How To Get a Mortgage With an IVA? Your Complete Guide

Getting a mortgage after an Individual Voluntary Arrangement (IVA) in the UK might seem tricky.

Lenders often see you as a high-risk borrower. But don’t worry – it’s not as tough as it used to be.

Years ago, most lenders wouldn’t give mortgages to people with poor credit histories. Things changed in the late 20th century when more lenders started to accept such borrowers.

Then came the property boom of the early 2000s. Many people with bad credit histories got mortgages, but then the financial crisis hit in 2007-2008.

This crisis led to stricter rules and lenders became more careful. Yet, as time passed, the market started to recover.

Now, some lenders even specialise in helping people with IVAs or other financial issues. These lenders do charge higher interest rates to balance out the risks they take.

So, it’s entirely possible to get a mortgage with an IVA in your past.

This article will explain how an IVA affects your chances of getting a mortgage. Plus, it’ll give you some practical tips to boost your chances of getting that mortgage approval.

How Does an IVA Work?

An IVA, or Individual Voluntary Arrangement, is a legally binding agreement between you and your creditors. It’s designed to help people in financial difficulty make manageable payments towards their total debt.

When you set up an IVA, you agree to pay a specific amount to an insolvency practitioner. These professionals can be either qualified accountants or solicitors, and they are authorised by the UK government to manage IVAs.

The agreement lasts for a set period, usually around five years. During this time, your creditors can’t take further action against you.

Here are the steps in setting up an IVA:

- Assessment. An insolvency practitioner evaluates your financial situation to see if an IVA is suitable.

- Proposal. The practitioner develops a payment plan based on what you can afford.

- Approval. The proposal is sent to your creditors, who vote on whether to accept it.

- Commencement. If approved, the IVA starts. You make monthly payments to the practitioner, who distributes the money among your creditors.

- Completion. Once the agreed period ends, any remaining debt is usually written off. You’re then free from these particular debts.

Can I Get a Mortgage After an IVA?

While it’s possible to get a mortgage after an IVA, it’s not a sure thing. Lenders can be a bit wary of people who’ve had financial difficulties in the past.

High-street lenders might be a bit hesitant, as they tend to have stricter rules. They might see an IVA as a red flag and say no.

Specialist lenders might be more open-minded. They’ll look at your current situation, like your income, job, and how you’ve been handling your money lately. But, they might charge higher interest rates or ask for a bigger deposit to cover the risk.

The good news is: time can help.

The longer it’s been since your IVA finished, the better your chances might be. But even then, it might still be tough to find a mortgage.

So, while it’s possible, it’s best to be realistic and explore all your options.

How Long Does an IVA Stay on My Credit File?

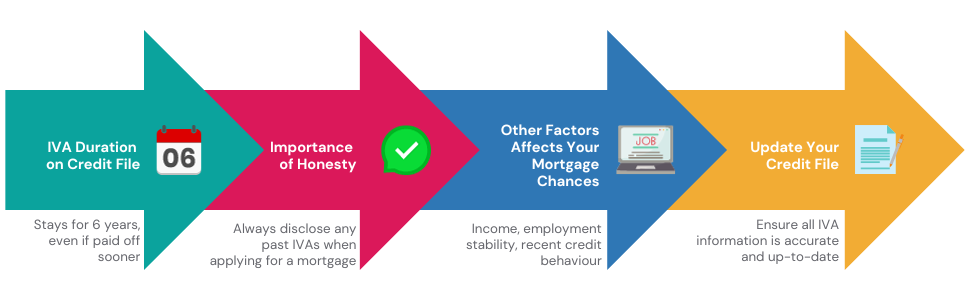

An IVA typically stays on your credit file for six years from the start date, even if you’ve paid it off sooner. During this time, it can make securing credit, including mortgages, more difficult.

When applying for a mortgage, honesty is crucial. If a lender asks about any past IVAs, it’s essential to disclose this information.

