- What is a Mortgage and How Do They Work?

- What Types of Mortgages Are Available in the UK?

- What Deposit Will You Need for a Mortgage?

- Is It Better to Use a Mortgage Broker or Go Direct?

- How Much Can You Actually Borrow for a Mortgage?

- How to Get Approved for Your Dream Mortgage

- How To Apply for a Mortgage?

- What Other Fees Are Involved with Getting a Mortgage?

- How to Manage Your Mortgage Repayments

- The Bottom Line

Complete Guide To Mortgages: What You Need To Know

Owning a home—it’s a dream for many. Yet, with property prices soaring and hefty deposits required, it often feels like a distant reality.

Unless you’ve got a generous relative ready to hand over a small fortune, one thing is certain: you’ll need a mortgage.

The mortgage process can seem overwhelming, especially for first-time buyers. Endless paperwork, strict affordability checks, and countless options can be discouraging.

But here’s the secret: with the right knowledge and guidance, it doesn’t have to be.

Once you know the basics, get your finances in order, and enlist a professional mortgage advisor – those keys could be closer than you think.

So, buckle up. In this comprehensive guide to mortgages, we’ll walk you through everything you need to know about mortgages.

What is a Mortgage and How Do They Work?

Let’s start with the basics – what exactly is a mortgage?

A mortgage is a loan that lets you buy a property, whether that’s your dream home or an investment.

It’s a secured loan, which means the property itself acts as collateral. So if you fail to keep up with your monthly repayments, the lender has the right to repossess and sell the property to recoup their money.

With a mortgage, you’ll borrow a large sum upfront to cover the bulk of the property’s cost. You then pay this back over an agreed term (usually 25-30 years) in monthly instalments, plus interest charged by the lender.

It’s a long-term commitment, but often the only viable way for most people to get on the property ladder.

The amount you can borrow depends on factors like your income, deposit size, credit history and the property’s value.

Typically, lenders will cover 75-95% of the purchase price if you meet their criteria. The remaining portion is what you’ll need to save for your deposit.

Image showing the definition of a mortgage.

What Types of Mortgages Are Available in the UK?

Now we’ve covered the mortgage basics, let’s explore the different mortgage types you can choose from.

The right option for you depends on your circumstances and goals:

Do You Want a Fixed or Variable Interest Rate?

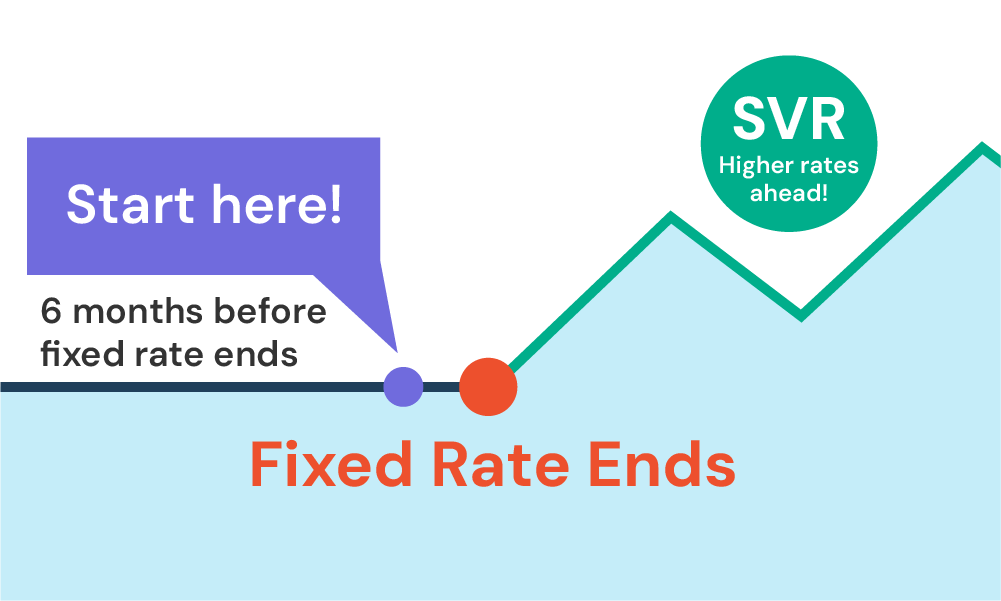

- Fixed-rate mortgages. The interest rate is fixed for an initial period, typically 2-5 years. Your monthly payments stay the same during this time, regardless of interest rate fluctuations.

