- Can I Get a Bad Credit Mortgage in Northern Ireland?

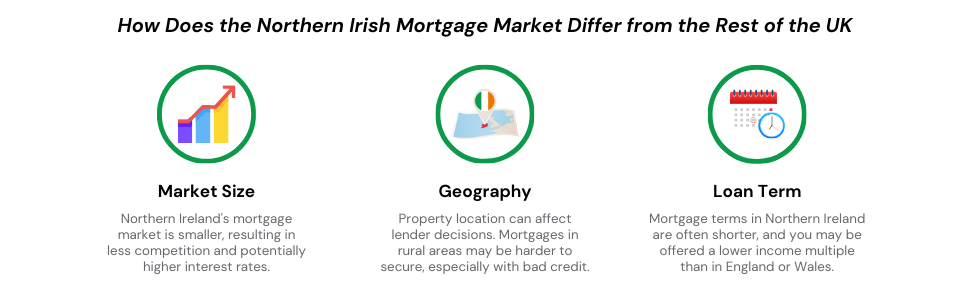

- How Does the Northern Irish Mortgage Market Differ from the Rest of the UK?

- How is Bad Credit Assessed in Northern Ireland?

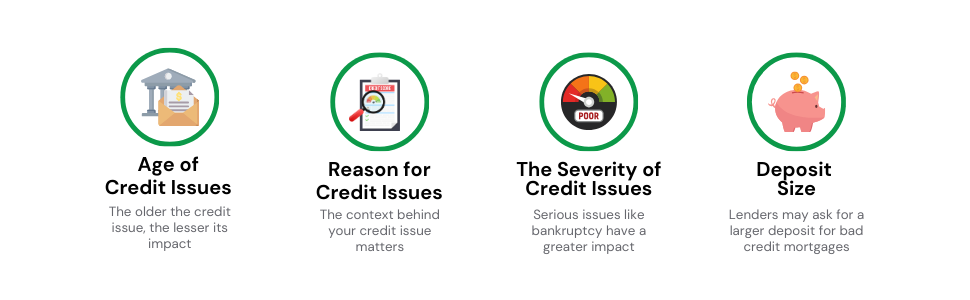

- What Factors Do Lenders Consider in Northern Ireland?

- Why Should You Consider a Local Bad Credit Broker?

- Which Lenders Offer Bad Credit Mortgages in Northern Ireland?

- Key Takeaways

- The Bottom Line

How To Get Bad Credit Mortgages in Northern Ireland?

Worried your credit history might stop you from buying a home in Northern Ireland?

Maybe you’ve had missed payments or debts, and now you’re unsure if a mortgage is even an option.

It can feel disheartening when you’re ready to settle down with your family but past financial issues hold you back.

This guide will make things clearer.

You’ll find out how bad credit mortgages work in Northern Ireland, what lenders look for, and why the market here is unique.

Plus, we’ll share tips to help you take steps towards owning the family home you’ve been dreaming about.

Can I Get a Bad Credit Mortgage in Northern Ireland?

Yes, but it does come with some challenges.

If your credit history has a few bumps, getting a mortgage in Northern Ireland might feel tricky. Here’s what you could face:

- Fewer mortgage options because the market in Northern Ireland is smaller.

- Lenders taking a closer look at your financial history, including missed payments, defaults, or bankruptcies.

- Higher interest rates compared to regular mortgages due to the added risk.

- A bigger deposit, often more than the usual 10%.

- Limited choices for lenders specialising in bad credit mortgages.

- A longer application process as lenders carefully check your details.

- Extra paperwork to prove your financial stability, such as steady income or reduced debts.

- Rejections from mainstream lenders, meaning you may need a specialist lender.

But don’t worry—it’s not all bad news. With the right advice and a lender who understands your situation, you could still get a mortgage.

But, it’s important to know that approval isn’t guaranteed, even with the help of a specialist broker.

What’s possible will depend on your situation and how lenders review your application.

The key is being informed, prepared, and open to exploring your options.

How Does the Northern Irish Mortgage Market Differ from the Rest of the UK?

The mortgage market in Northern Ireland has a few key differences compared to the rest of the UK. These can affect how lenders make their decisions:

- Market Size. The market in Northern Ireland is smaller, with fewer lenders to choose from. This means less competition, which can sometimes lead to higher interest rates.

- Property Location. Where the property is located matters. Some lenders are less willing to offer mortgages in rural areas because of postcode restrictions. This can make it harder to secure a mortgage outside bigger cities like Belfast or Bangor, especially if you have bad credit.

- Loan Terms. Mortgage terms in Northern Ireland are often shorter. Lenders may also offer lower income multiples compared to what’s available in England or Wales.

Knowing these differences can help you understand what to expect and prepare better when looking for a bad credit mortgage.

How is Bad Credit Assessed in Northern Ireland?

Lenders in Northern Ireland consider the applicant’s credit history when assessing applications, just like lenders elsewhere. But, they may apply stricter criteria due to the region’s higher average debt levels.

It’s important to note that every lender has its unique risk appetite and assessment procedures. Some may be willing to look past minor credit issues, while others might view the same issues as significant obstacles.

