HMO Mortgages Explained: Are They Right For You?

Nowadays, the idea of counting on the government for your pension seems a bit old hat.

With the UK’s economy being as wobbly as a jelly on a fast train, putting your money in the right place has never been more important.

Perhaps you’re itching to boost your income, save more dosh, and have a solid plan B for whatever the future throws at you.

Either way, you’re looking to invest in real estate.

You’re eyeing up the idea of snapping up a property or turning one you’ve already got into an HMO (House in Multiple Occupation).

But, there’s a snag – the funds just aren’t there, and it feels like your hands are tied.

Don’t worry, this guide helps you understand all about HMO mortgages and see if this is the right option to finance your property.

What is an HMO?

An HMO, or House in Multiple Occupation is a property where 3 or more people live together but aren’t a family.

This setup is popular with students and young professionals because it’s cheaper than living alone. It includes various types of shared housing, such as bedsits, hostels, and employee housing.

If you’re looking to rent out your property, making it an HMO could give you more income than renting to just one person or family.

However, it’s a bit more complex. You’ll need to follow specific rules and might need a special licence.

What Are HMO Mortgages?

An HMO mortgage is a specific type of buy-to-let mortgage designed for properties that will be rented out to multiple tenants from different households, known as Houses in Multiple Occupation (HMOs).

Generally, you can get an HMO mortgage through specialist lenders in the UK. They take into account the higher rental income you might earn and the unique challenges of having several unrelated tenants under one roof.

HMO mortgages often operate on an interest-only basis. This means your monthly payments only cover the interest, not the loan’s principal amount.

This setup is due to the potential for higher earnings from multiple tenants, balanced against the complexities and rules of managing an HMO.

Who Can Apply?

If you’re thinking about getting an HMO mortgage in the UK, here are the key things you need to know to qualify:

- Property Owners. You need to own a property that qualifies as an HMO or be looking to purchase one.

- Income Proof. Lenders will ask for evidence of your income to ensure you can afford the mortgage payments.

- Credit History. A good credit score is important. It shows lenders you’re reliable at managing your finances.

- Experience as a Landlord. Some lenders prefer you to have experience in renting out property, but it’s not always a must.

- Deposit. You’ll likely need a larger deposit for an HMO mortgage compared to a standard mortgage, often around 25% of the property’s value.

- Age. Most lenders have age limits, usually you need to be at least 18 years old to apply, and there might be an upper age limit for when the mortgage term ends.

- UK Resident. You should be a UK resident, or have a strong UK connection, such as a history of living or working in the UK.

Meeting these criteria doesn’t guarantee you’ll get an HMO mortgage, but it’s a good start.

Each lender has its specific requirements, so it’s worth shopping around or speaking to a mortgage broker who specialises in HMOs.

HMO Mortgage Rates

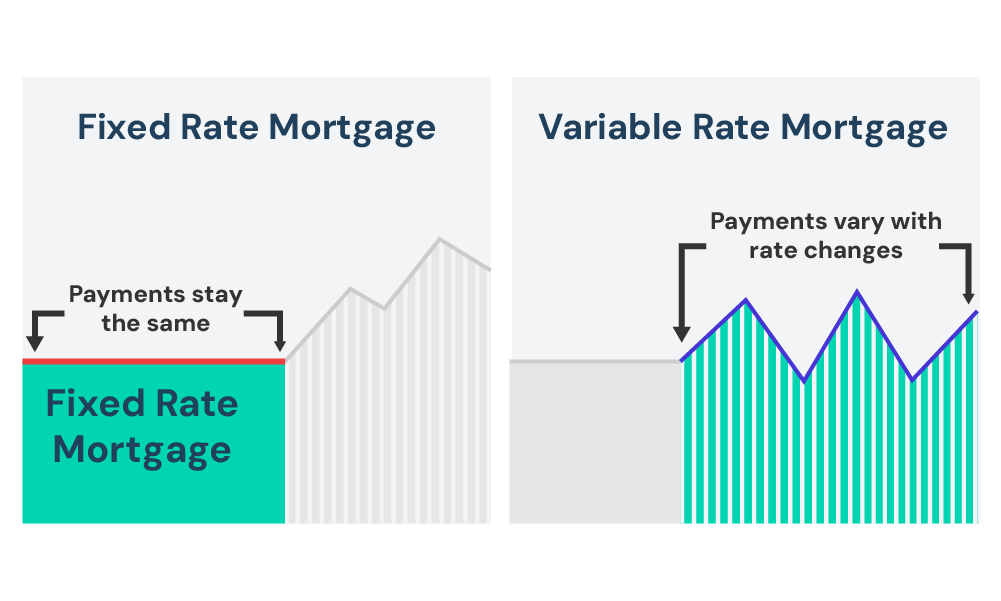

The type of HMO mortgage you choose—fixed or variable—can change how much you pay each month and how well your investment works out in the long run.

