- Can I Get a Mortgage With Missed Payments?

- Late Payments, Missed Payments, Arrears, and Defaults Explained

- Does Your Late Payment Type Matter?

- How Long Do Late Payments Stay on My Credit File?

- Can Mortgage Applications be Declined Due to Late Payments?

- The Consequence of Missing One Payment on Your Credit Score

- What Happens if You Miss a Mortgage Payment?

- Applying for a Mortgage After Arrears

- Is Paying Your Mortgage with a Credit Card Possible?

- What Lenders Consider When Assessing Mortgage Applications

- How To Increase Your Chances of Mortgage Approval with Late Payments

- Key Takeaways

- The Bottom Line

How To Get Mortgages With Missed Payments? A Complete Guide

Do missed payments on your bills keep you up at night when thinking about getting a mortgage?

Missed payments can tag you as a risky borrower in the eyes of lenders. Yet, don’t consider it a dead-end.

There’s a silver lining here!

With strategic planning and the right guidance, you can pave the path to homeownership despite these financial hiccups.

In this guide, we’ll explain how missed payments affect your credit score and your mortgage prospects.

We’ll also provide practical tips on how to improve your credit score and increase your chances of getting a mortgage.

Can I Get a Mortgage With Missed Payments?

You may be able to get a mortgage with a history of missed payments. But it’s not easy.

Success depends on many factors, including your current finances, the lender’s rules, and how you’ve improved your situation since the missed payments.

Missed payments can make you look like a higher-risk borrower, and if you’ve got bad credit, you might face extra challenges, such as:

- Fewer lenders willing to accept your application.

- Higher interest rates because lenders see you as a higher risk.

- Stricter conditions, such as needing a larger deposit or providing extra proof of financial stability.

That said, there are things you can do to improve your chances:

- Show you’re responsible with money by saving regularly and paying down debts.

- Explain why you missed payments and highlight the steps you’ve taken to fix your finances.

- Look for lenders who specialise in helping people with credit issues. These lenders will check the reason for your credit issue, how recent it is, and how much was involved.

Working with a bad credit mortgage broker may increase your pool of lenders and your chances of mortgage approval.

If you need one, don’t hesitate to reach out to us and get matched with a specialist broker.

Late Payments, Missed Payments, Arrears, and Defaults Explained

- Late Payments. A late payment happens when you make a payment after the due date. Although it may seem minor, it can damage your credit report and make lenders wary.

- Missed Payments. A missed payment occurs when you don’t make a payment within a specific billing cycle. This can mark you as a risky borrower to lenders, potentially damaging your chances of getting a mortgage.

- Arrears. If you miss several payments, your account will go into arrears. This ongoing non-payment can have a serious impact on your credit score.

- Defaults. A default occurs when a lender formally closes your account due to persistent non-payment. Defaults are a red flag for mortgage lenders and could significantly limit your loan options.

In essence, these terminologies represent varying degrees of financial hiccups, each escalating in severity and the level of potential impact on your credit file and mortgage application.

Does Your Late Payment Type Matter?

The type of late or missed payment you’ve encountered plays a significant role in your mortgage application. Missed payments generally fall into two categories: unsecured and secured.

Here’s a simple guide to understanding them:

Unsecured Late Payments

Unsecured late payments are associated with unpaid bills like phone services, credit cards, personal loans, and overdrafts.

Essentially, these debts aren’t linked to any assets, so the creditors rely on your capacity to manage your finances and meet payment obligations.

If you’ve experienced late payments in this category, mortgage lenders might show a degree of flexibility.

While it can still impact your application, some lenders could overlook this and still offer their usual products. But, it’s essential to choose a mortgage lender that accommodates late payments.

Secured Late Payments

Secured late payments involve debts such as mortgages and secured loans, where the loan is anchored to an asset, like a property.

To put it simply, when you secure a mortgage, the debt is tied to your property, and failure to meet the payment schedule could lead the lender to claim the house as collateral.

Late payments in this secured category might meet with stricter reactions from lenders. This is particularly true if the missed payments are recent or frequent.

While lenders may still consider your application, you might need a larger deposit than usual to secure a mortgage following late payments.

This highlights the importance of managing secured debts diligently to maintain your credit profile and your chances of successful mortgage applications.

How Long Do Late Payments Stay on My Credit File?

