How to Remortgage to Buy a Car: A Complete Guide in 2025

Car financing options like auto loans and leasing agreements typically come with scary double-figure interest rates.

This coupled with the escalating car costs can discourage you from even dreaming of buying a new vehicle. But whether you’re eyeing a sleek electric sports car or a vintage camper van, getting behind your dream wheels isn’t out of reach.

Remortgaging lets you tap into your home’s worth to access a lump sum of cash and secure better mortgage terms. You could step into a showroom as a cash buyer with your freshly acquired money, potentially striking an unbeatable offer.

But as with any financial decision, research and careful analysis are key to avoiding the risks. We delve deep into remortgaging to buy a car to help you make an informed decision.

Can I Remortgage to Buy a Car?

Yes, but it’s important to note that not all mortgage lenders are on board with this idea.

Those who do permit it view it in the same light as releasing home equity for other non-essential activities, like going on a holiday.

Securing a car falls under the ‘non-essential’ category. Because of this, some lenders might put certain rules and limits on how much you can borrow, while others may examine your application more thoroughly before giving a nod.

Choosing the right mortgage lender can greatly influence your success in this venture. The correct selection can be the key to getting approval instead of rejection and avoiding strict loan-to-value (LTV) caps and other lender stipulations.

How Much Equity Can I Access to Buy a Car?

The amount of equity you can release is significantly influenced by your lender’s loan-to-value (LTV) guidelines.

Some lenders might allow you to borrow between 65-75% of your home’s value if you are remortgaging for non-essential expenses, while others are willing to extend up to 85% or even potentially 95% LTV.

To explore your options and see what might work for your circumstances, just use the remortgage calculator. It could provide the insights you need!

What Do Lenders Consider When Remortgaging to Buy a Car?

You might find lenders more willing to offer a higher LTV remortgage for this non-essential purchase if:

- You’re an Existing Customer. Some lenders may offer more favourable LTV rates if you’re already a customer, especially compared to new clients switching from a different lender.

- Have a good credit score. Maintaining a good credit score can smooth the path to securing a high LTV remortgage. However, if you have some credit glitches, securing a high LTV might be more challenging, irrespective of your current equity status. Checking your credit reports through a free service could give you a clear picture.

- Have stable financial standing. If nothing major has changed in your financial circumstances since your initial mortgage agreement, it could be easier to gain approval from your current lender.

- Not Nearing Retirement. Lenders may be hesitant to extend a mortgage that goes into your retirement years. Keeping the new term within your working years might give you a better shot at a high LTV mortgage.

- Be Employed Full-Time. Your employment status matters too. For example, Coventry Building Society has a cap of 75% LTV for full-time employees but limits it to 65% for self-employed individuals.

To get an accurate assessment of your chances of approval, speak to a mortgage broker. They can help you find a lender that is likely to approve your application and get you the best possible deal.

Potential Roadblocks When Remortgaging to Buy a Car

While considering remortgaging to finance a car purchase, you may come across a few hiccups. Lenders often have specific criteria that could potentially limit your options. Here are some common restrictions you might face:

- Buying as an Investment or Business Use. If you intend to buy a car as an investment or for business reasons, some lenders might not approve your application.

- Additional Checks. Be prepared for extra underwriting checks. Some lenders might want assurance that the equity you wish to release is on par with the car’s purchase price.

- Proof of Purchase. You may be asked to provide proof that the funds will be used to purchase a car.

- Strict LTV Caps. If your property is already mortgage-free, some lenders might impose a stricter LTV cap.

Furthermore, it’s essential to meet the eligibility criteria outlined by mortgage lenders. Your creditworthiness will be evaluated anew, so make sure to familiarise yourself with the lending criteria, which we have detailed in our comprehensive article on mortgage applications.

Other Options to Finance Your Car Purchase

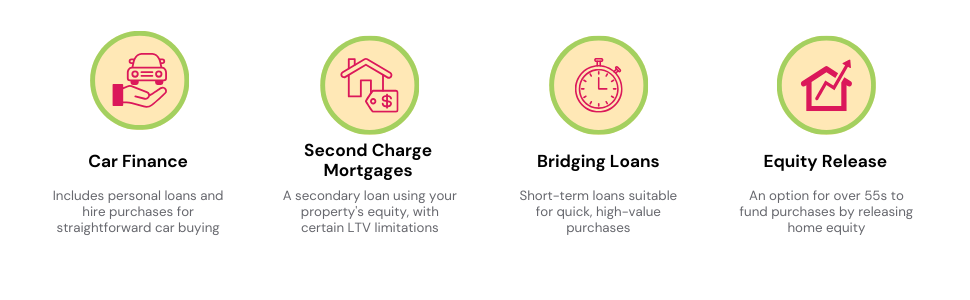

If buying your next car outright isn’t feasible, don’t fret; there are other ways to finance your purchase besides remortgaging. Here are some alternatives you might consider:

- Car Finance – A conventional method to cover the cost of a new car. You have various options including personal loans, personal contract purchases, hire purchases, and leasing agreements.

- Second Charge Mortgages – If remortgaging doesn’t suit your circumstances, a second charge mortgage might be an alternative. This type of mortgage is a secondary loan secured against your property’s equity. Although available for car purchases, note that some lenders might limit the total LTV to 75%.

