What Can Go Wrong With A Mortgage In Principle?

You’ve received a mortgage in principle, and it feels like the hard part is over. Congratulations! But hold on popping the champagne just yet.

While an AIP is a great first step, it’s not a guaranteed ticket to homeownership. There can still be bumps in the road before you secure your final mortgage offer.

This guide will explore the potential pitfalls you might encounter after getting a mortgage in principle, so you can be prepared and avoid any surprises.

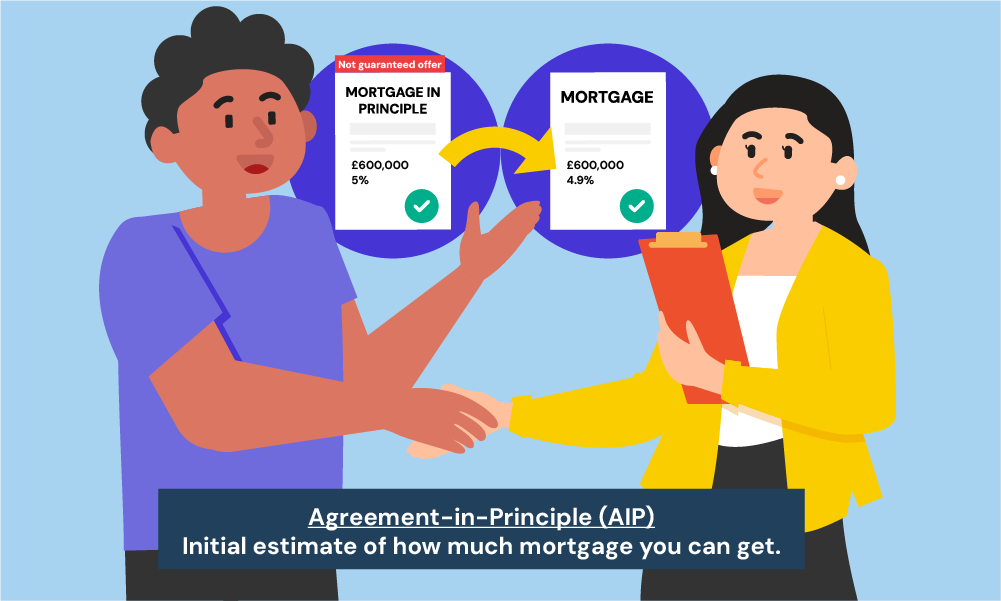

What Is a Mortgage in Principle?

But first, let’s quickly recap what a mortgage in principle actually is.

A mortgage in principle, also called a decision in principle (AIP), is a lender’s estimate of how much they might be willing to lend you.

It involves basic checks into your income, outgoings, and credit history, but it’s not a guaranteed mortgage offer.

Unlike a full mortgage application, you won’t need to go through a lot of detailed checks.

Why Should You Get a Mortgage in Principle?

There are several good reasons to get an AIP before you start house hunting. Here’s why:

- It’s quick and easy. Unlike a full mortgage application that takes weeks, an AIP can be done in minutes.

- It helps you budget. You’ll know how much you can borrow, so you can focus on houses that fit your budget.

- It makes your offer stronger. Estate agents and sellers will take you more seriously if you have an AIP.

Just be aware that an AIP usually only lasts 30 to 90 days, so you might need to renew it later.

