- What’s the Difference Between Joint Tenants and Tenants in Common?

- How Does Joint Tenancy Work?

- Pros and Cons of Joint Tenancy

- How Does Tenancy in Common Work?

- Pros and Cons of Tenancy in Common

- How To Choose Between Joint Tenancy and Tenancy in Common?

- What Are the Mortgage Implications?

- How Does This Affect First-Time Buyers?

- What Happens If You Want to Sell or Buy Out a Co-Owner?

- Can You Switch Between Joint Tenancy and Tenancy in Common?

- What Should You Consider When Making Your Decision?

- The Bottom Line

Should You Choose Joint Tenants or Tenants in Common?

When you’re looking to buy a property with someone else, you’ll need to decide how you want to own it together.

In the UK, there are two main options: joint tenants and tenants in common. But what’s the difference, and which one is right for you?

This guide explores the difference between joint tenants and tenants in common. We’ll walk you through its pros and cons, and how to pick the right one for you.

Let’s dive deeper into each option to help you make an informed decision.

What’s the Difference Between Joint Tenants and Tenants in Common?

In the UK, up to four people can own a share in one property. But how they own it makes all the difference.

You have two choices: joint tenants or tenants in common.

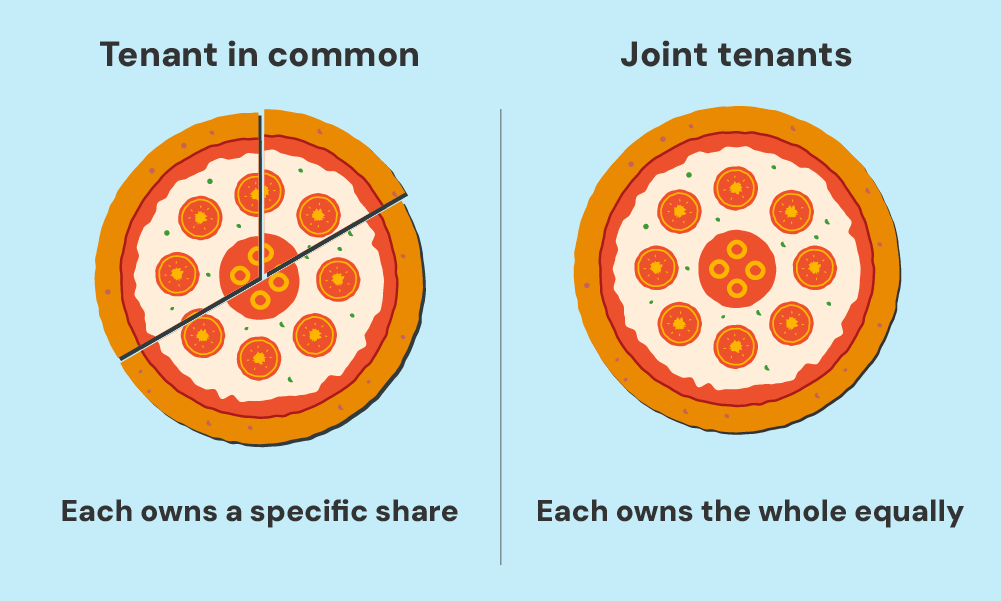

Joint tenants share everything equally. The property isn’t divided. You and your co-owner both have full rights to the whole property.

It’s a bit like being partners in every sense. And if one of you passes away, the other automatically inherits the entire property.

Now, consider tenants in common. Here, you each own a specific share of the property. These shares can be equal, but they don’t have to be.

One of you might own 60%, and the other 40%. It’s more flexible, allowing each owner to decide what happens to their share in their will.

Why does this matter? Because your choice affects everything: your mortgage, your rights, and the future of the property.

If you want shared ownership to be straightforward and seamless, joint tenancy might be your answer. But if you value flexibility and control over your share, tenants in common could be the better route.

How Does Joint Tenancy Work?

Joint tenancy is often the go-to choice for couples buying a home together.

When you’re joint tenants, you each own 100% of the property. It might sound odd, but it means you have equal rights to the entire property.

One of the key features of joint tenancy is the ‘right of survivorship‘. This means that if one owner dies, their share automatically passes to the surviving owner(s), regardless of what their will says.

For many couples, this provides peace of mind that their partner will be secure in the home if anything happens to them.

Pros and Cons of Joint Tenancy

Joint tenancy can be straightforward and provide security, but it’s not always the best choice for everyone. Here are some pros and cons to consider:

Pros:

- You aim for less paperwork and a more straightforward home-buying process. (Joint tenancy is the easiest and most common form of owning property.)

