- What Is a Joint Mortgage?

- How Many People Can Be on a Mortgage?

- How Do Joint Mortgages Work?

- Who Can Get a Joint Mortgage?

- Can You Get a Joint Mortgage If Only One Person Has an Income?

- What Happens If One Person Stops Paying a Joint Mortgage?

- Can You Transfer a Joint Mortgage to One Person?

- What Is a Joint Borrower Sole Proprietor Mortgage?

- Is a Joint Mortgage Suitable for First-Time Buyers?

- What Are the Risks of a Joint Mortgage?

- Can You Get a Joint Buy-to-Let Mortgage?

- What Happens If You Want to Sell a Jointly Owned Property?

- Should You Get a Joint Mortgage?

- Key Takeaways

- The Bottom Line

Joint Mortgages in the UK: What You Need to Know

When it comes to buying a home, few things offer more flexibility and financial muscle than a joint mortgage.

But what exactly is a joint mortgage, and how does it work?

If you’re considering buying a property with someone else—be it a partner, a friend, or even a business associate—this guide is for you.

We’ll cover everything from how many people can be on a mortgage to what happens if one person stops paying.

Let’s dive in.

What Is a Joint Mortgage?

A joint mortgage is a home loan shared between two or more people, allowing you to combine your financial resources to purchase a property.

Whether you’re buying with a partner, a friend, or even a family member, a joint mortgage can be a strategic way to get onto the property ladder or invest in a buy-to-let property.

The most common scenario involves couples—either married, unmarried, or in civil partnerships—applying for a joint mortgage. But the rules are flexible, and lenders are open to various arrangements.

Joint mortgages can be particularly beneficial for first-time buyers who may struggle to secure a mortgage on their own due to income limitations.

How Many People Can Be on a Mortgage?

In the UK, most lenders allow up to four people to be on a single mortgage.

This is useful if you’re pooling resources with friends or family.

However, lenders typically only consider the two highest incomes when deciding how much you can borrow.

This means that even if four people are contributing, the borrowing potential might not increase proportionally.

Always check with your lender or mortgage broker to understand their specific criteria.

How Do Joint Mortgages Work?

Applying for a joint mortgage is similar to applying for a standard mortgage, but there are a few key differences.

All parties involved will need to agree on the mortgage terms, make joint decisions, and sign all relevant paperwork.

This process ensures that everyone is equally responsible for the mortgage repayments and has a stake in the property.

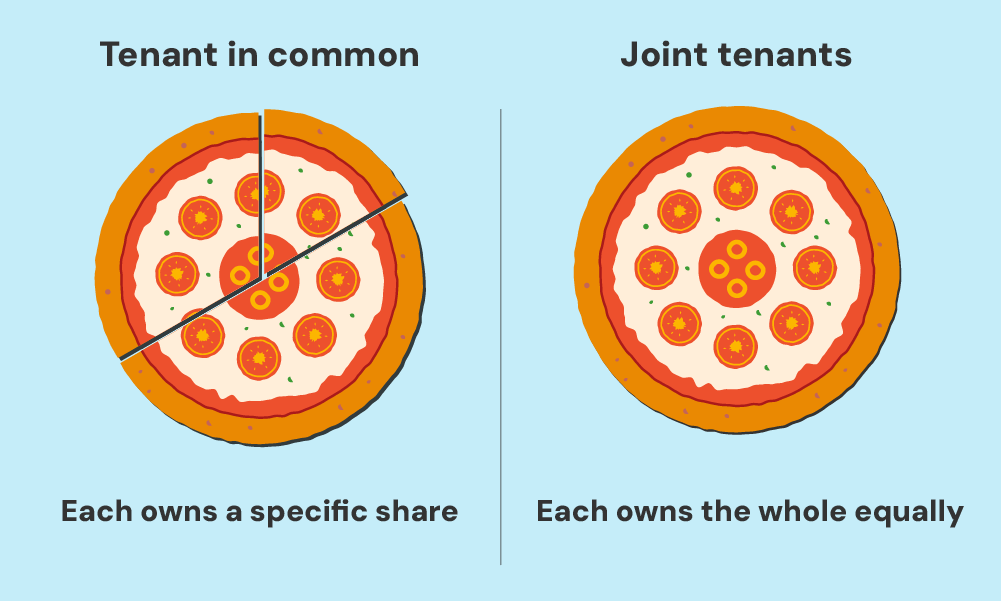

You must also choose on the type of legal ownership. In the UK, there are two main options

- Joint Tenants – All owners share the property equally. If one owner dies, their share automatically passes to the surviving owners. Profits from selling the property are divided equally. This is common for couples.

