Thinking about buying a second property? Maybe a cosy cottage in the countryside for weekend escapes, a chic city flat for rental income, or even a seaside retreat for family holidays. Whatever your plan, you need to know how the UK classifies second homes. This isn’t just about ticking boxes – different tax rules, mortgage […]

Blog

What Is Classed As A Second Home In The UK?

What Happens If My Mortgage Offer Expires?

What is a Mortgage Offer? A mortgage offer is a lender’s formal approval to provide you with a home loan, assuming you meet all the stated terms and conditions. It confirms that your full application – your finances, credit, income, deposit, and property – has passed the lender’s criteria. This checking process can take from […]

What Do I Need To Declare When Selling My Home?

Why You Need To Disclose Your Property’s Condition & History Disclosing your property’s condition and history in the UK is both legally required and builds trust with buyers. You must be upfront about any issues to avoid lawsuits under the Consumer Protection from Unfair Trading Regulations (CPR). Failure to do so could result in prosecution, […]

Mortgage Exit Fees Explained

What Is a Mortgage Exit Fee? A mortgage exit fee is an administration charge your lender hits you with when you pay off your mortgage in full before the end of the agreed term. So whether you’re remortgaging, moving house and porting your mortgage, or making lump sum overpayments to clear the balance early, there’s […]

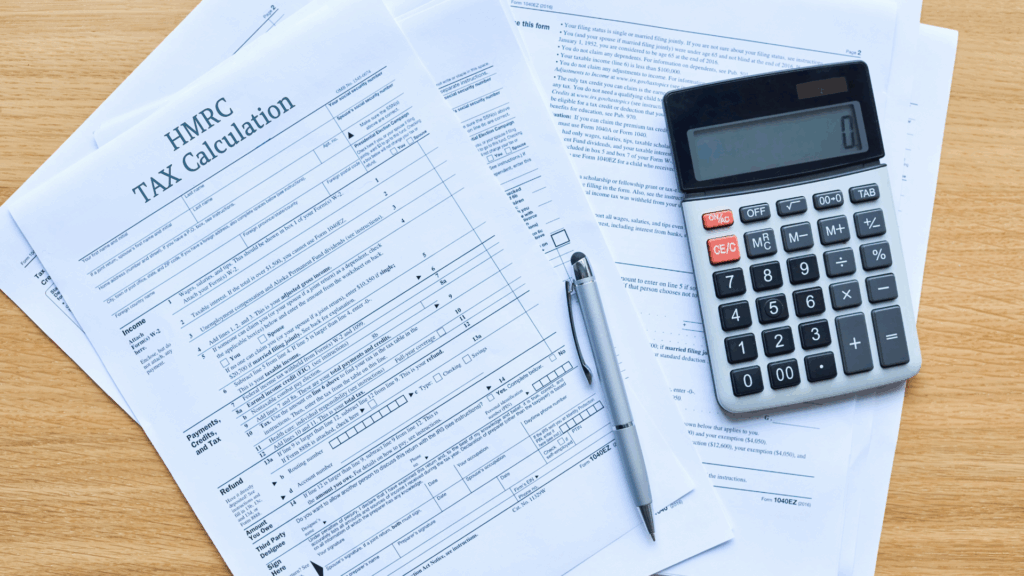

What Does An SA302 Look Like?

What Is an SA302 Form? An SA302 form, also known as a tax calculation form, is a document HMRC issues (HM Revenue & Customs, the UK tax authority) that summarises your tax return. It includes details about your total income, tax paid, and National Insurance contributions. Mortgage lenders ask for this to prove you can […]

What Is A Loan To Value (LTV) Ratio?

Has your mortgage lender ever mentioned your “loan to value” ratio? If you’re buying a property or remortgaging, it’s an essential concept to understand. Your LTV ratio could make or break your mortgage application and affect how much your mortgage ends up costing you. Here’s a clear explanation of what it is and why it […]