- Is Getting a Mortgage After a Payday Loan Possible?

- How Can You Secure a Mortgage after Using a Payday Loan?

- Factors Lenders Considers When Deciding on Your Mortgage

- Why Do Payday Loans Worry Mortgage Providers?

- The Impact of Payday Loans on Mortgage Applications

- Remortgaging after a Payday Loan

- Key Takeaways

- The Bottom Line: Your Next Steps

How To Get Mortgages After Payday Loans in 2025? A Guide

In today’s quick-paced world, payday loans offer a prompt solution for those facing financial crunches.

But, what consequences might these short-term loans have if you intend to secure a mortgage soon?

The connection between payday loans and mortgage applications isn’t black and white. Various factors can always influence the outcome.

These variables can range from the frequency of your payday loan usage and the borrowed amount to your income type and your repayment track record.

In this article, we will unpack these factors to provide a clear and comprehensive understanding.

We will also share tips to improve your mortgage application’s chances of success, despite your payday loan history.

Is Getting a Mortgage After a Payday Loan Possible?

Yes, it is possible to get a mortgage after using a payday loan. But, as with most things in life, the path is often complex.

Payday loans are short-term, unsecured loans that are usually repaid when you receive your next paycheque. They’re often used as a quick fix for unexpected expenses or to tide you over until the end of the month.

While they might offer a lifeline in the short term, their impact on long-term financial decisions like getting a mortgage can be significant.

The way payday loans affect mortgage applications comes down to the perception of risk.

To mortgage lenders, regular use of payday loans can show that you may struggle to manage your finances effectively.

Even if you’ve repaid your payday loans on time. Their presence on your credit history can make mortgage lenders think twice.

Here’s why:

- Frequent use of payday loans could signal to lenders that you rely heavily on credit to manage your finances. This increases your perceived risk as a borrower.

- If your last payday loan was taken out recently, lenders may consider you more likely to fall into financial difficulty and therefore a higher risk.

How Can You Secure a Mortgage after Using a Payday Loan?

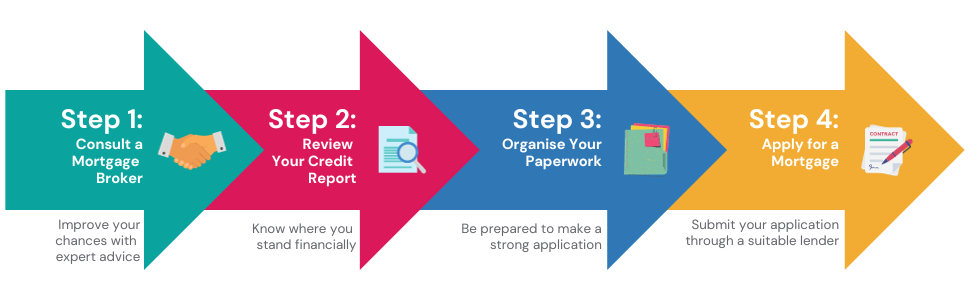

As we have discussed, securing a mortgage after a payday loan is possible. But it comes with a challenge. Here we’ve outlined 4 simple steps you can follow to get a mortgage:

1. Consult a Mortgage Broker

This is your first port of call. Working with a good mortgage broker who has experience with payday loan clients can significantly improve your chances of approval.

They understand the market, the lenders who might be willing to approve your application, and how to make your application appealing.

2. Review Your Credit Report

Obtain a copy of your credit report from credit reporting agencies (CRA) such as Experian, Equifax, and TransUnion. It’s always advisable to review the details in your credit file to ensure they are correct before your lender checks this.

Your broker can also help you interpret the report and recommend ways to improve your credit score if necessary.

3. Organise Your Paperwork

Gather all the necessary documents for your application. This usually includes bank statements, payslips, proof of address, and identification documents.

4. Apply for a Mortgage

Under your broker’s guidance, submit your mortgage application to a suitable lender. They will know which lenders are more likely to approve applications from individuals who’ve used payday loans in the past.

While working with a specialist broker can improve your chances, mortgage approval isn’t guaranteed and will depend on the lender’s criteria and your overall financial situation.