It’s a nuanced landscape where a decline from one lender doesn’t necessarily spell doom for your mortgage prospects.

The trick is to find a lender whose criteria you meet, which is where expert guidance can be invaluable.

What Factors Do Lenders Consider in Northern Ireland?

When evaluating mortgage applications in Northern Ireland, lenders typically consider the following factors:

- Age of Credit Issue. The older your credit issues, the less impact they may have. A financial misstep from several years ago is usually less concerning to lenders than a recent one.

- Severity of Credit Issue. Some forms of bad credit, such as bankruptcies, are difficult to overlook. But, minor issues like a missed payment may not be a significant hindrance.

- Reason for Credit Issue. Lenders may be more understanding if your credit problems were caused by unexpected life events, such as an illness or job loss. But, they may be more concerned about credit issues that resulted from poor financial management.

- Deposit Amount. Lenders may require a larger deposit if you have a history of credit issues. The exact amount may vary depending on the specifics of your credit history.

Why Should You Consider a Local Bad Credit Broker?

Getting a mortgage with a bad credit history can be a challenge. However, local bad credit brokers can play a crucial role in making this task more manageable.

Local brokers, especially those familiar with Northern Ireland’s specific financial conditions, have the knowledge and network to match you with the right lenders.

These experts understand the unique characteristics of the Northern Ireland market and have established relationships with local lenders.

Consequently, they can tailor their advice to your circumstances and connect you with the most suitable lenders, improving your mortgage chances.

If you need help with this, don’t hesitate to inquire with us. We’re more than ready to match you with a mortgage broker who can guide you through this process.

Which Lenders Offer Bad Credit Mortgages in Northern Ireland?

Northern Ireland’s bad credit mortgage market has many different lenders. Each one has its way of looking at bad credit. Understanding how each lender views bad credit can help when you apply for a mortgage.

For example, Finance Ireland looks at each case individually. But, they typically require any arrears from unsecured loans (like credit cards and overdrafts) to have been cleared for 2 years.

In contrast, any arrears from secured lending (e.g., a mortgage or hire purchase of a car) should be cleared for 4 years.

Halifax is another lender that operates in Northern Ireland. They consider lending to applicants with a default on a case-by-case basis, showing that they are open to some forms of bad credit.

Lastly, Natwest takes a more lenient stance towards County Court Judgements (CCJs). They consider applicants with a CCJ, provided it was registered more than a year ago.

What About Other Forms of Bad Credit?

If you have an active debt management plan, a handful of specialist lenders might consider your application. The condition here is usually that you approach via a broker.

The criteria for getting a mortgage after a debt management plan can vary from lender to lender. But usually, you will need to have waited at least 3 to 6 years since the end of your plan.

If you’ve had an Individual Voluntary Agreement (IVA) or bankruptcy, the situation could be trickier. Lenders in this niche generally expect them to have been discharged for at least 2-3 years before your application.

Key Takeaways

- Getting a bad credit mortgage in Northern Ireland is possible, but it’s not always straightforward. You might face fewer options, stricter checks, higher interest rates, and bigger deposit requirements.

- The Northern Irish mortgage market is smaller than the rest of the UK, which means fewer lenders to choose from. Lenders may also be cautious with rural properties due to postcode restrictions.

- Lenders assess bad credit based on the age, severity, and reasons behind it. Older or minor issues may be less of a problem, but serious or recent credit problems can make approval harder.

- Specialist brokers can improve your chances by connecting you with lenders who are more open to bad credit cases. But, approval is never guaranteed and depends on your individual circumstances.

The Bottom Line

There you have it!

Getting a mortgage with bad credit is not easy, especially with Northern Ireland where fewer lenders are available. That said, it’s definitely not out of reach.

There are specialist lenders who are open to helping people with bad credit. Of course, there are no guarantees, as everything depends on your unique circumstances and how lenders view your application.

That’s where a good mortgage broker comes in handy. They know the Northern Irish market inside out and can help you find realistic options while guiding you through the next steps.

Want to check your options? Reach out today, and we’ll connect you with a broker who gets what you’re going through and may help bring your homeownership dreams to life.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How easy is it to secure a mortgage in Northern Ireland?

Getting a mortgage in Northern Ireland depends on factors like your credit score, income, job, and the size of your deposit.

While many people can find a suitable mortgage with proper advice and planning, approval isn’t guaranteed. Lenders look at your full financial situation before deciding, so results can vary based on your circumstances.

Is there a minimum credit score requirement for mortgages in Northern Ireland?

Every lender is different. Some might require a minimum credit score, others look at your whole financial situation. Talking to a specialist broker can help you know your chances with different lenders.

Can I secure a mortgage in Northern Ireland with a past bankruptcy?

Bankruptcy can make it harder to get a mortgage, but it’s not impossible. Some lenders may consider you if enough time has passed since your bankruptcy.

While it’s not guaranteed that everyone will have mortgage options, speaking to a specialist broker with experience in bad credit can help you understand what might be possible for your situation.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.