How To Improve Mortgage Credit Score? 10 Best Tips in 2025

When you’re applying for a mortgage, your credit score is like a summary of your financial behaviour.

It shows how well you’ve managed credit in the past, and lenders use it to decide if they’ll approve your application.

Your credit score doesn’t just affect approval—it also impacts the interest rate you’ll be offered.

A higher score could mean lower rates, saving you money and making it easier to afford your dream home.

In this guide, we’ll explain what credit scores are, how they influence your mortgage, and, most importantly, how you can improve yours step by step in 2024.

Let’s get started!

How Do Credit Scores Work in the UK?

A credit score is like a financial report card. It’s a number from 0 to 999 that shows how well you’ve managed your money and credit.

The higher your score, the better your ‘grades’. This score comes from credit reference agencies – which are Experian, Equifax, and TransUnion. Each agency uses a slightly different scoring system.

Here’s a look at what counts as excellent, good, fair, and poor scores for each of them:

| Credit Status | Experian | Equifax | TransUnion |

|---|---|---|---|

| Excellent | 961-999 | 811-1000 | 781 – 850 |

| Very Good | – | 671-810 | – |

| Good | 881-960 | 531-670 | 721 – 780 |

| Fair | 721-880 | 439-530 | 661 – 720 |

| Poor | 561-720 | 0-438 | 601 – 660 |

| Very Poor | 0-560 | – | 300-600 |

Your credit score can be based on factors like your payment history, how much debt you have, and how long you’ve had credit.

How Your Credit Score Influences Your Mortgage Application

When you apply for a mortgage, lenders want to know whether they can trust you to repay the loan on time. Your credit score helps them make this decision.

The better your score, the more reliable you appear in the eyes of the lender.

For instance, if you have a high credit score, lenders are more likely to approve your application. Not only that, but a good credit score can also secure you more favourable interest rates.

This is because you’re viewed as a low-risk borrower, so lenders are willing to offer you better terms.

On the other hand, a low credit score may result in your mortgage application being declined or, if approved, at higher interest rates.

But don’t worry, even if your credit score isn’t where you want it to be, you can always improve it.

Tips to Improve Your Credit Score for a Mortgage

Here are some easy ways to improve your credit before you apply for a mortgage:

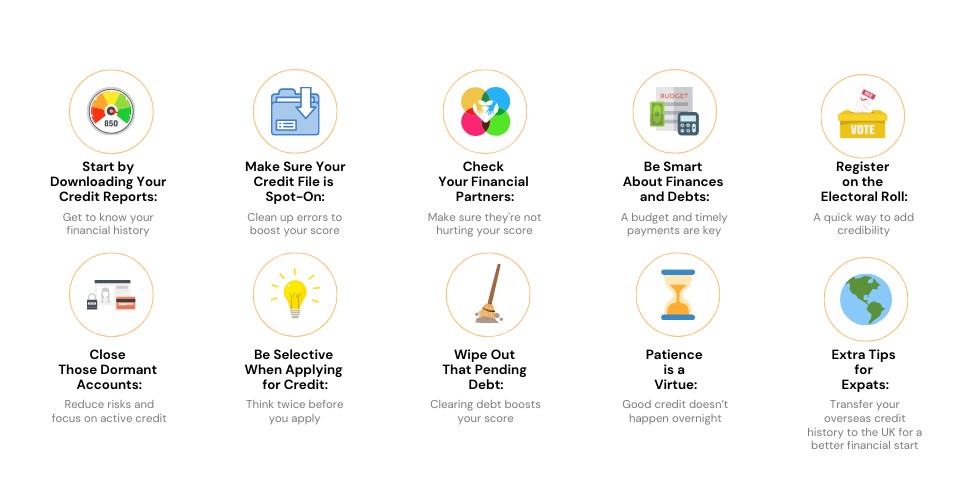

Download Your Credit Reports

Before you start, you need to understand where you stand. And that begins with downloading your credit report.

As mentioned earlier, in the UK, there are three major credit reference agencies: Experian, Equifax, and TransUnion.

Each agency might have slightly different information about you, so it’s a good idea to get your report from all three.

Here’s how to download your credit report:

- Step 1: Visit the official websites of Experian, Equifax, and TransUnion.

- Step 2: Follow their respective processes to request your credit report.

- Step 3: Review each report carefully and ensure all the information is correct.

Ensure Your Credit File is Accurate and Up-to-Date

Making sure your credit file is accurate is a big deal when it comes to keeping your credit score in good shape.

Even small mistakes, like an old address or an incorrectly reported late payment, can drag your score down unfairly.

That’s why it’s a good idea to check your credit reports regularly to make sure everything’s in order.

If you spot something that doesn’t look right—whether it’s an error or outdated info—don’t panic.

You can raise a dispute with the credit reference agency, and they’ll look into it. If you’re right (and hopefully you are), they’ll fix the mistake, helping your credit score reflect your actual creditworthiness.

Here’s a quick checklist of what to look out for when reviewing your credit report:

- Personal details. Check your name, address, and other personal information for accuracy.

- Account details. Ensure all your credit accounts are listed and their details are accurate.

- Payment history. Confirm that your payment history is correct. Look out for any wrongly reported late or missed payments.

- Hard enquiries. Hard credit checks should only occur when you apply for credit. If you see any you don’t recognise, you could be a victim of identity fraud.

Check Your Financial Connections

Being financially linked to someone can impact your credit score. This often happens when you share a joint account, but many people don’t realise how it could affect them.

If you’re still connected to someone financially and no longer need to be, it’s a good idea to get it updated.

