- What Is a Mortgage Valuation?

- Who Conducts the Mortgage Valuation?

- What Types of Mortgage Valuations Are There?

- What Happens During a Mortgage Valuation?

- How Much Does a Mortgage Valuation Survey Cost?

- Is a Mortgage Valuation the Same as a Property Survey?

- What Happens After a Mortgage Valuation?

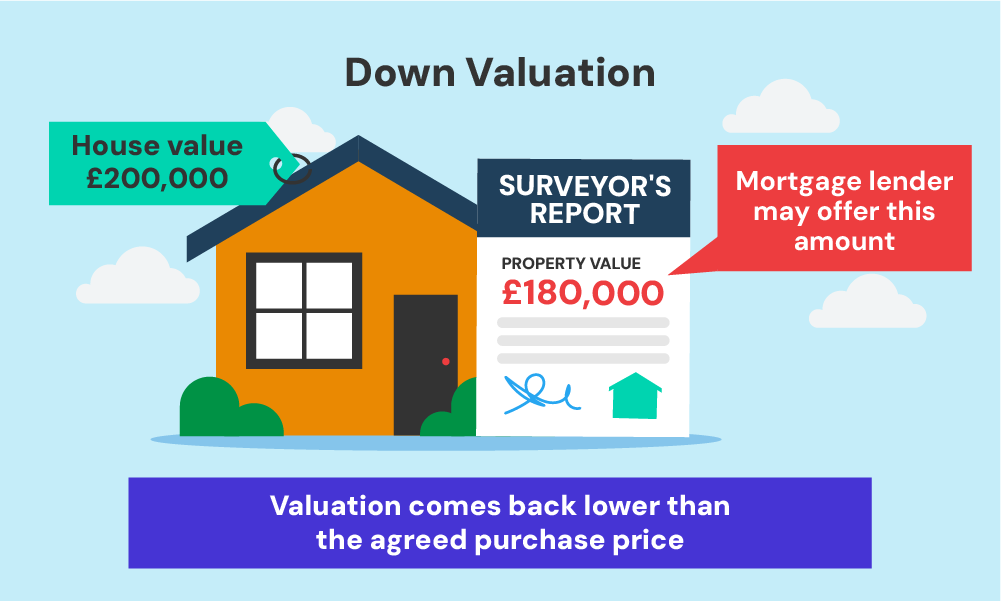

- What If The Valuation is Lower Than Expected?

- How Do I Avoid a Down Valuation?

- How Does a Remortgage Valuation Survey Differ?

- Key Takeaways

- The Bottom Line

Mortgage Valuation Types & Fees: What Should You Expect?

Wondering how much the property you want to buy is really worth? A mortgage valuation helps both you and your lender figure that out.

But not all valuations are the same, and costs can vary. Knowing which type of valuation fits your situation can save you time and money during the mortgage process.

In this guide, we’ll explain the different types of mortgage valuations, how much they cost, and when each one might be needed.

Whether you’re a first-time buyer or looking to remortgage, this article will make the process easier to understand.

What Is a Mortgage Valuation?

A mortgage valuation is a professional assessment where the lender checks your home value’s worth.

It helps them decide if the property is worth the loan amount and if it’s a secure investment (the property can cover the loan, if needed).

While this assessment mainly benefits the lender, it can still be helpful to you. As it gives you a rough idea of whether the asking price is fair.

Who Conducts the Mortgage Valuation?

Mortgage valuations are typically carried out by qualified surveyors who are members of the Royal Institution of Chartered Surveyors (RICS).

These professionals have extensive knowledge of property values and construction.

Your lender will arrange the valuation, but you’ll usually have to pay for it. The surveyor works for the lender, not for you, which is an important distinction we’ll come back to later.

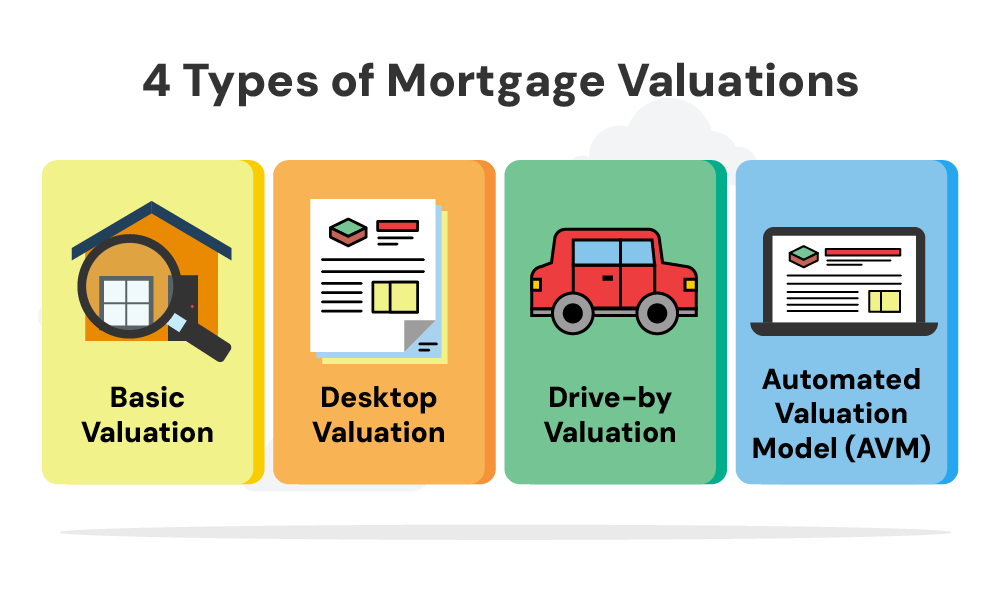

What Types of Mortgage Valuations Are There?