- Variable-rate mortgages. The interest rate can go up or down in line with the Bank of England base rate. Your payments could change on a monthly basis.

- Tracker mortgages. These variable-rate deals directly track the base rate, rising and falling in perfect correlation.

- Discount mortgages. These offer a discount off the lender’s standard variable rate (SVR) for a set period. Your payments can still vary, but you benefit from a lower rate.

- Capped mortgages. These variable-rate mortgages have an interest rate cap, meaning the rate won’t go above a certain level, giving you some protection against significant rate increases.

Are You Repaying the Capital Too or Just the Interest?

- Repayment mortgage. Your monthly payments go towards repaying both the capital amount borrowed and the interest charged. At the end of the term, the mortgage is fully repaid.

- Interest-only mortgage. Your payments just cover the interest, with the entire capital still owed at the end. You’ll need a separate repayment plan in place.

Do You Need Special Mortgage Features?

Sometimes, you need a bit more flexibility with your mortgage. Here are some features that might help:

- Overpay and save. You can pay more than your minimum monthly amount. This reduces your mortgage term and saves interest in the long run. Most lenders allow a certain amount of penalty-free overpayments each year.

- Underpayments. Need a break? Talk to your lender about underpayment options. This can help during tight financial periods, but it’s usually for a limited time and requires prior approval.

- Payment Holidays. This lets you pause your mortgage payments for a set period, typically up to 6 months. This can be helpful in unexpected financial hardship, but you’ll often need a history of on-time payments to qualify.

- Offset Mortgages. Link your mortgage to a savings or current account. The balance in your linked account reduces your mortgage balance, lowering the interest you pay.

- Drawdown Facility. This lets you borrow additional funds up to a pre-agreed limit, without needing to renegotiate your mortgage. This is handy for home improvements or other expenses.

- Portability. With this, you can transfer your existing mortgage deal to your new property, avoiding early repayment charges. This saves time and money compared to getting a new mortgage.

- Flexible Drawdown. Similar to a credit line, a flexible drawdown lets you withdraw additional funds from your mortgage as needed. This is handy for managing fluctuating expenses without applying for separate loans

- Interest-Only Periods. Pay only the interest for a while, reducing your monthly payments temporarily. The principal remains unchanged, but it provides short-term financial relief.

Do You Need Any Special Mortgage Features?

- First-time buyer mortgages. Designed to make it easier for those purchasing their first home, often accepting lower deposits.

- Buy-to-let mortgages. This is for those wanting to purchase a property to rent out as an investment.

- Self-employed mortgages. Taking into account income patterns for self-employed applicants.

- Bad credit mortgages. An option for those with adverse credit histories who may struggle to get approved elsewhere.

- Guarantor mortgages. These involve a third party, usually a family member, who guarantees the mortgage repayments if the borrower cannot meet them.

- Commercial mortgages. Used to purchase property for business purposes, offering higher borrowing limits compared to residential mortgages.

- Equity Release. Allows older homeowners to access the equity tied up in their homes, providing a lump sum or regular income.

- Bridging Loans. Short-term loans are intended to ‘bridge’ the gap between the purchase of a new property and the sale of an existing one.

- Development Finance. Designed for property developers looking to fund large-scale construction or renovation projects.

- Self-build mortgages. Specifically for those building their own homes, releasing funds in stages as the build progresses.