- Tenants in Common – Each owner has a separate share of the property. Shares can be different sizes, and owners can leave their share to someone else in their will. This option is often used by friends or business partners.

Who Can Get a Joint Mortgage?

Anyone can apply for a joint mortgage, including couples, family members, friends, or business partners.

All applicants must meet the lender’s criteria, like credit score, income, and age.

Can You Get a Joint Mortgage If Only One Person Has an Income?

Yes, you can get a joint mortgage even if only one person has an income.

But, this scenario can be more complex.

Lenders will usually base the affordability on the sole income, which might limit the amount you can borrow.

The person without an income might be seen as a dependent, affecting the overall assessment.

Some lenders are more flexible and may allow for benefits or other forms of income to be considered, but this varies by lender.

It’s advisable to consult a mortgage broker to find the best options available.

What Happens If One Person Stops Paying a Joint Mortgage?

With a joint mortgage, everyone shares responsibility.

If one person stops paying, the others have to cover the difference.

Missing payments damages everyone’s credit score and could lead to the property being repossessed.

To prevent issues, it’s important to have a clear agreement from the start on how payments will be managed and what happens if one person can’t pay.

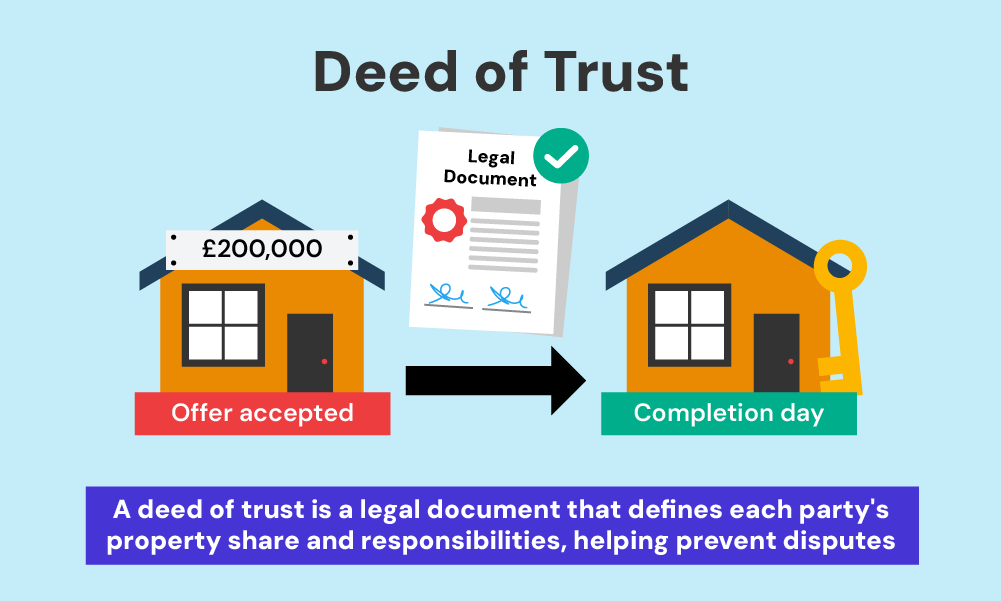

Some people opt for a deed of trust, a legal document that outlines each party’s share of the property and their responsibilities. This can help avoid disputes later on.

Can You Transfer a Joint Mortgage to One Person?

Life changes, and there may come a time when you need to transfer a joint mortgage to one person.

This could happen due to a relationship breakdown, a friend moving out, or simply a change in financial circumstances.

The easiest way to handle this situation is to sell the property and split the proceeds according to your ownership shares.

But, if one person wants to keep the property, they can buy out the other owner(s).

This process is known as a transfer of equity and involves removing one party’s name from the mortgage and deeds.

To do this, the remaining borrower must show that they can afford the mortgage on their own.

If affordability is an issue, extending the mortgage term or remortgaging might be necessary to reduce monthly payments.

Legal and administrative fees will apply, so it’s worth factoring these into your decision.

