What You Need to Know About Co-Signing a Mortgage

You’ve saved diligently for years, building the deposit you need for your first home.

But when you apply for a mortgage, your application is rejected. Maybe your income isn’t high enough, or your credit score needs improvement.

Disappointment and frustration set in – you were so close to achieving your dream of homeownership.

If this sounds familiar, don’t give up yet. One option to consider is having a parent or close relative co-sign your mortgage application.

A co-signer can improve your chances of getting approved for the mortgage. However, co-signing is a big favour to ask and shouldn’t be taken lightly.

Both you and the potential co-signer need to fully understand the significant legal and financial commitments involved.

Let’s explore the pros and cons to help you decide if this is the right step for you.

What Does It Mean To Co-Sign a Mortgage?

When someone co-signs your mortgage, they are essentially acting as a guarantor. The co-signer agrees to take on joint liability for the mortgage debt, without any ownership rights to the property itself.

In practical terms, it strengthens your mortgage application by adding the co-signer’s income and assets into the equation. Lenders will assess both your finances combined when calculating what you can borrow.

Having your mum or dad as a co-signer could mean getting approved for a larger mortgage. Or it might tip the scales if you were borderline based on your own finances.

Who Can Co-Sign My Mortgage?

It’s most common for parents or close family members like grandparents to co-sign a mortgage for their children or grandchildren. Lenders tend to prefer this family connection rather than friends acting as guarantors.

Age can be a factor too, as some mortgages have a maximum age that the co-signer cannot exceed by the end of the term. That’s because the co-signer remains liable for the full mortgage term.

To act as your co-signer, your parent (or whoever) will typically need:

- A good credit score

- A stable and sufficient income

- Low existing debts or debt-to-income ratio

- Equity or savings to put up as security

Essentially, your co-signer needs to be in a financially robust position themselves.

If they also have bad credit or money troubles, they could actually end up hindering rather than helping your mortgage application.

How Does Co-Signing Work?

In practice, the co-signer signs the mortgage deed alongside you, the primary borrower. Their income and outgoings will be scrutinised by the lender in addition to your own.

The property and mortgage itself remain entirely in your name – the co-signer has no ownership rights. But they become jointly liable for the debt, so the mortgage payments must be made regardless of any relationship issues.

While your parent co-signing can boost your chances of mortgage approval, it doesn’t automatically make the process easier. You’ll still need to evidence the usual things like:

- A decent deposit (relative to the property value)

- Sufficient income to afford the mortgage repayments

- A good credit history

- Standard documentation like ID, payslips, bank statements etc.

Having a co-signer won’t compensate for coming up short in these areas. But it can provide a level of support that helps you meet the lender’s lending criteria overall.

Benefits of a Co-Signed Mortgage

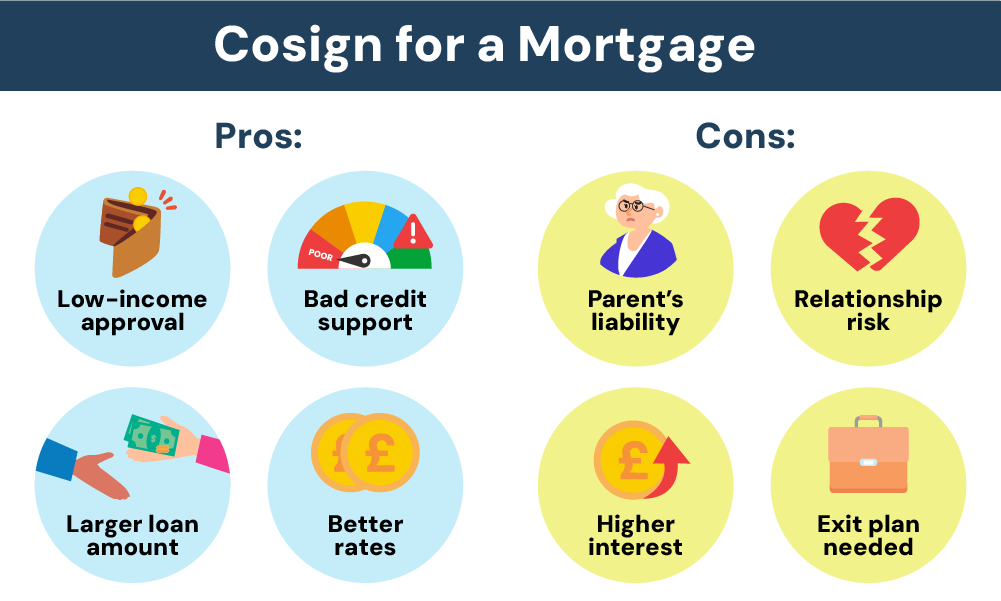

So in what situations can having a parent co-sign your mortgage really help? Here are some of the key benefits:

Get a Mortgage With a Low Income

One of the most common reasons for needing a co-signer is having a low or irregular income which makes affordability difficult. This is particularly common for first-time buyers starting in their careers.

Even if you could theoretically afford the mortgage payments thanks to assistance from your parents, lenders still need assurances. Having your parents co-sign provides that financial backing.

Buy a Home With Adverse Credit

Having your parent act as a co-signer can help mitigate issues caused by a poor credit history, such as:

- Low credit score

- Previous missed payments

- County Court Judgments (CCJs)

- Defaults

- Bankruptcies

Their financial standing as co-signer could make up for your adverse credit, allowing you to still get approved.