Late payments in the UK can stay on your credit file for six years, from the date of the missed payment.

The impact of these late payments on your credit score generally decreases over time, especially if they are isolated incidents rather than a pattern of behaviour.

If you spot any errors on your credit file, such as late payments that you have not missed, it is essential to dispute them with the credit reference agencies.

You can do this by contacting them directly and providing evidence to support your claim. Keeping your credit file accurate is an important step in maintaining your financial health.

Can Mortgage Applications be Declined Due to Late Payments?

Mortgage lenders are naturally cautious. They critically scrutinise your ability to repay, and past late payments could ring alarm bells.

They might wonder: will past payment struggles predict future issues?

Lenders evaluate various factors such as the type of late payment (secured or unsecured), how long ago it occurred, and whether it was a single event or part of a trend.

If there have been multiple late payments in recent times, the mortgage application may be declined.

But don’t lose hope! Here are some tips for potential borrowers with late payments:

- Check Timing – Lenders often focus on recent late payments. Keep recent records clean before applying for a mortgage.

- Choose Lenders – Different lenders have varying views on late payments. Some might be strict while others, especially specialist lenders, may be more understanding.

- Clarify Reasons – Explain unexpected events like job loss or illness to lenders.

- Consult Brokers – Work with experts who can guide and increase approval odds.

- Correct your Credit Record – Monitor your credit file and address any inaccuracies.

- Contribute More – Save for a larger deposit to appeal to lenders.

The Consequence of Missing One Payment on Your Credit Score

You may overlook a single missed payment, but it can considerably dent your credit score.

A missed payment, particularly on a large debt like a mortgage, can significantly reduce your credit score. It tells lenders you may not be a reliable borrower. This adverse mark stays on your credit report for six years, potentially affecting future borrowing prospects.

Therefore, it is in your best interest to strive to meet all payment deadlines. Establishing a strong and consistent financial track record paves the way for more lending opportunities and simplifies the process of securing loans, especially substantial ones like mortgages.

What Happens if You Miss a Mortgage Payment?

Even the most organised amongst us can slip up now and then. But what happens if that slip-up involves a missed mortgage payment?

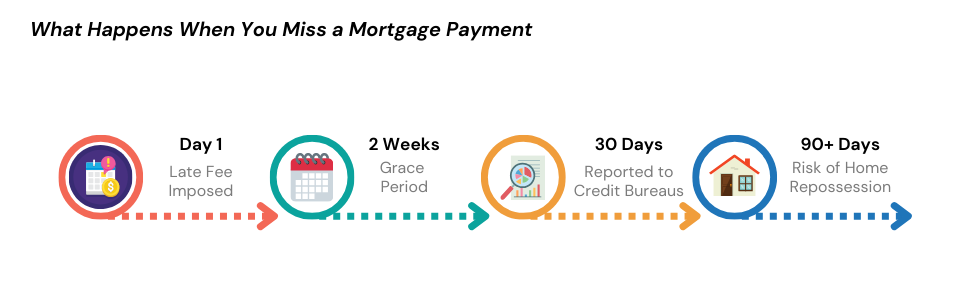

Initially, most lenders will impose a late fee if they don’t receive your payment by the due date. This fee typically equates to a percentage of the missed payment.

Some lenders will offer a grace period, usually around two weeks, allowing you to settle the missed payment without them reporting it to the credit bureaus.

Nevertheless, if your payment is 30 days overdue, the lender usually reports it to the credit bureaus, leading to a substantial dip in your credit score.

Worse yet, if this missed payment becomes a habit and you fall behind by 90 days or more, the lender may classify the loan as defaulted and initiate proceedings to repossess your home.

So, what’s the best way to handle this? Here’s some advice:

1. Get in touch with your lender

If you know you’re going to miss a payment or have already missed one, contact your lender immediately.

They might be able to work out a repayment plan or temporary loan modification to help you through your financial hardship.

2. Consider seeking professional help

If you’re facing ongoing financial difficulties, talking to a debt counsellor or financial advisor could be beneficial. They can provide advice tailored to your specific situation.

Applying for a Mortgage After Arrears

Having arrears on your credit file can make applying for a mortgage more challenging, but not impossible. Here’s what you can expect:

- Fewer options. Not all lenders will be willing to take on the perceived risk of lending to someone with past arrears. This could limit your mortgage options.

