- What Is Mortgage Redundancy Cover?

- How Does Redundancy Cover Work?

- Why Might You Need Redundancy Cover for Your Mortgage?

- What Does Mortgage Protection Insurance Redundancy Cover?

- What Are the Types of Redundancy Cover Available?

- How Much Does Mortgage Redundancy Insurance Cost?

- What Are the Pros and Cons of Mortgage Redundancy Cover?

- When Might Redundancy Cover Not Be Suitable?

- How Do You Choose the Right Redundancy Cover?

- Can You Get Redundancy Cover if You’re Already Worried About Your Job?

- What Are the Alternatives to Mortgage Redundancy Cover?

- How Do You Make a Claim on Your Redundancy Cover?

- Is Mortgage Redundancy Cover Worth It?

- The Bottom Line

Mortgage Redundancy Insurance: Is It Worth It?

Job loss is scary, especially when you’re paying a mortgage. In today’s shaky job market, anyone can be made redundant, leaving them struggling to afford their biggest monthly bill.

But there is a safety net available. Redundancy cover, also known as Mortgage Payment Protection Insurance (MPPI), can help ease the financial burden of job loss.

Let’s explore how redundancy cover can give you peace of mind and protect your homeownership journey.

What Is Mortgage Redundancy Cover?

Mortgage redundancy cover, also known as redundancy insurance or mortgage protection insurance redundancy, is a financial safety net designed to help you keep up with your mortgage payments if you lose your job.

In today’s uncertain job market, many homeowners worry about how they’d manage their mortgage if they were made redundant.

This type of insurance can provide peace of mind and financial protection during challenging times.

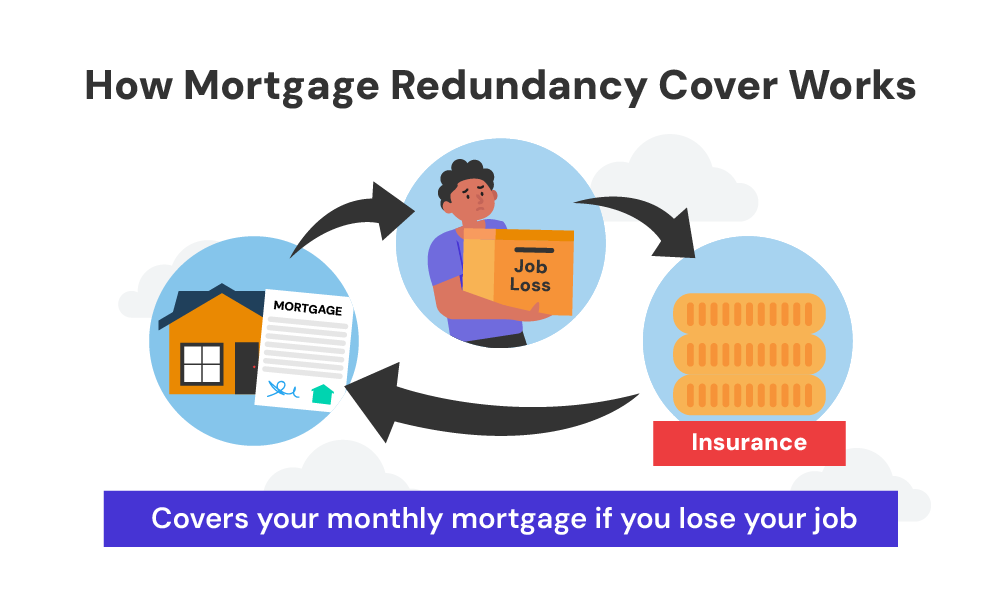

How Does Redundancy Cover Work?

When you take out mortgage redundancy cover, you’re essentially buying a policy that will step in to cover your mortgage payments if you’re made redundant.

Here’s how it typically works:

- You pay regular premiums to maintain your cover.

- If you’re made involuntarily redundant, you make a claim with your insurer.

