- What is a Debt Management Plan (DMP)?

- Is a Debt Management Plan Right for You?

- Distinguishing between Priority and Non-Priority Debts in a DMP

- What Debts are not Covered by a DMP?

- How to Calculate Your Monthly Payments for DMP?

- How long Does a DMP last compared to Other Debt Solutions?

- How To Calculate the Duration of Your DMP?

- Can You Modify Your DMP Over Time?

- DMP Calculators: Your Online Aid in Debt Management

- Key Takeaways

- The Bottom Line

How a Debt Management Plan Calculator Work

Debt: a common issue, often causing stress and sleepless nights. It can leave you feeling stuck, juggling bills, and unsure if there’s a way forward.

It doesn’t just affect your finances either—it can take a toll on your relationships, your health, and your peace of mind.

But what if there was a plan tailored to help you manage it step by step?

That’s what a Debt Management Plan (DMP) offers – an informal, adaptable strategy designed to handle unsecured debts.

In this article, we’ll explain: how to set up a DMP, the difference between priority and non-priority debts, how to calculate your monthly DMP payments, and how a DMP compares to other debt solutions.

What is a Debt Management Plan (DMP)?

A Debt Management Plan, often referred to as a DMP, is a structured strategy for managing your unsecured debts.

It is a flexible arrangement designed to help individuals who find themselves struggling to meet their non-priority debt repayments. To know more about this, here are some things about DMP:

- Flexible – DMPs are not set in stone. They are designed to adapt to your financial circumstances. If your income or expenses change, your DMP can be adjusted accordingly.

- Informal – Unlike some other debt solutions, DMPs are informal. This means they are not legally binding and can be altered or cancelled at any time without legal repercussions.

- Exclusive to Unsecured Debts – A DMP can only incorporate your unsecured debts, such as credit card debts, overdrafts or personal loans. Priority debts like your mortgage, rent, council tax and court fines aren’t covered.

- Long-term Solution – A DMP is not typically a quick fix. It is a long-term solution, which can extend for many years, depending on your debt amount and repayment capacity.

In a DMP, you make a single monthly payment which is then distributed among your creditors. These payments are based on what you can realistically afford after considering your income and essential living costs.

This strategy can simplify your financial management and potentially reduce the stress associated with managing multiple debt repayments.

Is a Debt Management Plan Right for You?

Deciding if a DMP is the right choice for you boils down to your personal financial circumstances.

If you’re consistently finding it difficult to meet your non-priority debt repayments but can afford to make smaller regular payments, a DMP could be a feasible option.

It’s also worth considering if you’re looking for a structured, yet flexible solution that simplifies your repayments.

But, keep in mind that a DMP typically extends the period you’re in debt as it lowers your monthly repayments.

A DMP isn’t a cure-all solution for every debt problem. For those dealing with priority debts or those seeking a quick fix to their debt issues, alternative solutions might be more suitable.

Always seek professional financial advice to help you assess your options and make the best decision for your financial future.

Distinguishing between Priority and Non-Priority Debts in a DMP

When it comes to setting up a Debt Management Plan, understanding the difference between priority and non-priority debts is crucial.

In simple terms, priority debts are the ones that carry severe consequences if you don’t pay them. These could include loss of your home, legal action, or even imprisonment.

Examples of priority debts include mortgage repayments, rent arrears, council tax, and court fines.

On the other hand, non-priority debts, while still important, do not have such immediate and severe implications if you miss a payment.

These usually include unsecured debts such as credit card bills, personal loans, overdrafts, and store card debts.

What Debts are not Covered by a DMP?

As mentioned, a Debt Management Plan is designed to manage non-priority or unsecured debts. It does not cover priority debts like your mortgage, rent, council tax, and court fines.

If you’re dealing with these types of debts, you’ll need to address them separately and ensure they’re paid first, before considering any payments towards a DMP.

Additionally, DMPs also exclude secured debts like secured loans or hire purchase agreements.

How to Calculate Your Monthly Payments for DMP?

