- What is the Mortgage Guarantee Scheme in the UK?

- How Does the Mortgage Guarantee Scheme Work?

- Who is It For?

- Who Offers 95% Mortgages Under the Scheme?

- What are the Available Terms?

- Interest Rates

- Are There Any Additional Fees Associated with the Scheme?

- How to Apply for the Mortgage Guarantee Scheme?

- The Pros and Cons of the Mortgage Guarantee Scheme

- Can I Remortgage Through the Scheme?

- Alternative Options for Mortgage Guarantee Scheme

- The Bottom Line

The Mortgage Guarantee Scheme Explained

On average, a first-time buyer pays around £293,464 for their first home. To make a 20% deposit on this, you’d need to set aside a hefty £58,693.

That’s a lot of money, and saving it can be really hard.

With the cost of food, energy, and rent on the rise, a deposit seems impossible for many hopeful first time buyers.

But there’s some good news: the Mortgage Guarantee Scheme.

What is the Mortgage Guarantee Scheme in the UK?

The Mortgage Guarantee Scheme is a way to help you buy a home with a smaller deposit. Normally, you need a big deposit of at least 10% – 20% to get a good mortgage.

But with this scheme, you can have a smaller deposit, and the government will help make sure you get a mortgage.

This scheme started on 19th April 2021. It was supposed to end in December 2023, but it’s now going to last until 30th June 2025.

This is good news if you’re thinking of buying a home soon!

How Does the Mortgage Guarantee Scheme Work?

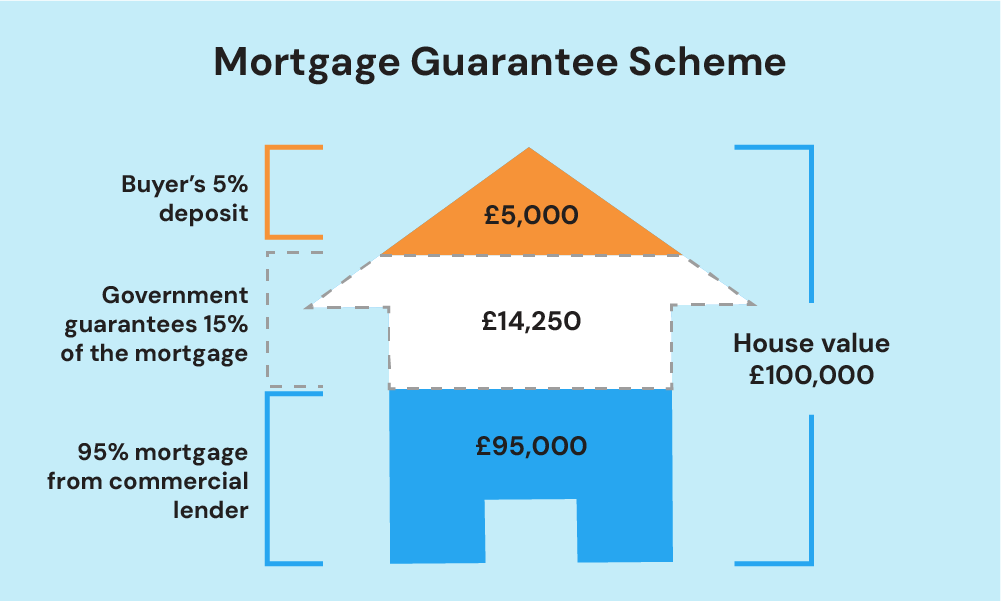

This scheme is similar to a 95% mortgage.

Here’s how it works: You start by saving a deposit of between 5% and 9%. Then, a lender gives you a mortgage for 95% of the home’s value.

What’s special about this scheme is that the government helps out. They promise to cover some of the money you borrow if you can’t pay it back.

This means if you’re buying a home for £100,000, you need to save £5,000 for your deposit. Then, you borrow the remaining £95,000 from the lender.

The government guarantees 15% of this £95,000, which is £14,250. This helps your lender feel more secure. They only have to worry about £80,750 of the loan. This makes it easier for you to get a mortgage.

You don’t need to do anything special to get this help from the government. Your lender takes care of it.

But they do pay a fee to the government for this extra security. This fee might mean your loan costs a little more, maybe through higher interest rates or fees.

