- Can You Get a Mortgage Even with Student Loans?

- Do Student Loans Affect Mortgage Affordability?

- How Much Do Student Loans Reduce Mortgage Affordability?

- Does A Student Loan Affect Your Credit Score?

- Do You Have To Declare A Student Loan On A Mortgage Application?

- Can You Use Student Loans To Buy A House?

- Can Consolidating Your Student Loan Onto A Mortgage Help?

- What If Youâre A First-Time Buyer With Student Loan Debt?

- How To Improve Your Mortgage Affordability?

- Key Takeaways

- The Bottom Line

Getting a Mortgage with Student Loans: What to Know

As someone looking to get on the property ladder, you already know how important it is to have your finances in order.

For many, student loans are a big part of that picture, especially when the average student debt for recent graduates in the UK is £45,600.

While it may sound like a lot, student loans don’t have to hold you back from buying a home.

What matters is how lenders assess your monthly repayments and overall affordability when you apply for a mortgage.

In this guide, we’ll explore everything you need to know about mortgages and student loans.

We’ll cover how student loans impact your mortgage affordability, what lenders look at in terms of repayments, whether you need to declare your loan, and tips to boost your chances of getting approved.

Can You Get a Mortgage Even with Student Loans?

Yes, you can still get a mortgage even if you have student loans. Having a student loan doesn’t automatically stop you from being approved.

Lenders understand that student loans are common, and they don’t see them in the same way as other debts like credit cards or personal loans.

What matters most is your affordability. This means lenders will look at how much you earn, your monthly expenses (including your student loan repayments), and how much disposable income you have left.

The size of your student loan doesn’t really matter—it’s the monthly repayments that count.

As long as you can comfortably cover your mortgage payments alongside your other outgoings, including your student loan, there’s no reason why you can’t get approved.

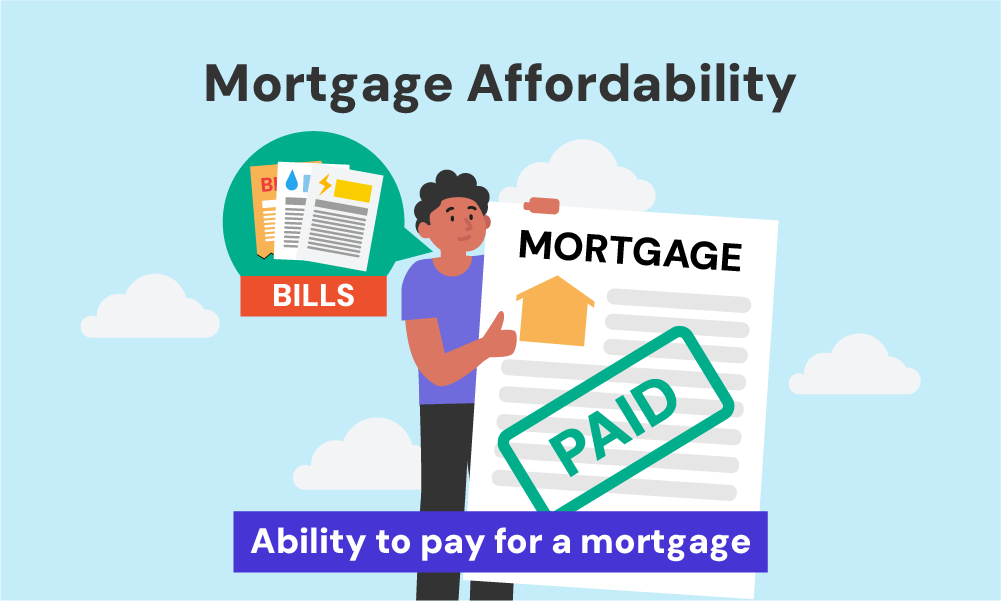

Do Student Loans Affect Mortgage Affordability?

Yes, student loans can impact how much you can borrow for a mortgage.

As discussed, lenders need to assess whether you can comfortably afford the monthly payments. This is known as an affordability check.

Lenders consider your current income, regular expenses, and how much of your salary goes toward existing financial commitments like student loans.

Your student loan repayments are treated like any other regular outgoing, such as utility bills or insurance.

The size of your overall student loan doesn’t matter—it’s the monthly repayment amount that will affect your mortgage affordability.

How Much Do Student Loans Reduce Mortgage Affordability?

The impact of your student loan on your mortgage affordability depends on how much you earn and repay.

In the UK, repayments are based on income—so the more you earn, the more you repay.

Here’s an example:

- If you’re on a Plan 2 loan, you repay 9% of what you earn over £27,295 a year. So, if you earn £35,000, your monthly repayment will be around £57.

