- How Much Will I Pay Monthly on a £450,000 Mortgage?

- What Affects Your Monthly Payments on a 450k Mortgage?

- How Much Do I Need to Earn to Get a £450,000 Mortgage?

- What About the Deposit?

- How Can You Reduce Your £450k Mortgage Repayments?

- Other Costs to Consider

- Why Use a Mortgage Broker for a £450,000 Mortgage?

- Key Takeaways

- The Bottom Line

What’s the Cost of a £450,000 Mortgage Per Month?

Getting a big mortgage can be confusing with lots of numbers, percentages, and options to think about.

If you’re eyeing a £450,000 mortgage, you might be wondering: How much will it cost me every month? How long will I need to keep paying? And how can I make those numbers work in my favour? Well, you’ve come to the right place.

This guide will tell you how much your monthly repayments will be for a £450,000 mortgage, and what things affect the cost.

How Much Will I Pay Monthly on a £450,000 Mortgage?

The big question on everyone’s mind—what’s this going to cost me each month?

There isn’t a one-size-fits-all answer, because the monthly repayments on a £450,000 mortgage depend on several factors: the interest rate, the mortgage term, and the type of mortgage.

But let’s break it down simply.

On average, monthly repayments for a £450,000 mortgage (assuming a typical 25-year term with an interest rate of around 5%) sit at about £2,631.

Of course, if you manage to snag a lower interest rate, those payments could drop to a more comfortable level.

Plus, if you extend the mortgage to 30 or even 35 years, you could see those monthly costs shrink even further—although you’ll end up paying more overall.

Here’s an overview of the monthly payments you can expect for a £450,000 mortgage, depending on the interest rate and the term length:

| Term | 2% Rate | 3% Rate | 4% Rate | 5% Rate | 6% Rate | 7% Rate |

|---|---|---|---|---|---|---|

| 5 Years | £7,910 | £8,087 | £8,263 | £8,442 | £8,621 | £8,801 |

| 10 Years | £4,142 | £4,341 | £4,554 | £4,777 | £5,010 | £5,252 |

| 15 Years | £2,901 | £3,107 | £3,327 | £3,558 | £3,800 | £4,053 |

| 20 Years | £2,278 | £2,495 | £2,727 | £2,970 | £3,224 | £3,489 |

| 25 Years | £1,906 | £2,134 | £2,375 | £2,630 | £2,899 | £3,180 |

| 30 Years | £1,663 | £1,897 | £2,149 | £2,415 | £2,698 | £2,994 |

Want to get a clearer picture of your monthly costs? Try out our monthly repayment calculator to see exactly how different rates and terms impact your payments. It’s a quick way to find the plan that best suits your budget.

What Affects Your Monthly Payments on a 450k Mortgage?

The monthly repayments on a £450,000 mortgage can vary quite a bit, depending on a few key things:

- Interest Rates. Simply put, the higher the interest rate, the more you’ll pay each month. So, it’s always worth shopping around for the lowest rate possible. Mortgage brokers can be handy here as they often have access to exclusive deals that aren’t available to the public.

- Term Length. The term of your mortgage—how long you’re planning to pay it off—plays a massive role. For example, a 15-year mortgage will mean higher monthly payments, but you’ll pay much less in interest over the long term. A 30-year mortgage will keep those monthly payments lower, but you’ll be in it for the long haul, with more interest paid overall.

- Mortgage Type. Are you looking at a repayment mortgage or an interest-only mortgage? With a repayment mortgage, your monthly payments cover both the interest and the original loan (the principal). With an interest-only mortgage, you’re only covering the interest, which makes the monthly payments lower—but remember, you’ll still owe the full £450,000 at the end of the term. Plan wisely, so you don’t get any nasty surprises.

