Your Guide to Proving Income for Buy-To-Let Mortgages

Every mortgage starts with proving your income.

For buy-to-let mortgages, it’s key to show that your rental income can easily cover the mortgage payments.

Whether you’re new to investing or want to grow your portfolio, knowing what lenders want is crucial.

This guide will clearly explain what you need to show to get your mortgage.

We’ll cover everything from the lender’s criteria to the financial documents required, making sure you’re ready to meet lender expectations.

What Lenders Want from You

Lenders have a checklist for anyone looking to get a buy-to-let mortgage. For starters, here are things you need to know:

- Your potential rental income is ideally 125-145% of what you’ll pay on the mortgage. (Also known as rental yield)

- You’re at least a certain age, often 25 years old.

- You live in the UK, making it easier for them to check your finances. Some lenders might consider non-residents but under stricter conditions.

- Your deposit can cover 20-25% of the property’s value.

- You have a clean credit history that shows you’re good with money.

- Some lenders might also want you to earn at least £25,000 a year on top of the rental income.

- Owning another property could help show you know what you’re doing with property. (Depends on the lender)

1. Know Your Potential Rental Income

To get a buy-to-let mortgage, you need to know how much rent you can realistically charge.

Lenders want your rent to cover your mortgage payments with a buffer, usually 125% to 145%. For instance, with a £800 monthly mortgage, you’d need a minimum rent of £1,000 (1.25 x £800).

Start by looking at rental prices for similar properties in your area on websites like Rightmove or Zoopla.

But for a more accurate estimate, talk to local letting agents. They know current market rates and can value your property based on its features and location.

Remember to factor in vacancy periods, letting agent fees, and maintenance costs when estimating your rental income. These can affect your profit, so account for them in your calculations.

2. Sort Out Your Tax Papers

Start by gathering your SA302 forms and P60.

For self-employed individuals, your SA302 is a summary from HMRC that shows your income and the tax you’ve paid on it.

You can download it from your HMRC online account or request it directly from HMRC.

On the flip side, P60 is for employed individuals. It’s a statement from your employer outlining your annual earnings and the tax deducted.

These documents prove to lenders that your income is consistent and taxed appropriately, highlighting your reliability and financial stability.

3. Get Your Bank Statements Ready

Get your bank statements in order for your buy-to-let mortgage application. They show lenders how you manage your money, how much you earn, and most importantly, if you can afford the deposit.

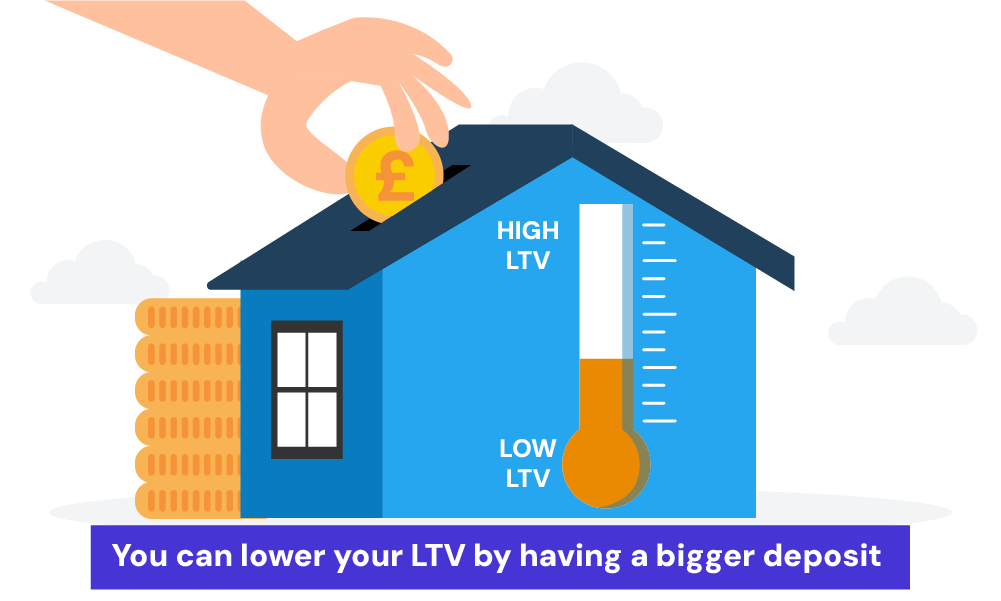

Buy-to-let mortgages typically require a 20-25% deposit. This lowers the loan-to-value ratio (LTV), making you a less risky borrower and potentially qualifying you for a better interest rate.

Show the bank statements with steady income and savings.

Lenders want to see responsible money management and confidence that you can afford the mortgage payments, even when the property is vacant.

4. Show Your Employment and Income

Prepare to show proof of your income for your buy-to-let mortgage application:

- Employed applicants – Show your recent payslips and a confirmation of employment letter from your employer to prove steady income.

- Self-employed applicants – Provide your financial statements and business accounts, ideally checked by an accountant, to demonstrate your earnings.