Fixed Rate Mortgage

With a fixed-rate mortgage, your monthly payment stays the same for a set period, no matter what happens to interest rates. This makes it easier to plan your spending because you always know how much you’ll need to pay.

The downside? If interest rates drop, you won’t get to enjoy lower payments because your rate is locked in.

Variable Rate Mortgage

A variable-rate mortgage is different because your payments can go up or down, depending on changes to the lender’s main rate.

The good news is that if rates drop, you might pay less. But the flip side is that if rates rise, your payments could become more expensive.

This option can be unpredictable, so it’s important to be ready for changes.

Tracker Rate Mortgage

With a tracker mortgage, suppose the Bank of England’s base rate is at 0.5% and your mortgage rate is 2% above this, making it 2.5%.

If the base rate climbs to 0.75%, your interest rate will adjust to 2.75%. This mortgage type is clear-cut, as your rate follows the Bank of England’s base rate directly.

It means you could benefit from lower rates. However, if the base rate climbs, so will your payments.

Picking the right mortgage rate boils down to how comfortable you are with potential changes and your financial stability.

What Rates Should You Expect?

Your mortgage rate can vary based on your rental experience, the loan size, whether you apply as an individual or a company, and the specifics of your HMO.

Lenders usually give better rates to those who’ve managed rentals before. If you’re new to this or it’s your first property purchase, be prepared for higher rates.

Going through a limited company for your application might also bump up your rate a bit.

The size and uniqueness of your HMO play a big role too. Bigger properties, or ones that don’t fit the usual mould, tend to have higher rates.

They’re seen as riskier by lenders and might require someone with more know-how to run them smoothly.

How Much Can You Borrow with an HMO Mortgage?

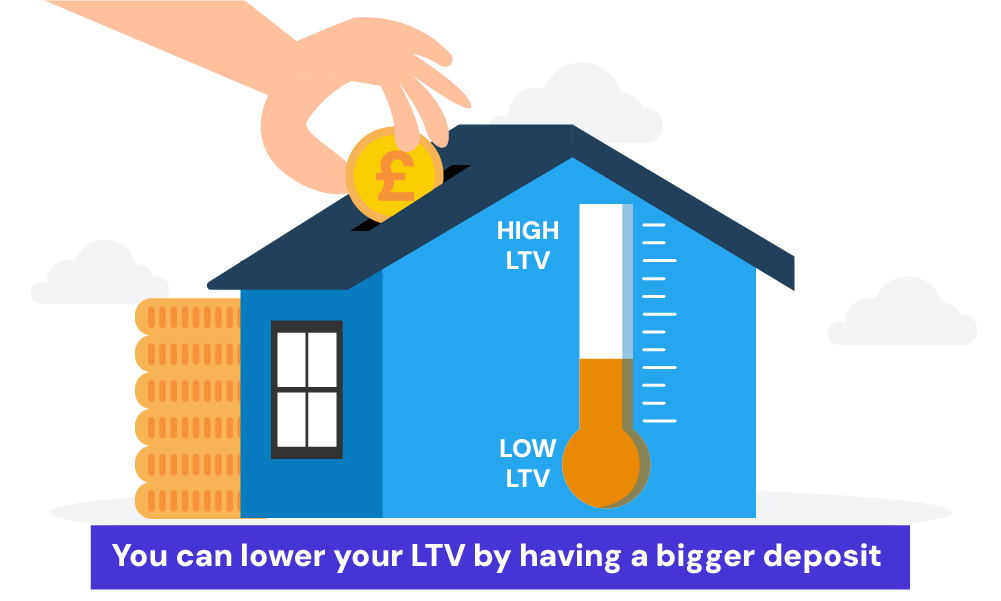

Loan-to-value (LTV) ratios tell you what percentage of the property’s price the lender will let you borrow.

For HMO mortgages, the maximum LTV is 80%. This means, that for every £100 in the property price, you can borrow £80. The rest is your deposit.

Another factor is rental coverage. Lenders use it to make sure the rent you’ll get covers the mortgage payments, usually 125% to 145% of your monthly mortgage cost.

This means if your mortgage payments are £1,000 a month, you need to be making £1,250 to £1,450 in rent.

To borrow more, aim for a lower LTV ratio by putting down a bigger deposit.

Showing strong rental income can also help. Some lenders might lend more if the property and your landlord experience meet their criteria.

HMO Licences and Regulations

Running an HMO isn’t just about finding tenants; you need to follow certain legal rules too.

First, get an HMO licence. This is crucial for two reasons: to keep your business legal and to secure a mortgage.

