A First Time Buyers Guide To Buy-To-Let Mortgages

Thinking about getting on the property ladder as a landlord?

Buy-to-let mortgages can be an option, even for first-time buyers.

Unlike a regular mortgage for your own home, a buy-to-let mortgage lets you purchase a property to rent out to tenants. This brings you a steady rental income stream and helps you build wealth over time.

To get started, here’s what you need to know about buy-to-let mortgages for first-time buyers.

Can First-Time Buyers Get a Buy-to-Let Mortgage?

Yes, you may secure a buy-to-let mortgage. But, there are some extra hurdles compared to experienced buyers.

Lenders see first-time buyers, defined as someone who has never owned a residential property, as more riskier because you haven’t rented out a property before.

Here’s what you need to know:

- Less experience in the property market. Since you haven’t bought or sold property before, lenders may be cautious about your understanding of the market.

- May have a smaller deposit saved. Many lenders require a larger deposit (typically at least 25%) for buy-to-let mortgages compared to standard residential mortgages.

- Might find it trickier to prove affordability. Since you won’t have a rental income history, lenders will dig deeper into your finances. They’ll want to know you can handle the mortgage payments even if the property sits empty for a while.

- Stamp Duty Tax Relief Isn’t an Option. If you’re buying a rental property, you won’t get first-time buyer stamp duty relief. This only applies to homes you’ll live in, with no tax on properties up to £425,000 (dropping to £300,000 in April 2025). But since this doesn’t apply to buy-to-let properties, you’ll need to budget for higher upfront costs, including standard rates and an extra 5% surcharge for rentals.

While it’s not impossible, getting a buy-to-let mortgage as a first-time buyer isn’t always straightforward.

Some lenders may be open to it, but others might prefer working with more experienced buyers.

If you’re serious about starting your property journey, it’s worth speaking to a mortgage adviser to explore your options and get tailored advice.

How To Get A Buy-To-Let Mortgages As A First Time Buyer?

As discussed, it’s trickier to get a buy-to-let mortgage for first-time buyers, but it’s not impossible. Here’s how:

1. Assess Your Eligibility

To qualify for a buy-to-let mortgage, here’s what you need to know:

- You need a deposit of 25-40% of the property price; sometimes 20% works but it’s rare.

- A good credit score is key to showing lenders you’re reliable.

- Your expected rental income should be 25-30% more than your mortgage payments for a safety margin. This means rental income must cover 100% of the loan, with 25%-30% on top of it.

- Your personal income must be stable to cover the mortgage during empty periods.

- Age limits usually apply: you need to be at least 18 or 21, and not older than 70 or 75 at the mortgage’s end.

- Lenders check all your finances, including debts, to see if you can afford the mortgage.

- If you’re a non-UK resident, you may face additional criteria or restrictions.

Don’t worry if you’re not ticking every single box. Different lenders have different rules, and there might be some wiggle room.

For example, a bad credit score might not be a deal-breaker if you’ve got a strong plan for the rental income or can put down a bigger deposit

2. Get Ready With Your Finances

Buy-to-let mortgages require large upfront costs. This may include:

- Deposit – As mentioned earlier, expect a higher deposit requirement (25-40%) compared to standard residential mortgages.

- Mortgage Fees – These can vary depending on the lender and the size of the mortgage. Typically, application fees range from £150 to £500, and arrangement fees might be a fixed amount or a percentage of the loan (usually 0.5% to 1%).

- Property Surveys– Before buying, you’ll want a professional to check the property’s condition. Surveys can cost between £400 and £700.

- Solicitor Fees – Legal conveyancing fees (property transfer) are a necessary expense.

- Stamp Duty – This is a government tax on property purchases. For buy-to-let properties, there’s an additional 5% surcharge on top of the standard rates. The exact amount depends on the property price.

- Landlord Insurance – While not mandatory, landlord insurance protects you against unexpected events like damage caused by tenants. Expect to pay several hundred pounds per year, depending on the level of coverage.

- Letting Agent Fees (Optional) – If you choose to use a letting agent to manage finding tenants and property upkeep, factor in their fees.

- Ongoing Costs – Budget for property taxes, maintenance costs, potential repairs, and vacancy periods where you might not have rental income. For repairs and maintenance, expect to set aside around 1% of your property’s value each year. So, a £200,000 property would need a roughly £2,000 annual budget for repairs.

Having a buffer for these expenses is highly recommended.

To get an idea of how much you can afford, use the buy-to-let calculator. It gives you an estimate of your monthly repayments and an idea of how much you may borrow.

Once you’ve got these costs sorted out, you must be prepared to show evidence of stable income and projected rental income from your property.

But before that, you must get to know about which buy-to-let property you want.

