- Can I Get a Mortgage With Credit Card Debt?

- How Do Lenders Consider Your Credit Card Debt?

- What Amount of Credit Card Debt is Too High for a Mortgage?

- How to Manage Credit Card Debt for Mortgage Applications?

- Can First-Time Buyers with Credit Card Debt Get a Mortgage?

- Can Individuals Over 50 Get a Mortgage with Credit Card Debt?

- Can you Get a Joint Mortgage if One Partner has Credit Card Debt?

- Practical Tips on How to Get a Mortgage with Credit Card Debt

- Key Takeaways

- The Bottom Line

How To Get Mortgages with Credit Card Debt in the UK?

Thinking of buying a home but worried about credit card debt? You’re not the only one.

In 2024, the average UK household had around £2,471 in credit card debt, yet many still managed to achieve their dream of homeownership.

The good news is that credit card debt doesn’t mean you can’t get a mortgage. It’s more of a hurdle than a dead end, and with the right steps, you can overcome it.

This guide will show you how lenders view debt, how to strengthen your financial profile, and how to balance paying off credit cards with your goal of buying a home.

Can I Get a Mortgage With Credit Card Debt?

Yes, you can secure a mortgage even if you have credit card debt. But, the true answer is more nuanced and depends on a variety of factors.

Primarily, the amount of credit card debt you have comes into play. The greater the debt, the more of a challenge it may be to obtain a mortgage. But that’s not all.

Lenders also assess your overall financial picture. This involves looking at your credit history, other outstanding loans, financial commitments, and importantly, your debt-to-income ratio.

Your ability to manage repayments is another critical consideration. If your earnings are sufficient to cover your debt payments along with your living costs and potential mortgage repayments, lenders may still consider you a viable candidate for a mortgage.

But, remember that every lender will weigh these factors differently, so shopping around and getting expert advice can make all the difference in your mortgage journey.

How Do Lenders Consider Your Credit Card Debt?

Lenders use your debt-to-income ratio (DTI) to assess your ability to repay a mortgage. DTI shows what portion of your gross monthly income goes towards your debts, such as loans and credit card payments.

Here’s a simple way to calculate it:

- Add up all your monthly debt payments.

- Divide the total by your gross monthly income (before tax).

- Multiply the result by 100 to get a percentage.

Let’s illustrate this with an example. Suppose you have the following monthly financial commitments:

| Financial Commitments | Amount (£) |

|---|---|

| Credit Card Repayment | 200 |

| Car Finance | 200 |

| Hypothetical Future Mortgage Repayment | 700 |

And let’s assume your monthly income before tax is £2,800. Then, your DTI calculation would look like this:

| Calculation Steps | Result |

|---|---|

| Total Monthly Debt (Credit Card + Car Finance + Hypothetical Mortgage) | 1,100 |

| Monthly Income Before Tax | 2,800 |

| DTI Calculation [(Total Monthly Debt / Monthly Income) x 100] | 39% |

Lenders generally prefer a DTI below 36%. The lower your DTI, the better your chances with lenders. To improve your DTI, consider reducing your monthly debt or increasing your income.

What Amount of Credit Card Debt is Too High for a Mortgage?

The amount of debt that’s considered ‘too much’ can vary from person to person.

For instance, if you owe £1,000 on your credit card, but have a high and steady income, one lender might still approve you. But another might reject your application.

Every lender has different criteria, so a ‘no’ from one doesn’t mean all doors are closed.

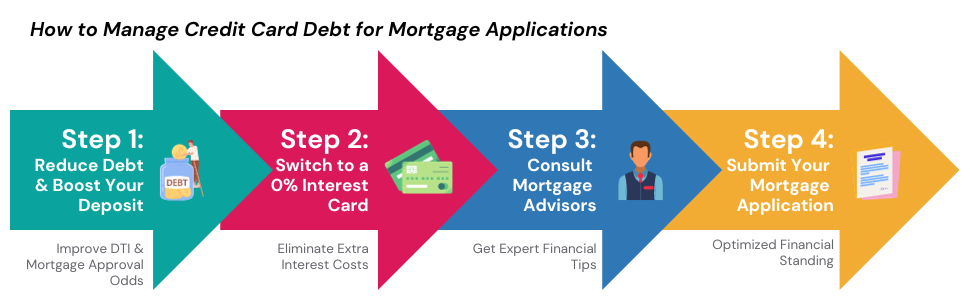

How to Manage Credit Card Debt for Mortgage Applications?

Knowing how to effectively manage your credit card debt can significantly boost your chances of securing a mortgage. Here are three strategies that can help:

Paying Off Debt Before Applying

Think about cutting down or even clearing your credit card debt before applying for a mortgage. Why? This action lowers your debt-to-income ratio—a key factor lenders look at when reviewing your application.

If you can clear your debt without exhausting your savings, go for it. But remember to strike a balance with saving for a significant deposit, another way to bolster your mortgage application.

Move to a 0% Credit Card

Consider transferring your current balance to a card that charges 0% interest. This way, you can dodge the extra costs that pile up due to interest.

But be careful to review the terms. Be sure you can repay the full amount within the no-interest period to avoid even steeper interest rates down the line.

Role of Mortgage Advisors

They can guide you through the financial maze. Tailoring their advice to your unique situation, they can suggest effective ways to manage your debt.

