Mortgages For Second-Time Buyer Explained

Ready to take the next step on the property ladder?

As a second-time buyer, you’ll notice the mortgage scene has evolved since your first purchase.

Whether you’re moving to a bigger place, a smaller one, or buying a holiday home, knowing your options is key.

This guide covers all you need to know about second-time buyer mortgages in the UK. From mortgage types to deposit requirements, we’ve got you sorted.

What is a Second Time Buyer?

A second-time buyer is someone who has owned a property before and is now looking to buy another.

It doesn’t matter if you had a mortgage or paid cash, or how long it’s been since your last purchase.

Even if you no longer own your previous home, you’re still a second-time buyer. This status can influence your mortgage choices and eligibility for various schemes.

What Mortgages Are Available for Second Home Purchases?

When it comes to mortgages for second-time buyers, there are several options to consider:

- Residential Mortgages – If you’re selling your current home to buy a new one, you’ll likely be looking at a residential mortgage. You can choose between fixed-rate mortgages, where the interest rate stays the same for a set period, or variable-rate mortgages, where the rate can change.

- Buy-to-Let Mortgages – If you’re purchasing a property to rent out, a buy-to-let mortgage is the way to go. These mortgages typically require a larger deposit and come with higher interest rates.

Mortgage Types for Second-Time Buyers

As a second-time buyer, you’ll find that most standard mortgage products are available to you.

These include:

- Fixed-Rate Mortgages – These give you predictable monthly payments with an interest rate locked in for a set period, usually 2 to 10 years. It’s easier to budget since your payments stay the same, no matter what happens with the Bank of England’s base rate. After the fixed term, the rate often switches to the lender’s standard variable rate (SVR), which can be higher. Be sure to review your options before the fixed term ends.

- Variable-Rate Mortgages – The interest rates on these can change, often tied to the Bank of England’s base rate or the lender’s SVR. They might start with lower rates than fixed-rate mortgages, but your payments can go up or down. If rates drop, so do your payments. If they rise, your payments increase. These are best if you’re okay with changing monthly costs.

- Tracker Mortgages – A type of variable-rate mortgage, tracker mortgages follow the Bank of England base rate plus a set percentage. For example, if the base rate is 0.5% and your tracker rate is base rate plus 1%, you pay 1.5%. It’s transparent and easy to understand, but your payments can rise or fall with the base rate.

- Offset Mortgages – These link your mortgage to your savings. Instead of earning interest on your savings, the amount offsets your mortgage balance, reducing the interest you pay. If you have a £200,000 mortgage and £20,000 in savings, you pay interest on £180,000. This can lower your interest costs and shorten your mortgage term. Great if you have substantial savings.

- Interest-Only Mortgages – Here, you pay only the interest each month, not the loan amount. Your monthly payments are lower, but at the end of the term, you still owe the original loan. You need a plan to repay this, like investments or selling the property. Popular with buy-to-let investors who plan to sell or refinance.

- Repayment Mortgages – You pay off both interest and capital each month, so by the end of the term, you own your home outright. Payments are higher than interest-only mortgages, but you build equity over time and avoid a large debt at the end. This is the most common type for residential properties.

Government Schemes for Second Home Buyers

While the Help to Buy scheme is no longer available for new applications as of March 2023, there are still some government initiatives that might be useful:

- The Mortgage Guarantee Scheme: Available until June 2025, this scheme helps buyers with smaller deposits access mortgages.

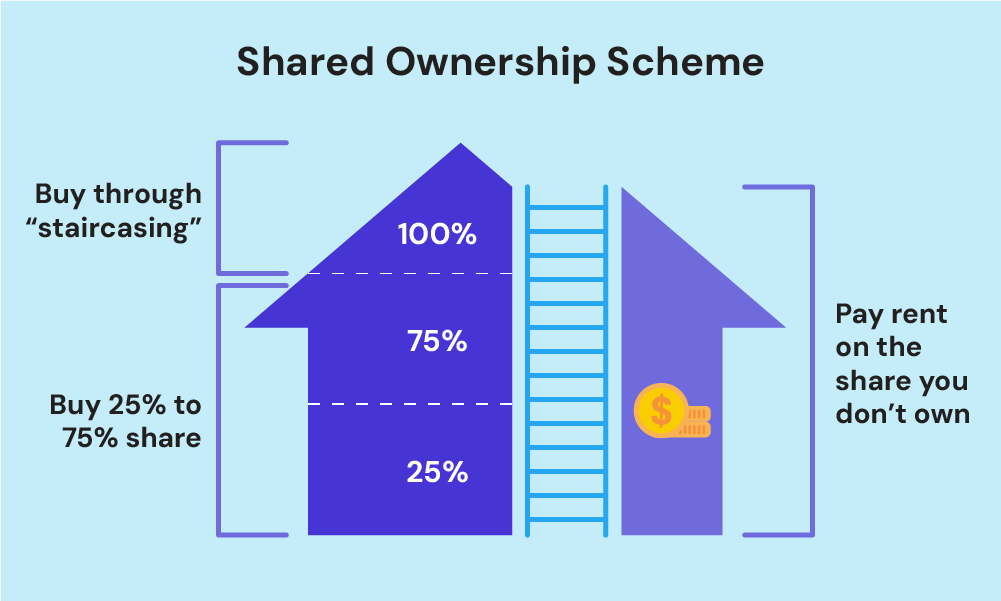

- Shared Ownership: While you can’t own another property simultaneously, you can use this scheme if you’re in the process of selling your current home.