When you apply for a mortgage, the lender will want to know if your property is properly licensed. This is because they want to make sure they’re putting their money into a place that meets all legal standards.

If you don’t have the right licence, you might find it hard to get a mortgage.

To make sure you and your property stay compliant (and profitable), get to grips with the local rules for HMOs.

Apply for any licences you need, make sure your property meets all the standards required, and keep an eye on any law changes that might affect you.

You should also know about any fees for the licence and that you usually have 28 days to get or renew a licence.

Steps To Apply for HMO Mortgages

Applying for an HMO mortgage in the UK involves a few detailed steps. Here’s how to navigate through each one:

1. Speak with a Commercial Mortgage Broker

Starting, it’s wise to consult a commercial mortgage broker who specialises in HMO mortgages.

They can offer you tailored advice, help you understand the market, and guide you towards the best deals suited to your needs.

2. Gather All Important Documents

Before applying, you’ll need to collect essential documents.

This usually includes proof of income, identification documents, details about the property, and any existing landlord experience you have.

Having these ready can speed up your application process. During this, you can also assess your finances to get an idea of what you can afford.

It’s important to consider all the fees, rates, and deposits to be better prepared for the application.

3. Apply to the Right HMO Mortgage Lender

Your broker will help you identify which lenders are most likely to accept your application based on your circumstances. Applying to the right lender increases your chances of approval.

4. Get a Property Valuation

The lender will require a professional valuation of the HMO property to ensure it’s worth the investment. This step is crucial for determining how much you can borrow.

5. Mortgage Offer

If your application is successful, the lender will make you a mortgage offer.

This will detail the terms of your mortgage, including interest rates and repayment terms. Review this carefully with your broker to ensure it meets your expectations.

6. Completion with a Solicitor

Finally, to complete the mortgage process, you’ll work with a solicitor.

They handle the legal aspects, ensuring the property is transferred to you under the terms of the mortgage. They’ll also ensure that all legal requirements for an HMO are met.

Should You Get an HMO Mortgage?

Investing in HMO properties comes with its own set of advantages and challenges. Here’s a simple breakdown:

Pros

- Higher Rental Income. Renting out individual rooms usually earns more than leasing the whole property to one family.

- Steady Tenant Demand. Students, young professionals, and companies often look for this type of accommodation, making it easier to find tenants.

- Resilient Income Stream. With multiple tenants, if one moves out, you still have income from the others, reducing the risk of losing all your rental income at once.

- Potential for Greater Profitability. With careful management, the income from HMOs can significantly exceed the mortgage rates, leading to higher profits.

Cons

- More Complex Management. Handling multiple tenancy agreements and ensuring shared spaces are well-maintained requires more effort than managing a single-let property.

- Regulatory and Licensing Requirements. You might need a special licence to run an HMO, and there are strict regulations you must comply with, adding to the complexity.

- Higher Initial Costs. Setting up an HMO can be more expensive due to the need for suitable facilities in shared areas and meeting safety regulations.

Key Takeaways

- An HMO (House in Multiple Occupation) is a shared home where three or more people live together but aren’t family. Renting an HMO can earn you more money, but you need to follow special rules and get a licence.

- HMO mortgages are loans for shared houses with multiple tenants. You might need a bigger deposit, but the higher rent from more tenants can help cover the costs.

- Running an HMO means keeping the house safe and following the rules. It can earn you good money, but it takes more work and costs more to set up.

The Bottom Line

Using your property to let out as an HMO can be a lucrative venture. However, it’s not without its complexities, especially with mortgages.

So you must consider if this is the right choice for YOU.

To help you make a smart decision, speak with a good mortgage broker with experience in HMO mortgages. They can guide you through the application process, help you navigate the challenges, and find the best mortgage deal for your situation.

Ready to take the next step? Contact us to get matched with a skilled mortgage broker who specialises in HMO mortgages.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How is my HMO valued?

There are two main ways:

- Bricks and Mortar – This focuses on the building’s physical state as if it were empty.

- Commercial or Investment Valuation – This looks at the property as a business, considering potential earnings from tenants.

Converting to an HMO doesn’t always mean a big jump in value. It’s more about the building’s condition and less about how many people could rent.

Can I turn my property into an HMO?

Yes, but you need the right permissions first. Some lenders are okay with this, offering loans that suit the process. Interest rates may change during the conversion but can be settled once done.

What’s an Article 4 direction?

It’s a rule by local councils. In some places, you can’t change a home into an HMO without asking first. If your area has this rule, you’ll need permission to change your property’s use.

Do I need an HMO licence?

For big HMOs, yes.

This usually means homes with five or more tenants who aren’t one family and share things like bathrooms. Each HMO needs its licence, which lasts 5 years. Lenders will want to see your licence or that you’re getting one before they offer a mortgage.