- After a waiting period (usually 30-90 days), the policy starts paying out.

- The insurance covers your mortgage payments for a set period, often up to 12 or 24 months.

It’s important to note that most policies won’t cover you for voluntary redundancy or if you knew redundancy was likely when you took out the policy.

Why Might You Need Redundancy Cover for Your Mortgage?

Losing your job can be stressful enough without the added worry of potentially losing your home.

Mortgage redundancy cover can provide a financial buffer, giving you time to find new employment without falling behind on your mortgage payments.

Consider this cover if:

- You work in an industry with a higher risk of redundancies.

- You don’t have substantial savings to cover your mortgage if you lose your job.

- You’re the primary earner in your household.

- You want extra peace of mind about keeping your home if you face unemployment.

Remember, your home is likely your most valuable asset. Protecting it should be a priority.

What Does Mortgage Protection Insurance Redundancy Cover?

Typically, mortgage protection for redundancy covers your monthly mortgage payments if you’re made involuntarily redundant.

Some policies offer additional benefits:

- Coverage for mortgage-related costs like buildings insurance

- Contributions towards utility bills or council tax

- Option to cover other debts like personal loans or credit cards

Most policies will pay out for a maximum of 12 to 24 months, giving you time to secure new employment. However, it’s crucial to check the specific terms of any policy you’re considering.

What Are the Types of Redundancy Cover Available?

When looking at redundancy cover mortgage options, you’ll typically find three main types:

- Unemployment Only – This covers you solely for involuntary redundancy.

- Accident and Sickness Only – While not strictly redundancy cover, this protects you if you can’t work due to illness or injury.

- Accident, Sickness and Unemployment (ASU) – This comprehensive cover protects you against redundancy, as well as being unable to work due to accident or illness.

Choose the type that best fits your needs and budget. If you’re primarily concerned about redundancy, an unemployment-only policy might be sufficient.

How Much Does Mortgage Redundancy Insurance Cost?

The cost of redundancy cover varies depending on several factors:

- Your age

- Your occupation

- The amount of your monthly mortgage payment

- The level of cover you choose

- The length of the payout period

As a rough guide, you might expect to pay between £4 and £8 per £100 of monthly benefit. So, if your monthly mortgage payment is £1,000, you could pay between £40 and £80 per month for cover.

Always shop around and compare quotes from different providers to ensure you’re getting the best deal.

What Are the Pros and Cons of Mortgage Redundancy Cover?

Like any financial product, redundancy cover has its advantages and disadvantages:

Pros:

– Peace of mind knowing your mortgage is protected

– Time to find new employment without risking your home

– Can cover other bills beyond just your mortgage

– May be tax-deductible (check with a tax advisor)

Cons:

– Can be expensive, especially if you’re in a high-risk occupation

– Policies often have exclusions and waiting periods

– May not pay out if you take voluntary redundancy

– Usually only pays out for a limited time (12-24 months)

Consider these carefully when deciding if redundancy cover is right for you.

When Might Redundancy Cover Not Be Suitable?

While redundancy cover can be valuable, it’s not right for everyone. You might want to reconsider if:

- You’re self-employed or on a temporary contract (many policies won’t cover you)

- You have substantial savings that could cover your mortgage for several months

- You’re close to retirement and could potentially take early retirement if made redundant

- You work in the public sector or another area with low redundancy risk

- Redundancies have already been announced at your workplace (insurers won’t cover you)

Always assess your personal circumstances before committing to a policy.

How Do You Choose the Right Redundancy Cover?

Selecting the right redundancy cover for your mortgage requires careful consideration:

- Assess your needs: How much cover do you need? For how long?

- Check the exclusions: What situations aren’t covered?

- Look at the waiting period: How long before the policy pays out?

- Consider the payout period: How long will the policy cover your payments?

- Compare quotes: Don’t just go with your mortgage provider; shop around.

- Read the small print: Understand exactly what you’re signing up for.

