- Why Do Some People Have No Credit History?

- Can I Get a Mortgage without a Credit History?

- How To Get a Mortgage with No Credit History? Step-by-Step

- Which Lenders Will Lend to You?

- Understanding Lenders Criteria

- What are the Challenges in Getting a Mortgage with No Credit History?

- Building Your Credit Rating: A Step-by-Step Guide

- Key Takeaways

- The Bottom Line

How To Get a Mortgage With No Credit History in the UK?

You’re a first-time buyer dreaming of owning your own home, but there’s one hiccup—you’ve never had a credit card, a loan, or anything that builds your credit history.

Maybe you’ve always avoided debt or relied on cash and debit cards.

Now that you’re ready for a mortgage, you’re realising lenders might see your blank credit file as a red flag.

This guide is for you. You’ll learn why having no credit history can make lenders cautious, but more importantly, you’ll discover practical steps to boost your chances of approval.

From building a basic credit profile to finding lenders who specialise in cases like yours, we’ve got you covered.

Why Do Some People Have No Credit History?

Let’s take a closer look at why someone might have no credit history. The reasons can be varied and often include:

- Being new to adulthood, i.e., just turning 18

- Recently relocating to the UK

- Returning to the UK after an extended time abroad

- Not owning a UK bank account

- Not being listed on any utility bills or mobile phone contracts

- Having no permanent UK address

- Lacking any employment history in the UK

No credit history can create a ripple effect on your financial capabilities. The most apparent impact is the potential difficulty in securing financial products, such as loans, credit cards, and most importantly, mortgages.

As mentioned before, lenders might find it challenging to assess your reliability as a borrower, leading to hesitations in approval.

Can I Get a Mortgage without a Credit History?

Yes, it’s possible to get a mortgage without a credit history, but it can be more challenging.

While having a good credit score makes the process simpler, some lenders are open to considering other factors like your income, employment stability, and financial habits.

That said, you may face certain limitations. For instance, you might need a larger deposit or encounter higher interest rates.

Not all lenders will be willing to approve your application, so it’s important to explore your options carefully.

Working with a specialist broker can help you find a lender who understands your situation and might consider your application.

But, getting a mortgage without a credit history depends on your financial situation, why you don’t have a credit history, and the lender’s requirements.

While it’s possible with the right plan and effort, approval isn’t guaranteed, as each lender assesses applications differently.

How To Get a Mortgage with No Credit History? Step-by-Step

Getting a mortgage with no credit history follows the same process as buying a home in the UK.

The main difference lies in proving your financial reliability without a credit history.

Here’s how you can work towards it:

1. Build Your Financial Reputation

Think of this as putting your best foot forward for the lenders. Start simple:

- Open a UK bank account and keep it active.

- Register to vote—it’s a quick win that helps lenders find you on the system.

- Pay your bills on time (yes, even the pesky little ones).

Once you’ve got that sorted, it’s time to figure out how much house you can afford. Crunch those numbers! Factor in your monthly payments and extras like legal fees, surveys, and stamp duty. You can use our mortgage calculator to see how much mortgage you can get based on your income.

Now, let’s talk about deposits.

While some lucky folks can get away with 5–10%, lenders might want you to put down more without a credit history. Aim for at least 10–20% to play it safe.

Finally, gather proof of your financial awesomeness: bank statements, rent receipts, or anything that shows you’re good with money. Trust us, this will come in handy later.

2. Work with a Specialist Mortgage Broker

This is where having an expert in your corner pays off—literally. A specialist broker knows the ropes and can connect you with lenders who are willing to work with people in your situation.

They’ll look for lenders who care less about your credit history and more about things like your income, rent payments, and the size of your deposit.

Plus, they’ll save you the headache of applying to lenders who might not even consider you.

Think of your broker as your mortgage matchmaker—they’ll guide you through the process and make sure your application shines.

