- What is a Mortgage Repayment?

- Can You Get a £30,000 Mortgage in the UK?

- How Much Will a £30,000 Mortgage Cost Per Month?

- What Mortgage Can I Get on a 30k Salary?

- What Deposit Do You Need for a £30,000 Mortgage?

- What Factors Affect Your Monthly Repayments?

- Can You Get a £30,000 Mortgage if Youâre Self-Employed?

- What Mortgage Can I Afford on a £30k Salary?

- What Happens if You Miss Repayments?

- Key Takeaways

- The Bottom Line

How Much Will You Repay on a £30,000 Mortgage?

If you’re looking to borrow £30,000, you might think it’s simple—but there are still a few key things to keep in mind.

Whether you’re thinking of a £30k mortgage over 5 years, 10 years, or somewhere in between, you’ll need to consider how your repayments, interest rates, and income will affect things.

But don’t worry, we’ll break it down for you in simple terms so you can see exactly what to expect.

Let’s look at what you need to know about getting a £30,000 mortgage: how much you’ll repay each month, the income you’ll need to qualify, and any other costs that might come up.

By the end, you’ll feel ready and confident to make the right decision for you.

What is a Mortgage Repayment?

A mortgage repayment is the monthly payment you make to your lender. It covers both the original loan amount (the principal) and the interest charged on it.

With a repayment mortgage, you gradually pay off both the loan and interest over the mortgage term.

But, if you choose to have an interest-only mortgage, your monthly payments will only cover the interest on the loan. This means that at the end of the mortgage term, you’ll still owe the full loan amount.

To avoid this, you’ll need to have a plan in place to repay the principal, such as by selling your home or taking out a new mortgage.

Image

Can You Get a £30,000 Mortgage in the UK?

Yes, you can get a £30,000 mortgage in the UK. Many lenders offer this option, particularly for remortgaging or buying a lower-priced property.

However, your eligibility depends on factors such as your income, deposit size, credit history, and the property’s value. Lenders often assess your loan amount based on a multiple of your annual income.

For smaller mortgages, they’ll also consider your financial situation. If your income is low or you’re self-employed, you might need to provide extra documents to demonstrate your repayment ability.

How Much Will a £30,000 Mortgage Cost Per Month?

The amount will depend on a few things: the interest rate, the length of your mortgage, and whether you’re repaying just the interest or both the interest and the loan itself (capital repayment).

For a quick estimate, let’s say you’ve got a typical 25-year term and an interest rate of 5%. Your monthly repayment on a £30,000 mortgage would be around £175.

But if you go for a shorter term, like 10 or 5 years, your monthly payments will go up—but you’ll pay off the mortgage quicker, which means less interest overall.

A 30k mortgage over 5 years could have monthly repayments close to £566.

Here’s a quick overview of what you might need to pay every month for a £30,000 mortgage:

| Term (Years) | 2% Rate | 3% Rate | 4% Rate | 5% Rate | 6% Rate |

|---|---|---|---|---|---|

| 5 years | 525.83 | 539.06 | 552.5 | 566.14 | 579.98 |

| 10 years | 276.04 | 289.68 | 303.74 | 318.2 | 333.06 |

| 15 years | 193.05 | 207.17 | 221.91 | 237.24 | 253.16 |

| 20 years | 151.77 | 166.38 | 181.79 | 197.99 | 214.93 |

| 25 years | 127.16 | 142.26 | 158.35 | 175.38 | 193.29 |

Fancy knowing exactly how much you’d pay each month? Use the repayment mortgage calculator for a quick snapshot of what to expect based on different rates and terms.

What Mortgage Can I Get on a 30k Salary?

The answer depends on a few factors, including how much a lender will let you borrow based on your income.

Lenders typically offer between 4 to 4.5 times your annual income, which means on a £30,000 salary, you could potentially borrow around £120,000 to £135,000.

But when we’re talking about a smaller mortgage of £30,000, the good news is that you might not need a big income.

In fact, if you’re borrowing £30k, you might only need to earn around £7,000 to £10,000 a year, depending on the lender.