Borrow More to Buy a Larger Home

With the combined income from you and your co-signer, lenders may approve a larger mortgage amount than they would based on your finances alone.

This could mean being able to afford higher property prices, perhaps even in neighbourhoods that would otherwise be off limits based on your solo borrowing power.

Improve Your Loan-to-Value Ratio

The more deposit you can put down versus the property price, the lower the loan-to-value (LTV) ratio on your mortgage application. Lower LTV mortgages tend to attract lower interest rates.

If your parents provide some of the deposit funds (or allow you to use their home as security), this could lower your LTV and save money via a cheaper mortgage deal.

Drawbacks & Risks of Co-Signed Mortgages

While co-signing can be advantageous, it isn’t a magic solution and there are some risks involved for both you and your co-signer parent(s). Be mindful of these drawbacks:

Legal Responsibility For Parent(s)

As co-signers, your parents become fully legally liable for the mortgage debt if you default. This responsibility stays in place until the mortgage is paid off in full.

If you were ever to stop making payments, the lender could chase your parent(s) for the entire outstanding balance. Their credit score could be damaged, assets may be at risk – it’s a major legal commitment they are taking on.

Relationship Strain if Things Go Wrong

Money issues and personal relationships don’t mix well.

No matter how well-intentioned, having your parents financially tied to your mortgage is a risk to your relationship. Any missed payments or difficulties paying it off could cause stress and conflict.

Potentially Higher Interest Rates

If your situation is viewed as a higher risk by lenders, you may face higher interest rates than a standard residential mortgage deal.

So the trade-off for getting approved with a co-signer could be paying an inflated rate.

An Exit Strategy is Needed

Most lenders will expect to see your co-signed mortgage as just a starter home scenario or short-term solution.

You’ll likely need to demonstrate a clear exit strategy or plan to take over the mortgage independently within a certain timeframe (e.g. 3-5 years).

The Bottom Line: Find Out if It’s Right For You

As you can see, co-signed mortgages are very much situational. The pros and cons depend entirely on your specific circumstances, those of your intended co-signer, and whether it truly is the most suitable path to homeownership for you both.

The only way to know for sure is by speaking to an independent mortgage broker. Their expert guidance can help you weigh up all the factors and decide whether co-signing or an alternative option, is the right mortgage solution.

Our fee-free mortgage brokers have helped thousands of co-signers and guarantors onto the property ladder. Book a quick introduction call to get started.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can a co-signer be removed from a mortgage?

Yes, you can remove a co-signer from a mortgage, but it’s not a straightforward process.

The main borrower will need to remortgage the property in their sole name. This means applying for a new loan and proving they can meet the mortgage requirements on their own.

The lender will assess the borrower’s credit score, income, and financial stability during the remortgage process.

If the borrower qualifies, the new loan will replace the original mortgage, and the co-signer will be released from any further obligations.

Will cosigning affect getting a mortgage?

Yes, cosigning can make it harder to get a mortgage yourself. That’s because when you co-sign, the loan shows up on your credit report as a debt, even though you’re not the main borrower.

Lenders consider this extra debt when they assess your debt-to-income ratio, which is a key factor in whether they approve you for a mortgage or other loans.

In short, co-signing reduces how much you can borrow and may result in higher interest rates or stricter terms on future loans.

Can a cosigner lose their house?

Co-signing a mortgage doesn’t directly threaten your own house.

While you wouldn’t own part of the property you co-signed for, you are on the hook if the main borrower stops paying.

If that happens, the lender could sue you to get the money back. This could damage your credit score and finances, but it wouldn’t put your own home at risk.

How long does a cosigner stay on a mortgage?

A cosigner typically stays on a mortgage until it’s either paid off in full or refinanced. There’s no automatic way to remove a cosigner.

The main borrower needs to take action, like remortgaging the property solely in their name. This, of course, means they’ll have to prove they can afford the mortgage on their own.

Otherwise, selling the property will also pay off the mortgage and remove the cosigner’s responsibility.

Is co-signing a bad idea?

Co-signing a loan is a risky decision, best avoided unless you absolutely trust the borrower to repay it.

Why? Because if they don’t, you’re on the hook for the entire debt. This can wreck your credit score and make it difficult to borrow money yourself in the future.

So, before you co-sign, take a good look at the borrower’s finances and think carefully about the risks involved.

What's the difference between a guarantor and a co-signer mortgage?

Co-signing and guarantor roles differ on when you’re liable for repayments.

As a co-signer, you’re liable straightaway if the main borrower misses payments. The lender can come after you for the money without messing around first.

Guarantors are more like backups. They only have to pay if the borrower defaults and the lender has tried everything else to get the money back.

How many co-signers can I have on my mortgage?

In most cases, UK lenders allow one or two co-signers on a mortgage, but the exact number can vary depending on the lender and the specific mortgage program.

It’s always best to check directly with your lender to confirm their rules on co-signers.

What is the difference between co-signing and co-borrowing?

Co-signing and co-borrowing sound similar, but there’s a key difference: ownership.

As a co-signer, you’re on the hook for repayments if the main borrower defaults, but you don’t own any part of the property.

Your name is on the mortgage but not the deeds.

Co-borrowing, on the other hand, means you’re buying the house together. You share the responsibility for paying the mortgage and you both own the property, with your names on both the mortgage and the deeds.