Equity Release Eligible Property Types: An In-Depth Guide

Equity release: an enticing prospect for many homeowners over 55.

The idea of unlocking a tax-free lump sum from your home, without having to pack up and leave, is an appealing one indeed. It’s not surprising that its popularity is on the rise.

But here’s the rub: not all homes are created equal.

When it comes to equity release, the type and condition of your property take the leading role.

In this article, we’ll be breaking down how different characteristics of your home might affect your route to equity release. From the type of materials used in construction to the present state of your home, we’ll emphasise how these factors play a critical role in deciding your possibilities.

Can I Get Equity Release On Any Property Type?

Regrettably, not every property can tap into the benefits of equity release. Lenders focus their decisions on distinct attributes of a property to ensure a profitable and secure agreement.

But fear not; the stage is wide, and many property types are invited to perform.

Location, Value, and Condition

From bustling city centres to the peaceful countryside, the location of your property can influence a lender’s decision.

Similarly, the overall value and condition of your home play a significant role. Lenders are keen to invest in properties that promise to retain their value in the long term.

Use and Construction Material

The principal usage of your home, whether it’s a personal haven or a part-time letting, can influence eligibility.

Furthermore, the construction materials – are we talking traditional bricks and mortar, or something a bit more unconventional? – can be a decisive factor for lenders.

The types of properties approved for equity release are numerous. Still, it’s worth noting that each lender follows a unique set of rules.

Teaming up with a seasoned mortgage advisor could pave your way towards securing a lender who appreciates the unique aspects of your property and offers an equity release deal to match.

Pro-Tip

Equity release isn’t just for grand estates; even the most humble bungalow can qualify. Don’t hold back – reach out to us. We’ll bridge the gap between you and a mortgage broker who can help unlock your home’s financial potential.

Which Properties Are Likely to be Eligible?

When it comes to equity release, certain properties seem to have the edge. What gives these properties a leg up? Let’s find out:

- Standard Construction. If your house, flat, or bungalow is made of bricks and mortar, you’re in good shape. Lenders favour these traditional materials due to their durability and wide acceptance in the resale market.

- Good Condition. Homes that have been well-maintained and show no significant structural issues are likely to be approved. After all, a well-kept home is easier to resell if the need arises.

- Permanent Residence. The property must be your primary place of residence. Lenders want to ensure that the property is not just well-kept, but also regularly inhabited.

- Ownership of Land. If the land on which your property sits is also under your ownership, your chances of eligibility for equity release rise. This adds to the overall value of the property deal.

Why are Some Properties Ineligible for Equity Release?

Often, it boils down to resale concerns and risk factors. Here are a few reasons:

- Resale Complications. If factors like being located in a flood zone, near high-voltage power lines, or containing asbestos might impede a future sale, lenders could hesitate.

- Unconventional Neighbours. A property situated next to commercial establishments or in an area deemed undesirable could be considered less attractive to future buyers.

- Non-Standard Features. Single-skin walls or other unconventional building features could make a property harder to sell and thus, less likely to be approved for equity release.

- Ownership Issues. Certain property types such as Shared Ownership properties, park homes, and commercial properties often face complications due to ownership or usage issues, making them ineligible for equity release.