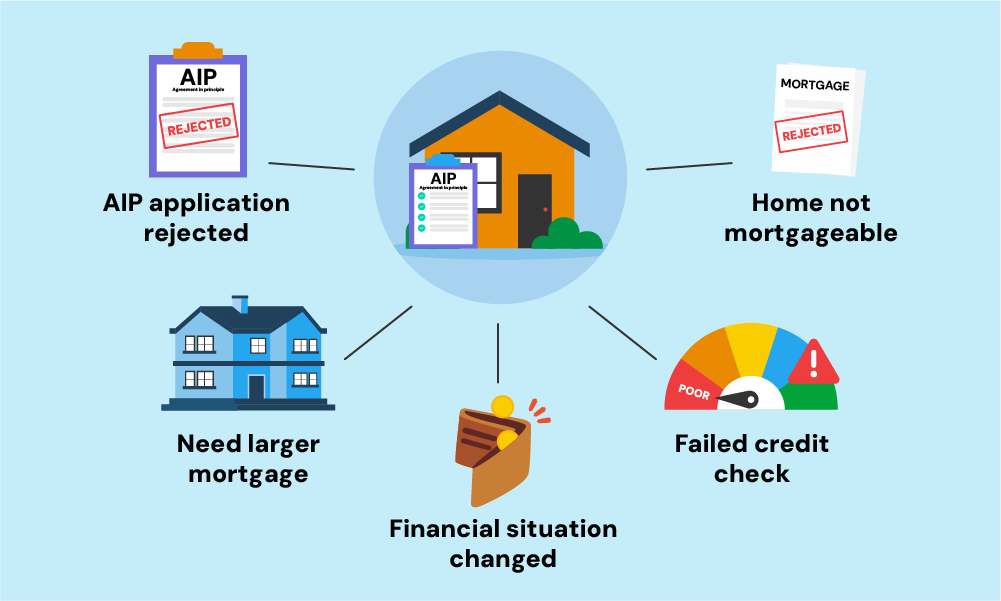

What Can Go Wrong with Your Mortgage in Principle?

While an AIP is a good start, there are still steps to take before getting the final mortgage.

Here are some of the main pitfalls that could happen:

1. Your Application For An AIP Is Rejected

The first hurdle you might encounter is not getting the mortgage in principle at all. This could be due to a variety of reasons, such as:

- Poor Credit Score. Lenders use your credit score to gauge your reliability. A low score can result in a rejection.

- Inaccurate Information. Any discrepancies in the information you provide can lead to an unsuccessful application.

- Recent Job Changes. If you’ve recently changed jobs, especially if it’s a probationary role, lenders might view this as unstable.

2. You Need a Larger Mortgage For Your Dream Home

One major issue is when your approved mortgage amount isn’t enough for the property you want to buy.

If your AIP estimated you could borrow £250,000, but your dream home costs £300,000, you’ll need to provide a larger deposit to cover the difference.

If you can’t do that, you’ll need to ask the lender for a higher mortgage. This will likely require a full affordability check from scratch.

Even if you’re approved for a higher amount, remember that you’ll pay more overall with bigger monthly repayments. Do the sums and be realistic about what you can actually afford.

3. Your Finances Situation Changed

Your mortgage in principle is based on a snapshot of your financial situation when you first applied. But a lot can change before you get a full mortgage offer, even within just a few months.

If your circumstances take a turn for the worse, a lender could view you as a higher risk and reject your full application. Red flags include:

- Losing your job/income source

- Missing credit payments

- Racking up more debt

- Changing from employed to self-employed status

A change in a family situation like divorce can also impact what you’re able to borrow. The more your finances have changed since that initial AIP, the more likely it is your full application could be declined.

4. Your Failed The Final Credit Check

For a mortgage in principle, lenders usually only do a “soft” credit check which doesn’t leave a mark on your report. But before giving you a full mortgage offer, they’ll do a far more comprehensive “hard” credit check.

If you’ve had any issues with credit in the months since your AIP – like missed payments or maxing out cards – these may now show up as red flags not seen in that initial check.

Things like County court judgments, bankruptcy, or too many hard searches on your report in a short period can all be reasons for declining your mortgage application at the last stage.

5. Your Dream Home Is Not Mortgageable

Up until applying for your full mortgage, the lender hasn’t actually assessed the property you want to buy. They’ve only looked at your personal circumstances.

However not all properties will be acceptable security to all lenders. Reasons a lender could refuse on the property include:

- It’s a non-standard construction (e.g. timber-framed)

- There are structural defects that need repair

- It’s an unusual building like a converted windmill

- It has commercial and residential mixed-use

- It fails to meet the lender’s minimum valuations

Some lenders can be very strict, so a property that seems fine could still be denied.

Getting rejected at this stage can be heartbreaking if you’ve had your heart set on that dream home.