There are also mortgages tailored to older borrowers, those buying second homes/holiday homes, as well as various government schemes to be aware of.

Getting professional mortgage advice is wise to understand all the options.

What Deposit Will You Need for a Mortgage?

The bigger your deposit, the lower the amount you’ll need to borrow – meaning cheaper mortgage rates and lower monthly payments.

Aim for at least 10% of the property’s value as a minimum, but ideally 20% or more to access the best deals.

Having a smaller deposit of just 5% is possible with some specialist mortgages. However, this higher loan-to-value ratio means you’ll face higher interest rates and stricter borrowing criteria to offset the increased risk for the lender.

100% mortgages are also an option for some borrowers, allowing you to purchase a property without any deposit. These often require a guarantor or special conditions set by the lender to lower the risk.

Is It Better to Use a Mortgage Broker or Go Direct?

You can apply for a mortgage directly with a specific lender. But for most people, using an independent mortgage broker is the smarter approach.

Here are some key benefits of going through a broker:

- They have knowledge of the entire market and can compare thousands of deals to find the most suitable option.

- Often have access to exclusive rates that you can’t get by going direct.

- Understand complex lending criteria and can match you to the right lender the first time.

- Handle the entire application process for you, making it quicker and easier.

- Unbiased and focused on getting you the best possible deal.

While brokers may charge a fee, this is often offset by the money you’ll save through finding a cheaper mortgage. Their service is completely free in many cases too.

How Much Can You Actually Borrow for a Mortgage?

There’s no one-size-fits-all answer here as each lender has different criteria for assessing how much they’re willing to lend you. However, some key factors they’ll take into account include:

- Your household income (combined with joint mortgages)

- Your age and employment status

- Your credit history and existing debts

- The property’s value

- Your ability to afford payments if interest rates increase

As a rough guide, most lenders will cap mortgage borrowing at around 4-4.5x your annual income. But it’s best to use our online mortgage calculator to get a more personalised estimate based on your circumstances.

[Embedded Online Mortgage Calculator]

How to Get Approved for Your Dream Mortgage

If you’re ready to buy your new home, you’ll need to get approval for a mortgage. Here are some top tips to give yourself the best possible chance of approval:

- Save up for a deposit. Aim to save at least 10-20% of the property’s value. The average UK house price is around £282,000 in 2024, this means you must save at least £28,200 for better mortgage deals.

- Get your credit report in order. Lenders will scrutinise your credit history, so take steps to improve your score if needed.

- Prepare proof of your income. Have payslips, accounts and tax returns ready to back up what you’ve stated.

- Provide all documentation upfront. Supplying things like ID, bank statements and proof of deposit quickly and accurately will speed up the process.

- Be prepared for interviews and questions. Lenders may want to discuss your finances and plans in more detail.

- Get an agreement in principle. It’s not a requirement but, an AIP gives you an idea of how much you can borrow. It’s a preliminary decision from a lender based on your financial information and credit score.

- Use a mortgage broker. Their knowledge will maximise your chances of approval while getting you the most competitive rates.

The mortgage application process can seem daunting. But by being prepared, demonstrating you can comfortably afford the repayments, and letting a professional guide you, the path to securing your mortgage can be smooth and stress-free.

How To Apply for a Mortgage?

Once you’ve found your dream home and are ready to apply for your mortgage, here’s what the typical process looks like:

- Complete the Application Form. Fill out the application form with details about yourself, your finances, the property, and the mortgage product you want.

- Supply Supporting Documents. Provide necessary documents such as ID, payslips, bank statements, and proof of deposit.

- Credit Check and Evaluation. The lender will run a credit check and assess your application.

- Property Valuation. The lender will conduct a property valuation to ensure the property is worth the amount being borrowed.

- Receive a Mortgage Offer. If approved, you’ll get a mortgage offer detailing the amount, interest rate, fees, and other terms.

- Review the Offer. Carefully review the offer and hire a solicitor or conveyancer to handle the legal aspects.