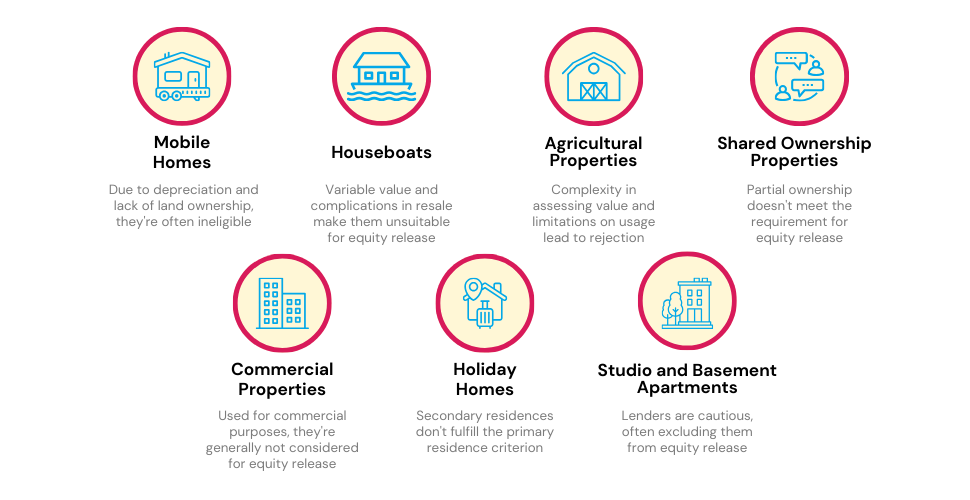

The Properties That Usually Don’t Qualify

When it comes to equity release, lenders can be quite selective about the types of properties they accept. They often veer away from these:

- Mobile Homes – Mobile homes, including park homes, may serve as residences, but their potential for depreciation and lack of land ownership make them tricky for equity release.

- Houseboats – Residing on the water sounds delightful, yet houseboats often face disqualification due to the variable nature of their value and complications in resale.

- Agricultural Properties – Farmhouses or properties on agricultural land often face rejection due to complexities in assessing their value and potential limitations on their usage.

- Shared Ownership Properties – Equity release requires you to fully own your property. If you own only a part of it in a shared arrangement, it is usually not possible to get equity release.

- Commercial Properties – Properties used, even just part-time, for commercial endeavours, such as being rented out on Airbnb, leased to long-term tenants or run as a hotel, generally cannot be considered for equity release.

- Holiday Homes – Equity release demands that the property in question be your primary residence. Therefore, a holiday home or a second home doesn’t meet this criterion.

- Studio and Basement Apartments – Lenders generally approach studio and basement flats with caution, resulting in such properties often being left out of equity release schemes.

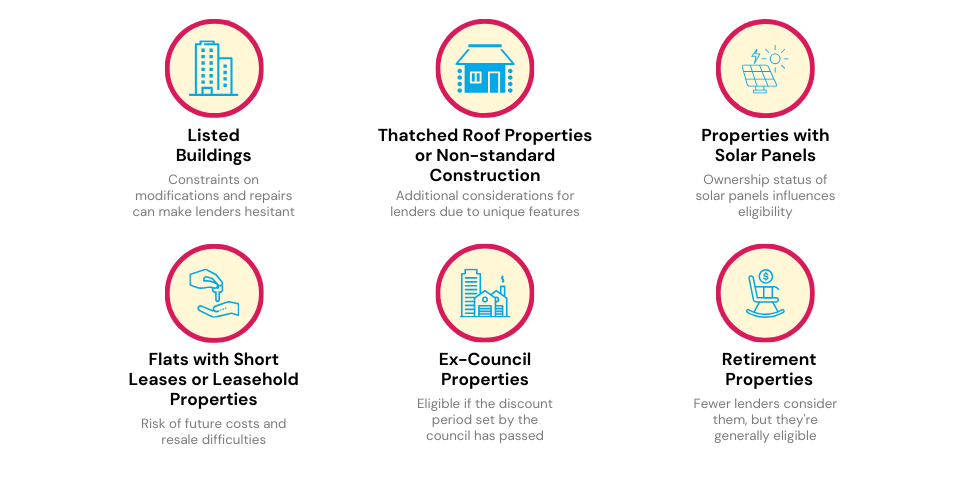

Grey Areas: Properties that may or may not Qualify

Then there are those properties that sit in a grey area, where their eligibility for equity release could go either way. Here’s what you need to know:

- Listed Buildings – Properties with a listed status can sometimes be approved, though the extra constraints on modifications and repairs can make lenders hesitant.

- Thatched Roof Properties or Non-standard Construction – Whether it’s a thatched roof or the property is made of materials other than bricks and mortar (like timber or steel), these characteristics introduce additional considerations for lenders.