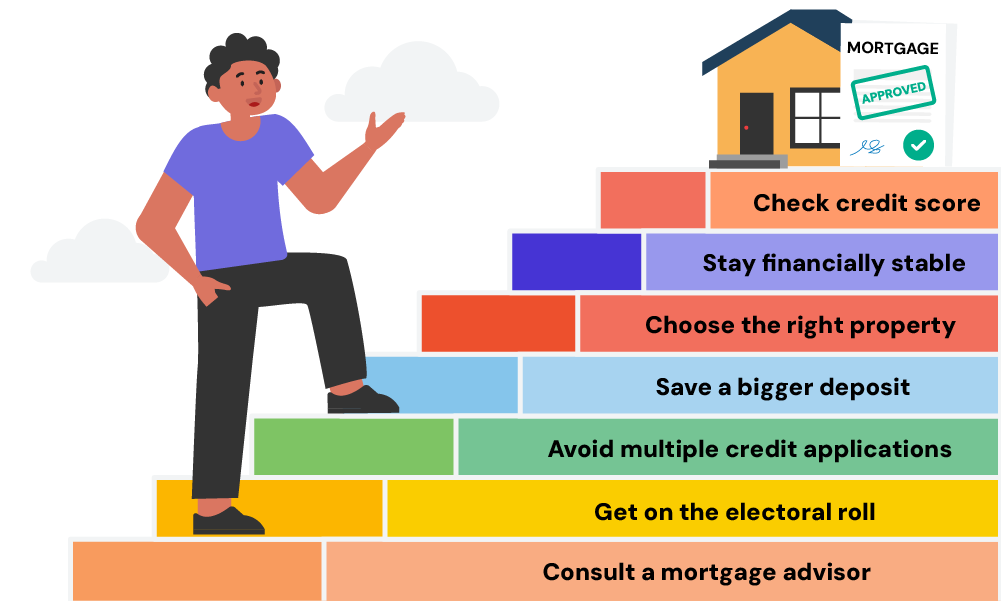

What Steps Can You Take to Reduce These Risks?

Applying for a mortgage can be tricky, but here’s how to boost your chances of success:

- Check Your Credit Score – Before applying, make sure your credit report is accurate and up-to-date. Get your report from Experian, Equifax, or TransUnion and fix any errors you find.

- Stay Financially Stable – Don’t make big financial changes like changing jobs, taking on new debt, or making large purchases while applying for a mortgage. Lenders want to see you’re financially reliable.

- Choose the Right Property – Pick a property that meets the lender’s criteria. This means it should be well-built, structurally sound, and valued appropriately. Consider getting a survey to uncover any potential issues.

- Save Up a Bigger Deposit – The bigger your deposit, the better. This lowers your loan-to-value ratio, making you more attractive to lenders and potentially qualifying you for better interest rates. Look into government schemes like Help to Buy for assistance.

- Don’t Apply for Lots of Credit – Limit the number of credit applications you make before applying for a mortgage. Each application can slightly lower your credit score and might make lenders think you rely heavily on credit.

- Get on the Electoral Roll – Registering to vote can improve your credit score and make you seem more creditworthy. Lenders use the electoral roll to verify your address and identity, so being registered can speed up the application process.

- Talk to a Mortgage Advisor – A professional advisor can guide you through the process and help you overcome any challenges you face.

The Bottom Line

Getting an agreement in principle (AIP) is a great start, but it doesn’t guarantee smooth sailing to homeownership.

Be sure to:

- Get your finances in top shape before applying

- Seek advice to find the right mortgage product/lender

- Prepare for the lender to scrutinise you & the property

- Act quickly once your AIP expires

With some planning and help from a qualified mortgage broker, you can avoid common problems and secure the mortgage for your dream home.

A good broker will assess your situation from the start and advise you on how to improve your chances of getting approved. They’ll also guide you smoothly through the process, avoiding any nasty surprises.

They have access to special deals from lenders that you won’t find on your own, so you’ll have the best chance of getting a mortgage.

Their job is to help you every step of the way, so you can focus on the fun parts of buying a home.

Looking for a broker? Get in touch. We’ll connect you with a qualified mortgage broker to maximise your chances at competitive mortgage rates.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

At what stage can a mortgage be declined?

Mortgages can be refused at several points.

- Lenders can reject you initially for a mortgage in principle if your finances don’t meet their requirements.

- Even with an Agreement in Principle (AIP), a full application can be declined after a detailed credit check, income and employment verification, or property valuation.

- Changes in your finances, like job loss or new debt, can also lead to rejection.

- Property problems, like a low valuation or structural issues, can stop the lender from going ahead.

How many times does a mortgage lender check your credit?

Mortgage lenders typically check your credit two times during the application process.

- The first happens when you apply for a mortgage in principle. This is a soft check, which means it shouldn’t affect your credit score.

- The second check is a hard check, which is more detailed and will affect your credit score. This happens during the full mortgage application.

Lenders do this to get a complete picture of your finances before approving your mortgage. To improve your chances of getting approved, it’s a good idea to maintain a good credit score and avoid taking on new debt during the mortgage process.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.