- Are There Mortgage Lenders That Don’t Credit Score?

- Why Don’t Some Lenders Credit Score?

- Does No Credit Score Mean Bad Credit?

- How Lenders Assess Applications With No Credit Score

- How to Improve Your Mortgage Chances With No Credit Score

- Mortgage Lenders That Don’t Credit Score in the UK

- Lender Fees Without Credit Score

- The Bottom Line

Mortgage Lenders That Don’t Credit Score Explained

Let’s face it – getting your foot on the property ladder is tricky without a credit score.

But, if you’re just starting or new to managing credit, you might be wondering – can I get a mortgage with no credit score?

Yes, you can. While chances might be slim, there are ways to get approved for a mortgage even without a credit rating.

However, you need to do some EXTRA effort on your part.

Let’s dive into the details.

Are There Mortgage Lenders That Don’t Credit Score?

The short answer is yes, there are some mortgage lenders in the UK that don’t rely as heavily on credit scoring for approval.

But, the reality is that most BIG high street banks and mainstream lenders do use credit scoring as a KEY part of their mortgage application process.

So while it’s possible to get a mortgage with no credit score, your options may be more limited compared to someone with an established credit history.

The more flexible lenders tend to be smaller building societies and specialist mortgage providers.

Why Don’t Some Lenders Credit Score?

Some mortgage lenders don’t rely heavily on credit scores for a few reasons:

- They assess each application thoroughly, considering the borrower’s entire financial situation.

- They target borrowers who might have a limited credit history, like the self-employed, expats, or young professionals.

- Their scoring systems prioritise factors like income, employment, and assets over credit reports.

Does No Credit Score Mean Bad Credit?

Having no credit score is different from bad credit. No credit history simply means there’s no information for lenders to assess you.

Bad credit, however, means you’ve missed payments or defaulted on loans in the past. This poor credit history makes lenders less likely to approve you for financing.

There are two main credit scores:

- A credit reference agency (like Experian and Equifax) score shows your past financial behaviour.

- A lender’s score for your mortgage application, which looks at your risk as a borrower.

Even though it’s harder, having no credit score is usually better than bad credit.

A clean slate with no credit is less worrying for a young borrower than a history of late payments and defaults.

How Lenders Assess Applications With No Credit Score

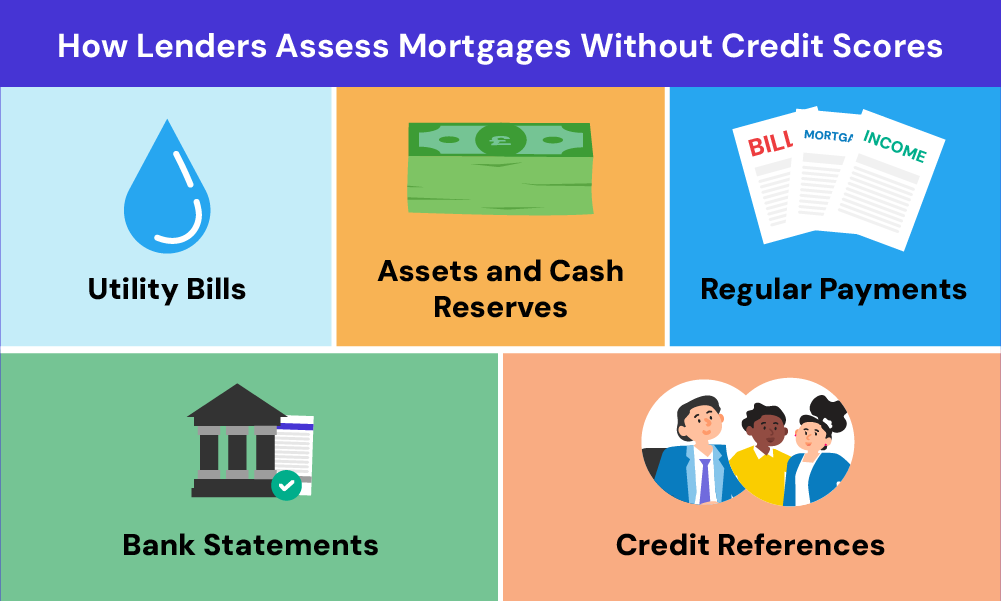

So if not through traditional credit scoring, how do mortgage lenders check borrowers with a thin or non-existent credit file?

