- Is Equity Release on Jointly Owned Property Possible?

- How Does Joint Equity Release Work?

- Eligibility Criteria

- How Much Equity Can You Release on Jointly Owned Property?

- What if Your âTenants in Commonâ?

- What if one joint owner is under 55?

- What if Only One Person is Named on the Title Deeds?

- What Happens With Properties Owned by More Than Two Individuals?

- Costs Associated with Equity Release on Jointly Owned Property

- What Are the Alternatives to Equity Release?

- The Bottom Line

Equity Release on Jointly Owned Property: An In-Depth Guide

If you’re thinking about equity release, it might be because you’re at an age where you want to use the money that’s tied up in your home. This might be even more interesting if you own your home with someone, like your husband, wife, or partner.

So, what’s the process if you own a home with someone else, and what can you do next?

In this article, we’ll talk about equity release on jointly owned property. We’ll explain how it works, what it means, and any problems you might face. We’ll also talk about other things you can do to find the right borrowing solution for you.

Whether you want extra money for retirement, have specific money needs, or just want to know more about equity release, we’re here to help.

Is Equity Release on Jointly Owned Property Possible?

Yes, equity release on a jointly-owned property is possible. If both homeowners tick the eligibility boxes, obtaining a joint equity release is as simple as getting a joint mortgage.

But, challenges might come up if there’s a big difference in ages or if the title deeds don’t match.

If you are both over 55, equally own the property, and your home fits the lender’s criteria, you fall under the ‘joint tenants’ category. This makes equity-release financial options accessible in your later years.

That said, it’s essential to grasp the implications of equity release. Consulting with a seasoned equity release broker can guide you in determining if this borrowing option aligns with both your needs.

How Does Joint Equity Release Work?

A joint equity release lets two homeowners get some of the money that’s tied up in their home as cash. They don’t have to move or sell. It’s designed for people over 55 who own a property together.

Here’s how it works:

- The lender first assesses your eligibility for equity release. They look at factors such as age, property details, and whether there is an outstanding mortgage loan.

- Once approved, the lender calculates how much money you can release.

- The lender then draws up legal papers. This will detail the terms of the equity release plan, such as interest rates and repayments.

- You should discuss and agree to the terms of the plan. After that, your provider will release the funds, either as a lump sum or in instalments.

- The loan is repaid once the house is sold after you and your partner have passed away or moved into long-term care.

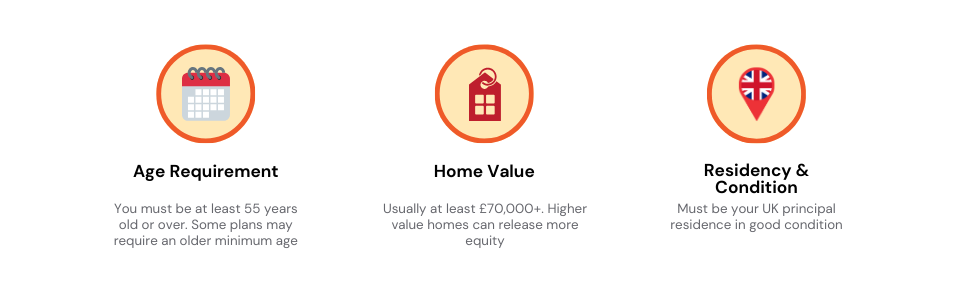

Eligibility Criteria

Here are the eligibility criteria for equity release on a jointly owned property:

- Both homeowners must be at least 55 years old.

- The property must be worth at least £70,000 and in good condition.

- Any existing mortgages or loans on the property must be paid off, possibly using the funds from the equity release.

It is important to note that these are just the general eligibility criteria. Specific requirements may vary depending on the equity release provider. It is always best to check with a provider directly to confirm your eligibility.

How Much Equity Can You Release on Jointly Owned Property?

The amount of equity you can get from jointly owned property relies on a few things. Your age, how much your property is worth, and the type of equity release plan you choose all play a part.

Usually, older applicants can get more equity. In some special cases, providers might offer up to 60% of the property’s value.

To get an estimate of how much you can release, use our equity release calculator below:

[Embedded Equity Release Calculator]

What if Your “Tenants in Common”?

[Description of the ideal image: A side-by-side comparison of “joint tenants” and “tenants in common”, possibly using a two-column table or visual icons.]

Tenants in common have separate shares of a property and often have unequal financial contributions. This makes equity release on a jointly owned property a bit more complicated, but it is still possible.

Here are some specific things to consider when you are tenants in common and considering equity release:

> The ownership shares of the property.

> What will happen to your share of the property if you die?

> The type of equity release plan you choose.

One of the main things to consider is what will happen to your share of the property if you die. If you do not have a will, your share of the property will pass to your heirs according to the laws of intestacy. This may mean that the remaining owner does not get to inherit your share of the property.

It is also important to consider the type of equity release plan you choose. Some plans, such as lifetime mortgages, allow you to retain ownership of your entire share of the property. Others, such as home reversions, require you to sell part of your share of the property to the lender.

