Everything You Need To Know About Mortgage Applications

Got your heart set on buying a home? First, let’s talk about the mortgage application process.

A mortgage application is how you ask a lender, like a bank or building society, to give you a loan to buy the house.

Here’s how it works: the lender looks at your income, debts, credit history, and the house you want to buy. They use this information to decide if they can lend you money and how much they can offer.

In short, the mortgage application is your key to buying your dream home. 🏡

It might seem a bit tricky, especially if it’s your first time, but don’t stress. This guide will break it down for you, step by step, so it’s easy to understand. 😀

What Do I Need For a Mortgage Application?

Let’s get one thing straight – the mortgage lenders don’t owe you anything. They’re not doing you a favour by giving you a mortgage.

Buying a house is a big privilege and a big responsibility.

If you don’t get your act together before applying for a mortgage, you’re just wasting everyone’s time.

The lender’s time, your time, the estate agent’s time…all that time spent submitting paperwork and making calls, only to be rejected because you didn’t prepare properly.

Here’s the truth: Lenders are looking for any reason at all to not give you a mortgage.

They’re minimising their risk, which is smart for their business. Your job is to be so buttoned-up and organised that you give them no other choice but to approve you.

And here’s how:

Sort Out Your Finances

Sorting out your finances is the cornerstone of a successful mortgage application.

Start by determining your budget – calculate how much you can borrow, typically up to 4.5 times your annual income. For instance, if you earn £30,000 annually, you could borrow up to £135,000.

To know how much you can borrow, use a mortgage affordability calculator. This will give you an initial estimate of your mortgage amount.

Next, review your bank statements to determine your true disposable income after bills, expenses, and debts. This will dictate your maximum mortgage payment.

Ensure your financial health is also solid – get a FREE financial health check here to see if you can qualify for a mortgage.

Save Up for a Deposit

Your deposit is a critical component of your mortgage application.

Aim for at least 10% of the property’s value, though some schemes may allow for a 5% deposit.

Set a savings goal and create a plan to achieve it. Cut unnecessary expenses, set up a dedicated savings account, and consider automating your savings to ensure consistency.

If receiving help from family, ensure you have a gift letter to show the deposit’s source.

Check Your Credit Reports Properly

Your credit reports from Experian, Equifax, and TransUnion are Make or Break for your mortgage application.

A missed payment here, a dodgy credit account there…it all adds up to the lender saying “No thanks”.

So go through those reports line by line, leave no stone unturned. If there are errors or things you can justifiably explain, get it sorted before applying.

Convince the lender you’re an A++ borrower. 👍

Improve Your Credit Utilisation

While you’re looking at those credit reports, calculate your overall credit utilisation ratio across all cards/loans. The magic number is keeping it below 30%.

If you’re using more than 30% of your total available credit, that’s a huge red flag for lenders.

Pay down those balances, and become a responsible borrower. They want to see if you can handle debt sensibly before giving you more.

Get Your Documents Ready

Don’t go around hunting for documents when the lender asks for them. That’s amateur hour.

Gather every single possible document they could ever ask for in advance:

- Proof of income (payslips, P60s, accounts if self-employed, tax returns, etc.)

- Proof of income/affordability (3+ months of bank statements)

- Workings for any bonuses/commissions

- Proof of deposit source (savings, gift letter if family helped, etc.)

- Proof of identity (passport, driving licence)

- Proof of address (utility bills, bank statements)

- Details of any debts/loans/credit commitments

- College transcripts if you’ve recently graduated

- Cost breakdown for the property

- Hired conveyancer/solicitor details

- Divorce/separation paperwork if applicable

Anticipate everything and be prepared for anything. The time you spend getting organised now will pay dividends later.

Going Solo vs. With a Broker?

Should you tackle the mortgage process yourself or use a broker? This choice can make a big difference.

There are two main ways to get a mortgage, each has its pros and cons.