- Arrange Insurance. Arrange life insurance and any other protection policies required by the lender.

- Sign the Mortgage Deed. Complete and sign the mortgage deed.

- Set a Completion Date. Your solicitor will set a completion date, at which point you’ll get the keys to your new home!

The entire process can take 4-6 weeks from application to completion. Having an experienced broker on your side can help ensure everything runs smoothly.

What Other Fees Are Involved with Getting a Mortgage?

Aside from the mortgage itself and the interest charged, be aware that taking out a new mortgage deal involves several upfront fees and additional costs:

- Arrangement/booking fees charged by the lender

- Property valuation costs

- Account fees for transferring mortgage funds

- Legal/conveyancing fees

- Stamp duty (payable on properties over £125k)

- Broker fees if using a mortgage advisor

- Moving costs if purchasing a new property

Factor in these fees from the outset, as they can easily run into thousands of pounds on top of your mortgage deposit. Some lenders do offer incentives or fee-free options to reduce the upfront costs involved.

How to Manage Your Mortgage Repayments

So you’ve got through the mortgage application gauntlet and received those coveted keys to your new home.

Congratulations! But the financial responsibilities don’t stop there.

First, make sure you’ve budgeted carefully and can genuinely afford the monthly mortgage payments, even if circumstances change. It’s wise to have at least 3-6 months’ worth of payments and living costs set aside in an emergency fund.

Setting up a direct debit is highly recommended, so your payments never slip through the cracks. You should also consider taking out income protection insurance to cover your mortgage if you are unable to work for any reason.

If you do happen to run into difficulties meeting the payments, don’t ignore the situation. Speak to your lender immediately – they have processes in place to provide temporary support until you get back on your feet.

Finally, keep an eye on the mortgage market. Depending on your deal, it may be worth remortgaging every few years to take advantage of lower rates and save on your monthly costs.

The Bottom Line

Missing mortgage payments can have serious consequences. You could face penalties, increased interest rates, and even the risk of repossession.

Your credit score will take a hit, making it harder to secure future loans. It’s crucial to stay on top of your payments to avoid these issues.

Using a mortgage broker can make the process much smoother. They handle the complexities, saving you time and stress.

With a broker’s expertise, you can focus on other important things, or simply relax at home, knowing your mortgage application is in good hands.

Need a broker? Get in touch. We’ll connect you with a qualified mortgage broker for a free, no-obligation consultation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Where do I get mortgages in the UK?

In the UK, you can get mortgages from a number of places. High street banks, building societies and online lenders all offer different mortgage deals.

To find the best fit for you, it’s wise to compare options from across the market. You can also use a mortgage broker who has access to deals from many lenders and can help you choose the best one for your situation.

How do I know if I have the right mortgage deal?

Choosing the right mortgage in the UK involves looking at a few key things: the interest rate, fees, repayment terms and any special features you might need. Compare these across different lenders.

Think about your long-term financial goals too – does the mortgage fit with them? A mortgage broker can help you compare deals and find the best one for your situation.

What is remortgaging?

Remortgaging is simply switching your current mortgage to a new deal. You can do this with your existing lender or a new one, all while staying in your same home.

People remortgage for a few reasons: to get a better interest rate, borrow more money for improvements on their home, or even to pay off other debts.

But remember, it’s important to consider all the costs involved, like fees or early repayment charges, before deciding if remortgaging is right for you.

How do I find the best mortgage?

The best mortgage for you depends on your finances. First, take stock of your income, expenses and credit score. Then, research the mortgage deals on offer from different lenders.

Look closely at the interest rates, fees and terms each offers. Online comparison tools can help you see what’s out there.

Getting help from a qualified mortgage broker is the smartest way to find the best deals. They have access to a wider range of deals and can give personalised recommendations based on your situation.

Don’t forget to think about your long-term plans as well. The mortgage you choose should fit in with your financial goals for the future.