Factors Lenders Considers When Deciding on Your Mortgage

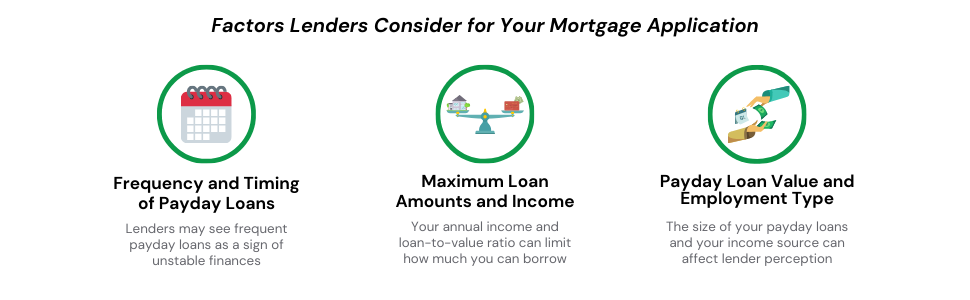

Frequency and Timing of Payday Loans

When it comes to mortgages, your track record with payday loans can play a big part. Lenders often view regular payday loan use as a red flag; it suggests you might not have a solid grip on your finances.

And that’s a key concern for them because a mortgage is no small commitment.

If you’re currently paying off a payday loan, that could set off alarm bells for potential lenders. It raises questions about whether you can comfortably manage mortgage repayments on top of your existing obligations.

Now, it’s not all doom and gloom. While some mortgage providers may hesitate to lend to someone with recent payday loans, not all will.

As time passes, your payday loan history becomes less of an issue. Generally, two years clear of payday loans improves your standing with high street lenders.

Keep in mind, any active payday loans will likely need to be paid off before you can seal the deal on a mortgage.

Lenders will also consider your payday loan repayments when they’re calculating how much you can afford to borrow. It’s all about ensuring you won’t be stretched too thin financially once you have a mortgage to maintain.

Maximum Loan Amounts and Income

When you apply for a mortgage, another two key factors are the maximum loan amount and your annual income.

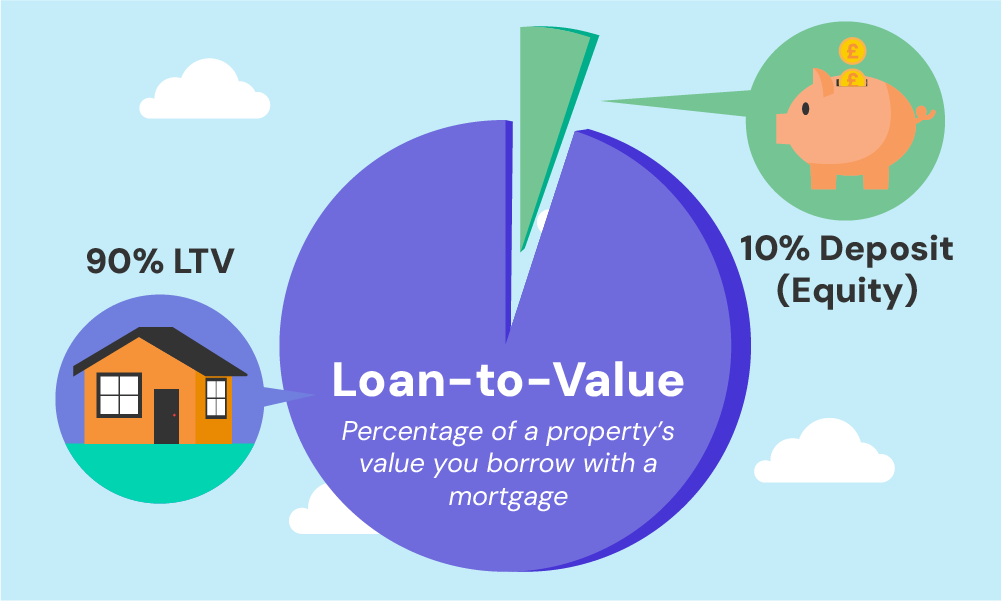

The maximum loan amount often correlates with the Loan Value ratio (LTV). The LTV is a comparison of the loan amount to the value of the property you want to buy.

So, if a lender caps their LTV at 75%, this means you’ll need to come up with a 25% deposit. Higher LTVs may be available under certain circumstances and with specific lenders.

Your annual income plays a significant role in how much you can borrow. Some lenders limit the amount you can borrow to four times your annual income, especially if your credit history has some red flags like payday loans.

But, with the right lender and a solid financial standing, it’s not impossible to borrow up to five times your income.

It’s important to note that each lender has its criteria and approach to payday loans and income.

Pay Day Loan Value and Employment Type

The value of the payday loans you take out can also sway mortgage applications. Larger payday loans might lead lenders to question why you needed such substantial short-term funds.

Your employment type, too, plays a part in how your application is viewed. Different income sources – from salaried work to self-employment income to benefits – are all seen differently by lenders.

