- What Does Loan To Value (LTV) Mean?

- Why Does My LTV Matter?

- How Do I Calculate LTV?

- What Is a Good LTV in The UK?

- What’s The Maximum LTV Allowed in The UK?

- How To Get a Lower LTV?

- How LTV Changes Over Time

- Benefits of a Low LTV

- Disadvantages of a High LTV

- The Bottom Line: Does This Help Explain LTV?

What Is A Loan To Value (LTV) Ratio?

Has your mortgage lender ever mentioned your “loan to value” ratio? If you’re buying a property or remortgaging, it’s an essential concept to understand.

Your LTV ratio could make or break your mortgage application and affect how much your mortgage ends up costing you.

Here’s a clear explanation of what it is and why it matters.

What Does Loan To Value (LTV) Mean?

Your loan to value ratio, often shortened to LTV, is simply the amount you’re borrowing compared to the total value of the property. It’s expressed as a percentage.

For example, if you’re buying a £200,000 home with a £180,000 mortgage, your LTV would be:

£180,000 ÷ £200,000 = 0.9 or 90%

The remaining 10% would be your deposit.

Why Does My LTV Matter?

LTV is crucial because it shows lenders how much risk they’re taking by lending to you. The higher the LTV, the riskier the mortgage is for them.

Think about it – if you borrowed 100% of a property’s value with no deposit, the lender would be completely exposed if house prices dropped and you defaulted. They’d potentially lose everything if they had to repossess and sell.

But with a lower LTV like 60%, there’s a much bigger safety cushion for the lender. The property would have to lose over 40% of its value before they started making a loss.

So in short, lower LTVs = lower risk for lenders = better mortgage rates for you.

How Do I Calculate LTV?

Calculating your Loan-to-Value (LTV) ratio is simple. Here’s how:

- Determine the Property Value. Start with the current market value of the property you want to buy or remortgage.

- Know Your Loan Amount. Find out how much you plan to borrow from the lender.

- Use the Formula. Divide the loan amount by the property value, then multiply by 100 to get the percentage.

For example, if the property is valued at £200,000 and you need a £150,000 loan:

LTV Ratio = (Loan Amount ÷ Property Value) x 100

LTV Ratio = (£150,000 ÷ £200,000) x 100 = 75%

This means your LTV ratio is 75%.

Try Our LTV Calculator

To make it even easier, use our LTV calculator.

Simply enter the property value and the loan amount to quickly find your LTV ratio. Give it a try now and get accurate results instantly.

Understanding your LTV ratio can help you secure better mortgage rates and manage your finances effectively.

What Is a Good LTV in The UK?

There’s no single “good” LTV that applies to everyone, but as a general rule, you want your LTV to be as low as possible to get the best rates.

Anything at 80% LTV or below is considered fairly low-risk, while 90% or higher is seen as higher risk and means fewer options.

For first-time buyers, the average LTV is around 82%. But remember, that’s just an average – going lower is better if you can.

For remortgaging, the average LTV is around 74% as people have built up more equity over time.

What’s The Maximum LTV Allowed in The UK?

It is possible to get a 100% mortgage in the UK with no deposit required, but these are very rare these days.

The main way is with the help of a guarantor, typically parents, who will be on the hook if you can’t pay. They may have to put up their own property as collateral.

Alternatively, you may need to pay an additional insurance premium on top of the 100% loan.

Given the extra cost and risk involved, these deals are quite niche and have strict requirements, so may not suit everyone.

So in most cases, a maximum 95% LTV is far more realistic to aim for when purchasing with a small 5% deposit.