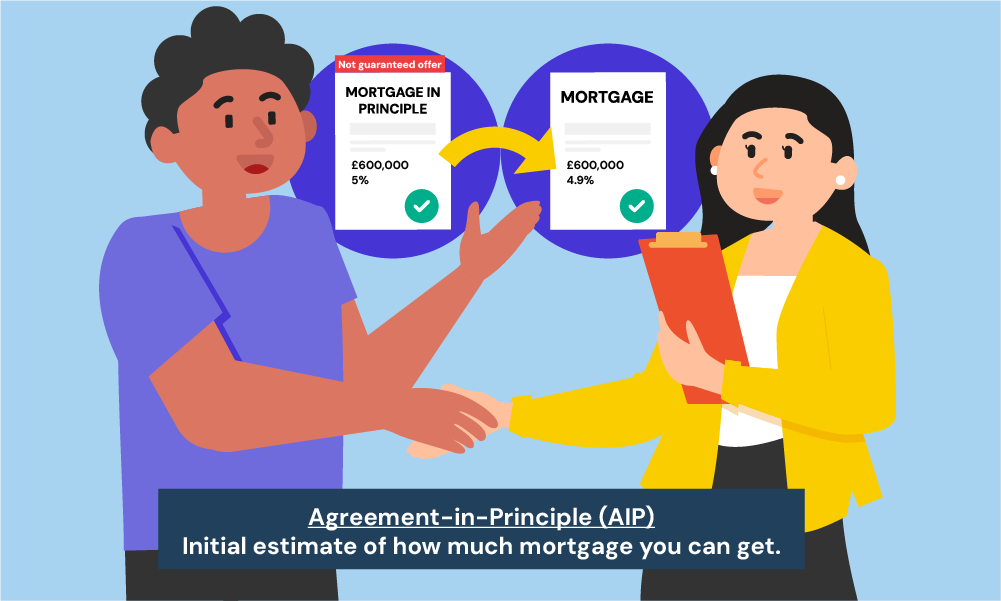

3. Get an Agreement in Principle (AIP)

An Agreement in Principle (AIP) is an early step that estimates how much you might be able to borrow.

While it’s not binding, it’s useful for setting a budget and showing sellers you’re a serious buyer.

If you don’t have a credit history, lenders will focus on things like your income, deposit size, and how responsible you are with money. Your broker will know exactly where to take your application to get the best chance of approval.

4. Find a Property and Apply for a Mortgage

With your AIP sorted, it’s time for the fun bit—house hunting! Stick to homes within your budget and get ready to make an offer.

Once your offer is accepted, you’ll move on to the mortgage application stage. Here’s where all the prep work you’ve done earlier really pays off.

If you’ve already gathered your documents—like proof of income, savings, and rent payments—this part will be much smoother and way less stressful. It’s like baking a cake when all the ingredients are measured and ready to go.

If you’re working with a broker, especially an online one, this step gets even easier.

Online brokers often have streamlined systems where you can upload your paperwork directly to their platform.

From there, they’ll handle everything – processing your documents, finding lenders, and submitting your application.

Without a credit history, lenders might ask for extra information to assess your financial stability. But your broker will help you stay on track and ensure nothing falls through the cracks.

5. Lender Checks and Completion

Once your application’s in, the lender will review everything and arrange a valuation to make sure the property is worth the loan.

If they’re happy, you’ll get a formal mortgage offer. Then it’s over to your solicitor to sort out the legal bits.

Once everything’s signed, sealed, and delivered, the keys are yours! 🔑

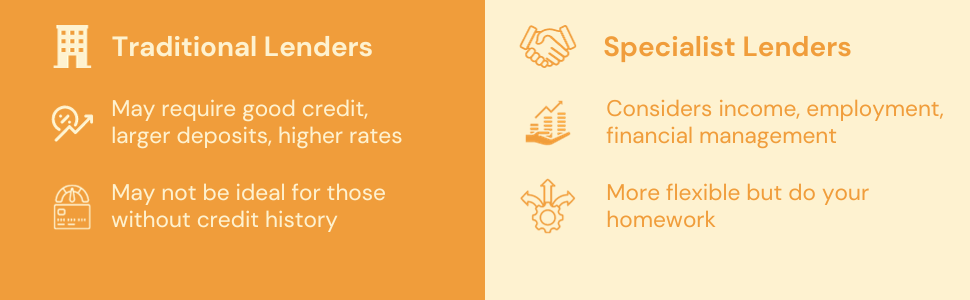

Which Lenders Will Lend to You?