They use different checks if you have no credit score. This means a deep dive into:

- Your employment history & income stability. You must have a steady job and a reliable income to cover the mortgage payments. This is especially important with no credit score to rely on.

- Your asset statements & cash reserves. You need to have at least 15-20% of the home’s value as a deposit and extra cash to show financial responsibility.

- Your regular bills and spending. Lenders check your payment history of paying rent, utilities, and phone bills to see if you’re reliable.

- Your bank statements. These reveal overdrafts, missed payments, income sources, and how you manage your money.

- Your past landlord/creditor references. Some lenders ask for references to confirm your payment history.

Basically, lenders who don’t rely on credit scores use traditional checks to understand your financial habits.

How to Improve Your Mortgage Chances With No Credit Score

Even if you don’t have an established credit history, there are steps you can take to increase your odds of getting approved:

- Get on the Electoral Roll – Being on the electoral roll at your current address proves who you are to mortgage lenders.

- Save a Bigger Deposit – A larger deposit (15-20% ideally) shows you’re financially responsible and reduces the risk for the lender.

- Build Your Credit File – You can start with a basic credit card, phone plan, or small credit line. Make sure to always pay on time – this builds a good credit history.

- Explain Your Situation – Tell the lender why you have no credit history. Maybe you’re new to the UK, re-entering the workforce, or young. Provide context about your finances.

- Consider a Guarantor or Joint Mortgage – Having a relative guarantee the loan or co-borrow with you, or even applying with someone who has good credit, can reassure lenders.

- Seek Expert Broker Advice – An experienced, whole-of-market mortgage broker will know which lenders offer the best mortgages for no credit scoring. They can guide you through the appropriate application process.

Mortgage Lenders That Don’t Credit Score in the UK

While options are limited, a few mortgage providers cater specifically to borrowers with no credit history.

This includes building societies like Tipton & Coseley Building Society. Most of these specialist lenders have mortgage products for borrowers with no credit scores. They’ll check your application through other ways we’ve discussed earlier.

Lender Fees Without Credit Score

It’s important to note that mortgages approved without credit scoring often come with higher fees and interest rates to offset the increased risk for the lender.

Some common fees for no-credit score mortgages include:

- Higher arrangement/booking fees (£999 – £1,500)

- Higher mortgage rates (5-7% is common)

- Larger deposit requirements (15-20%+)

So while you may be able to get approved with no credit history, you’ll likely pay a premium compared to applicants with robust credit scores.

The Bottom Line

As you can see, not having a credit score doesn’t necessarily disqualify you from homeownership in the UK.

While big lenders often use credit scores, building societies and niche mortgage companies still assess applications manually.

To get approved, show you’re a good borrower with things like a stable job, savings, a history of on-time payments, and a big deposit.

Working with an experienced mortgage broker is highly advisable to find the best no-credit score mortgage products and navigate the complex application process.

Looking for a broker? We can help you. Simply, get in touch with us, and get matched with a qualified mortgage broker in the UK.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Who is the easiest lender to get a mortgage in the UK?

It’s hard to pinpoint the easiest lender as it varies depending on your circumstances. However, smaller building societies and specialist lenders often have more flexible criteria than major banks.

They might be more willing to consider your application if you have unique financial situations or need a more personalised assessment.

Can I get a mortgage with a poor credit score?

Yes, you can get a mortgage with a poor credit score, but it may be more challenging. You’ll likely need to look at lenders who specialise in bad credit mortgages.

These lenders usually require a higher deposit and might charge higher interest rates to offset the risk they take by lending to you.

What is the lowest credit score allowed for a mortgage?

In the UK, there isn’t a set minimum credit score required to get a mortgage.

Each lender sets their own criteria. However, a lower credit score usually means fewer options and potentially higher costs.

If your score is low, consider lenders focusing on manual underwriting rather than automated credit scoring systems.