That’s because lenders calculate how much you can borrow by multiplying your income by a certain number—usually 4, but some might go as high as 6.

Not sure what you qualify for? It’s always a good idea to chat with a mortgage broker who can give you a better sense of what you’re eligible for, especially if your income is lower or you’ve got other financial commitments.

What Deposit Do You Need for a £30,000 Mortgage?

For a typical residential mortgage, you’ll need a deposit that’s around 5% to 10% of the property’s value, not the mortgage amount.

So, for a £30,000 mortgage, you’re likely looking at a house worth £100,000 or more, which means a deposit between £5,000 and £10,000.

Of course, this can vary depending on the lender, the property type, and whether you’re buying to let or live in.

Buy-to-let mortgages often require a higher deposit—usually around 20% to 25%.

If you’ve got a larger deposit, though, you’re in luck! A bigger deposit means smaller monthly repayments, lower interest rates, and a better shot at being approved.

Image

What Factors Affect Your Monthly Repayments?

There are a few key things that can impact how much you’ll need to repay on a £30,000 mortgage:

- Interest rates. The higher the rate, the more you’ll pay each month. It’s always good to shop around for the best deal—especially now, with rates around 5% or 6% in 2024.

- Loan term. A longer loan term means smaller monthly payments, but you’ll end up paying more in interest over time. A shorter term equals higher monthly payments but less interest overall.

- Your credit score. Lenders will have a peek at your credit history, so it’s always a good idea to check your score and fix any issues before applying.

- Other costs. Don’t forget product fees, insurance, and legal fees, which might increase your overall cost. Stamp duty could also apply, depending on the property’s value.

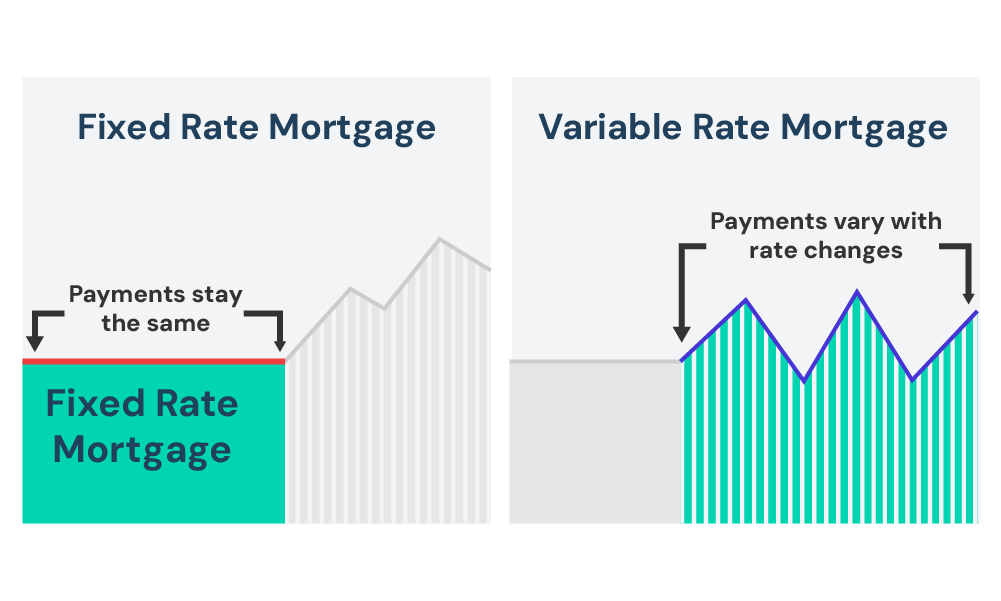

- Fixed vs. tracker mortgages. Fixed-rate mortgages mean you’ll have the same repayment each month, which is great for budgeting. Tracker mortgages, on the other hand, can fluctuate with the Bank of England’s base rate—sometimes higher, sometimes lower.

Can You Get a £30,000 Mortgage if You’re Self-Employed?

The answer is yes, but it might take a bit more work. Lenders want to see proof that you’ve got a stable income, so you’ll need to show at least one to three years of accounts.