- For a Plan 5 loan (for students starting in 2023 or later), you repay 9% of what you earn over £25,000. On a £50,000 salary, you’ll repay roughly £187 a month.

These repayments come straight from your salary. While they don’t affect your credit score, they reduce your disposable income, meaning you’ll have less to spend on a mortgage.

Lenders will consider this when deciding how much to offer you.

But, lenders consider your overall financial situation, so things like the size of your deposit, your credit history, and other expenses also play an important role in determining how much you can borrow.

Does A Student Loan Affect Your Credit Score?

No, your student loan won’t directly impact your credit score.

Unlike credit card debt or personal loans, student loans do not appear on your credit report in the UK.

This means that when a lender checks your credit file during a mortgage application, they won’t see the details of your student loan.

However, that doesn’t mean it won’t influence your mortgage application in other ways.

Lenders will still factor in your student loan repayments when calculating your affordability, which could indirectly affect how much you’re able to borrow.

Do You Have To Declare A Student Loan On A Mortgage Application?

Yes, you must declare your student loan on your mortgage application. Even though it doesn’t appear on your credit file, it’s still a financial commitment that lenders need to consider.

Failure to declare your student loan could be considered mortgage fraud, which could lead to serious consequences.

Lenders will review your income and outgoings, so your student loan repayments will be visible on your payslips if you’re employed through PAYE.

If you’re self-employed, your repayments will be noted in your tax return.

Being upfront about your student loan won’t necessarily harm your chances of getting a mortgage, but it’s crucial to be honest and transparent about all your financial obligations.

Can You Use Student Loans To Buy A House?

Student loans cannot be used directly as income to secure a mortgage. Lenders don’t count them because they aren’t taxable income.

That said, there are ways to use student loan benefits to your advantage when saving for a deposit.

You can build up savings in a government-backed Lifetime ISA (LISA) while making your student loan repayments. You can save up to £4,000 a year in a LISA, and the government will add a 25% bonus—giving you up to £1,000 each year towards your deposit.

This can help you save for a bigger deposit faster, which might improve your mortgage options and get you better interest rates.

Can Consolidating Your Student Loan Onto A Mortgage Help?

In theory, it’s possible to consolidate student loan debt onto a mortgage, but it’s rarely advisable.

Student loans in the UK are charged at relatively low interest rates and are only repayable once your income reaches a certain threshold.

Additionally, after a set period—30 years for most plans—any outstanding student loan debt is written off.

Consolidating this debt onto your mortgage could end up costing you more in the long run, as mortgage interest rates are typically higher, and the debt wouldn’t be written off.

Instead, it’s generally better to focus on paying off higher-interest debts, like credit cards or car loans, or use any extra funds to save for a larger deposit.

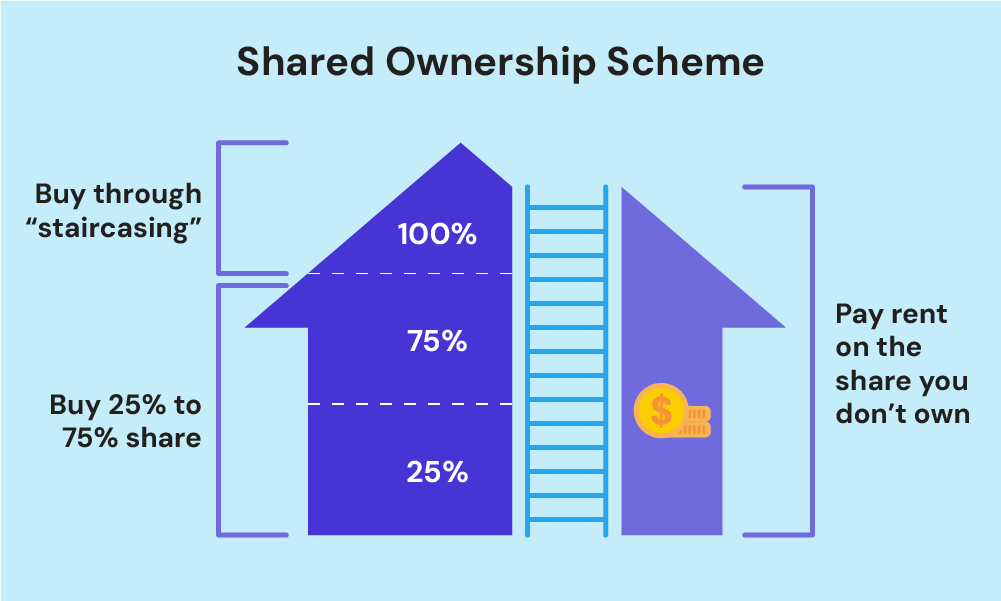

What If You’re A First-Time Buyer With Student Loan Debt?