The lenders that might consider your application will depend on why you haven’t built up a credit history.

It’s worth noting that each lender has their own eligibility criteria, so it’s important to speak to a good broker who can help you understand these different requirements.

If you’re returning to the UK after living overseas, some lenders may consider your application, but most will want you to have either secured employment or been back in the country for a certain period of time.

Some lenders have specific criteria. For example, Precise Mortgages typically require applicants to have lived in the UK for at least 3 years.

But, there may be exceptions in cases where an applicant’s job required a temporary assignment overseas.

It’s important to remember that this is general advice, and every situation is different. It’s always best to seek personalised advice based on your specific circumstances.

Understanding Lenders Criteria

From a lender’s point of view, granting a mortgage to someone with no credit history is a bit like stepping into the unknown. They prefer to lend to individuals with a proven track record of managing credit responsibly.

But don’t lose hope – there are lenders willing to consider your application, even if your credit history is a blank page.

Different lenders use different eligibility criteria, but some common factors can make you more appealing:

- Stable income to show you can afford the repayments

- A substantial deposit to increase mortgage chances and pool of lenders.

- Regular bill payments to show you’re a responsible borrower.

- Voting registration to show proof of your residence and identity.

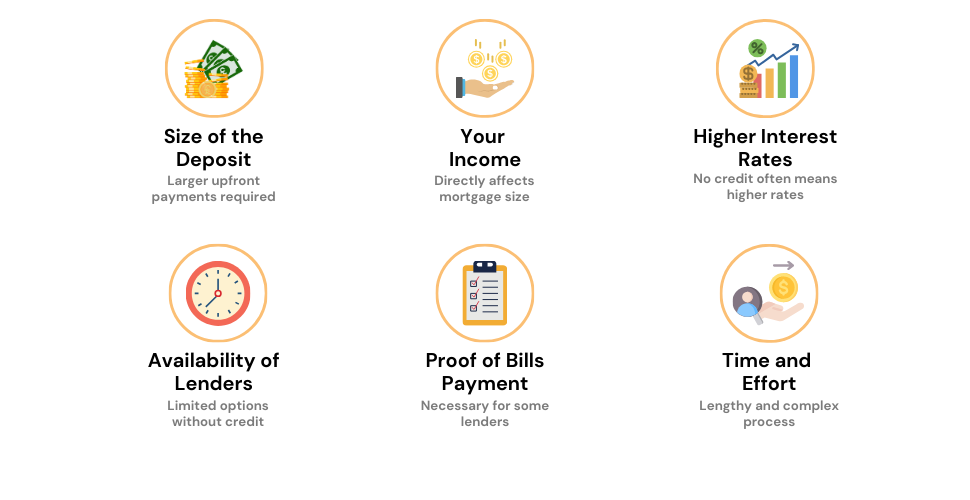

What are the Challenges in Getting a Mortgage with No Credit History?

Here are some hurdles you may encounter while applying for a mortgage with no credit history:

- Size of the Deposit. This is the initial amount you contribute towards buying the property. A larger deposit lowers the risk for the lender, potentially boosting your approval odds.

- Your Income. Lenders generally factor in your earnings while deciding the mortgage amount. They typically offer around 4 to 4.5 times your annual salary, although this isn’t a fixed rule and can differ between lenders.

- Higher Interest Rates. In the absence of credit history, lenders may see you as a higher risk, which could result in higher interest rates for your mortgage. A proficient broker, however, can aid in securing more favourable rates.