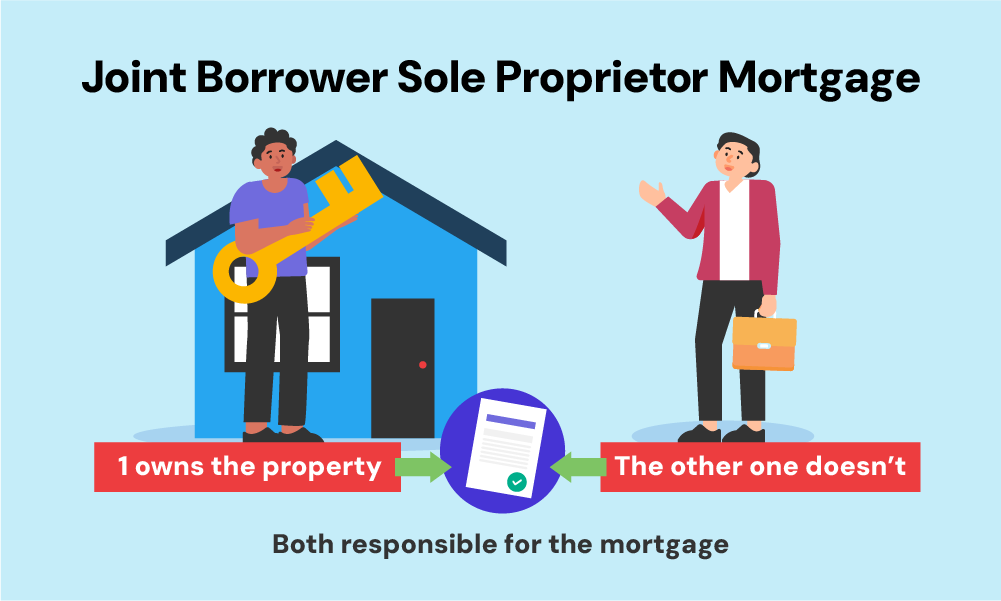

What Is a Joint Borrower Sole Proprietor Mortgage?

A Joint Borrower Sole Proprietor (JBSP) mortgage lets up to four people apply for a mortgage together, but only one person owns the property.

This is often used when parents help their child buy a home. By including the parent’s income, the mortgage amount can be higher.

However, only the child owns the property, so the parents avoid extra stamp duty and keep their own property rights.

This helps the child buy a home without the parents becoming legal owners.

Is a Joint Mortgage Suitable for First-Time Buyers?

Yes.

A joint mortgage can be a great way to get on the property ladder if you’re struggling to save for a big enough deposit on your own.

By teaming up with someone else, you can combine your income, which usually means you can borrow more money.

But there are a few things to think about. If one of you has owned a home before, you might miss out on some government help for first-time buyers, like saving on stamp duty.

Also, remember that you’re joining forces with someone else financially, so it’s important to trust each other and be open about money matters.

What Are the Risks of a Joint Mortgage?

Joint mortgages come with benefits but also risks.

One major risk is shared liability—if one person misses a payment, everyone on the mortgage is responsible. This can strain relationships and cause financial trouble.

Another risk is the impact on your credit report. A joint mortgage links your credit history with your co-borrowers, so if one person has a poor credit score, it could affect your ability to get credit or result in higher interest rates.

Lastly, getting out of a joint mortgage can be complicated and costly if circumstances change.

Selling the property or transferring the mortgage can take time and money.

Can You Get a Joint Buy-to-Let Mortgage?

Yes, joint buy-to-let mortgages are available and can be a smart way to invest in property with others.

The application process is similar to that of a standard joint mortgage, but the affordability assessment will also consider the potential rental income from the property.

It’s important to note that buy-to-let mortgages often require a larger deposit (usually around 25% or more) and come with different tax implications.

Be sure to consult a qualified mortgage broker who specialises in buy-to-let properties to navigate the complexities of this investment type.

What Happens If You Want to Sell a Jointly Owned Property?

If you decide to sell a property owned under a joint mortgage, the process is straightforward but requires agreement from ALL parties.

Once the property is sold, the proceeds will be divided according to the ownership shares agreed upon when the mortgage was taken out.

If there are disagreements about selling or how the proceeds should be split, this can lead to legal disputes.