What if one joint owner is under 55?

Many lenders want both owners to be at least 55 for equity release. Some might even set the age higher. If one of you is younger, there might still be a way to proceed.

The younger owner could give their share of the property to the older one. They may also need to sign a special document called an occupancy waiver to complete the equity release.

This can be a complicated step with potential legal effects on future ownership. It’s important to know all the details and risks. Speaking with a professional who knows about equity release on jointly owned property can help you understand what’s involved and make the right choice.

What if Only One Person is Named on the Title Deeds?

In cases where only one person is named on the deeds of a jointly owned property, equity release is still possible. Both parties must agree, and the name can be added during the equity release process, although additional legal fees may apply.

Remember that the youngest person involved must still meet the minimum age limits for the equity release plan to proceed.

What Happens With Properties Owned by More Than Two Individuals?

If a property has more than two owners, equity release gets a bit tricky. Only one or two owners can apply for an equity release plan.

The others must agree to be taken off the title deeds if they still want to go ahead with the plan. This choice might have clear drawbacks for those being removed. It can change their legal rights to property and might even affect things like inheritance.

Because it’s a big decision, it’s often wise to talk to a legal expert or an equity release specialist. They can make sure everyone understands what’s involved and help handle the process properly.

Costs Associated with Equity Release on Jointly Owned Property

The borrowed amount from an equity release on a jointly owned property is tax-free, whether you opt for one lump sum or instalments.

Other costs include legal fees, arrangement fees, and interest, usually between 5-9% APR*. If you’re considering a home reversion plan where you sell part of the property to the lender, be aware that they may not pay you full market value for that portion.

*Annual Percentage Rate (APR) – total cost of borrowing money including interest, fees, & other charges. Just a quick note – rates may have changed since this article was last updated.

>> More about Equity Release Rates

What Are the Alternatives to Equity Release?

Equity release on jointly owned property is becoming a common way for couples to finance retirement or care needs. But what if this option doesn’t suit your situation? Fortunately, there are alternative solutions available.

Remortgaging the Property

Joint owners can remortgage their property to release the required funds. It’s a valid way to access the value tied up in the home without having to move out.

Opting for a Personal Loan

If the amount needed is not substantial, a personal loan might be a more flexible and less complex alternative.

Downsizing

Selling the existing home and moving into a smaller, more affordable one could release a substantial amount of equity. This can be especially relevant for jointly owned properties that have been appreciated.

Retirement Interest-Only Mortgages

Retirement interest-only mortgages let you borrow against your home, and you only pay the interest. This keeps your regular payments lower. The main amount, or principal, is paid when you sell the house.

Joint Retirement Interest-Only Mortgages

This is a special kind of mortgage designed for couples. It works like the regular retirement interest-only mortgage but takes into account both partners’ needs.

It can be hard to know which option is best for your specific situation, especially with a jointly owned property.

An equity release expert can help you understand the advantages and disadvantages of each choice. They’ll make sure you have all the information you need to make a decision that’s right for you. Remember, what works for one person might not be the best fit for someone else.

[Description of the ideal image: Visual side icons representing each of the alternatives to equity release

Design Specifics:

Layout: Individual icons with accompanying labels, each representing one alternative. These icons can be placed within their respective sections, breaking up the text.]

>> More about Alternatives to Equity Release

The Bottom Line

Equity release on jointly owned property is an option many are considering. But with unique circumstances and various options to choose from, the decision-making process can be complex.

That’s where expert mortgage brokers can guide you. They have the knowledge and experience to tailor solutions specific to your situation. They will explain your options and ensure that you are getting the right one.

Just imagine a personalised equity release plan, tailored to your needs, without you having to struggle through complex financial jargon.

The brokers we’ll connect you with can make this happen. They’ll consider factors such as your home value and your age. This will help them guide you to a choice that fits your special situation.

If you’re considering equity release, don’t wait to get started. Simply fill out our quick form today. And we’ll match you with a qualified mortgage broker who specialises in equity release on jointly owned properties.

Get Matched With Your Dream Mortgage Advisor...

Frequently Asked Questions

Is equity release safe for joint owners?

Yes, it can be safe if you choose the right plan and provider. Equity release is controlled by rules, and trustworthy providers follow standards from groups like the Equity Release Council. But it’s vital to get expert advice that fits your unique needs to make sure the plan works for both owners.

What if one owner wants to sell or move?

This situation can get tricky. If one owner wants to sell or move, you’ll need to talk to an equity release specialist. They’ll help you understand what you can do under your specific plan. The choices might change depending on the equity release type, the agreement terms, and your situation. You might have to pay back the equity release or make a new deal with the provider.

Can you release equity on a property with shared ownership?

No, you can’t release equity if the property has shared ownership. You need a single or joint mortgage on the whole property to do this. You must be the owner/s to qualify.

Do both names have to be on the equity release plan for jointly owned properties?

Yes, both names must be on the equity release plan if you’re joint tenants or tenants in common. This isn’t just a legal rule; it makes sure both people agree and get the loan together.