- Availability of Lenders. When you have no credit history, fewer lenders might be willing to offer you a mortgage. This could limit your choices and make the process a bit more complicated.

- Proof of Bills Payment. Some lenders might want to see evidence of regular bill payments as an alternative way to assess your reliability. If you’ve been living with parents or sharing a flat and don’t have bills in your name, this could pose a problem.

- Time and Effort. Without a credit history, getting a mortgage can take longer and require more effort on your part, as you may have to provide additional documents and details to lenders.

Each of these challenges underscores the importance of personalised advice from a good mortgage broker when you’re dealing with a lack of credit history.

Building Your Credit Rating: A Step-by-Step Guide

If you don’t want to face some of the hurdles mentioned about, it’s worth considering building your credit rating first.

Although these steps do not guarantee success in your mortgage, they offer a few advantages before applying for a mortgage. These may include:

- Higher loan amounts

- Higher mortgage approval rates

- Better interest rates

- Wider access to lenders and mortgage products.

As for building a credit rating in the UK, here are some practical steps:

- Register to Vote. Registering on the electoral roll at your current address provides proof of address and stability, which lenders view favourably. You can click here to register.

- Open a UK Bank Account. This can serve as proof of your financial activity and establish a financial footprint.

- Pay Bills on Time. Regularly paying bills such as utilities, broadband, and mobile phone bills can help to build a positive credit history.

- Take out a Credit Card. Use a credit card responsibly for small, manageable purchases and pay off the balance each month. This shows that you can handle credit effectively.

- Avoid Excessive Debt. Having too much debt or frequently maxing out your credit cards can negatively impact your credit score.

- Check Your Credit Report Regularly. This allows you to spot errors and track your credit-building progress. You can get a copy of your credit report from these Credit Reporting Agencies – Experian, Equifax, and TransUnion.

Key Takeaways

- Having no credit history can make getting a mortgage harder, but it’s not impossible. Some lenders consider other factors like your income, deposit size, and financial habits.

- You might need a larger deposit (10–20%) and could face higher interest rates, stricter requirements, and a longer process due to additional checks and documents, as lenders may view you as a higher risk.

- Working with a specialist broker increases your chances by matching you with lenders open to applicants without a credit history.

- You can build financial credibility to improve your mortgage application: register to vote, pay bills on time, and keep a UK bank account active.

The Bottom Line

Let’s make this simple: you can get a mortgage without a credit history.

It’s not impossible, but it does depend on your financial situation, the lender’s requirements, and having the right plan in place.

Lenders need to know you can afford to pay them back. That means showing you’re financially stable, meeting their criteria, and, if possible, building a basic credit profile to boost your chances.

The good news? You don’t have to tackle this alone.

A specialist mortgage broker can make things much easier. They understand the process, can explain the tricky bits, and will guide you step by step. Think of them as your go-to expert, saving you time and stress.

If you’re still unsure, don’t hesitate to reach out and inquire about your unique situation. We’re here to match you with the right mortgage broker to help you make your mortgage dreams a reality.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can you get a mortgage if you've never had credit?

Absolutely! It may seem challenging, but it is indeed possible. Several lenders consider applications from individuals with no credit history. They look at other aspects like employment status, salary, and your ability to manage finances responsibly.

In some cases, they may require a larger deposit or charge a slightly higher interest rate. But, rest assured, there are options available for you.

Do you need a credit card to get a mortgage?

No, you don’t necessarily need a credit card to get a mortgage. However, having a credit card and using it responsibly can help build your credit history, which lenders often check when assessing your mortgage application. A solid credit history can increase your chances of securing a mortgage and possibly lead to more favourable terms.

Can a First Time Buyer get a mortgage with no credit history?

Yes, a first-time buyer can indeed get a mortgage with no credit history. While the process might be challenging, lenders often consider other factors such as income, employment stability, and financial management. A larger deposit and higher interest rates might apply. Seeking advice from a mortgage broker can also be helpful.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.