Going solo lets you call the shots and saves you money upfront on broker fees. But beware, it’s a marathon, not a sprint.

You’ll be spending a lot of time researching lenders, comparing rates, and wading through mountains of paperwork.

There’s also a chance you’ll miss out on better deals brokers can access thanks to their lender contacts.

Using a mortgage broker puts a qualified expert on your side, making the whole process smoother. They can:

- Search high and low for the best rates across multiple lenders

- Take care of the overwhelming paperwork

- Explain your mortgage options in clear terms

- Find deals you might miss and streamline the entire process.

There are fees involved, but a good broker’s expertise can save you money overall by securing a lower interest rate that outweighs their costs.

Money Saving Guru can match you with your ideal mortgage broker – for FREE. Get started here.

The Mortgage Application Process

With your finances sorted and documents ready, you’re prepared to dive into the mortgage application process.

Here’s a step-by-step guide to what comes next:

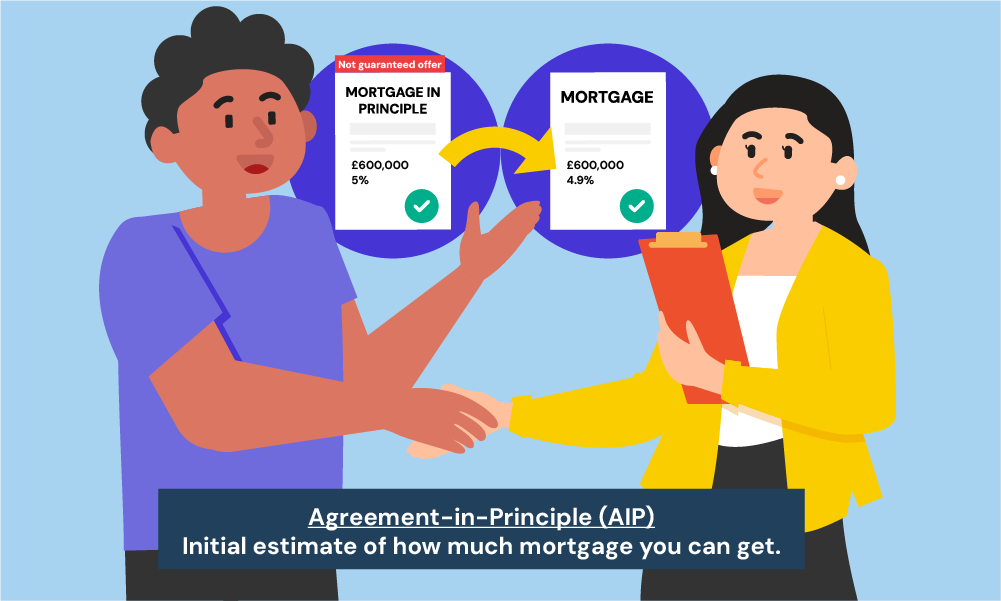

Step 1: Get An Agreement in Principle

First things first: secure an Agreement in Principle.

This isn’t a formal offer, but it’s your golden ticket indicating how much a lender might let you borrow based on your initial financial snapshot.

Think of it as your mortgage passport, giving you a strong footing when you start viewing properties.

Typically, an AIP is valid for 60 to 90 days, giving you ample time to explore your options without feeling rushed.

Step 2: Start the Property Hunt!

With your AIP secured, you can begin house hunting with confidence. Focus on homes within your budget, and don’t rush—this is a significant investment.

When you find a property you love, make an offer.

The AIP shows sellers that you have the financial backing to proceed, which can give you an advantage in competitive markets.

Step 3: Formally Apply for the Mortgage

Your offer is accepted? Fantastic! Now, it’s time to submit a full mortgage application.

This step requires detailed financial documentation: proof of income (payslips, P60s, or tax returns if self-employed), bank statements, proof of deposit, and identification.