There are several types of mortgage valuations, each with its own level of detail and purpose. Let’s explore them:

Basic Valuation

This is the most common type of mortgage valuation. It’s a quick check of the property’s value and condition. The surveyor will look at the outside of the property and may do a brief internal inspection.

They’ll also compare the property to similar ones in the area that have sold recently.

Desktop Valuation

This is becoming increasingly common, especially since the COVID-19 pandemic. The surveyor doesn’t visit the property at all.

Instead, they use online data like Land Registry records and recent sales to estimate the property’s value.

Drive-by Valuation

As the name suggests, this involves the surveyor driving past the property to check its external condition and the surrounding area. They don’t go inside the property.

This type of valuation is faster and cheaper, but it won’t account for internal issues.

It also became more common during the pandemic when surveyors wanted to limit in-person visits.

Automated Valuation Model (AVM)

This is a computer-generated valuation based on statistical modelling. It uses data from various sources to estimate the property’s value.

AVMs are often used for remortgages or when the loan amount is low compared to the property value.

What Happens During a Mortgage Valuation?

The process varies depending on the type of valuation:

- For a basic valuation, the surveyor will visit the property. They’ll look at its overall condition, check for any obvious defects, and consider factors like the property’s size, location, and any recent improvements.

- In a drive-by valuation, the surveyor will assess the property’s exterior and the surrounding area from their car.

- For desktop valuations and AVMs, the process is entirely computer-based, using available data to estimate the property’s value.

After the valuation, the surveyor will provide a report to the lender. This report will include their estimate of the property’s value and any significant issues they’ve noticed.

How Much Does a Mortgage Valuation Survey Cost?

The cost of a mortgage valuation survey can vary widely depending on the type of valuation, the lender, and the property value.

Here’s a general guide:

- Basic valuation: £150 – £1,500

- Drive-by valuation: £100 – £150

- Desktop valuation: Often free or low cost

- AVM: Usually free

Remember, some lenders offer free valuations as part of their mortgage deal, especially for remortgages.

Always check with your lender or mortgage broker about the specific costs for your situation

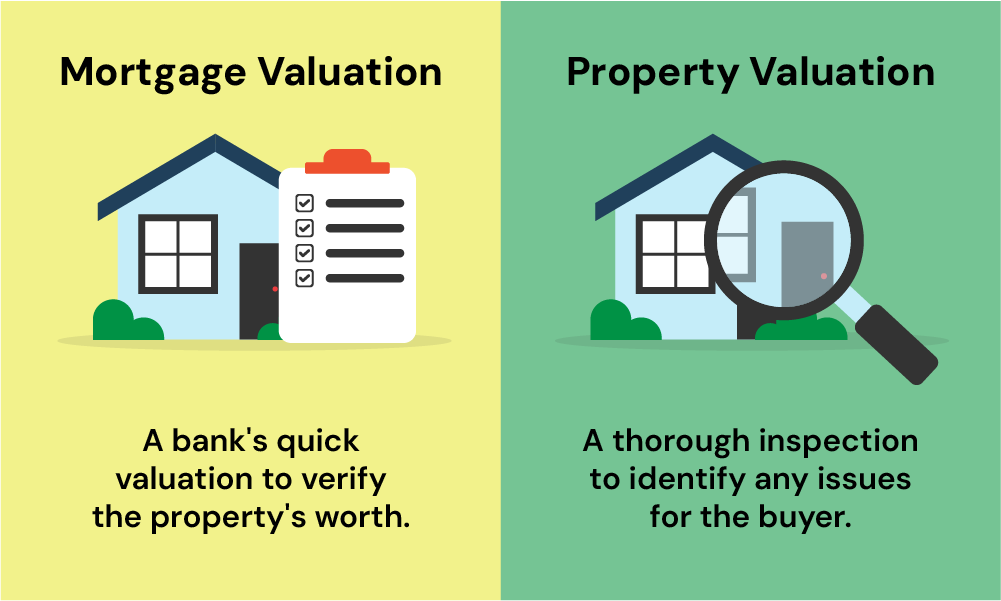

Is a Mortgage Valuation the Same as a Property Survey?

No, and this is a crucial point.

A mortgage valuation is for the lender’s benefit, not yours. It doesn’t provide a detailed assessment of the property’s condition or highlight potential problems.