If you’re a first-time buyer with student loans, you can still get a mortgage.

While the Help to Buy scheme is no longer open, there are other options to help you get on the property ladder.

Here are some updated options:

This lets you buy a portion of a property (usually 25% to 75%) and pay rent on the rest. You can buy more shares over time, which is known as ‘staircasing’.

It’s a good option if student loan repayments make it harder to save for a big deposit.

This scheme offers a 30% to 50% discount on new build homes for first-time buyers and key workers.

It makes buying a home more affordable, even if you have student debt. The discount stays with the property for future buyers too.

Lifetime ISA (LISA)

You can save up to £4,000 a year in a LISA, and the government adds a 25% bonus (up to £1,000 each year).

It’s a great way to save for a deposit faster, available for anyone aged 18 to 39.

These options can help make homeownership possible, even with student loans. A mortgage broker can also help you find lenders who look at your full financial situation.

How To Improve Your Mortgage Affordability?

If you want to boost your chances of getting a mortgage and increase how much you can borrow, here are some simple steps you can take:

Increase your deposit

The larger your deposit, the smaller the loan you’ll need, which can make lenders more willing to offer you better rates.

Aim to save at least 10% of the property’s value, but if you can stretch to 15% or 20%, it’ll help you secure a better deal.

Pay off existing debts

Clearing credit card balances, personal loans, or other debts before applying for a mortgage will reduce your monthly outgoings and improve your affordability. The less debt you have, the more disposable income lenders will see.

Cut unnecessary spending

In the months leading up to your mortgage application, reduce non-essential spending.

Lenders check your bank statements to see how you manage your money, so showing that you’re in control of your finances can increase your chances.

Improve your credit score

A strong credit score can make a big difference. Check your credit report and take steps to improve it, such as paying bills on time and keeping credit card balances low.

A higher credit score can result in better mortgage deals and lower interest rates.

Consider a longer mortgage term

Opting for a longer mortgage term, like 30 or 35 years, can reduce your monthly payments, making it more affordable.

Just remember, you’ll pay more interest over time, but this can help you get the mortgage approval you need.

Get expert advice from a mortgage broker

A good mortgage broker can help you find deals tailored to your situation, including those from lenders who specialise in helping people with student loans or lower deposits.

Their expertise can make a big difference in improving your affordability.

Key Takeaways

- Student loans don’t stop you from getting a mortgage, but lenders will consider your monthly repayments in their affordability check.

- Your monthly student loan repayments matter more than the total loan amount when assessing your mortgage affordability.

- Student loans do not appear on your credit file in the UK, so they won’t impact your credit score directly.

- You must declare your student loan on your mortgage application, even though it doesn’t show on your credit report.

- Saving for a larger deposit can improve your chances of getting a mortgage and give you access to better interest rates.

- It’s generally not advisable to consolidate your student loan onto a mortgage, as student loans have lower interest rates and are often written off after 30 years.

- First-time buyer schemes like Shared Ownership and the First Homes Scheme can help make buying a home more affordable, even with student loan debt.

- Improving your mortgage affordability can be achieved by paying off other debts, cutting unnecessary spending, and increasing your deposit.

The Bottom Line

After learning how student loans impact your mortgage application, it’s clear that lenders take a close look at your overall financial health.

The good news is that student loans don’t have to be a stumbling block.

With the right approach, you can manage your loan repayments and still position yourself as a strong mortgage candidate.

Working with a good mortgage advis/get-started/or can make the process smoother and increase your chances of approval. They can help you:

- Find lenders who are flexible with student loans

- Compare mortgage deals suited to your situation

- Offer expert tips to improve your affordability

- Handle the paperwork to save you time

Need help finding the right broker? Get in touch with us. We’ll connect you with a reliable broker who can help you solve your specific mortgage situation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can a student get a mortgage in the UK?

It’s possible, but it’s harder than for people with a job. Lenders usually want to see a steady income, which students often don’t have.

You might need a guarantor, like a parent, to promise to pay if you can’t. Some special lenders offer student mortgages, but you’ll need a good deposit and credit score.

Speaking to a mortgage broker can help you find suitable options based on your situation.

At what age can I own a house and secure a mortgage in the UK?

You can own a house and apply for a mortgage in the UK once you turn 18. However, lenders will still assess your financial situation, including your income, credit history, and deposit, before approving a mortgage.

Some lenders may have additional requirements or higher age limits, so it’s a good idea to check with different providers or seek advice from a mortgage broker.