3. Search The Market

Lenders usually prefer properties and areas with a strong rental market, as these are seen as less risky investments. They prefer properties that appeal to a broad range of tenants and can maintain steady rental income.

To start your search, check out places with high rental demand. Good spots are often near trains, buses, or big employers like universities or companies.

Make sure to think about what tenants are looking for. Some might prioritise a flat near their workplace, while others might need a family-sized home.

Another thing is to identify your tenants— families, students, or young professionals. And from there pick a property size, number of bedrooms, and amenities that suit their needs.

Once you’ve settled on a property type, research the average rental rates in your chosen area.

There are a few ways to find buy-to-let properties. Online property portals like Rightmove or Zoopla let you search specifically for “investment” or “buy-to-let” listings.

Letting agents can also be helpful, particularly those specialising in your target area. They might even have access to properties not yet advertised publicly (off-market).

To see if a property is worth the investment and meets the rent needed for a buy-to-let mortgage, try the rental yield calculator.

4. Prepare All The Necessary Documentation

This can vary depending on your lender’s requirement, but here’s a general list to get you prepared:

- Rental income evidence such as rental valuations from letting agents or comparable rental listings in the area.

- Proof of Identity such as passport or driving licence, recent utility bill or council tax statement to confirm your address.

- Proof of income such as Payslips (P60s for employed) for the last 3-6 months, or your latest self-assessment tax return (SA302), and business accounts for the last 2-3 years if self-employed.

- Bank statements for the past 3-6 months showing your regular income and outgoings.

- Proof of deposit such as bank statements showing the source and availability of your deposit funds.

- Property details from estate agents, including property address, and valuation report from a qualified surveyor.

- Business plan (Optional) – While not mandatory, a well-structured business plan outlining your investment strategy, property costs, and potential risks can strengthen your application and demonstrate your preparedness as a landlord.

- Your credit report – Although you might not need to submit this yourself, it’s wise to check your credit report in advance. Lenders will review this to assess your creditworthiness.

Additional Documents You Might Need:

- Proof of any benefits you receive.

- Documentation of any existing debts or loans.

- If you’re applying jointly, proof of income and identity for your co-applicant.

It’s always best to check with the specific lender you’re applying with for their exact requirements. They may have additional documents they need to see.

4. Choose The Right Mortgage Type

There are two main types of buy-to-let mortgages: interest-only and repayment. Here’s an overview:

- Interest-only – Lower monthly payments sound tempting but remember – you’re only paying the interest, not the loan itself. This means the total amount you owe stays the same. If property prices fall, you might struggle to sell and repay the full mortgage when the time comes.

- Repayment – With repayment mortgages, your monthly payments cover both the interest and some of the loan amount. This means you gradually own more of the property over time. While the monthly payments are typically higher, you’ll eventually own the property outright.

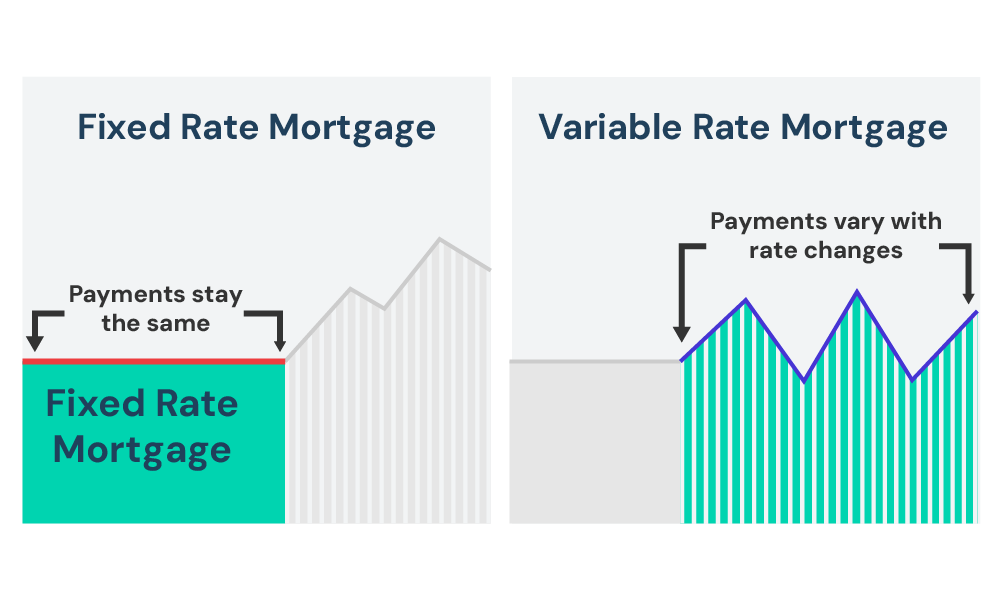

You also have fixed and variable rates to consider.