Having a deed of trust in place can simplify this process by clearly outlining each person’s rights and responsibilities.

Should You Get a Joint Mortgage?

Getting a joint mortgage is a BIG commitment – there are some good points and bad points to consider. Here’s a look at the pros and cons:

Pros:

- You can borrow more money by combining incomes, letting you buy a pricier home.

- You can pool your savings for a bigger deposit, which might get you better mortgage rates.

- Sharing the monthly payments can make it easier to manage.

- Works well for couples, friends, or family members buying together.

- It can help first-time buyers who might not qualify on their own.

- You can choose how to split ownership, whether equally or with different shares.

- If one person has a good financial history, it might improve your chances of getting approved.

- Family members can support each other without taking full ownership.

Cons:

- If one person misses payments, everyone’s credit scores can suffer.

- Being financially linked can affect your chances of getting future credit.

- It can be hard to sort out if someone wants to sell their share or leave the mortgage.

- Disagreements over money or property decisions can put a strain on relationships.

- Removing someone from a joint mortgage or switching to a single name can be costly and tricky.

- If one person has bad credit, it could harm your chances of getting a good deal or even getting approved.

- Legal and admin fees can be higher, especially if a deed of trust or changes in ownership are involved.

- You might lose first-time buyer perks if one person has owned a home before.

Key Takeaways

- A joint mortgage lets two or more people combine their finances to buy a property, making homeownership more accessible.

- Up to four people can be on a joint mortgage in the UK, but lenders usually only consider the two highest incomes.

- You can choose between joint tenants (equal ownership) or tenants in common (different ownership shares) for property ownership.

- If one person stops paying, everyone on the joint mortgage is responsible for covering the repayments, which can impact credit scores.

- A Joint Borrower Sole Proprietor (JBSP) mortgage allows multiple people to help with mortgage payments, but only one person owns the property.

- Selling a jointly owned property requires agreement from all parties, and proceeds are divided based on ownership shares.

The Bottom Line

A joint mortgage can be a great way to buy property in the UK, whether you’re a first-time buyer, investing in a buy-to-let, or pooling resources with others.

However, it comes with its own complexities and risks.

It’s important to fully understand how joint mortgages work and be aware of potential pitfalls.

Speaking with an independent mortgage broker can help you explore your options and secure the best deal.

Need a good broker? Get in touch with us. We’ll connect you with a qualified mortgage broker who can help you get the best joint mortgage for your situation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Are joint mortgages different from standard mortgages?

Yes, joint mortgages involve multiple people sharing responsibility for the loan. The application process is similar, but lenders consider the financial profiles of all applicants. This can increase borrowing power but also means everyone is liable for repayments.

How much can you borrow with a joint mortgage?

You can usually borrow more with a joint mortgage because lenders consider combined incomes. Typically, lenders offer 3.5 to 4.5 times the applicants’ combined annual income, sometimes going up to 5 or 6 times, depending on financial profiles.

How much deposit is needed for a joint mortgage?

The deposit for a joint mortgage is generally the same as for a standard mortgage, ranging from 5% to 25% of the property’s price. The advantage of a joint mortgage is that you can combine savings to meet the deposit requirement.

How do credit scores impact joint mortgages?

Credit scores are crucial for joint mortgages, as lenders review the credit history of all applicants. If one person has a poor credit score, it can negatively impact the mortgage application and might lead to higher interest rates.

What happens to a joint mortgage if I’ve separated from my partner?

If you separate, both of you remain responsible for the mortgage until an agreement is reached. Options include selling the property, one partner buying out the other, or transferring the mortgage to one person. It’s important to communicate with your lender and possibly seek legal advice.

What is joint mortgage protection insurance, and do I need it?

Joint mortgage protection insurance covers mortgage payments if one borrower dies, loses their job, or becomes unable to work. It’s not mandatory but provides financial security by ensuring that payments are covered in unexpected situations.

Do I need a deed of trust if I take out a joint mortgage?

While not required, a deed of trust is recommended, especially if ownership shares are unequal. It outlines each person’s share and responsibilities, helping to avoid disputes and providing clarity on what happens if the property is sold.

Can I get a joint mortgage if I already own a property?

Yes, but buying a second property might involve higher stamp duty and stricter affordability checks. Your existing financial commitments will be considered, and some lenders may require a larger deposit.