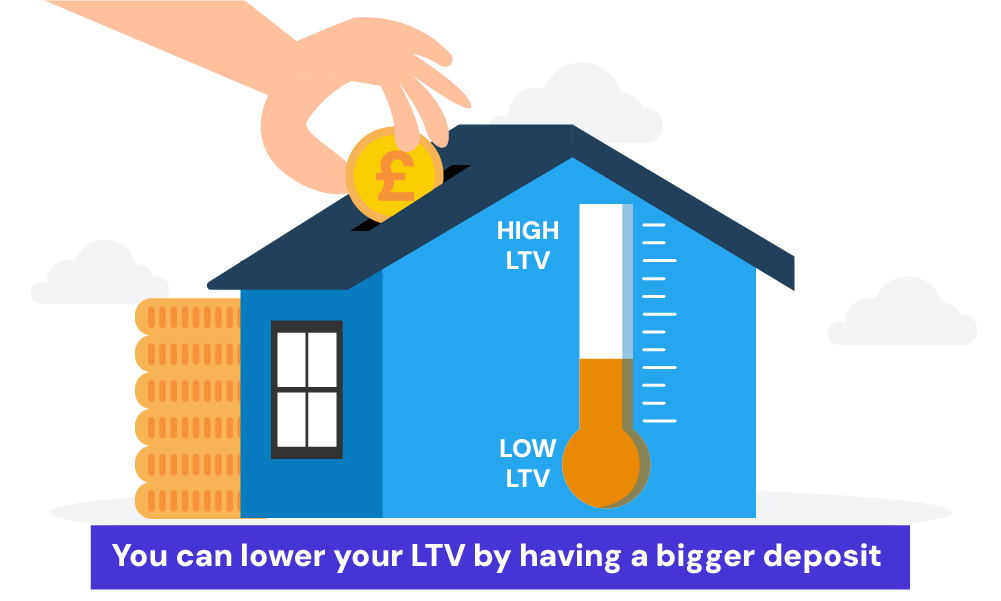

How To Get a Lower LTV?

OK, so a lower LTV is better for getting top mortgage rates. But how can you actually improve your LTV as a borrower?

Well, the two main ways are through a bigger deposit and negotiating a lower purchase price on the property.

The bigger the deposit you can save up, the lower your loan amount will be as a percentage of the property value.

More deposit = lower mortgage loan amount = lower LTV.

You can build up a larger deposit by:

- Saving more over a longer period

- Using gifted deposits from parents/family

- Accessing deposit boosting schemes like Lifetime ISAs or Help to Buy

- Buying a lower-priced property than you maximally qualify for

And if you can haggle the seller’s down on price, you’ll need to borrow less for the same property, dropping your LTV.

Alternatively, if you’re remortgaging rather than buying, you may be able to get a lower LTV if your remaining mortgage is smaller compared to your property’s current value.

You can reduce your LTV over time by:

- Making regular mortgage overpayments to pay down your loan faster

- Increasing your mortgage term to reduce monthly payments

- Making home improvements that increase your property’s value

House price rises over the years you’ve been paying your mortgage can improve your LTV ratio too.

The lower you can get your LTV, the better mortgage deals you’ll have access to when buying or remortgaging.

