Mortgage Exit Fees Explained

Ending your current mortgage deal or remortgaging with a new lender?

If so, you’ll want to understand exactly what mortgage exit fees are and how they could impact your finances.

In this comprehensive guide, we’ll cover everything you need to know about these pesky fees – from what they are, to how much they typically cost, to how they differ from early repayment charges.

Consider this your one-stop shop for being fully informed before your next mortgage move.

What Is a Mortgage Exit Fee?

A mortgage exit fee is an administration charge your lender hits you with when you pay off your mortgage in full before the end of the agreed term.

So whether you’re remortgaging, moving house and porting your mortgage, or making lump sum overpayments to clear the balance early, there’s a good chance you’ll be stung with an exit fee.

Now, your lender doesn’t give this fee a fun, catchy name. Instead, they dress it up with monikers like “redemption administration fee”, “deeds release fee”, or “mortgage closure fee”.

But no matter what they call it, the principle is the same–it’s a charge for all the admin work of closing out your mortgage account.

Image showing the definition of mortgage exit fee. Clue this is a fee when you leave your mortgage before the end of the agreed term.

How Hefty Are These Exit Fees Typically?

Unfortunately, there’s no one-size-fits-all answer here as mortgage exit fees vary drastically between different lenders.

Generally speaking though, you’re looking at being charged somewhere between £50 to £300.

To give you some real-world examples, Nationwide Building Society currently charges a £65 exit fee on their mortgages.

Meanwhile, HSBC is one of the few lenders that doesn’t sting you with any exit fees at all.

It’s worth noting that some cheeky lenders actually hit you with this fee before you’ve even stepped foot in the door, charging you an “account fee” upfront rather than an exit fee later on.

So be sure to check the small print carefully.🧐

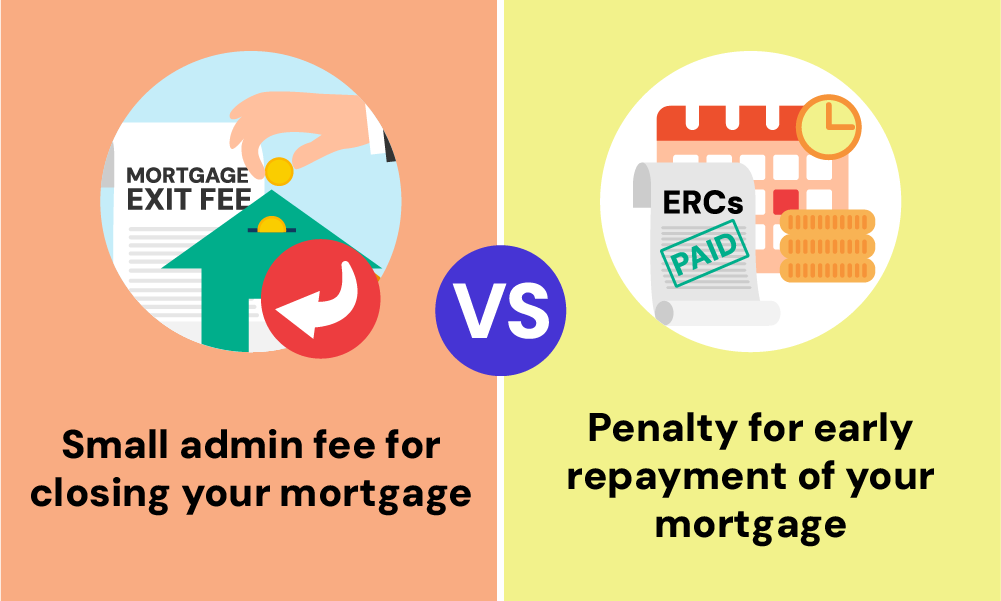

What’s the Difference Between Exit Fees and Early Repayment Charges?

Exit fees and early repayment charges (ERCs) might seem confusing, but they’re actually quite different.