- Properties with Solar Panels – If the solar panels are owned outright, they could improve your chances. However, if they’re leased or under a rent-a-roof scheme, approval becomes less certain.

- Flats with Short Leases or Leasehold Properties – Whether it’s flat with a short lease or a leasehold property in general, it can be considered a risk due to potential future costs and difficulties with resale. A significant time left on the lease is usually a requirement.

- Ex-Council Properties – Properties once owned by the council could be eligible for equity release, as long as the discount period set by the council has passed.

- Retirement Properties – Though there might be fewer lenders willing to consider these, retirement properties don’t usually pose more difficulties than standard houses for equity release.

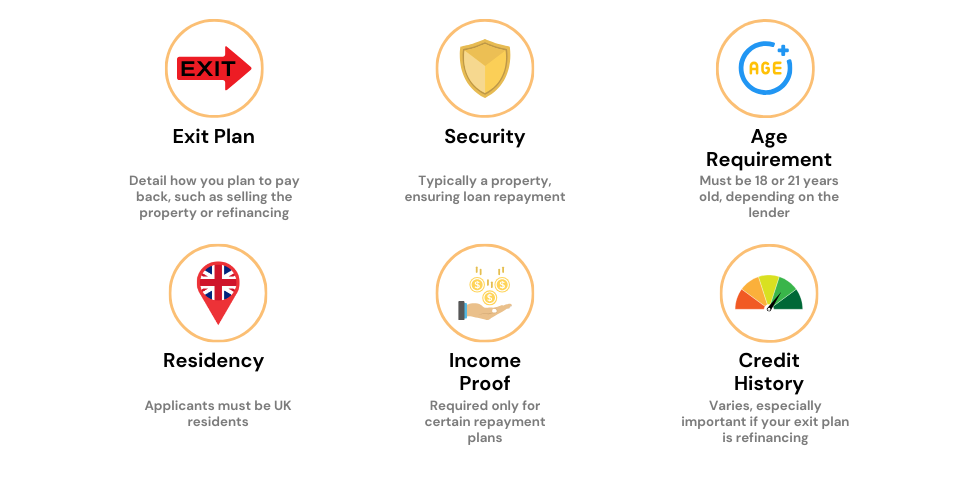

Beyond the Property: Other Factors Lenders Consider

While property type and condition are crucial, lenders also pay close attention to other factors. Here are some worth noting:

- Ownership Status – Lenders prefer properties that are fully owned by the applicant. Shared ownership or properties with existing liens can complicate matters.

- Duration of Stay in the UK – Some lenders require you to have been a UK resident for a certain period usually half of the year before considering your application.

- Property Value – The worth of your home directly influences how much equity you can unlock. As a rule of thumb, homes valued at £70,000 or higher, along with fitting the lender’s guidelines, stand a good chance for equity release. The pricier the property, the bigger the potential equity release.

- Age of Applicant – You need to be 55 or older to be eligible for equity release. As a trend, the older you are, the more equity you can release. This is because lenders see less risk with older borrowers.

The Bottom Line

You’ve learned about equity release and how your property’s type and condition can influence your eligibility.

While some properties are a straightforward fit, others might need a bit more insight. That’s where a specialist equity release mortgage advisor comes into play.

Having an expert by your side means you get personalised advice tailored to your unique situation. They not only help determine if your home is suited for equity release but also connect you with the right lender and assist with the application process.

They’re there to shed light on factors like ownership status and property value, ensuring all your questions are answered.

Thinking of taking the next step? Reach out to us today. We’ll match you with a seasoned broker who can provide the advice you need. Fill out our enquiry form for a free, no-commitment consultation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I get an equity release on a prefab house?

Prefab homes are generally viewed as non-standard properties by lenders, making them a higher risk.

As a result, it might prove more challenging to find a lender willing to grant equity release on such a property. Nonetheless, there are lenders who might still consider them, so obtaining expert advice is definitely recommended.

Is it possible to get equity release on Grade 2 listed buildings?

While they can be considered for equity release, listed buildings come with more restrictions due to their historic or architectural importance. Your mortgage advisor can guide you through this process.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.