Failure to do so can result in rejection if the lender later discovers it, as it raises doubts about your integrity and honesty.

Although an IVA on your credit file is a significant factor, lenders also consider several other aspects when assessing your mortgage application.

They’ll look at your current income, employment stability, and how well you’ve managed other credit agreements since your IVA. A positive recent credit behaviour can boost your chances of getting a mortgage even with an IVA in your past.

Ensuring your credit file is accurate and up-to-date is also a crucial step towards improving your mortgage approval chances.

If you’ve paid off your IVA and it’s still listed on your credit file, you should contact the credit reference agencies to update your status.

How Can You Prepare for a Mortgage Application After an IVA?

When you’re ready to apply for a mortgage after an IVA, planning ahead and being well-prepared will be your best friends.

Here are the steps you should consider:

Wait it Out. The longer you wait after an IVA before applying for a mortgage, the better your chances of approval. This waiting period allows you to demonstrate responsible credit behaviour.

Check Your Credit File. Ensure your IVA is marked as satisfied, and that there are no other mistakes on your credit file.

Remember to also review the list of your financial associations, as they could influence your mortgage application. You can get a copy of your credit file or check them in the following CRA links – Experian, Equifax, and TransUnion.

Rebuild Your Credit Score. Take small steps to rebuild your credit score. This could involve paying your bills on time, keeping your credit utilization low, and disputing any errors on your credit report.

Save for a Deposit. A larger deposit can make a lender more willing to offer a mortgage. It shows you’ve been able to save and reduce the lender’s risk.

Seek Advice. A good mortgage broker, especially one with experience in poor credit mortgages, may provide valuable insight into which lenders are more likely to approve your application.

Key Takeaways

- An IVA is a legal agreement between you and your creditors, managed by an insolvency practitioner, usually lasting about five years.

- You can get a mortgage after an IVA, but it’s not guaranteed. It depends on your finances, how long ago your IVA was, and the lender. Some specialist lenders may help if you have a steady income and good recent credit.

- To improve your chances, focus on rebuilding your credit score, checking your credit file for accuracy, saving for a deposit, and seeking advice from a mortgage broker.

The Bottom Line

Working with a mortgage broker, especially when dealing with an IVA, brings many advantages.

A good broker not only understands the complexities of the mortgage market but can also provide tailored advice, access to specialist lenders, and aid in building a robust application. This expertise can greatly increase your chances of a successful mortgage application after an IVA.

If you’re considering a mortgage with an IVA, we encourage you to get in touch with us. Our dedicated team is ready to connect you with a skilled broker to guide you through every step.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How long does an IVA stay on my credit history?

An IVA stays on your credit history for six years from the date it starts. Furthermore, an IVA can impact your ability to obtain any type of loan, not just a mortgage, because it leaves a mark on your credit file that lenders will see when they conduct a credit check. This means that getting loans could become more difficult while an IVA is on your record.

What actions should I take after my IVA has been settled?

After your IVA has been settled, check your credit file to ensure the IVA is marked as satisfied. Start rebuilding your credit score by demonstrating responsible credit behaviour.

Will I receive any documentation after my IVA is settled?

Yes, once your IVA is completed, you will receive a completion certificate from your insolvency practitioner. This is a formal document that signifies the end of your IVA. It’s advisable to use this document to confirm that your credit file has been updated correctly.

Can I apply for a mortgage while my IVA is still in effect?

It’s technically possible to apply for a mortgage during your IVA, but it’s significantly more challenging. Lenders might view you as a high-risk borrower, making it harder to secure a mortgage.

How much deposit will I need for a mortgage after an IVA?

The deposit you’ll need can vary, and the recency of your IVA matters. Generally speaking, if your IVA was over 6 years ago, you may be able to put down a 5% deposit. But, if your issue was recent, you might be asked for a large deposit of at least 10% or more to offset the lender’s risk.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.