Fixed-mortgage rates keep your payments the same for a set period, which can make budgeting easier.

Variable mortgage rates can go up or down, which might save you money or cost you more, depending on interest rates.

As a first-time buyer, be prepared that you might face higher interest rates for buy-to-let mortgages. Lenders often see first-timers as a bit more of a gamble, so they might charge you more.

5. Apply Through A Mortgage Broker

A mortgage broker can be a big help, especially with tricky buy-to-let mortgages for first-time buyers.

They can get you deals you might not find on your own, saving you cash. They’ll look at lots of mortgage options to find the best one for your budget and what you want to achieve.

During the application, brokers come into their own. They’ll handle the paperwork and talk to the lender for you, making sure everything’s filled out right.

If there are any bumps along the way, they know how to sort them out. Plus, they can explain all the mortgage jargon in simple terms, so you know exactly what’s going on.

Need a broker? Reach out to us for a free, no-obligation consultation with a buy-to-let mortgage broker to start your journey.

6. Consider the Long-Term Commitments

Being a landlord comes with rewards, but also responsibilities. Here’s what to think about:

- Conduct Safety Checks – Make sure a registered engineer instals and maintains your gas and electrical equipment safely, including regular gas safety inspections.

- Provide an Energy Performance Certificate (EPC) – Give your tenants an EPC, which shows how energy efficient your property is. This should meet the EPC rating E or higher before letting tenants.

- Install Smoke and Carbon Monoxide Alarms – Put smoke alarms on every floor and carbon monoxide alarms in rooms with solid fuel appliances.

- Protect Deposits – Keep any deposits from tenants in a government-approved tenancy deposit scheme.

- Perform Right to Rent Checks – In England, ensure your tenants have the legal right to rent by checking their status.

- Handle Property Repairs – Take care of repairs to the property’s exterior, structure, and essential systems like heating and hot water.

- Treat Tenants Fairly – Avoid discrimination, follow eviction procedures correctly, and apply rent increases fairly.

- Acquire Necessary Licence – Some rental properties, depending on their location and type, require a landlord licence.

- Issue a Tenancy Agreement – Give your tenants a written agreement that clearly states both parties’ rights and responsibilities.

- Resolve Tenant Complaints Promptly – Quickly address and fix any issues your tenants report.

Beyond these landlord responsibilities, you must also make sure you will pay your mortgage repayments, even if you face periods without rent. Missing payments could lead to repossession of the property.

A Note on Regulation

Most buy-to-let mortgages aren’t regulated by the Financial Conduct Authority (FCA). This means they might offer fewer protections compared to residential mortgages. Be sure to understand the terms carefully before committing.

7. Seek Advice From Solicitors

Use a solicitor when buying your first buy-to-let property. These legal experts will guide you through the purchase process.

They’ll check documents to ensure you understand the deal and uncover any issues like boundary disputes. They can fix any legal problems before they become bigger.

Finally, they’ll handle transferring ownership from the seller to you, ensuring everything is done correctly.

8. Finalise The Deal

Once you’ve got your mortgage offer and checked everything with your broker and solicitor, you’re nearly there. Your solicitor will sort out swapping contracts with the seller.

When this happens, you’re both locked into the deal, and you’ll pay your deposit.

Next, your solicitor double-checks everything to make sure there are no surprises with the property.

If it’s all good, the money you’re borrowing is sent over to the seller’s side, and the keys are handed to you. Now, the place is yours to rent out.

Finally, your solicitor will make it official by registering you as the new owner with the Land Registry.

It’s important to keep in touch with your solicitor and lender during all this to make sure everything goes to plan.