- You want the property to automatically pass to the surviving owner(s) without going through probate. (This ensures a seamless transition.)

- You like the idea of both owners having equal rights to the entire property. (Fairness is key.)

Cons:

- You can’t leave your share to someone else in your will. (Lack of flexibility.)

- If you sell, the proceeds are split equally, even if one of you contributed more. (This can feel unfair.)

- It might not be the most tax-efficient option. (Potential tax implications.)

How Does Tenancy in Common Work?

Tenancy in common gives you flexibility. You can own different shares of the property, maybe you own 60%, and your co-owner has 40%.

This setup works well if you’re buying with friends, or family, or if one person is contributing more to the purchase.

Each tenant in common can leave their share to whomever they choose in their will. This is particularly useful if you have children from a previous relationship and want to ensure they inherit your share.

Pros and Cons of Tenancy in Common

Tenancy in common offers more flexibility, but it also comes with its own set of considerations:

considerations:

Pros:

- You can own unequal shares and leave your share to whoever you choose.

- It reflects different financial contributions more accurately.

- It offers more options for inheritance tax planning. (Tax benefits.)

- All co-owners have equal rights to the property. (Equal rights regardless of share size.)

Cons:

- It requires more paperwork and can be complicated to set up.

- Your share doesn’t automatically pass to the other owner(s) if you die.

- Disagreements can arise over the property’s use or sale.

- Tenants can sell their shares to anyone without needing permission from other co-owners. (Risk of unwanted co-owners.)

- All parties need to agree to sell the entire property. (Consensus needed for sale.)

How To Choose Between Joint Tenancy and Tenancy in Common?

Your choice will depend on your circumstances, relationship with your co-owner(s), and long-term plans. Here are some scenarios to consider:

- Married or long-term couples – Often choose joint tenancy for simplicity and automatic inheritance.

- Friends or relatives buying together – You might prefer tenancy in common to reflect different contributions or keep inheritance separate.

- Couples with children from previous relationships – You might opt for tenancy in common to ensure their share can be left to their children.

- Buy-to-let investors – A joint buy-to-let mortgage with a tenancy in common arrangement can be tax-efficient and flexible.

Remember, you can change from one type to the other later if your circumstances change. It’s always worth seeking legal advice to understand the implications fully.

What Are the Mortgage Implications?

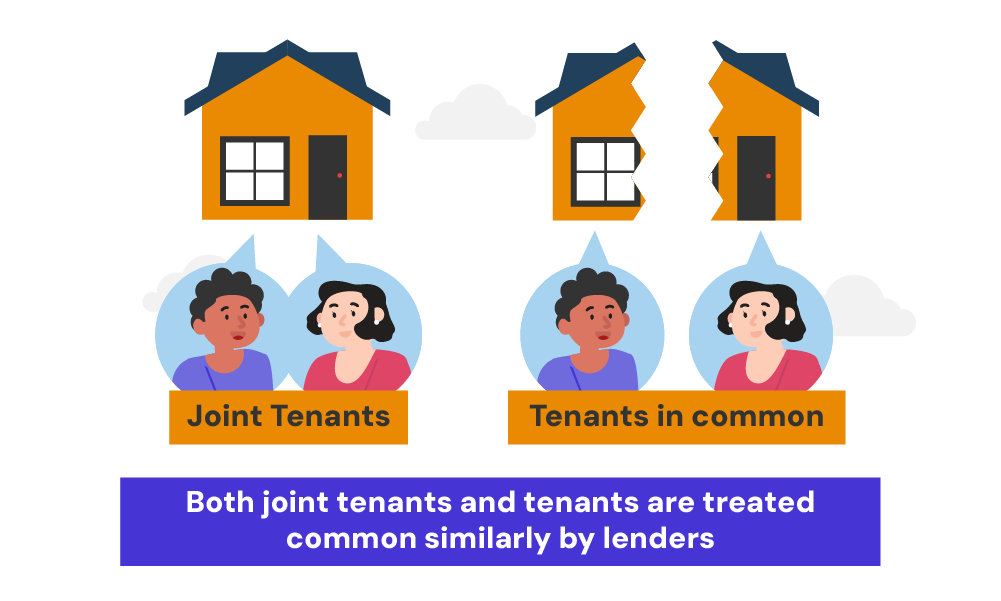

When it comes to mortgages, lenders typically treat joint tenants and tenants in common similarly.

In both cases, you’ll usually need a joint mortgage where all owners are equally responsible for the repayments.