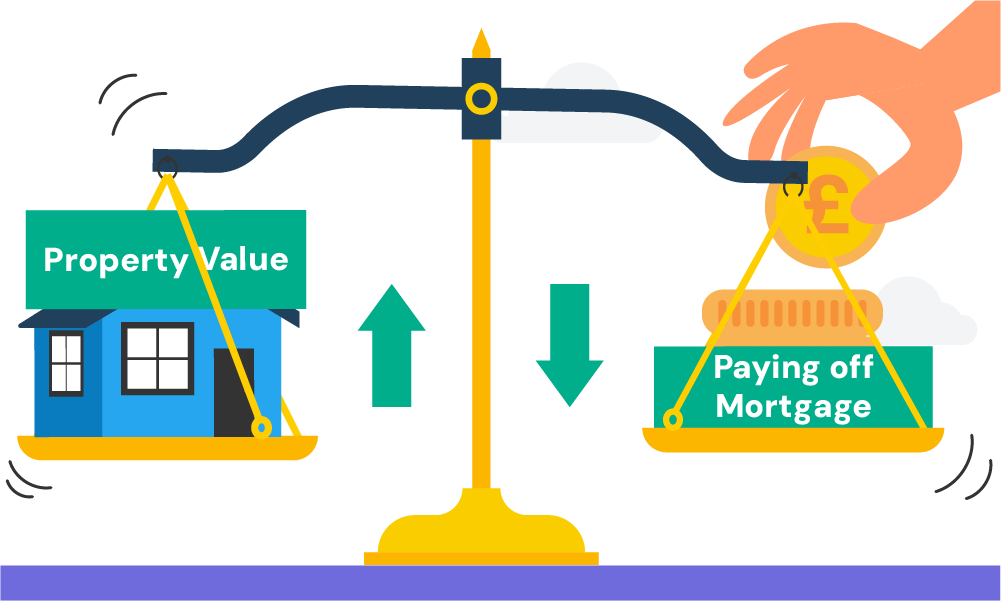

How LTV Changes Over Time

Your LTV isn’t set in stone forever after you first get a mortgage. It can move quite a bit in either direction based on two factors:

- Your remaining mortgage balance – As you keep paying it off month by month, your loan amount drops compared to the original property value.

- Changes in your property’s value – If it rises over time, your loan is a smaller percentage of the total worth. But if it falls, your LTV increases.

Some people try to actively improve their LTV over time by overpaying their mortgage or making home improvements to increase the property’s value.

This puts them in a better position when it’s time to remortgage or move home down the line.

But if their LTV worsens due to negative house price growth during that period, the opposite happens – they lose that equity cushion.

Benefits of a Low LTV

As we’ve covered, having a lower LTV ratio brings some great benefits:

- Access to more mortgage deals and better rates from lenders

- Pay less overall interest over the life of the mortgage

- Lower risk of negative equity if house prices fall

- More options to remortgage down the line

Disadvantages of a High LTV

On the flip side, a high LTV can create issues:

- Fewer lenders willing to offer deals, especially at 90%+ LTV

- You’ll pay higher mortgage rates as it’s seen as riskier

- Harder to remortgage or move home down the line

- Greater risk of negative equity squeezing your options

Of course, a higher LTV isn’t the end of the world if you have no other option as a first-time buyer. However, aiming for a lower ratio gives you much more flexibility.

The Bottom Line: Does This Help Explain LTV?

There you have it, our full breakdown of the property loan to value ratio!

To sum up, your LTV expresses how much of the property’s value you need to borrow through a mortgage, compared to the equity you’re putting down yourself.

It directly impacts the rates and deals you’ll be offered, with lower LTVs getting more affordable mortgages.

While a high LTV isn’t ideal, it can be a necessary stepping stone for affording that first home. But you’ll want to work on improving your LTV over time to get the very best deals.

Of course, if you need any more guidance on LTVs and mortgages, speak to a professional mortgage broker. They’ll crunch the numbers to find your best options and rates.

Simply, get in touch with us and we’ll connect you with a qualified mortgage broker who can help you find the right mortgage lenders for your needs.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What factors affect my LTV ratio?

Several factors can impact your Loan-to-Value (LTV) ratio:

- Property Value – Changes in the market value of your property will affect your LTV. Higher property values lower your LTV, while lower values increase it.

- Loan Amount – The size of the mortgage you take out directly impacts your LTV. Larger loans increase your LTV ratio, while smaller loans decrease it.

- Deposit Size – A larger deposit lowers your LTV by reducing the amount you need to borrow.

- Home Improvements – Upgrading your property can increase its value, which may lower your LTV ratio.

- Market Conditions – Fluctuations in the property market can change your LTV. Rising property values decrease your LTV while falling values increase it.

- Principal Payments – Regular mortgage payments that reduce your loan balance will also lower your LTV over time.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.