When considering a Debt Management Plan (DMP), a key factor is determining how much you can afford to pay each month towards your debts.

This calculation is essential, as it will affect the length of your DMP and how quickly you can become debt-free. Here’s a step-by-step guide to help you with this important process.

Determine Your Monthly Income

Your monthly income is the starting point in determining your DMP monthly payments.

If you have a steady income, this is straightforward – simply total all the money you receive each month from your salary, benefits, pensions, and any other income sources.

If your income varies, you’ll need a bit more calculation. A good way to establish an average income is to add up your total earnings from the past 6-12 months and then divide by the number of months. This will give you a decent estimate of your monthly income.

Calculate Your Monthly Expenditure

The next step is calculating your monthly expenditure. To do this, gather your bank statements and receipts from the last few months to see how much you’ve spent.

Be sure to include all essential living costs, such as rent or mortgage payments, utility bills, food, travel costs, and payments towards priority debts.

Avoid including discretionary or non-essential expenses like entertainment, eating out, or luxury items. Remember, the goal here is to free up as much money as possible to put towards your DMP.

Why is Disposable Income Crucial for Your DMP?

Once you’ve calculated your monthly income and expenditure, subtract the latter from the former. The result is your disposable income, which is essentially the money you have left after covering all essential living costs.

Why is this important? Your disposable income determines how much you can afford to pay towards your DMP each month.

This payment should ideally be a significant portion of your disposable income, but it also needs to be sustainable. Overestimating this and struggling to keep up with payments can lead to more financial stress.

So, it’s essential to calculate your disposable income accurately and make a realistic offer for your DMP monthly payments. This will help set you on a path towards a more secure financial future.

| Steps | Explanation | Example |

|---|---|---|

| Calculate Monthly Income | Add up your income from all sources each month. | Salary: £2000 + Benefits: £200 + Pension: £300 = Total Income: £2500 |

| Calculate Monthly Expenditure | List out all your essential living costs and add them up. | Rent: £800 + Utility Bills: £200 + Food: £300 + Travel Costs: £100 + Priority Debts: £100 = Total Expenditure: £1500 |

| Calculate Disposable Income | Subtract your total expenditure from your total income. | Total Income (£2500) – Total Expenditure (£1500) = Disposable Income: £1000 |

| Determine Monthly Payment for DMP | Choose a sensible amount from your disposable income as your monthly DMP payment. | DMP Payment: £500 |

This table should guide you in determining your DMP monthly payment. Remember to be honest and realistic in your calculations.

Overestimating your disposable income or underestimating your expenditure could lead to further financial stress. So, take a sensible approach to your DMP payment to secure your financial future.

How long Does a DMP last compared to Other Debt Solutions?

It’s important to understand that a Debt Management Plan (DMP) is not a quick fix to your financial problems. Rather, it’s a long-term strategy to manage your debts over an extended period.

The length of your DMP can be influenced by many factors, including the total amount of your debt, your monthly disposable income, and the acceptance of your creditors.

Compared to other debt solutions, a DMP typically lasts longer. For instance, an Individual Voluntary Arrangement (IVA) usually spans five years, while a DMP could potentially last over ten years depending on the circumstances.

But, the flexible nature of a DMP can provide peace of mind, even if it may take longer to clear your debts.

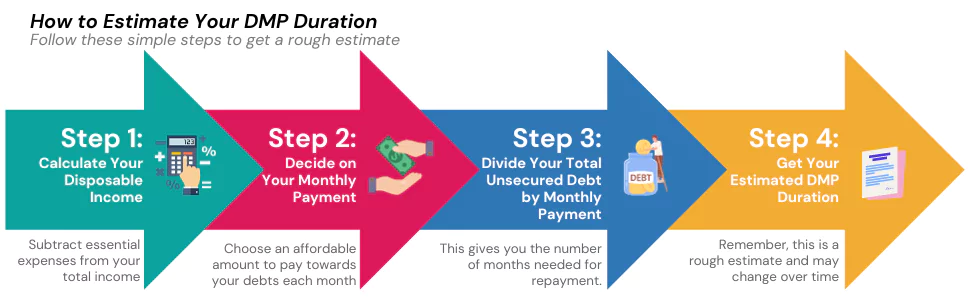

How To Calculate the Duration of Your DMP?

