- What Are Self-Certificate Mortgages?

- How Did Self-Cert Mortgages Work?

- Are Self-Cert Mortgages Still Available in the UK?

- Who Used Self-Cert Mortgages?

- Will Self-Cert Mortgages Come Back?

- What Are the Alternatives to Self-Cert Mortgages?

- How Can You Prove Your Income for a Mortgage Now?

- Can You Get a Self-Cert Mortgage Outside the UK?

- The Bottom Line

Self-Cert Mortgages: Everything You Need to Know

Remember when getting a mortgage was as easy as saying, “Trust me, I can afford it”?

That’s what self-cert mortgages were all about.

Popular with the self-employed and those with irregular incomes, there was no need for payslips or traditional proof—just declare your earnings and get a mortgage.

But why did they disappear? Regulators banned them in 2009 due to the risks and the financial crisis that followed.

Self-cert mortgages had good intentions but led to unexpected problems. Now, lending is about balancing access and responsibility.

If you’re self-employed or have a complex income, don’t worry—you still have options.

Let’s explore what happened and what you can do now. Here’s what you need to know about self-cert mortgages.

What Are Self-Certificate Mortgages?

A self-certificate mortgage (also known as self-cert mortgage) lets you state your income without the usual proof like payslips or tax returns.

These mortgages were especially popular with self-employed folks, freelancers, and anyone with complex income streams who struggled to prove their earnings the usual way.

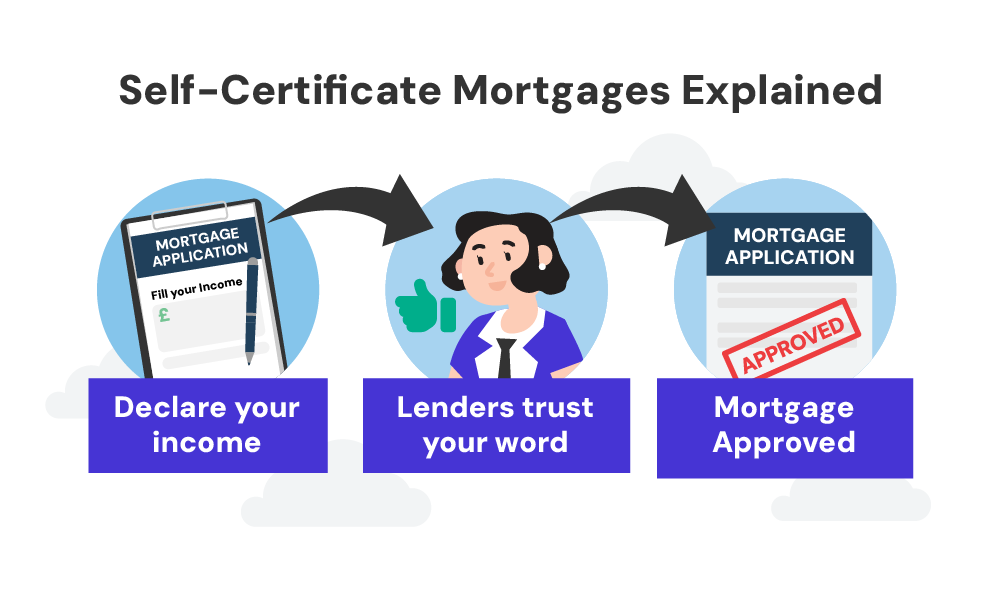

How Did Self-Cert Mortgages Work?

When available, self-cert mortgages seemed like an easy fix for those who couldn’t provide traditional income proof.

Here’s how they worked:

- You’d state your income on the application without needing backup documents.

- Lenders would take your word for it, hence “self-certification.”

- The mortgage would be approved based on your declared income.

It sounded convenient, but there were significant downsides. Interest rates were usually HIGHER to cover the lender’s risk.

Plus, without proper income checks, some borrowers ended up with mortgages they couldn’t really afford.

Are Self-Cert Mortgages Still Available in the UK?

Self-cert mortgages are no longer available in the British mortgage market.

The Financial Conduct Authority (FCA) banned them in 2009 after the financial crisis.

Why were they banned, you ask?

Self-cert mortgages, often dubbed “liar loans,” let borrowers inflate their income to get larger mortgages.

This led to risks for both lenders and borrowers, adding to the housing market instability before the 2008 financial crisis.

The FCA’s ban was a move towards more responsible lending. Now, lenders must verify a borrower’s income and ensure they can afford the repayments.

Who Used Self-Cert Mortgages?

As we mentioned, self-cert mortgages appealed to specific types of borrowers:

- Self-employed

- Contractors or those working on short-term contracts often struggled to show consistent income.

- Commission-based workers

- People with multiple income sources such as part-time jobs or had a mix of employed and self-employed income

Will Self-Cert Mortgages Come Back?