If your business is doing well and your profits are steady or increasing, you should be in good shape.

One tip: if you’ve got a larger deposit or can show healthy profits, your chances of approval will be much higher.

So, don’t worry if you’re not on a traditional salary—you’ve still got options.

What Mortgage Can I Afford on a £30k Salary?

As mentioned earlier, lenders will generally offer up to 4 or 4.5 times your income, but they’ll also look at your outgoings—things like credit card payments, loans, and dependents.

To give you a ballpark figure, someone on a £30,000 salary might be able to borrow up to £135,000.

For a tailored estimate, use the affordability calculator. And for a more accurate figure, speak with a qualified mortgage broker.

What Happens if You Miss Repayments?

Missing mortgage repayments can lead to serious consequences, so it’s important to act quickly if you find yourself unable to make a payment.

Here’s what can happen if you miss repayments:

- Late Fees and Additional Charges. If you miss a payment, your lender will typically charge late fees. These can add to your financial strain and make it harder to catch up.

- Damage to Your Credit Score. Missed payments are usually reported to credit agencies, which can negatively affect your credit score. A lower credit score could make it harder to borrow in the future, or lead to higher interest rates on loans and credit cards.

- Increased Interest. Some lenders might increase your interest rate if you miss multiple payments, which means your monthly repayments could go up, making it even harder to manage your finances.

- Risk of Repossession. If you continue to miss payments, your lender could eventually begin repossession proceedings. This is the worst-case scenario, where your home could be taken away to recover the debt.

- Arrangement with Lender. Before things get worse, it’s a good idea to contact your lender. Many will work with you to create a repayment plan or provide temporary relief, such as a payment holiday or extending your loan term to reduce monthly repayments.

What Should You Do If You Miss a Repayment?

- Contact your lender right away – they may be able to help.

- Review your budget to see if you can cut any non-essential spending.

- Speak to a mortgage advisor for advice on how to manage your mortgage and other debts.

Missing a repayment is serious, but the sooner you act, the more options you’ll have to resolve the situation before it escalates.

Key Takeaways

- Your monthly payments on a £30,000 mortgage will depend on the interest rate and loan term. For a 25-year term at 5%, expect around £175 a month.

- On a £30,000 salary, you can borrow around 4 to 4.5 times your income, which could allow for a mortgage of £120,000 to £135,000.

- A deposit of 5% to 10% of the property’s value is typical, but buy-to-let mortgages may require 20% to 25%.

- Interest rates, loan terms, credit scores, and additional costs like fees and insurance will affect your monthly payments.

- Self-employed can still get a mortgage, but you’ll need to show 1 to 3 years of steady income.

- If you miss a payment, contact your lender straight away to avoid late fees, a damaged credit score, or repossession.

The Bottom Line

A £30,000 mortgage can be a great option for downsizing, topping up a remortgage, or buying an affordable property.

Remember, interest rates, loan terms, your income, deposit, and credit score all affect your monthly payments and borrowing capacity.

A mortgage broker can simplify the process. They’ll help you find the best deals and guide you through the process to avoid any surprises.

Get in touch with us and we’ll connect you with the right mortgage broker who can help you get mortgage deals that suit your financial situation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How do I calculate a monthly mortgage payment?

To work out your monthly mortgage payment, you need the loan amount, interest rate, and how long you’ll take to repay. You can use a mortgage calculator by entering these details, and it will give you the monthly payment.

For more accuracy, check with your lender, as they may include other costs like fees and insurance.

Can I get a £30,000 joint mortgage?

Yes, you can get a £30,000 joint mortgage. Lenders will look at both incomes together, which could help you borrow more. The application process is similar to applying alone, but the lender will consider both your finances to check what you can afford.

Can I get a mortgage with a £30,000 income as a single person?

Yes, you can get a mortgage with a £30,000 income.

Lenders may offer around 4 to 4.5 times your yearly income, meaning you could borrow £120,000 to £135,000. The amount will also depend on your deposit, credit score, and other expenses.

A larger deposit or a better credit score can help you borrow more. A mortgage broker can show you your best options.