- Higher interest rates. Those lenders who are willing to consider your application might charge higher interest rates to compensate for the perceived risk.

- Sizeable deposit. A larger deposit can help mitigate the lender’s risk and improve your chances of getting a mortgage.

Is Paying Your Mortgage with a Credit Card Possible?

The idea of paying your mortgage with a credit card might seem attractive, especially if you’re earning reward points or cashback. But is it even possible?

Most UK lenders don’t accept credit card payments for mortgages because transaction fees are high. Also, shifting debt from your low-interest mortgage to a high-interest credit card might cost you more over time.

If money problems are forcing you to consider this, think twice. Credit cards are not a long-term solution for mortgage payments. So, get financial advice if you’re struggling.

What Lenders Consider When Assessing Mortgage Applications

When you apply for a mortgage, lenders take a holistic view of your financial situation to determine your creditworthiness. Here are the key factors they consider:

- Credit history – Lenders assess if you’ve managed credit well before.

- Employment status and income – A steady work and regular income convince lenders you can repay the mortgage.

- Deposit size – The larger deposit, the better your chances of securing a good deal.

- Outgoings – Lenders examine your usual spending to see if you can easily afford mortgage payments.

How To Increase Your Chances of Mortgage Approval with Late Payments

Getting a mortgage with a history of late payments isn’t easy, but it’s not impossible. Here’s how you can improve your prospects:

- Download your Credit Report. Get a copy of your credit file from credit reference agencies – Experian, Equifax, and TransUnion. Validate your details and ensure everything is accurate. Promptly report any discrepancies to the relevant credit reference agency.

- Register on the Electoral Roll. This eases the identity verification process for lenders. Make sure your information is current and accurate. If you’re not yet registered click here.

- Ensure Your Name is on the Bills. Having your name on any bill payments contributes positively to your credit score.

- Manage your Credit. Responsible usage of credit can boost your credit score. Don’t max out your cards; lenders assess this during your affordability check.

- Stay Vigilant Against Fraud. Regular credit report checks can help spot any irregularities or suspicious activities.

- Dissolve Unnecessary Joint Accounts. If you’re financially linked to someone with poor credit, it could impact your score negatively. Consider removing yourself from such accounts.

- Space out Credit Applications. Frequent credit applications can signal financial distress to lenders. Try to leave some time between applications.

- Check Credit Score Regularly. Regular checks help spot any issues or errors. Plus, it’s motivating to see your score improve over time. Always check before applying for credit to get an idea of what lenders will see.

Improving your mortgage prospects takes time and consistent effort, but the benefits make the hard work worthwhile.

With time, discipline, and good financial habits, you can increase your chances of securing that dream home, even with a history of late payments.

Key Takeaways

- Getting a mortgage with missed payments is possible, but it’s more challenging. You might face higher interest rates, fewer lender options, and stricter rules like needing a bigger deposit.

- Lenders consider the type and timing of missed payments. Recent or frequent missed payments on secured debts (like mortgages) are seen as more serious than older or smaller ones.

- Working with a specialist broker can help find lenders who accept missed payments, but approval isn’t guaranteed, and some options may not suit your needs.

The Bottom Line

For many of us, missed payments on your credit history can feel like a big hurdle. But don’t worry—it’s something you can fix.

By improving your credit file and showing lenders you’re responsible with money, you can rebuild their trust.

Here’s where a mortgage broker can really help. They know which lenders are more flexible about missed payments and can guide you with advice tailored to your situation. Plus, they’ll handle the complicated stuff so you can focus on moving forward.

If you’d rather skip the stress and endless Googling for the right broker, we can help you.

Reach out to us, and we’ll match you with a good specialist broker who knows how to tackle your unique mortgage challenges.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can a late payment be removed from the credit report?

Yes, but only if it’s an error. You can dispute it with the credit bureau. If it’s accurate, it will stay on your report for six years.

How late does a mortgage payment have to be to be considered late?

In general, if your mortgage payment is more than 15 days late, it means you’re out of the grace period and you’ll have to pay a late fee.

If you’re 30 days late, your mortgage company will report your late payment to credit bureaus such as Experian, Equifax, and Transunion. But, it’s best to check with your lender as policies may vary.

How do you explain late payments on a mortgage application?

Be honest and clear. Explain the reasons for late payments, such as job loss or health issues. Show the lender what you’ve done to improve your financial situation since then.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.