The key difference is that early repayment charges (ERCs) only apply if you’re leaving a fixed-rate, tracker or discounted mortgage deal before the introductory period ends.

For example, if you have a 5-year fixed rate deal and remortgage after 3 years, you’d likely face an ERC penalty.

This is a percentage of your remaining mortgage balance – let’s say it’s 2% on a £200,000 loan – that’s a hefty £4,000. Ouch!

Meanwhile, exit fees apply anytime you close your account, regardless of your mortgage type (fixed, tracker, or standard variable). The lender charges them simply to handle the paperwork and finalise your mortgage.

And yes, it’s entirely possible you could be hit with both an ERC and an exit fee if you remortgage before the end of your fixed-rate period. So it really pays to do your sums and factor in all the potential penalties.

How Can You Avoid or Reduce Mortgage Exit Fees?

Now for the million-dollar question – how can you dodge these annoying fees, or at least reduce the amount you pay?

Well, one obvious answer is to simply ride out your mortgage term until the very end before moving lenders or clearing the balance.

That way, you’ll avoid any early repayment charges and most likely won’t have to pay exit fees either.

But we know that’s not always possible or desirable, especially if you spot a stellar new mortgage deal and want to take advantage of it early.

In that case, your best bet is to check the fee structures of lenders very carefully.

As we’ve seen, some like HSBC don’t charge exit fees at all, making them an attractive option if you know you’ll want to remortgage every few years.

Others have higher or lower exit fees than the norm, so you can potentially shave money off by picking a lower-fee lender.

Finally, don’t forget that exit fees – unlike early repayment charges which are set percentages – may actually be negotiable in certain cases.

It never hurts to politely ask your lender if they’d be willing to waive or reduce their exit fee, especially if you’re a long-standing customer.

The Bottom Line: The True Cost of Exit Mortgage Fees

There you have it – you’ve learned about those tricky mortgage exit fees and how they can affect your plans.

The key takeaway is to always check the fine print of any new mortgage deal.

Understand both the exit fees and Early Repayment Charges (ERCs). These charges can add up to thousands of pounds over the life of your mortgage.

Here’s how to be a savvy borrower and avoid getting caught out:

- Read about the fees upfront so you can make informed decisions about remortgage or overpaying your mortgage.

- Don’t rush into remortgaging or overpaying. Being aware of potential fees helps you decide the right time to make changes to your mortgage.

- Factor exit fees into your calculations. Make sure a lower interest rate with a new lender actually saves you money in the long run, even after exit fees.

In the end, a little knowledge about fees can save you a lot of money.

When considering your mortgage options, don’t underestimate the value of a qualified broker. They can help you save money not just on interest rates, but on exit fees too.

Get in touch with us for a free, no-obligation consultation with a qualified mortgage broker today.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How can I find out the exit fee for my mortgage?

You can find the exit fee details in your mortgage agreement or by contacting your lender directly.

Why do lenders charge mortgage exit fees?

Lenders charge mortgage exit fees to cover the administrative costs of closing your mortgage account and handling the necessary paperwork.

Do all lenders charge mortgage exit fees?

No, not all lenders charge mortgage exit fees. Some lenders might charge an account fee upfront instead.

Are mortgage exit fees tax-deductible?

No, mortgage exit fees are not tax-deductible as they are considered administrative charges rather than interest payments.

What happens if I can't pay the mortgage exit fee when closing my mortgage?

If you can’t pay the mortgage exit fee, it may delay the closing process. Contact your lender to discuss payment options or potential fee waivers.

Are there any regulations governing mortgage exit fees?

Yes, mortgage exit fees are regulated by financial authorities to ensure they are fair and transparent. In the UK, the Financial Conduct Authority (FCA) oversees these regulations.

Can I get a refund on mortgage exit fees if I switch back to my original lender?

Generally, mortgage exit fees are non-refundable, even if you switch back to your original lender. It’s best to clarify this with your lender beforehand.