- Bridging Loans – In certain niche circumstances, like quickly securing a high-value vintage car at an auction, a short-term bridging loan might come in handy if other lending avenues aren’t accessible.

- Equity Release – If you’re above 55 and don’t want to remortgage to fund your car purchase, equity release can be a viable option, permissible for any legal purpose, including lifestyle purchases.

Remember, it’s always best to weigh all your options before settling on a financial plan. Make sure to choose the one that aligns best with your financial situation and goals.

Should You Use Your Mortgage to Fund Your Car Purchase?

Using your mortgage to fund a car purchase is a big decision that should not be taken lightly. It is a significant commitment and requires careful consideration.

Here are some things you need to think about:

- Your specific needs and current financial situation.

- Whether you can afford the monthly repayments on the car and the mortgage.

- The interest rates and fees associated with using your mortgage to fund a car purchase.

- The impact on your credit score.

- The alternatives to using your mortgage to fund a car purchase, such as a personal loan or a car loan.

It is important to speak to a mortgage broker before making a decision. They can help you understand your options and find the best solution for your needs. Remember, making informed decisions is essential for protecting your financial health in the long term.

The Bottom Line

Many mortgage lenders are reluctant to approve a remortgage for buying a car, as they often view it as a non-essential expense similar to a luxurious holiday. This means that your application may be subject to more scrutiny than other loan requests.

It is therefore important to understand the different eligibility criteria and requirements of each lender. This is where working with an experienced remortgage broker can be helpful.

They can help you save time and money by going through the complex process quickly and efficiently. They also have strong industry connections, which can help them find the best deals and negotiate terms that align with your financial goals.

If you want to find the best remortgage deal without any hassle, get in touch with us. We will connect you with a qualified remortgage broker who will make the entire process easy and help you secure a deal that is good for your long-term financial health.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

When should I refrain from remortgaging to buy a car?

Remortgaging to buy a car may not be beneficial in certain scenarios. For instance:

- If your current mortgage deal is within its fixed term or initial rate period, the exit fees may be high, making it less cost-effective to switch.

- Changes in your circumstances, such as transitioning from a dual-income to a single-income household, may affect your eligibility for remortgage deals.

- Self-employed individuals may face challenges with mainstream lenders and may require a specialist approach.

- Significant credit rating issues can make it difficult to obtain any form of remortgage, although there are specialist lenders who can help.

What are alternatives to remortgaging to buy a car?

If remortgaging your home to buy a car is not a suitable option, there are ample alternatives you could choose from:

- Personal Loans: You can apply for a personal loan from a bank or a financial institution. This type of loan is typically unsecured, meaning you don’t need to provide collateral. However, interest rates and terms may vary based on your creditworthiness, and they’re usually higher than with remortgages.

- Car Financing: Dealerships and lenders offer car financing options where you borrow the funds specifically for buying a car. These loans are secured by the car itself and typically have fixed repayment terms.

- Purchase (HP) or Personal Contract Purchase (PCP): HP and PCP are finance options commonly offered by dealerships. With HP, you make fixed monthly payments over a specific period until you fully own the car. PCP allows you to make lower monthly payments and gives you flexibility at the end of the term to either return the car, trade it in for a new one, or make a final balloon payment to own it outright.

- Savings or Cash Purchase: If you have enough savings, you can choose to pay for the car in cash. This eliminates the need for any loans or financing, and you own the vehicle outright from the start. It also helps you avoid paying interest charges.

How do I decide which car financing option is right for me?

Choosing the right car financing option depends on your circumstances, financial goals, and preferences. You should start by comparing interest rates offered by different lenders to determine the most affordable option. Lower interest rates can save you money in the long run.

Also, don’t forget to look at the repayment terms, including the loan duration and monthly payment amounts. Ensure they align with your budget and financial standing.

Your credit score and financial stability play a significant role. If you have a stellar credit score, you may qualify for better interest rates and mortgage options. If your credit score doesn’t exactly shine, risking a secured loan might not be the best alternative. In this case, take a breather, stash some cash, and let your savings grow.

Should I seek professional advice when exploring alternative financing options?

Yes, it’s highly recommended to seek professional advice when remortgaging to buy a car. They offer personalised guidance based on your specific needs and financial circumstances.

They can help you understand the pros and cons of each option, evaluate affordability, and ensure you make an informed decision. This is especially helpful as remortgaging for lifestyle upgrades almost always leads to stricter eligibility criteria.

Note though that the service might come with costs. Make sure to choose reputable brokers who offer exceptional quality for a fair price.

Are there any government programs or grants available to assist with car financing?

In some cases, government programs or grants may be available to assist with car financing. These programs are often specific to certain regions or target specific demographics, such as low-income individuals or students. Research local government resources or consult with relevant agencies to explore any available options.

Can I lease a car instead of buying one?

Leasing a car is another alternative to acquiring a vehicle. Unlike purchasing, leasing allows you to rent a car for a specific period. Monthly lease payments are typically lower than loan payments, but you don’t own the car and have to return it at the end of the lease term. Also, mileage restrictions and potential excess wear and tear charges should be considered.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.