The lender will conduct a thorough review, including a credit check, to ensure you meet their criteria. This stage can take a few weeks, so patience is key.

Step 4: Property Valuation

Next, the lender will arrange a property valuation to confirm its market value and ensure it’s worth the loan amount. This protects both you and the lender, verifying the property as a sound investment.

The valuation report might highlight any issues affecting the property’s value, giving you a clear picture of what you’re buying.

Step 5: Receive Your Mortgage Offer

If all checks out, you’ll receive a formal mortgage offer. This document outlines the terms: interest rate, loan amount, repayment terms, and conditions.

Review it carefully to ensure you understand and are comfortable with everything.

Typically, this offer is valid for 3 to 6 months, giving you time to complete the purchase.

Step 6: Hire a Conveyancer or Solicitor

Legal aspects now come into play. You’ll need a conveyancer or solicitor to handle the nitty-gritty legal work.

They will conduct necessary searches, review the contract from the seller, and manage the transfer of funds.

Their expertise ensures all legal requirements are met, guiding you smoothly through the process.

Step 7: Exchange Contracts

Exchanging contracts is a critical milestone. Once both parties sign the contracts and the deposit is paid, the sale becomes legally binding.

Your conveyancer facilitates this, ensuring everything is in order.

At this point, both you and the seller are committed to the transaction, marking a significant step towards homeownership.

Step 8: Complete and Get the Keys!

Finally, on the agreed completion date, the mortgage funds are transferred to the seller’s conveyancer, and you receive the keys to your new home.

This is the official transfer of ownership, allowing you to move in and start your new chapter.

Your conveyancer will handle the final checks and ensure all funds are correctly transferred.

Congratulations, you’re now officially a homeowner! 🎉

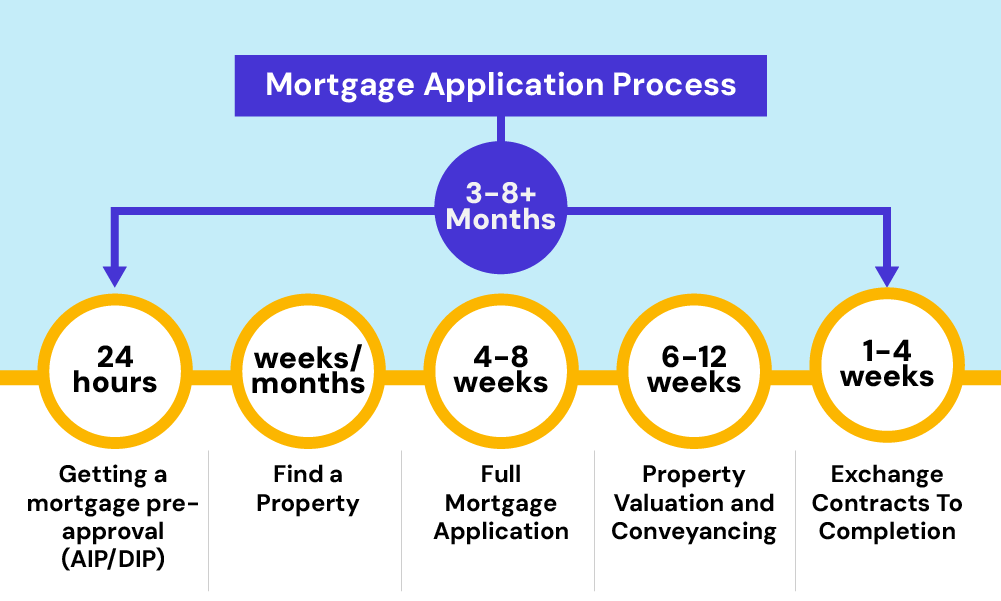

How Long Does the Mortgage Application Process Take?