First-Time Buyer Schemes and Buy-to-Let Mortgages

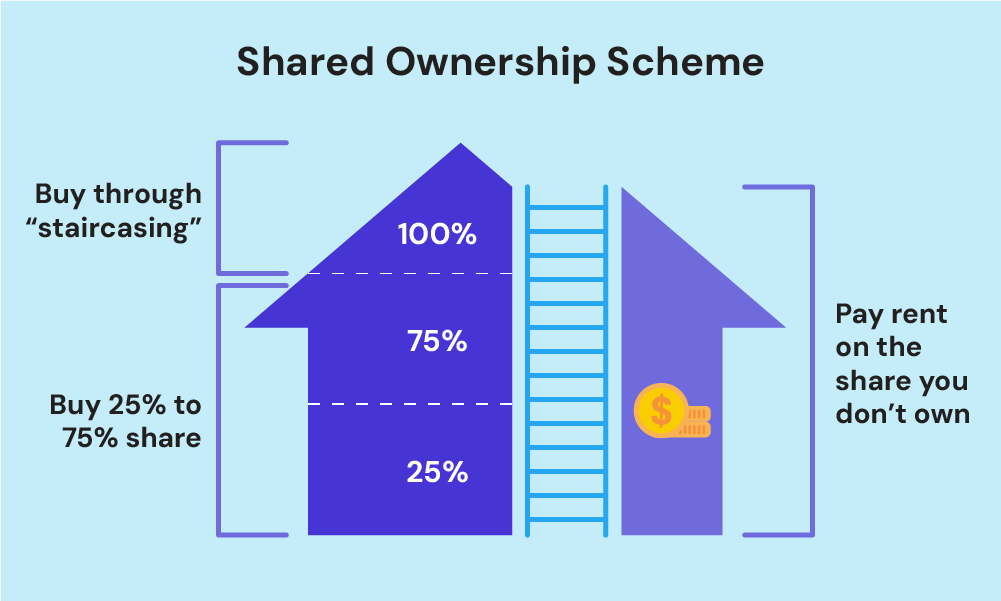

Most first-time buyer schemes in the UK, like Help to Buy and Shared Ownership, are for buying your own home to live in, not as buy-to-let investments. These schemes have strict rules – you must live in the property you buy.

For buy-to-let properties, there’s no specific government scheme for first-time landlords, but lenders offer buy-to-let mortgages.

However, these can be tougher to get. Lenders may ask for a bigger deposit, charge higher interest rates, and have stricter checks as they see you as a higher risk.

Alternatives for First-Time Buyers with Challenges

Getting a buy-to-let mortgage as a first-time buyer can be trickier. If you have a small deposit or a limited credit history, there are a few options to consider:

- Mortgage guarantor. With a guarantor, someone agrees to cover your repayments if you can’t. However, this option might be limited to buy-to-let purchases.

- Joint investment. Teaming up with another person to buy a property together can help you access a bigger deposit and improve your chances of getting a buy-to-let mortgage.

Key Takeaways

- Buying a buy-to-let as a first-time buyer is challenging but possible. Lenders see you as higher risk, so expect stricter checks, bigger deposit requirements (25-40%), and no stamp duty relief for rental properties.

- To qualify, you’ll need a good credit score, stable income, and projected rental income covering 125-130% of mortgage payments. Lenders will also review your debts and may require proof of your deposit funds.

- If meeting lender criteria feels tough, options like using a guarantor or buying with a partner can boost your chances. While there aren’t specific schemes for first-time landlords, some lenders offer flexible solutions.

The Bottom Line

Being a landlord can be rewarding, but remember it’s a financial commitment. Before you jump in, ask yourself these 3 questions:

- Can I afford the upfront costs and ongoing expenses of a buy-to-let property?

- Am I ready to take on the responsibilities of being a landlord?

- Does the rental income cover the mortgage payments and leave a profit?

As a first-time buyer, it might be harder for you to figure out all the answers by yourself.

To solve this–engage with a buy-to-let mortgage for personalised advice. They can assess your situation and recommend the best mortgage options for you. In this way, you can save time, stress, and potentially money.

We get how time-consuming it is to search for the right broker. With so many options to choose from, it’s hard to know which one you should trust.

For a faster and free service, we recommend reaching out to us. We’ll connect you with a reputable mortgage broker who can help you secure financing for your buy-to-let purchase as a first-time buyer.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can a guarantor help me get a buy-to-let mortgage?

Guarantors can be helpful for some mortgages, but it’s less common for buy-to-let. Lenders may prefer a larger deposit or a strong financial track record for buy-to-let purchases.

Can I get a buy-to-let mortgage with bad credit?

It might be challenging, but not impossible. Speak to a mortgage broker who specialises in buy-to-let. They can assess your situation and suggest suitable options. Be prepared for stricter criteria and potentially higher interest rates.

Can I live in a buy-to-let property I purchase?

No. Buy-to-let mortgages are for investment properties that must be rented out to tenants. Living there yourself breaches the mortgage agreement and could lead to repossession.

What if I want to live on the property in the future?

You can consider remortgaging the property to a residential mortgage product once your circumstances change.

Can first-time buyers get a holiday let mortgage?

There are a limited number of lenders offering holiday let mortgages to first-time buyers. Expect stricter criteria and higher deposits compared to standard buy-to-let options.

Can I rent out a room in my own home?

Yes, you can take in lodgers. However, there might be tax implications and limitations depending on your tenancy agreement. Speak to a letting agent or mortgage advisor for specifics.

Can I switch my current mortgage to a buy-to-let mortgage?

Potentially, but it depends on your lender and the terms of your existing mortgage. Speak to your mortgage provider to discuss possibilities.

>> More about Switching a Buy-to-Let Mortgage

What about taxes on buy-to-let income?

Rental income is considered taxable income. You’ll need to register for self-assessment and pay Income Tax. Capital gains tax might also apply when you eventually sell the property.

>> More about What Buy-to-Let Taxes You Have To Pay?