- Professional landlords – Show proof of income from your rental properties and discuss your portfolio with lenders to improve your mortgage prospects.

5. Showcase Your Assets

Highlighting your assets is a smart move in bolstering your buy-to-let mortgage application.

Consider which assets demonstrate your financial stability best. This could be property, savings, investments, or other valuable items.

Prove you have other savings or investments with bank statements, property deeds, or investment statements.

This shows lenders you have a financial safety net and can handle the mortgage even during difficult times, making you a more attractive borrower.

6. Check Your Credit History

Before applying for a buy-to-let mortgage, check your credit history. Get reports from credit agencies like Experian, Equifax, and TransUnion.

Look for any mistakes like wrong debts or payments and get them corrected by contacting the agency.

A good credit score shows you’re a reliable borrower and helps your application. If your score is low, try to improve it by paying off debts or fixing errors on your report.

7. Listing Your Property Investments

List your existing property investments if you have any. This can strengthen your application for a buy-to-let mortgage.

Lenders might ask for accounts related to your other properties or your self-assessment tax return to understand your rental income better.

There’s no set number of properties required, but some lenders might have limits.

8. Wrapping Up Your Application

Before you send off your buy-to-let mortgage application, take a moment to ensure you’ve got all the necessary paperwork in order. You should have:

- SA302 forms or tax overviews if you’re self-employed.

- Your P60 to show your annual income and tax paid if you’re employed.

- Recent bank statements, highlighting your income and savings.

- Proof of your deposit, showing you’ve got the required 20-25% of the property’s value.

- Employment verification or business accounts, depending on whether you’re employed or self-employed.

- A detailed credit report from agencies like Experian, Equifax, or TransUnion.

- Information on any other properties you own, including rental income and mortgage details.

Remember, lenders often give more weight to the potential rental income of the property than your personal income.

They want to see that the rent you plan to charge can comfortably cover the mortgage payments, usually around 125-145% of the mortgage cost.

So, when you present your case, highlight the rental income potential clearly. It’s also wise to show you’ve thought about risks, like periods when the property might be empty, and how you’d handle them. This approach shows lenders you’re a thoughtful and reliable investor.

Key Takeaways

- Lenders want to see that the rent you’ll charge will cover 125-145% of the mortgage payment, so it’s a good idea to check what similar properties in your area are renting for.

- Get your income proof ready—whether it’s SA302 forms if you’re self-employed or a P60 if you’re employed—to show you’ve got a steady financial history.

- Your bank statements should tell a story of stable income and savings. They’ll also help prove you can handle the deposit and any quiet months with no rental income.

- A solid credit history is a big deal. Check your reports for mistakes, fix any issues, and do what you can to bump up your score before applying.

- If you’ve got other properties or investments, show them off! They reassure lenders that you’ve got experience and a safety net if things get tough.

- Be ready to back up your income claims, whether it’s with payslips, business accounts, or proof of rental income from your other properties.

The Bottom Line

Getting ready for a buy-to-let mortgage means understanding exactly what lenders want.

It’s about showing them you’re a safe bet with a solid income, reliable rental income forecasts, and a clear financial history.

However, buy-to-let mortgages can be tricky. The best way to make things much easier and quicker is to talk to a mortgage broker.

They can guide you through the process, making sure you tick all the right boxes. They can save you a lot of time, hassle, and potentially money in the long run.

So, if you’re thinking about getting into the buy-to-let market, why not give yourself the best start?

Get in touch with us today. We can connect you with a top-notch buy-to-let mortgage broker who’ll make the journey smoother and successful.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I use my personal income to cover rental shortfalls?

Yes, you can use your personal income to cover any gaps in rental income, known as top-slicing. Lenders will assess your overall financial stability to ensure you can afford this.

Can I get a buy-to-let mortgage if I'm retired?

Yes, retirees can get buy-to-let mortgages. The key is to show you have enough pension income or other savings to cover the mortgage repayments.

For people over 55, you can even tap into your pension to fund a buy-to-let investment, with the initial 25% being tax-free.

Unlike regular mortgages that might be harder to get in retirement, buy-to-let mortgages are often easier for retirees. This is because they’re seen as investments, not loans based on your current income or age.

If you’re considering this option, talking to a mortgage specialist is a good idea. They can help you navigate the process and make informed decisions.

Can I get a buy-to-let mortgage while on benefits?

Yes, you can apply for a buy-to-let mortgage while on benefits, but there are fewer lenders to choose from, making it more challenging.

Lenders will review your overall financial situation, so having additional income or savings alongside benefits can strengthen your application.

It’s crucial to show that the expected rental income can comfortably cover mortgage payments.

Can I get a buy-to-let mortgage without income or a job?

Yes, it’s possible to get a buy-to-let mortgage without a job or regular income, but it’s more difficult. Fewer lenders offer these types of mortgages because they see them as higher risk.

Without a job, you’ll need to prove that the rental income from the property will be enough to cover the mortgage payments.

Lenders might also look for additional financial security, such as a larger deposit or existing assets.