For instance, some lenders might be more cautious if your income comes largely from benefits or commission-based work, as they might see these as less reliable than a steady salaried income.

In complex cases, a good broker can be instrumental in presenting your case to the lender in the best possible light.

Brokers understand how different lenders operate, and what they value, and can guide you towards those most likely to consider your application favourably.

Why Do Payday Loans Worry Mortgage Providers?

Mortgage lenders are in the business of risk assessment – they want to be confident that they’ll get their money back. That’s why payday loans can raise eyebrows.

They may indicate to lenders that you’ve struggled with cash flow in the past, leading to concerns about your ability to meet regular mortgage repayments.

The way payday loans affect your mortgage application can vary based on different scenarios.

For instance, if you took out a single payday loan a few years ago to deal with an unforeseen expense and paid it back promptly, lenders might overlook this, particularly if the rest of your credit report is positive.

Some lenders might even offer you competitive mortgage rates under such circumstances.

On the other hand, if you’ve taken out several payday loans over a brief period, lenders could see this as a warning sign that you might be reliant on credit to meet your financial commitments.

This could considerably narrow down your selection of potential lenders.

Lastly, if your most recent payday loan was only a short while ago, this could also discourage lenders. They may have concerns about your capacity to handle your finances without the help of short-term loans.

Each lender will have their criteria when it comes to payday loans and mortgages. Some might reject applications outright, while others take a more balanced approach, considering other aspects of your financial behaviour.

The key to success here is understanding these nuances, and this is where a good mortgage broker can make a world of difference.

The Impact of Payday Loans on Mortgage Applications

An existing payday loan may lead some lenders to immediately decline your mortgage application.

A settled loan from five years ago might be less likely to result in rejection, but it’s crucial to know that many traditional lenders may not accept your application if you have a payday loan on your credit report.

Payday loans remain on your credit report for six years and may be labelled as:

- Income Advance – A loan borrowed against your future income, similar to a payday loan.

- Short-term Loan – A loan intended to be repaid quickly, often used for emergencies.

- Revolving Credit – A type of credit that can be used, repaid, and reused, such as credit cards or lines of credit.

Each lender has distinct criteria, and these can differ quite a bit. It’s essential to understand that you’ll be considered a high-risk borrower, which means you’re unlikely to be offered the lender’s best interest rates.

You may also face higher-than-average fees to counterbalance the additional risk, though this is not always the case.

Remortgaging after a Payday Loan

Remortgaging after a payday loan can throw up a different set of challenges. If you’ve taken out a payday loan in the past, lenders might view your remortgage application with a bit more caution.

They’ll look into your financial history, and a payday loan could lead them to question your financial stability.

But there’s good news. Just as in applying for a new mortgage, a good broker can be of great help in the remortgaging process.

They can find lenders who are more open to applicants with a payday loan in their past, smoothing your way to a successful remortgage.

Key Takeaways

- You can get a mortgage after using payday loans, but it may be harder. Frequent or recent payday loans can make lenders see you as a higher risk.

- Lenders look at factors like the timing and frequency of your payday loans, your income, and your financial stability. Clearing payday loans for at least two years improves your chances.

- A specialist mortgage broker can help you find lenders willing to consider your application, even if payday loans appear on your credit file. But, success isn’t guaranteed, and some mortgage options might not suit your needs.

- Payday loans stay on your credit report for six years and might result in fewer options, higher fees, or less favourable rates from lenders.

The Bottom Line: Your Next Steps

If you’ve had payday loans, finding the right mortgage broker can make a big difference to your application.

They can guide you on the best steps to take and connect you with lenders who won’t be put off by your payday loan history.

These days, broker matching services can pair you with a specialist broker who understands situations like yours.

They’ll take your circumstances into account and help you work towards getting a mortgage, even with payday loans in your past.

Looking to apply for a mortgage? Skip the guesswork and make it easier by speaking to an experienced broker.

Contact us, and we’ll match you with someone who can support you through every step of the process.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I still get a mortgage after a payday loan default?

Yes, while it might be a bit trickier, it is still entirely possible to secure a mortgage after a payday loan default. Much depends on the rest of your credit history, the time that has elapsed since the default, and the lender’s criteria.

How long after a payday loan default can I apply for a mortgage?

There’s no fixed time frame, but typically lenders prefer to see a clean period of at least one year from the time of the default. It varies from lender to lender, however.

Can a specialist bad credit mortgage broker help?

Absolutely. These brokers are experts in cases like yours and can guide you towards lenders who are open to lending to people with a payday loan default in their past.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.