Remember, your choice of mortgage will depend on your circumstances, including your income, credit score, and the amount of equity you have in your current property.

What Are the Pros and Cons of Buying a Second Home?

Purchasing a second property can be an exciting prospect, but it’s essential to weigh up the advantages and disadvantages before taking the plunge.

Pros:

- Investment opportunity: A second property can be a valuable asset that appreciates over time.

- Rental income: If you’re not using the property yourself, you could earn money by letting it out.

- Holiday home: Having a second property gives you a ready-made holiday destination.

- Diversification: It’s a way to spread your investments beyond just one property.

Cons:

- Additional costs: You’ll need to factor in mortgage payments, maintenance, and potentially higher stamp duty.

- Responsibility: Managing two properties can be time-consuming and stressful.

- Less flexibility: Your money is tied up in property, which isn’t as liquid as other investments.

- Market risks: Property values can go down as well as up.

Can I Afford a Second Home?

You must ask yourself this question before buying a second home. To guide you, here are factors to consider:

Deposit Requirements

As a second-time buyer, you’ll usually need at least 10% of the property’s value as a deposit.

Some lenders might ask for 15% or even 20%, based on the property type and your financial profile.

If you’ve built up equity in your current home, you can use it for the deposit on your new property.

For example, if your home’s value has increased, you could remortgage to release some of that equity.

Interest Rates

Interest rates for second-time buyers typically range from 5% to 8%, but they can vary.

Your rate depends on your deposit size, credit history, and mortgage type. A larger deposit usually means a better rate.

With good credit and experience, you might secure better rates than with your first home.

Costs of Second Mortgages

Second mortgages come with their own costs. Besides the mortgage payments, consider:

- Stamp Duty – This is the tax you pay for buying a property. In England, it’s an extra 3% on top of standard rates.

- Legal Fees – For conveyancing and other legal services, expect to pay between £800 and £1,500.

- Valuation Fees – Lenders often require a property valuation, costing between £150 and £1,500, depending on the property’s value.

- Mortgage Arrangement Fees – Some lenders charge to set up the mortgage, ranging from £0 to £2,000, paid upfront or added to the loan.

Debt-to-Income Ratios

Lenders will closely examine your debt-to-income ratio (DTI) to see if you can afford a second mortgage.

This ratio compares your total monthly debt payments to your gross monthly income.

A lower DTI ratio is better, showing you manage your debt well. Lenders usually prefer a DTI of 46% or less, but this can vary.

They’ll consider your current mortgage and other debts like car loans and credit cards along with the new mortgage.

If your DTI is too high, you might need to reduce your debt or increase your income before applying for a second mortgage.

Use our DTI Calculator to check if you can afford a second mortgage and ensure you’re financially ready.

Rental Maintenance and Upkeep Costs

If you’re buying a second property as an investment, consider these ongoing costs:

- Repairs and Renovations: £1,000 to £2,000 annually for keeping the property in good condition.

- Property Management Fees: Optional for buy-to-let properties; around 10-15% of the monthly rent.

- Void Periods: Times when the property is unoccupied and not generating income. Plan for at least one month of vacancy per year.

- Landlord Insurance: Around £150 to £300 annually to cover additional risks, such as liability and loss of rent.

And there’s more to think about.

You’ll need to budget for things like legal fees if there’s a tenant dispute, and regular safety checks to comply with regulations.

It’s also wise to set aside a contingency fund for unexpected expenses. The goal is to ensure your investment remains profitable and stress-free.

How To Buy a Second Home?

Buying a second home involves several steps:

- Assess your finances. Before you start house hunting, get a clear picture of your financial situation. This includes your income, existing debts, and available savings.

- Research the market. Understand property prices in your desired area and consider future growth potential.

- Get a mortgage in principle. This will give you a clearer idea of how much you can borrow and show sellers you’re serious.

- Consider the tax implications. Remember, you’ll likely pay a higher rate of stamp duty on a second property.

- Choose the right mortgage. Shop around or use a mortgage broker to find the best deal for your circumstances.

- Make an offer and complete the purchase. Once you’ve found your ideal property, make an offer and proceed with the conveyancing process.

- Plan for the future. Consider how you’ll manage two properties and whether you need additional insurance.

The Bottom Line

Buying a second home can be an excellent investment or lifestyle choice, but it’s not a decision to be taken lightly.

As a second-time buyer, you have the advantage of experience, but the market may have changed since your first purchase.

Take the time to thoroughly research your options, consider your long-term financial goals, and seek professional advice if needed.

Remember, while owning two properties can be rewarding, it also comes with additional responsibilities and financial commitments.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can you be a first-time buyer twice?

No, you can’t be a first-time buyer twice.

A first-time buyer is someone who has never owned a property, in the UK or abroad, whether bought outright, through shared ownership, or inherited.

Even if you sold your first property years ago and haven’t owned one since you’re still a second-time buyer.

This means you’re not eligible for schemes designed for first-time buyers, like stamp duty relief.

Is it okay to have two repayment mortgages?

Yes, it is possible to have two repayment mortgages. Lenders will assess your financial situation, including your income, expenses, and existing debt, to determine if you can afford the second mortgage.

They will consider factors such as your debt-to-income ratio and credit history to ensure you can manage both mortgage payments.

If approved, you can have two repayment mortgages, each with its own terms and interest rates.