This scheme is a helpful way for people who can’t save a big deposit to still buy a home. It makes lenders more willing to give you a mortgage, so you can start owning your own home sooner.

Who is It For?

The Mortgage Guarantee Scheme is for people who want to buy a home.

It’s especially helpful if you’re buying your first home, already own a home but want to move, or if you’re just looking to buy another home.

The great thing about this scheme is that it’s not just for one type of person. It’s open to a lot of different people who want to own a home.

To get a mortgage under this scheme, you need to meet certain criteria. Here’s what you need to know:

- You are buying a residential property in the UK. (not a second home or buy-to-let)

- You have a deposit of 5% to 9%. So you can get 95% and 91% mortgage LTV.

- You’re buying a property worth £600,000 or less.

- You’re applying for a repayment mortgage. (not interest-only)

- You can pass the lender’s affordability assessment.

- You must be an individual, not a corporation.

Who Offers 95% Mortgages Under the Scheme?

Several lenders offer 95% mortgages under the Mortgage Guarantee Scheme. This means they can lend you most of the money you need to buy your home.

Here’s a list of these lenders as of 2021:

- Lloyds Bank

- NatWest

- Santander

- Barclays

- HSBC

- Virgin Money

Each lender has its own rules and conditions for giving you a mortgage.

Some might have special offers, and others might be better if you have a certain type of home in mind.

Note though that many lenders offer 95% mortgage deals in the UK, and this is not the only option you have. It’s a good idea to consult a reliable mortgage advisor to see which works best for you.

What are the Available Terms?

When you use the Mortgage Guarantee Scheme, you usually get a mortgage that lasts for about 25 years.

But, some lenders in the scheme offer longer terms, up to 30-35 years. This longer period means you have more time to pay back the money you borrowed.

In the scheme, there are both fixed-rate and tracker mortgages. With a fixed-rate mortgage, your interest rate stays the same for a certain time.

The government made sure that each lender in the scheme offers at least one option where the rate doesn’t change for five years.

You might also find deals where the fixed rate lasts for two to five years. After this period, your mortgage switches to the lender’s standard rate, which could be higher, unless you choose to remortgage.

Interest Rates

The interest rates under this scheme can be higher than usual, especially compared to mortgages with a 10% deposit.

Typically, mortgages with a 5% deposit have an interest rate about one percentage point higher than those with a 10% deposit.

But remember, you might find similar or even better rates with other lenders outside the scheme. So, it’s worth looking around to see what fits your budget best.

Are There Any Additional Fees Associated with the Scheme?

When you use this scheme, there might be some fees. These can include things like arrangement fees or valuation fees.

But it’s not the same with every mortgage. Some might have no fees at all, which is great!

It’s important to look at the overall cost of the mortgage, not just the fees. Sometimes, a mortgage with no fees might have a higher interest rate.

This means you could end up paying more in the long run. Other times, paying a fee might mean you get a lower interest rate, which could save you money over time.

This is where a mortgage broker can help. They can compare different mortgages, including the fees and interest rates, to find the best deal for you. They’ll look at the whole picture to make sure you’re getting a good deal.

How to Apply for the Mortgage Guarantee Scheme?

Applying for the Government Mortgage Guarantee Scheme is straightforward. Here’s how you can do it:

- Step 1 – Find a Mortgage Broker. First, it’s a good idea to talk to a mortgage broker. They know all about different mortgages and can help you understand this scheme.

- Step 2 – Choose a Lender. Look at the different lenders who are part of this scheme. Your broker can help you decide which one might be best for you.

- Step 3 – Gather Your Documents. You’ll need things like proof of your income, ID, and details about the home you want to buy.

- Step 4 – Fill in the Application. Your mortgage broker will help you fill out the application. The good news is, there’s no extra paperwork just because it’s part of this scheme.

- Step 5 – Wait for Approval. After you apply, the lender will check everything and tell you if your application is successful.

Remember, each lender might have slightly different requirements, but your mortgage broker can guide you through this.

The Pros and Cons of the Mortgage Guarantee Scheme

The Mortgage Guarantee Scheme is a helpful plan from the UK government that makes buying a home more accessible. But, like most things, it has its good points and its not-so-good points. Let’s look at what these are.