Remember, the cheapest policy isn’t always the best. Look for cover that offers the right balance of cost and protection for your situation.

Can You Get Redundancy Cover if You’re Already Worried About Your Job?

If you’re already concerned about potential redundancy at your workplace, it might be too late to get cover. Most insurers have exclusion clauses that prevent you from claiming if:

- You knew your job was at risk when you took out the policy

- Redundancies had already been announced

- You take voluntary redundancy

Be honest when applying for cover. If you withhold information, your policy could be invalidated when you need it most.

What Are the Alternatives to Mortgage Redundancy Cover?

If you decide redundancy cover isn’t right for you, consider these alternatives:

- Emergency savings fund – Aim to save 3-6 months of living expenses.

- Income protection insurance – This covers a portion of your income if you can’t work due to illness or injury.

- Critical illness cover – This pays out a lump sum if you’re diagnosed with a specified serious illness.

- Mortgage payment holidays – Some lenders offer temporary breaks from payments, though this will increase your overall debt.

- Government support – Understand what benefits you might be entitled to if you lose your job.

These options might provide similar protection without the specific focus on redundancy.

How Do You Make a Claim on Your Redundancy Cover?

If you find yourself in the unfortunate position of being made redundant, here’s how to claim:

- Contact your insurer as soon as possible after being made redundant.

- Provide evidence of your redundancy, such as a letter from your employer.

- Complete any claim forms required by your insurer.

- Wait for the claim to be processed and approved.

- Payments typically start after the waiting period (usually 30-90 days).

Keep paying your mortgage during the waiting period if possible. If you’re struggling, contact your lender to discuss your options.

Is Mortgage Redundancy Cover Worth It?

Whether redundancy cover is worth it depends on your personal circumstances. Consider:

- Your job security

- Your savings

- Your ability to quickly find new employment

- The cost of the cover versus the peace of mind it provides

For many homeowners, knowing their biggest monthly expense is protected if they lose their job provides valuable peace of mind. However, it’s a personal decision based on your individual situation and risk tolerance.

The Bottom Line

Mortgage redundancy cover can be a valuable safety net, protecting your home during uncertain times.

Here’s how to decide if it’s right for you:

- Understand the details. Learn how redundancy cover works, its advantages and disadvantages, and how it fits your situation.

- Get expert advice. An expert advisor can help you by:

- Tailoring advice to your situation.

- Comparing policies to find the best deal.

- Demystifying complex terms.

- Guiding you through the application.

- Supporting you with claims if needed.

- Reviewing your policy regularly.

- Negotiating lower premiums (potentially).

- Taking the stress out of the process.

- Keeping you up-to-date with regulations.

- Offering an objective perspective.

Remember, your home is more than just a financial asset – it’s your sanctuary. Protecting it is an investment in your future security and peace of mind.

Still confused? Get in touch. We’ll connect you with a helpful advisor who can explain your options and see if mortgage redundancy cover is right for you.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How to protect yourself from redundancy?

There are a few things you can do to improve your job security.

First, keep your skills and qualifications up-to-date by taking relevant courses or getting certifications. This shows you’re proactive and invested in your career.

Second, try to develop a wider range of skills so you can be flexible within your company. Networking with colleagues inside and outside your field can open doors to new opportunities and give you a heads-up on industry trends.

Building strong relationships with your boss and co-workers can also be helpful.

Finally, having an emergency fund with at least three to six months’ living expenses can give you financial breathing room if redundancy does happen.

Is mortgage protection essential?

While not mandatory, mortgage protection is a wise choice for many homeowners. It acts as a safety net if you’re ever unable to make your mortgage payments due to illness, injury, or losing your job.

Without it, you could risk losing your home if you can’t keep up. Mortgage protection insurance steps in and covers your payments for a set time, giving you breathing room to recover or find a new job, and keeping your home secure.

Think about your financial situation and the potential risks – mortgage protection might be the peace of mind you need.