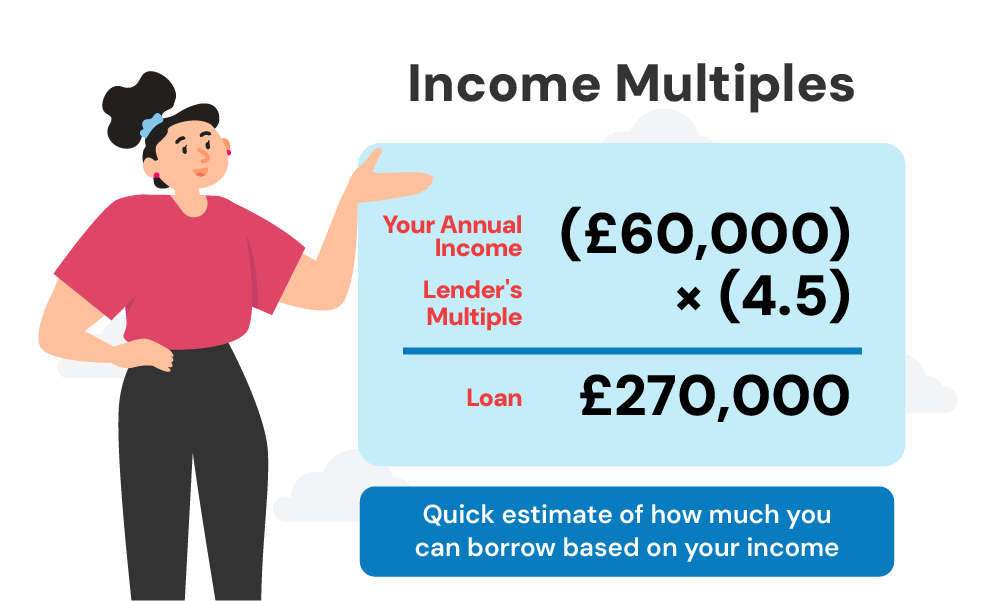

How Much Do I Need to Earn to Get a £450,000 Mortgage?

To qualify for a £450,000 mortgage, most lenders will want you to have an annual income that’s 4 to 4.5 times the mortgage amount.

That means you’re looking at needing an income of around £100,000 to £112,500. Of course, every lender is different.

Some might stretch that to 5 or even 6 times your salary, but you’ll need a stable, high-paying job and a stellar credit score for that. We’re talking about professions like doctors or lawyers.

If you’re applying with a partner, the combined income should meet these requirements, making it easier to reach that number.

Want to know if you can comfortably afford a £450,000 mortgage? Use our mortgage affordability calculator to check how much you could borrow based on your income and find the best mortgage option for you.

What About the Deposit?

The deposit is your key to the door of your new home. For a mortgage on £450,000, you’ll generally need a deposit of between 5% to 10% of the property value—that’s around £22,500 to £45,000.

The more you can put down, the better. A bigger deposit means a lower loan-to-value ratio (LTV), and lenders love a lower LTV.

Why? Because it means less risk for them, which translates into better interest rates for you.

However, if you have issues with your credit or are buying a non-standard property, you might need a deposit as high as 25%. And if you’re buying to let, expect at least a 20% deposit.

Wondering what your LTV is? Try our LTV calculator to find out where you stand and how your deposit size could impact your mortgage options.

How Can You Reduce Your £450k Mortgage Repayments?

We all want to save a few quid, so how can you reduce those monthly payments?

- Get the Best Interest Rate. A no-brainer, really. The lower the rate, the less you pay each month. Work with a mortgage broker to find the lowest rate possible. Good brokers often have access to deals that aren’t widely advertised.

- Save for a Bigger Deposit. The higher your deposit, the better your mortgage deal. Aim for at least 10%, but if you can manage 20%, even better. Lenders will reward you with lower interest rates.

- Extend the Mortgage Term. Increasing the mortgage term can reduce your monthly payments. Just keep in mind you’ll pay more interest over the life of the mortgage.

- Work on Your Credit Score. Before you apply for a mortgage, download your credit report and look for any errors or outdated information that could be dragging your score down. A better credit score can help you land a lower interest rate.

Other Costs to Consider

Thinking about a £450,000 mortgage? Great. But keep in mind, it’s not just the monthly payments you’ll need to cover. Here are some extra costs to budget for:

Product Fees

Many mortgages come with setup fees like arrangement or booking fees, sometimes even valuation fees. These can range from a few hundred pounds to a couple of thousand.