These links are common with ex-partners or housemates you’ve shared bills with.

For example, a joint account for rent or utilities can leave you tied together even after you’ve moved on. If the connection is no longer needed, you can contact the credit agency to have it removed.

When buying a home with a partner or friends, a joint mortgage will link your finances.

Their credit history could influence your future applications, so think carefully before combining accounts.

Reviewing your financial connections helps keep your credit profile clean and avoids problems down the line. It’s a quick and easy step to stay on top of things. 😀

Manage Your Finances and Debts Wisely

Fixing your credit report is just the start. The real magic happens when you manage your finances and debts wisely.

Building good financial habits might seem tough at first, but it’s worth the effort. Here are some ways to build financial discipline:

- Budgeting. Take some time each month to plan your income and spending. This helps you stay on track and ensure you can afford your debt repayments.

- Pay on Time. Late payments can damage your credit score. Set reminders or automate payments to avoid missing deadlines.

- Keep Balances Low. Avoid maxing out your credit cards. Keeping your balances low compared to your credit limit can boost your credit score.

- Limit Credit Applications. Applying for too much credit at once can harm your score.

- Pay Off Debt. Clearing your debts can improve your credit score and make you a more attractive borrower.

Remember, building a good credit score is not an overnight process, but with consistent effort, you’ll see your score improve.

Register on the Electoral Roll

Signing up for the electoral roll can give your credit score a helpful boost. Lenders and credit agencies use it to check your identity and where you live, which helps prevent fraud.

Being on the roll makes you look more trustworthy to lenders.

Getting registered is quick and simple. You can do it online, by post, or in person. Just provide your name, address, nationality, and date of birth—it’s that easy.

Once you’re registered, your details will show up on your credit report, helping you look more reliable as a borrower. It’s a small effort that can make a big difference to your credit score.

Close Unused Accounts

When it comes to credit accounts, it’s not always a case of ‘the more, the merrier.’

In fact, keeping old, unused credit accounts open can have a negative impact on your credit score.

Lenders may view multiple open accounts as a risk, thinking you could suddenly use all that available credit and potentially struggle with repayments.

So, it’s a good idea to trim down your accounts and close those that you’re not using. Start by making a list of all your credit accounts.

Review each one, and if there are any you haven’t used in a while, it’s worth considering closing them.

Be Wise When Applying for Credit

Contrary to what some may think, frequently applying for new credit can hinder your credit score. Each application creates a ‘hard search’ on your credit file, which lenders can see.

Numerous hard searches in a short period can give the impression that you’re reliant on credit, making you seem riskier to lenders.

So, it’s important to be wise about when and for what you apply.

Consider whether you genuinely need the credit, and if you do, make sure you choose a lender that’s likely to accept you based on your current credit score.

You can often find this out by using lenders’ eligibility checkers, which only perform ‘soft searches’ that don’t leave a mark on your credit file.

Clear Outstanding Debt

If you have outstanding debt, it can hold your credit score back and make lenders see you as a higher risk. Your credit score largely reflects how well you manage and repay money you borrow, so carrying unpaid debt doesn’t work in your favour.

Paying off your debts shows lenders that you’re responsible and reliable, which can help improve your credit score.

If you’ve got debts to tackle, it’s worth making a plan to start clearing them step by step. It might take some time, but every payment makes a difference.

Don’t Rush It

Building a strong credit history, saving for a deposit, and making sure you can afford a mortgage takes time and effort.

Knowing where you stand with your credit is a good start.

Keep working towards your goal, and you’ll be rewarded in the long run. It might seem slow, but your patience will pay off.

Extra Tips for Expats: Handling Credit History from Abroad

Moving to the UK? Unfortunately, your overseas credit history won’t tag along with you automatically.

But don’t worry—there are ways to bring it over and use it to your advantage.

If you’ve got a strong credit history in your home country, you can make it work for you here.

Some credit agencies can transfer your overseas credit information to the UK, helping lenders see a clearer picture of your financial habits.

It’s worth exploring this option, especially if your credit history back home shows you’ve been a reliable borrower.

Key Takeaways

- A credit score shows how well you manage money, ranging from 0 to 999 in the UK. Experian, Equifax, and TransUnion are the three main credit agencies, each with different scoring systems.

- A high credit score improves your chances of getting a mortgage and better interest rates.

- Regularly check your credit reports for mistakes and fix any errors to keep your score accurate.

- Register on the electoral roll to boost your credibility with lenders.

- Manage your finances by budgeting, paying on time, keeping credit balances low, and paying off debts.

- Avoid applying for too much credit at once, as it can lower your score.

- Close unused credit accounts to reduce risk in the eyes of lenders.

- Expats can explore transferring their overseas credit history to the UK if they have a good record.

- Building a strong credit score takes time, but consistent effort will improve it.

The Bottom Line: Where To Start?

If you’re feeling overwhelmed about where to start after taking in all this information.

Don’t worry, it’s completely normal to feel a bit unsure. The good news is that you don’t need to do everything at once.

You can start small: check your credit report, pay off a little debt, or register on the electoral roll. Each small step moves you closer to your goal.

The key is to take action, no matter how small it seems. Even logging into your credit report is progress—it’s the first step towards improving your credit score and getting closer to owning your dream home. You’ve got this! 😊

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How long does it take to build a credit score for a mortgage?

Building a credit score for a mortgage can take anywhere from a few months to a couple of years. It depends on your starting point, the actions you take, and how consistently you manage your finances.

If you’re starting from scratch, it might take at least 6 months of regular credit activity to generate a credit score. Remember, improving your credit score is a gradual process that requires patience and diligent financial management.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.