to assess your creditworthiness. It provides a comprehensive account of your credit history, including your repayment habits and the amount of debt you owe.

You can get a free copy from various credit reference agencies such as Experian, Equifax, and TransUnion.

An error or inconsistency in your credit report can lower your credit score, making it more challenging for you to obtain a mortgage.

Therefore, it’s crucial to regularly check your credit reports from all major credit bureaus, ensure all information is accurate, and promptly report any errors you find.

This vigilance can prevent unjust damage to your credit score, thereby improving your chances of mortgage approval.

Be Selective in Your Applications

When seeking a mortgage after bankruptcy, a common mistake is to apply to every lender you encounter. This approach can potentially harm your credit score due to multiple ‘hard credit’ checks and show a sense of desperation to lenders.

Instead, research and choose lenders who have policies favourable to those with a history of bankruptcy.

These lenders may offer specialised loan products or programmes that accommodate your situation. In doing so, you reduce unnecessary credit enquiries and increase your chances of being approved.

Build a Larger Deposit

The deposit you put down on a home significantly impacts your mortgage prospects.

Generally, the larger the deposit, the smaller the loan you need, which decreases the lender’s risk.

After bankruptcy, your risk profile to lenders is higher, but saving for a larger deposit can counterbalance this. It’s highly recommended to aim for a 10-20% deposit to unlock better deals and gain more access to lenders.

It shows lenders your financial responsibility and ability to save, which may make them more likely to approve your mortgage application.

Seek Expert Guidance

Navigating the mortgage landscape after-bankruptcy can be challenging. Therefore, consulting with a specialist advisor who has experience with adverse credit cases can be extremely beneficial.

These professionals understand the intricacies of the process and can provide you with tailored advice that suits your specific circumstances.

They can also point you towards appropriate lenders, assist with your application, and help you negotiate the best possible mortgage terms.

>> More about Bad Credit Brokers

Boost Your Credit Score

Your credit score is a key factor in determining your eligibility for a mortgage. After bankruptcy, improving your credit score should be a top priority.

Start by paying off existing debts, avoiding new credit, and consistently making all payments on time. Regularly monitor your credit score to track your progress.

Over time, these actions will demonstrate your improved financial behaviour and responsibility to potential lenders, boosting your chances of securing a mortgage.

>> More about Improving Your Credit Score

What Happens to My Credit After Bankruptcy?

It’s important to clear all credit issues before your bankruptcy, as that’s what bankruptcy is meant for. Once bankruptcy is over, it lets you start afresh on your credit file. However, having credit issues after this process can make getting a mortgage tricky.

Here are some things that can affect your bankruptcy:

- County Court Judgments (CCJs) on your credit record

- Missed payments

- Late payments on your credit record

- Taking payday loans before applying for a mortgage

Having new financial problems that harm your credit record can make it tougher to get a mortgage. But don’t lose hope; some lenders might still say yes.

However, most will want a perfect credit record since the bankruptcy. Any new bad credit limits the lenders you can apply to.

If this happens to you, it’s very important to talk to an advisor before you apply for a mortgage. You don’t want to just try your luck with any lender. That could seriously harm your chances of getting a mortgage after bankruptcy.

Buy-to-Let Mortgage After Bankruptcy

If you’re considering becoming a landlord after bankruptcy, you may be curious about buy-to-let mortgages. Despite the complexity, it’s not an unachievable goal.

A buy-to-let mortgage differs from a standard one as it allows you to buy property as an investment, with tenants covering the mortgage payments through rent.

Post-bankruptcy, this type of mortgage comes with some eligibility criteria, including:

- Time Since Discharge: Many lenders require a minimum period after your bankruptcy discharge, typically ranging from 1 to 6 years.

- Deposit: Buy-to-let mortgages usually require a larger deposit, often around 25% or more of the property’s value.

- Rental Yield: Lenders assess potential rental income. It should comfortably cover your mortgage payments, usually by 125%.

Key Takeaways

- Getting a mortgage after bankruptcy is possible, but it’s more challenging. Lenders may ask for higher deposits (up to 40%), charge higher interest rates, and have stricter criteria.

- Waiting at least 2 years after discharge improves your chances, with 3 years or more giving you access to better deals and lower deposit requirements.

- Focus on improving your finances. Build your credit score, save for a bigger deposit, and show lenders that you have a steady income and pay bills on time.

- A specialist broker can help, but it’s not guaranteed. They can find lenders open to your situation and help you apply in the best way possible.

The Bottom Line

Getting a mortgage after bankruptcy can feel tough, but it’s possible. The key is to take things one step at a time and find the right lender for you.

A bad credit mortgage broker can be a big help. They can guide you through the process, making it less stressful.

Remember, it might take time, but with patience, you can achieve your goal of homeownership.

Ready to start? Fill out this quick form and we’ll help you connect with a specialist broker who can guide you in your mortgage options and the process.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How long after bankruptcy can I get credit in the UK?

The time you must wait before obtaining credit varies depending on the lender. However, typically, you may start rebuilding your credit immediately after your bankruptcy discharge. It’s worth noting that bankruptcy will appear on your credit report for six years.

Can you recover from bankruptcy?

Yes. Recovery from bankruptcy is possible and fairly common. It involves rebuilding your credit, budgeting wisely, and managing your finances responsibly.

Does Bankruptcy Stay on Your Credit File Forever?

No, bankruptcy does not stay on your credit file forever. In the UK, bankruptcy typically remains on your credit report for six years from the date it was first registered. After this period, it is usually automatically removed, and you can begin rebuilding your credit profile.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.