- What is a Commercial Remortgage and How Do They Work?Â

- Should You Remortgage Your Commercial Property?

- Can You Remortgage to Release Equity from Your Commercial Property?

- What Criteria Affect Commercial Remortgage Eligibility?

- How To Remortgage a Commercial Property?

- Choosing the Right Lender for Your Commercial Remortgage

- Common Pitfalls in Commercial Refinancing and How to Avoid Them

- Key Takeaways

- The Bottom Line

A Definitive Guide to Commercial Remortgages: 2024

Remortgaging a commercial property is similar to a residential one, often done for several important reasons.

You might want to get a better deal, lower your payments, or free up some cash out of your property.

The main difference is that it’s for your business space, not your home.

Whether you run a business, invest in properties, or develop them, your main goal with remortgaging is probably to save money.

We’ve put together this guide to give you the key info you need about commercial remortgages. This way, you can go through the process smoothly and make the best choice for your business.

What is a Commercial Remortgage and How Do They Work?

Commercial remortgage involves changing the terms of your property loan. This could mean getting a new loan to pay off the old one.

You can renegotiate your loan terms with your current lender or a new one, aiming for lower rates or better terms.

The process is more in-depth than residential mortgages, with lenders carefully assessing your business’s finances to determine your ability to repay.

This might allow you to borrow more than your business profits suggest.

Overall, commercial remortgaging helps businesses secure better loan terms, free up equity from the property for further investment, or grow their operations.

Should You Remortgage Your Commercial Property?

The answer to this lies in your situation and decision. To help you decide, let’s look at the pros and cons:

Pros

- Lower Your Mortgage Rates. If rates have dropped since you got your original mortgage, remortgaging can save you money over time.

- Access Your Home Equity. You can free up cash tied up in your property for business expansion or paying off other debts.

- Get Better Loan Terms. You might find a deal with more favourable terms, like a longer repayment period or more flexible payment options.

- Consolidate Your Debts. Combining several debts into one loan with a lower rate can simplify your finances and reduce monthly outgoings.

Cons

- Prepare for Extra Costs. Remortgaging involves various fees, such as legal fees, valuation fees, and possibly early repayment charges on your existing mortgage.

- Higher Rates for Poor Credit. If your credit score has dropped, you might not qualify for the best rates, making the new loan more expensive.

- Property Valuation Risks. A lower-than-expected property valuation can affect the loan-to-value ratio and the terms you’re offered.

- Long-Term Costs. If you extend the loan term to lower monthly payments, you might pay more in interest over the life of the loan.

Can You Remortgage to Release Equity from Your Commercial Property?

Yes, you can remortgage your commercial property to access its equity. This process involves getting a new mortgage that’s larger than what you currently owe.

The difference is given to you in cash. It’s a useful way to get funds for reinvesting in your business, paying off debts, or supporting business growth.

However, you can’t take out all the equity. Lenders usually require you to leave a certain percentage, 25% of the property’s value untouched. This is known as the minimum equity requirement. It’s their way of keeping the loan safe.

When considering this option, think about how you’ll use the equity. Will it go towards something that grows your business?

Also, remember that taking out equity increases your loan amount. Make sure the benefits outweigh the costs.

What Criteria Affect Commercial Remortgage Eligibility?

When it comes to remortgaging your commercial property, several factors come into play.