There’s no single universal timeframe, as the mortgage application journey can vary quite a bit depending on your specific situation and how quickly you can provide documentation. However, most experts estimate:

- Getting a mortgage pre-approval (AIP/DIP) = A few days (usually within 24 hours)

- Finding a property = As long as your search takes (could be weeks/months)

- Processing the full mortgage application = 4-8 weeks on average

- Conveyancing = 6-12 weeks

- Exchanging contracts to completion = 1-4 weeks

So in total, it’s reasonable to expect the entire process from the first application to getting your keys to take approximately 3 to 8+ months for a straightforward purchase.

More complex situations may take longer.

Key Takeaways

- A mortgage application is how you ask a lender to borrow money to buy a home.

- Lenders assess your income, debts, and credit score to decide how much they can lend you.

- Prepare by sorting out your finances, saving for a deposit, and checking your credit report.

- You can apply for a mortgage on your own or use a broker to find better deals and handle paperwork.

- The mortgage process includes getting an Agreement in Principle, applying, property valuation, and finalising legal steps.

- Expect the entire process to take about 3-8+ months from application to receiving your keys.

The Bottom Line

Getting a mortgage in the UK can be stressful with all the paperwork and waiting. But don’t worry, it doesn’t have to be.

Many people find the process much smoother with the right help.

A qualified mortgage broker can save you time and hassle. They’ll handle the complicated details and help you find the best mortgage option for your situation, even if your credit score isn’t perfect.

This means you can focus on the exciting parts – planning your dream decor or that family holiday you’ve been dreaming of.

Ready to make your mortgage journey easier? We can match you with a qualified mortgage broker for a FREE, no-obligation consultation. Simply, get in touch today.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What extra checks are done for politically exposed persons applying for a mortgage?

Being a politically exposed person (PEP) means you’ll face extra checks when applying for a mortgage. That’s because lenders need to be super careful about money laundering and corruption.

Expect them to dig deep: verifying where your money comes from, running thorough background checks, and keeping a close eye on your transactions. This can make the whole process longer and trickier.

Some lenders might even say no straight away, but others will consider your application with a magnifying glass.

That’s why it’s vital to work with a mortgage broker who understands PEP checks and can guide you through the process smoothly.

Can I apply for a mortgage using power of attorney?

Yes, you can apply for a mortgage using power of attorney (POA).

The POA document must be registered and legally binding. The attorney must provide proof of identity and authority to act on your behalf.

Some lenders have specific requirements or restrictions. Additionally, extra checks from underwriters and the lender’s legal department may be needed. Working with a mortgage broker can help navigate these requirements smoothly.

Is it possible to get a mortgage if I have a terminal illness?

Getting a mortgage with a terminal illness is challenging but possible. Lenders assess your financial situation, including income and savings, to determine affordability. They might require additional medical information.

Some lenders may be more flexible, considering government benefits or insurance coverage as income. It’s beneficial to work with a mortgage broker who understands your situation and can find suitable lenders.

Is it necessary to apply for insurance when getting a mortgage?

While not always mandatory, applying for insurance is highly recommended.

Building insurance is usually required to protect the property.

Life insurance, critical illness coverage, and mortgage protection payment insurance (MPPI) can provide financial security.

MPPI covers “unemployment only,” “accident and sickness only,” or both. A mortgage broker can advise you on the best insurance options for your needs.

When is the best time to apply for a mortgage?

The best time to apply for a mortgage is before you even start looking for a house.

By getting your finances approved early, you’ll have an edge over other buyers and avoid any hold-ups.

Make sure your finances are in good shape, with a steady income, a healthy credit score, and a decent deposit saved.

It’s also wise to apply when interest rates are low. Talking to a good mortgage advisor can help you figure out the perfect time based on your specific situation.

How will I know if my mortgage application is approved?

You will know your mortgage application is approved when you receive a formal mortgage offer.

This document outlines the loan’s terms and conditions, including interest rate, loan amount, and repayment schedule.

Your lender or mortgage advisor will notify you once the offer is ready. Review and accept the offer to proceed with the purchase.