You can often add them to your mortgage, but remember, this means you’ll be paying interest on them too.

Stamp Duty

Stamp duty can be a surprise cost. If you’re a first-time buyer and your home is under £425,000, you’re off the hook.

But for others, stamp duty kicks in on properties over £250,000. The higher the price, the more you’ll pay, so it’s worth checking the latest rates to avoid any unexpected charges.

Check how much you’ll pay for stamp duty using our calculator.

Insurance

Most lenders will require buildings insurance to cover the cost of any potential damages to the property.

It’s also smart to consider life insurance or critical illness cover to help pay off the mortgage if something happens to you.

Income protection insurance can give extra peace of mind by covering payments if you can’t work. Think of it as a safety net for you and your family.

Legal Fees

You’ll need a solicitor to handle the legal work on your home purchase. This includes things like conveyancing and property searches.

Fees vary, but expect to pay between £800 and £1,500. It’s best to budget for this upfront so you’re ready when the bill comes.

Survey Costs

Your lender may do a basic valuation, but for older homes or for extra peace of mind, you might want a more detailed survey.

A HomeBuyer Report or a full structural survey can reveal hidden issues, potentially saving you from expensive repairs later. Survey costs typically range from £400 to over £1,000, depending on the type.

Moving Costs

Don’t forget the cost of moving itself. Whether you’re hiring a moving company or renting a van, moving costs can add up.

For a larger move, expect to budget between £300 and £1,500. There may also be extra costs for packing materials, storage, or even taking a day off work to manage the move.

Planning for these costs ahead of time means fewer surprises along the way. The more prepared you are, the smoother the whole process will be.

Why Use a Mortgage Broker for a £450,000 Mortgage?

You might think you’re perfectly capable of finding a mortgage on your own. And maybe you are.

But a mortgage broker can make your life a lot easier—and potentially save you a bundle.

A good mortgage broker will:

- Help you find the best interest rate.

- Guide you through the paperwork.

- Know which lenders are best for your particular situation.

- Help you navigate any bumps in the road that might come up during your application.

And often, they can access exclusive deals that aren’t available to the general public. Less stress, better rates, and someone else to do the legwork.

If you’re looking to get started, reach out to us. We’ll connect you with a qualified mortgage broker to help with your mortgage needs.

Key Takeaways

- Monthly repayments on a £450,000 mortgage depend on the interest rate, term length, and mortgage type. On average, a 25-year term with a 5% interest rate costs around £2,631 per month.

- Bigger deposits lower your loan-to-value (LTV) ratio, often unlocking better rates.

- Most lenders require an income of £100,000 to £112,500 to qualify for a £450,000 mortgage.

- To lower monthly payments, look for the best interest rate, save a larger deposit, consider a longer term, and boost your credit score.

- Don’t forget to budget for other costs such as product fees, stamp duty, insurance, and legal fees.

The Bottom Line

Taking out a mortgage on £450,000 is a big decision, and it’s not one to take lightly.

There are many moving parts to consider, from the interest rate and term length to the deposit and other associated costs.

But with the right preparation and a little help from a mortgage broker, you can make sure you get the best deal and that those monthly repayments are manageable.

So, do your calculations, speak to a broker, and take a good hard look at your finances. And when you get that key in your hand and step into your new home, all the planning and saving will be worth it.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I get a £450,000 mortgage with a 5% deposit?

Yes, it’s possible to get a £450,000 mortgage with a 5% deposit, although having a higher deposit will increase your chances of getting a better interest rate.

Is it worth using a mortgage broker?

Absolutely. A mortgage broker can help you find better rates, guide you through the process, and potentially save you money in the long run by accessing exclusive deals.

Can I still get a £450K mortgage even with a bad credit score?

Yes, you can still get a £450,000 mortgage with a bad credit score—it just might be a bit tougher. Some lenders are willing to work with lower credit, but you may face higher interest rates, need a larger deposit, or qualify for a smaller loan.

A mortgage broker can help by connecting you with lenders who specialise in bad credit mortgages. And if you can boost your credit score a little before applying, you could secure a better deal.