If you’re holding out hope for the return of self-cert mortgages in the UK, we hate to disappoint you, but it’s highly unlikely.

The FCA’s strict regulations aim to protect both borrowers and lenders, and the financial industry has moved away from those risky practices.

The focus now is on responsible lending, with thorough income verification here to stay.

But if you’re self-employed or have a complex income structure, don’t worry—there are still mortgage options available for you.

What Are the Alternatives to Self-Cert Mortgages?

Just because self-cert mortgages are no longer available doesn’t mean you’re out of luck if you have a non-traditional income.

The mortgage market now caters to a wider range of borrowers. Here are some alternatives:

- Contractor mortgages – If you work on a contract basis, some lenders specialise in mortgages that consider your contract rate rather than traditional employment income.

- Flexible income assessment – Some lenders are willing to consider multiple sources of income, including investment income, rental income, and even future contract earnings.

- Specialist self-employed mortgages – Many lenders now offer mortgages specifically designed for self-employed individuals. These take into account the unique nature of self-employment income.

- Joint borrower sole proprietor mortgages – This option allows you to add a family member’s income to your mortgage application without giving them ownership rights to the property.

- Guarantor mortgages – If you’re struggling to qualify on your own, a guarantor mortgage allows a family member to support your application by guaranteeing the loan.

- Asset-based mortgages – These loans are secured by your assets, like savings or investments, rather than your income. This can be a good option if you have significant assets but irregular income.

These options might need more documentation than self-cert mortgages, but they provide a safer, more sustainable path to homeownership.

How Can You Prove Your Income for a Mortgage Now?

With self-cert mortgages gone, you’ll need solid proof of income for your mortgage application.

But don’t worry—lenders are more flexible now. Here’s what you might need:

If you’re employed:

- Recent payslips (usually the last 3 months)

- Bank statements showing your salary

If you’re self-employed:

- 2-3 years of accounts from a qualified accountant

- SA302 forms and tax year overviews from HMRC

- Bank statements showing business income

If you’re a contractor:

- Copies of current and previous contracts

- Evidence of contract renewals or future contracts

If you have multiple income sources:

- Proof for each income stream (e.g., payslips, accounts, rental agreements)

- Bank statements showing all income

Different lenders have different requirements, so it’s worth shopping around or speaking to a mortgage broker who can guide you to the best options for your situation.

Can You Get a Self-Cert Mortgage Outside the UK?

While some countries still offer them, it’s not a good idea. Here’s why:

- Lack of protection. These mortgages aren’t regulated by the FCA, so you won’t have protection against mis-selling or unfair practices.

- Currency risk. Borrowing in a foreign currency to buy UK property exposes you to exchange rate fluctuations.

- Legal complications. Cross-border mortgages can be complex, with potential legal issues if things go wrong.

- Higher costs. Interest rates and fees are likely higher than UK-regulated products.

- Reputational risk. Using an overseas self-cert mortgage could be seen as an attempt to circumvent UK regulations, which might affect your future borrowing options.

The risks outweigh the benefits. There are safer, legal UK-based options for complex income situations.

The Bottom Line

While self-cert mortgages are a thing of the past in the UK, the mortgage market has adapted to cater to a wide range of income situations.

If you’re self-employed, a contractor, or have a complex income structure, there are still plenty of mortgage options.

The key is to be prepared.

Gather as much evidence of your income as possible.

Keep your accounts up to date.

And consider working with a whole-of-market mortgage broker who can guide you.They can offer you:

- Expert advice about the current mortgage market and find the best products for your situation.

- Get better suitable mortgage deals you might not find on your own.

- Prepare your mortgage application to strengthen your case.

- Streamline the mortgage process to save time and money.

- Answer your questions and provide help throughout the mortgage process.

Need a good broker? Get in touch with us. We’ll connect you with a qualified mortgage broker who can help with your mortgage application and get the best deal for your dream home.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What was the financial crisis in 2008 in the UK?

The 2008 financial crisis, starting in the US, quickly spread to the UK, causing a major banking meltdown. Institutions like Northern Rock and the Royal Bank of Scotland needed government bailouts.

Housing prices plummeted, unemployment soared, and the economy entered a prolonged recession.

The crisis was fueled by high-risk mortgage lending, excessive borrowing, and the housing bubble burst.

Were self-cert mortgages the main reason for the financial crisis?

No, self-cert mortgages weren’t the main cause of the financial crisis.

They contributed to risky lending, but the crisis stemmed from broader issues: subprime mortgages in the US, high debt levels, failures of big banks, and poor regulation.

In the UK, self-cert mortgages were part of irresponsible lending practices, but not the sole cause.

The crisis was a mix of global financial mismanagement and excessive risk-taking.