If you want a thorough inspection of the property, you should consider getting a separate survey. There are three main types:

- Condition Report (Level 1) – A basic overview of the property’s condition. (costing around £300.)

- HomeBuyer Report (Level 2) – A more detailed survey, suitable for conventional properties in reasonable condition (£400 to £1,000).

- Building Survey (Level 3) – The most comprehensive survey, ideal for older or unusual properties (£700 to £2,000).

These surveys are for your benefit and will give you a much clearer picture of the property’s condition and any potential issues.

What Happens After a Mortgage Valuation?

Once the valuation is completed, the surveyor sends a report to your lender.

This report confirms whether the property is worth the price you’ve offered (or the value in your remortgage application). It also assesses whether the property is suitable security for the loan.

If the valuation report comes back at or above the purchase price, the mortgage application can proceed smoothly.

What If The Valuation is Lower Than Expected?

Sometimes, the valuation comes back lower than the agreed purchase price. This is known as a “down valuation“.

It can cause problems because the lender will base their loan amount on the lower valuation, not the purchase price.

For example, if you’ve agreed to buy a house for £200,000 with a 90% mortgage, but the valuation comes back at £180,000, the lender will only offer a mortgage based on the lower figure.

This means you’ll either need to negotiate a lower price with the seller, find the extra money yourself, or potentially walk away from the purchase.

How Do I Avoid a Down Valuation?

A down valuation is something every buyer wants to avoid, as it can stall or even cancel the purchase.

While you can’t control the surveyor’s findings, there are some steps you can take to minimise the risk:

- Research local property prices – Look at recent sales in the area to ensure the property’s asking price is reasonable.

- Be cautious with offers – If the property seems overpriced, don’t hesitate to offer below the asking price.

- Get multiple estate agent valuations – If you’re selling, ask for valuations from several agents and avoid overpricing your home.

- Use a whole-of-market mortgage broker – They can help you find lenders who are more familiar with your property type, reducing the likelihood of a down valuation.

How Does a Remortgage Valuation Survey Differ?

When you’re remortgaging, the valuation process is often simpler.

Many lenders will use a desktop valuation or AVM unless there’s a specific reason to do a more detailed assessment.

This is because they already have some information about the property from your existing mortgage.

But, if you’re borrowing more money or if property prices in your area have changed significantly, the lender might require a more thorough valuation.

Key Takeaways

- A mortgage valuation is mandatory for securing a mortgage, and it ensures the property is adequate collateral for the loan.

- Different types of valuations include basic valuation, desktop, drive-by and automated valuations, each varying in cost and detail.

- Valuation fees range from £150 to £1,500+, depending on the type and property value.

- A mortgage valuation is for the lender’s benefit, not the buyer’s, and doesn’t inspect the property’s condition.

- To assess a property’s condition, you’ll need a separate survey, like a Condition Report, HomeBuyer Report, or Building Survey.

- Down valuations can reduce how much you can borrow, so it’s essential to research local property prices and consider a reasonable offer.

- Remortgage valuations are often simpler and use desktop or automated methods.

The Bottom Line

After going through the different types of mortgage valuations and their costs, you might wonder which one is right for you.

Each valuation has its own purpose, and knowing what you need can save you time, money, and avoid problems later.

The valuation is important for your lender to feel confident in the property, but it may not tell you everything about its condition.

A good mortgage broker can make things easier. They can:

- Help you choose the best valuation for your needs.

- Point you to lenders with free or discounted valuations.

- Help you avoid down valuations by choosing the right lender.

- Suggest additional surveys if you want a more detailed property check.

If you want to save time and find a trusted broker, contact us. We’ll connect you with someone who can help with your mortgage situation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What’s the difference between a mortgage valuation and a survey?

A mortgage valuation is for the lender to ensure the property’s value aligns with the loan amount. A survey, such as a HomeBuyer or structural survey, is more detailed and helps the buyer assess the property’s condition.

How long does a mortgage valuation take?

Typically, a mortgage valuation takes 1 to 2 weeks, but it may be faster if the lender uses a desktop or automated valuation model.

Can I challenge a down valuation?

Yes, but it can be difficult. You’ll need to provide evidence, such as recent sales data, to challenge the valuation with your lender.

Do I get a copy of the mortgage valuation report?

Usually, the lender commissions the valuation, and you won’t receive a full copy of the report. However, you can ask for a summary.

Can a mortgage be refused after valuation?

Yes, a mortgage can still be refused after the valuation. The valuation helps your lender check if the property is worth the amount you’re borrowing, but other factors matter too.

If the valuation is lower than expected (called a down valuation), the lender might refuse the mortgage or offer a lower loan amount.

Other reasons for refusal could include your financial situation, credit history, or changes in your circumstances during the application.

Does valuation mean a mortgage is approved?

No, a valuation doesn’t mean your mortgage is approved. It’s just one step where the lender checks the property’s value.

Even if the valuation is fine, the lender still needs to check your income, credit score, and whether you can afford the mortgage before giving final approval.