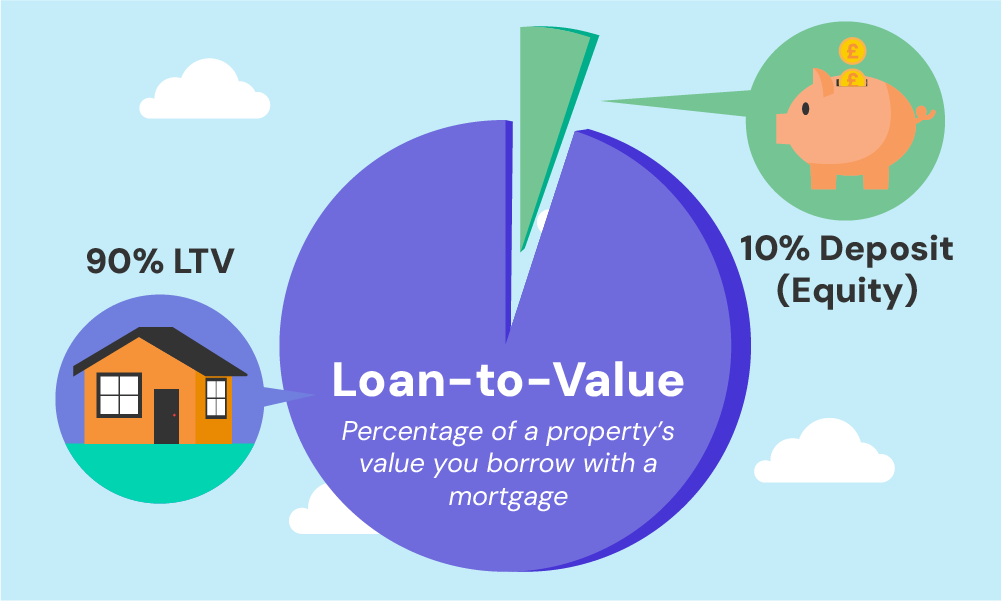

Your Loan-to-Value (LTV) ratio is crucial. It indicates the portion of your property covered by your loan. A lower LTV usually opens up better options, making lenders more comfortable.

Your business’s performance is key. Strong earnings and a solid credit history signal to lenders that you’re good for the loan. They need to trust you can handle the repayments.

The nature of your business and the property itself also matter.

Certain types of industries might be deemed riskier, affecting your chances with some lenders. This might narrow down your options for competitive rates and terms.

Digging a bit deeper, your business’s track record can play a significant role.

If you’ve been in business for years and have a history of success, you could access more favourable rates. It’s about proving your reliability over time.

Additionally, the equity you’ve built up in your property can influence your refinancing options.

More equity means a better LTV ratio, potentially leading to better offers from lenders. It shows you’ve already invested significantly in the property.

Lastly, don’t worry too much if your credit history isn’t perfect.

While a clean record is preferred, many lenders will consider the context of any issues. They’ll look at when and why problems occurred, assessing how much of a risk they pose.

In summary, remortgage eligibility isn’t just about numbers. It’s about your business’s story — where it’s been, how it’s doing now, and where it’s headed.

Show lenders a picture of stability, growth, and responsible ownership, and you’ll find the path to refinancing a bit smoother.

How To Remortgage a Commercial Property?

Commercial remortgage can be a complex process, especially without the help of an expert mortgage broker. As a general guide, here’s how can go about it:

1. Review Your Current Mortgage

Check the terms of your existing loan to understand any penalties for early repayment. Knowing where you stand will help you decide if remortgaging is worth it.

2. Assess Your Needs

Identify why you want to remortgage. Do you need lower rates, more flexible terms, or access to cash for business growth? Your goal will guide the process.

3. Gather Financial Information

Be prepared with your business’s financial records, including profit and loss statements, balance sheets, and tax returns.

Lenders will review these to assess your ability to repay the new mortgage.

4. Check Your Credit Score

Your credit history is crucial in securing a good deal. Access your free credit reports in these credit agencies – Experian, Equifax, and TransUnion.

If there are any errors on your credit report, get them fixed before applying.

5. Get Your Property Valued

Understanding your property’s current market value is key.

It affects your Loan-to-Value (LTV) ratio, which is a significant factor in determining your eligibility and the terms lenders will offer.

6. Shop Around

Don’t just go with your current lender without checking what else is out there. Compare rates, terms, and fees from different lenders to find the best deal for your situation.

7. Consider Using a Broker

A commercial mortgage broker can be invaluable. They have the expertise and contacts to find you a deal that matches your needs and can negotiate on your behalf.

8. Apply

Once you’ve chosen a lender, fill in the application form accurately and provide all necessary documentation.