Pros

- Lower Deposit Requirements. One of the best parts of this scheme is that you don’t need a big deposit. You can buy a home with just a 5% deposit. This is much lower than what’s usually required.

- Access to Better Mortgage Rates. Even with a small deposit, you can still get good mortgage rates. This means the amount you pay back each month might be less than you’d expect.

Cons

- Potential Negative Equity. This means if house prices fall, your home could be worth less than the amount you owe on your mortgage. It’s a risk, especially if you’re buying when prices are high.

- Higher Borrowing Costs. Sometimes, the total amount you pay back can be higher with these mortgages. This is because of things like higher interest rates over the long term.

- Limited Property Selection. You can only use this scheme for homes that cost up to £600,000. So, if you’re looking at more expensive homes, this scheme won’t apply.

Can I Remortgage Through the Scheme?

Yes, you can remortgage using the Mortgage Guarantee Scheme. This is handy, especially if you don’t have a lot of equity in your home – like if you have between 5% and 9% of your home’s value. It means you can switch to a new mortgage deal that might be better for you.

Remember, this scheme isn’t the only way to remortgage if you have a small amount of equity. Other lenders offer similar mortgages, not part of this scheme.

It’s a good idea to look at all your options and compare what’s best for you. But, not every lender offers the same remortgage deals. Some lenders have special rules.

For example, NatWest might not let you borrow more money for a certain number of years. Virgin Money, joining the scheme later, doesn’t allow certain types of remortgages.

That’s why it’s smart to talk to a mortgage broker. They can help you understand these rules and find a deal that’s right for you.

Even if there are some restrictions, a broker can guide you through them or help you find another lender that meets your needs.

Alternative Options for Mortgage Guarantee Scheme

The Mortgage Guarantee Scheme is just one way to help you buy a home, but there are other options too. Let’s look at some of them:

- First Home Scheme. This is for people buying their first home. It offers discounts on new homes to make them more affordable.

- Guarantor Mortgages. If you’re struggling to save a deposit, someone else, like a family member, can promise to cover your mortgage if you can’t. This is called a guarantor mortgage.

- Shared Ownership. You buy a part of a home and pay rent on the rest. Later, you can buy more of the home when you can afford it.

Each of these choices suits different people. For example, if you have someone who can be a guarantor, that option might work for you. It’s a good idea to look into all these choices and see which one fits your situation best.

The Bottom Line

If you have only a 5% deposit and are thinking about the Mortgage Guarantee Scheme, it’s really smart to talk to a reliable mortgage advisor first.

A mortgage advisor can explain everything you need to know. They can help you understand how the scheme works, what you need to do, and how to get the best deal for your situation. Plus, they can answer any questions you have, making sure you feel confident and informed.

Looking to save time and avoid stress in finding the right mortgage? Get in touch with us, and we’ll connect you with a trustworthy broker. They’ll be able to help you with your specific mortgage needs.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I get a guarantor mortgage through the scheme?

No, the scheme doesn’t offer guarantor mortgages. However, you can still get a guarantor mortgage with a 5% deposit made up of your own money and extra help from a guarantor.

Can I apply to the scheme to buy a newly constructed house?

No, it’s not for new-build homes. But, you can look into the other lenders outside the scheme that offer 95% mortgages for new-build homes.

How do the costs compare to 90% LTV mortgages?

Generally, mortgages under this scheme are more costly than 90% LTV mortgages. They usually have interest rates about one percentage point higher.

Are there any age restrictions in the scheme?

There’s no strict overall age limit, but some lenders have their age limits. For example, Santander might have a limit of 69 years, and Natwest 67 years. Others have no maximum age at the end of the mortgage term, like HSBC with 79 years.

Is the scheme suitable for self-build homes?

Usually, it’s not suitable for self-build homes. However, some specialist lenders might consider a 95% LTV mortgage for self-builds under special conditions.

Can self-employed individuals apply for the scheme with limited income proof?

Yes, if you’re self-employed, you can apply. However different lenders have different requirements for proving your income. Some might need two or three years of accounts. There are options for those with only one year’s accounts, but it’s best not to limit yourself to just this scheme.

Can I apply with bad credit?

Yes, you can apply even with bad credit. However, interest rates may be higher to offset the lender’s risk. The specific rate depends on the severity, cause, and duration of your credit issues.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.