The main difference comes in how lenders assess affordability. With joint tenants, they’ll usually consider your combined income. For tenants in common, they might look at your individual shares and incomes separately.

If you’re considering a buy-to-let property, a joint buy-to-let mortgage can be an option regardless of whether you’re joint tenants or tenants in common.

How Does This Affect First-Time Buyers?

If you’re a first-time buyer, the type of ownership doesn’t directly affect your eligibility for first-time buyer benefits. However, all owners need to be first-time buyers to qualify for schemes like the stamp duty relief.

It’s worth noting that taking out a joint mortgage, regardless of the type of ownership, will create a financial association between you and your co-owner(s).

This means their credit history could affect your future borrowing capacity, and vice versa.

What Happens If You Want to Sell or Buy Out a Co-Owner?

Whether you’re joint tenants or tenants in common, all owners must agree to sell the property.

If one owner wants to buy out the other(s), you’ll need to agree on a price and potentially remortgage.

If you’re tenants in common, the process can be more straightforward as you already have defined shares. For joint tenants, you might need to agree on how to split the proceeds.

Can You Switch Between Joint Tenancy and Tenancy in Common?

Yes, you can switch between these ownership types. This is known as ‘severing’ a joint tenancy to become tenants in common.

Changing from tenancy in common to joint tenancy is also possible, requiring all co-owners agreement.

Here’s why you might want to switch from joint tenancy to tenants in common:

- You plan to invest more into the property than your co-owner.

- You want to specify different ownership shares.

- You need clear inheritance plans for your children.

- Your relationship with your co-owner has changed, like becoming business partners.

- You want to manage your shares independently.

And you might want to switch to joint tenancy if:

- You get married or enter a civil partnership with your co-owner.

- You want the property to automatically transfer to the surviving partner.

- You wish to simplify inheritance.

- You aim to avoid potential disputes over ownership.

To make the switch, inform the Land Registry by submitting the necessary forms and documentation.

Consulting a solicitor ensures all legalities are handled correctly. They can also help you understand any mortgage implications.

You might need to discuss this with your lender and possibly remortgage, depending on your loan terms.

While the process is straightforward, legal advice is crucial to avoid issues and understand the full impact on your property ownership and financial situation.

>> More about Changing from Joint Tenants to Tenants in Common

>> More about Changing from Tenants in Common to Joint Tenants

What Should You Consider When Making Your Decision?

Choosing between joint tenancy and tenancy in common is an important decision that can have long-term implications.

Here are some key points to consider:

- Your relationship with the co-owner(s)

- Your financial contributions to the property

- Your long-term plans for the property

- Your wishes for inheritance

- Tax implications, especially for buy-to-let properties

- Your mortgage options

Remember, there’s no one-size-fits-all answer. What works best for you will depend on your unique circumstances.

The Bottom Line

Whether you choose to be joint tenants or tenants in common, it’s crucial to understand the implications for your mortgage, your rights, and your future plans.

Don’t hesitate to seek professional advice from a mortgage broker or solicitor to ensure you’re making the best choice for your situation.

After all, buying a property is likely to be one of the biggest financial decisions you’ll make – it’s worth getting it right from the start.

That’s why working with a qualified mortgage broker from the start is beneficial. They can:

- Help you understand different mortgage options and find the best fit for your needs.

- Access a wide range of mortgage products, including exclusive deals not available directly to consumers.

- Guide you through the application process, ensuring all documents are correctly completed and submitted.

- Provide expert advice on the financial implications of your choices.

- Negotiate with lenders on your behalf to secure favourable terms.

- Save your time by handling the research and paperwork involved in getting a mortgage.

- Offer ongoing support and advice even after your mortgage is approved.

Need a broker? Get in touch. We’ll connect you with a good mortgage broker who can help with your mortgage application and find the BEST deal.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Does equity release apply to a ‘tenants in common’ mortgage?

All co-owners must agree to an equity release arrangement. If an owner dies and leaves their share to another party, the lender might restrict further borrowing.

Contact your equity release provider for specific details and advice.

What exactly is a deed of trust?

A deed of trust is a legal document outlining the ownership shares and responsibilities of each co-owner in a property. It ensures clarity and protection by specifying each owner’s rights and investment details.

What steps should I take if I want to end joint ownership?

To end a joint ownership:

- Decide on the new ownership structure (tenants in common or selling the property).

- Inform all co-owners and seek their agreement.

- Consult a solicitor for legal advice.

- Notify the Land Registry with the necessary forms.

- Update your mortgage provider, as you may need to remortgage.