Be ready for the lender to conduct a thorough appraisal of your property and finances.

9. Legal Checks and Finalisation

Engage a solicitor for this critical step. They’ll manage legal checks, ensure all paperwork is correct and advise you before signing the new mortgage agreement.

10. Completion

After signing, there will be a period while the new mortgage is set up and your previous mortgage is paid off.

Once completed, you’ll start making payments on your new mortgage.

Choosing the Right Lender for Your Commercial Remortgage

In the UK, you can choose between high-street banks and specialist lenders for commercial refinancing.

High street banks offer familiarity and potentially lower rates. Specialist lenders, however, might be more flexible with their terms, especially for unique situations.

When comparing offers, look at the interest rates, loan terms, and any fees involved. Don’t just go for the lowest rate without considering the overall loan cost and flexibility.

Using a broker can make a big difference. They know the market inside out and can match you with the best lender for your specific needs. They can also help negotiate better terms on your behalf.

Common Pitfalls in Commercial Refinancing and How to Avoid Them

Not Understanding Fees and Penalties

Early repayment charges on your current mortgage can add up quickly. To avoid this, carefully review your loan agreement and don’t hesitate to ask your lender to explain any terms you’re unsure about.

Underestimating Property Valuation

Your loan terms heavily depend on how much your property is worth. A valuation that comes in lower than expected can limit your refinancing options, leading to less favourable terms.

Before you begin the remortgaging process, get a professional valuation. This way, you’ll have realistic expectations.

Not Shopping Around

Loyalty to your current lender or the convenience of sticking with what you know might seem appealing, but it could cost you.

Always compare offers from multiple lenders. Consider high-street banks, online lenders, and specialist financial institutions.

Each can offer different benefits, and shopping around ensures you find the best terms that fit your business needs.

Ignoring Long-term Costs

Lower monthly payments might seem great, but if they come with a longer repayment period, you could end up paying more in interest over the life of the loan.

Consider both the immediate benefits and the long-term impact when choosing your refinancing option.

Key Takeaways

- Remortgaging your commercial property can help you get a better deal. You could get lower interest rates, better payment terms, or pull cash out of your property to help your business grow.

- To qualify, your loan value ratio, how well your business is doing, your credit, and what your property’s like all matter.

- Picking a lender means looking at different options and getting a broker’s help for the best deal.

- Avoid mistakes by knowing all costs, getting your property valued, comparing offers, and thinking about long-term impacts.

The Bottom Line

While commercial remortgage can save you money and help grow your business, the process and options can be complex.

To simplify your journey, work with a commercial mortgage broker. They can offer personalised advice tailored to your unique situation, helping you make the best decision for your business’s future.

Looking for the right broker? Get in touch with us. We’ll set up a free, no-obligation consultation with a commercial mortgage broker to help you kickstart your remortgage process.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I remortgage if my business is new?

Yes, you can, but expect more challenges. Lenders usually prefer businesses with a proven track record. But, showing strong potential, a solid business plan and a stable income can improve your chances. Start by building a good financial foundation and seek advice on making your application stronger.

Will I save money by remortgaging?

Yes, in many cases, remortgaging can cut costs. Lower interest rates or improved terms reduce your monthly payments and overall interest.

It’s about finding a deal that matches your current needs better than your original mortgage. Always calculate the potential savings against any fees involved in remortgaging to see the full picture.

Can I remortgage with bad credit?

Yes, it’s possible, though harder. Some lenders focus on helping businesses with challenges in their credit history. You might face higher interest rates or need to provide additional security.

Improving your credit score before applying and being transparent about your financial history can also help. Consider seeking advice on how to present your case to lenders.

>> More about Remortgaging With Bad Credit.

Do I need a broker for a commercial remortgage?

No, but it’s often beneficial. A broker can save you time and hassle by finding deals that fit your situation.

They understand the market and can negotiate terms on your behalf. If you’re unsure where to start or how to get the best deal, a broker can be a valuable ally.

They can also offer insights into how different lenders view your application, increasing your chances of approval.