With a deep understanding of mortgages and lender policies, they can also point you to lenders more likely to say ‘yes’ to your application.

An expert’s perspective can offer clarity, minimise risk, and assist you in making informed decisions about your debt repayment plan and mortgage application. It’s a wise decision to ask for professional advice before making any financial moves.

With these strategies in your back pocket, you’re well on your way to managing your credit card debt more effectively, and significantly improving your chances of getting a mortgage.

Can First-Time Buyers with Credit Card Debt Get a Mortgage?

Absolutely, first-time buyers with credit card debt can still secure a mortgage. But, it can make the process a bit trickier. Lenders don’t just focus on the debt amount; they look at how you handle it.

Credit card debt isn’t a deal-breaker, but it’s not exactly a selling point either. Lenders run thorough checks to ensure you can handle mortgage repayments on top of your existing debt.

The trick to appeal to lenders? Show them you’re responsible. Regular, consistent repayments can demonstrate this.

Better yet, clearing your debt paints a picture of a reliable borrower. So, it’s not an ideal situation, but it’s definitely not a full stop on your home-owning journey.

Can Individuals Over 50 Get a Mortgage with Credit Card Debt?

Yes, they can. But, lenders may have concerns about their ability to sustain their income during retirement.

Therefore, it is essential to demonstrate that you have a stable income that meets mortgage affordability requirements.

Moreover, older applicants with credit card debt may face limited options. If you can afford a mortgage despite your credit card debt, you may still have options such as retirement interest-only mortgages, equity release, or remortgaging.

Can you Get a Joint Mortgage if One Partner has Credit Card Debt?

Yes, it can be beneficial to apply for a joint mortgage even if one partner has credit card debt. Lenders will consider the combined incomes of both partners when assessing your ability to repay the mortgage. This can help to offset the debt-to-income ratio.

It is important to prove to lenders that you and your partner can afford the mortgage payments. This means demonstrating that you have a stable income and that you are able to manage your debt. If you can do this, your chances of approval may be high.

Moreover, it’s wise to choose the right lender. Some are happier to lend to applicants with credit card debt than others. So, it’s important to shop around and find the best lender for you.

Practical Tips on How to Get a Mortgage with Credit Card Debt

Here are some tips you can follow when you get a mortgage with credit card debt:

Check Your Credit Report

Start by obtaining your credit report from credit reference agencies – Experian, Equifax, and TransUnion. This document outlines your credit history and forms the basis for your credit score, which lenders use to assess your application.

Look for any errors and dispute them with the credit agency if necessary. Keep an eye out for areas where you can make improvements.

Pay Down Debt

Work towards reducing your overall debt, including credit card debt, before applying for a mortgage. This lowers your debt-to-income (DTI) ratio, making you a more appealing candidate to lenders.

Even if it’s not possible to entirely eliminate the debt, reducing it can significantly improve your prospects.

Close Unused Credit Accounts

If you have any credit accounts that you no longer use, consider closing them. Having multiple lines of credit open can raise concerns for potential lenders.

Lower Your DTI Ratio

Besides reducing your debt, try to lower your DTI ratio by increasing your income. This could involve asking for a raise, looking for additional work, or even starting a side gig.

A lower DTI ratio can strengthen your application, showing lenders that you’re not overly reliant on debt.

Prepare Your Paperwork

When applying for a mortgage, you’ll need to present a variety of documents. These may include payslips, bank statements, proof of address, and more.

Be proactive and gather these items in advance to expedite your application process.

Key Takeaways

- You can get a mortgage with credit card debt, but it depends on factors like the size of your debt, your debt-to-income ratio (DTI), and your ability to manage repayments. Lowering your DTI improves your chances.

- Paying down debt before applying helps. Reducing or clearing your credit card debt shows lenders you’re financially responsible and makes you a more appealing candidate.

- Choosing the right lender is key. Some are more open to applicants with debt, and working with a specialist mortgage advisor can help you find the best match.

The Bottom Line

Securing a mortgage when you have credit card debt may seem like a tall order, but with the right approach and careful financial planning, it’s entirely feasible.

Keep a close eye on your credit score, manage your debts wisely, and ensure your debt-to-income ratio is in check.

Lastly, remember that every situation is unique—so don’t hesitate to seek tailored advice for your circumstances. The path to homeownership might be less complex than you think.

To make your journey less stressful, don’t hesitate to drop us a line today. We will connect you with a top mortgage broker who can get you a suitable deal for your circumstances.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Do I need a credit card to get a mortgage?

Not necessarily. While a credit card can contribute to your credit history, which is a factor in mortgage approval, it’s not the only way to build a positive credit profile. Regular payments towards loans, utilities, and rent can also create a favourable credit history.

Can you get a mortgage with credit card debt and car finance debt?

Yes, it is possible. However, having multiple sources of debt could impact your debt-to-income (DTI) ratio, which is a crucial factor for lenders.

Lenders assess your total financial obligations (including credit card and car finance debt) against your income. If your DTI ratio is too high, it could hinder your chances of mortgage approval.

Can you remortgage your home with credit card debt?

Yes, you can, but this decision should be made carefully. Remortgaging can be a way to consolidate your debts, reducing your interest costs in the process.

However, it does come with risks, as it ties your unsecured debt to your home. Always seek professional advice before going down this path.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.