Estimating the duration of your DMP is a relatively straightforward process.

Once you have calculated your disposable income and decided how much you can afford to pay towards your debts each month.

Simply divide your total unsecured debt by this monthly payment amount. This will give you the theoretical number of months it will take to pay off your debt.

Bear in mind, this is a rough estimate and doesn’t take into account any changes in your financial circumstances or if your creditors agree to freeze interest and charges on your debts.

Can You Modify Your DMP Over Time?

Yes, one of the benefits of a DMP is its flexibility. If your financial circumstances change, you can request to adjust your monthly payments.

For instance, if your income decreases, you can reduce your payments, though this will lengthen the duration of your DMP.

On the other hand, if your income increases, you can pay off your debts faster by upping your monthly payments.

It is essential to keep your DMP provider informed of any changes to your circumstances. They can help you manage your debts effectively throughout your DMP.

DMP Calculators: Your Online Aid in Debt Management

In the digital age, tools to help us manage our financial situation are just a click away. A Debt Management Plan (DMP) calculator is one such online aid that can help simplify your debt management process.

How Can an Online DMP Calculator Help You?

A DMP calculator is an online tool designed to provide you with a clear and convenient way to estimate your monthly repayments under a DMP. It’s designed to help you create a budget that you can comfortably follow while also satisfying your creditors.

What Factors Can a DMP Calculator Help Determine?

DMP calculators can assist you in determining several critical aspects of your debt management plan. They can provide an estimate of your monthly payment amount based on your income, expenditure, and total debt.

Furthermore, they can help estimate the duration of your DMP by factoring in your total debt and the proposed monthly payment.

Some calculators may even give you an idea of the interest savings if your creditors agree to freeze the interest and charges on your debts.

Key Takeaways

- A Debt Management Plan (DMP) helps manage unsecured debts like credit cards and loans, offering flexible payments based on what you can afford. It doesn’t cover priority debts like rent or mortgages.

- DMPs are long-term solutions, often lasting several years, depending on your debt and monthly payments. Payments can be adjusted if your financial situation changes.

- Calculating disposable income is key to determining your DMP payment. Subtract your essential expenses from your total income to find what you can realistically afford each month.

- Using a specialist adviser or DMP calculator can simplify the process, helping you create a manageable plan and estimate how long it will take to clear your debts.

The Bottom Line

While a DMP calculator is a valuable tool, it should not be the sole deciding factor when considering a Debt Management Plan.

They can provide helpful estimates, but remember, these are based on the data you input, which may change over time.

Your decision should be based on comprehensive factors, including your financial circumstances, the type of debts you owe, and the flexibility you require in a debt solution.

It’s also wise to seek professional advice from reputable debt charities or mortgage advisers who can provide personalised guidance based on your unique situation.

DMP calculators are a great starting point, giving you a broad idea of what a DMP might look like for you. But, they are just one piece of the puzzle in the journey towards successful debt management.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I do a debt management plan myself?

Yes, you can. Setting up a DMP yourself involves contacting your creditors, explaining your financial situation, and negotiating a payment plan that you can afford. Remember, this requires time and good communication skills.

Who is eligible for a DMP?

Anyone struggling with unsecured debt payments, such as credit card debt, overdrafts, or personal loans, can consider a DMP.

But, it’s important to understand that you should have some disposable income left after covering your essential costs to make the monthly payments.

What happens if I stop paying my debt management plan?

If you stop paying your DMP, your creditors may start adding interest and charges to your debt again, and they might ask for the whole debt to be repaid immediately. If you’re finding it hard to make payments, it’s vital to communicate this to your creditors or the company managing your plan.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.