- When Your Fixed-Rate Mortgage Endsâ¦

- What Should I Do When My Fixed-Rate Mortgage Ends?

- How Do I Change My Mortgage to a New Deal?

- Which One Should I Opt For?

- What Are the Costs of Changing My Mortgage?

- When Is the Best Time To Remortgage?

- Should I Always Remortgage After a Fixed Rate?

- Can I Pay Off My Mortgage At The End Of The Fixed Rate?

- Key Takeaways

- The Bottom Line

What Happens When Your Fixed-Rate Mortgage Ends?

As your fixed rate mortgage draws to a close, it’s natural to ponder what lies ahead. 🤔

Whether your deal was locked in for 2 years or stretched out over 5, the end of this period marks a significant turning point in your mortgage journey.

Let’s explore what’s in store when your fixed term is up.

When Your Fixed-Rate Mortgage Ends…

Once your fixed-rate deal ends, you won’t be automatically free of payments. Instead, your mortgage typically shifts to your lender’s Standard Variable Rate (SVR).

The SVR is a type of interest rate that can VARY at any time at the discretion of your lender.

This is often influenced by changes in the broader economic environment, like the Bank of England’s base rate.

A major drawback with these rates is their uncertainty. Since it can go up and down, it’s tough to plan your finances for the long term.

On top of this, these rates are often higher than fixed rates, so your monthly payments could jump.

Right now, the average SVR is a whopping 8.18% according to Moneyfacts. If you’re stuck on a lower fixed rate, say 4%, that could mean a BIG difference in your monthly bill.

For these two reasons, most experts recommend arranging a new fixed or tracker mortgage once your initial deal is up rather than defaulting onto the SVR.

What Should I Do When My Fixed-Rate Mortgage Ends?

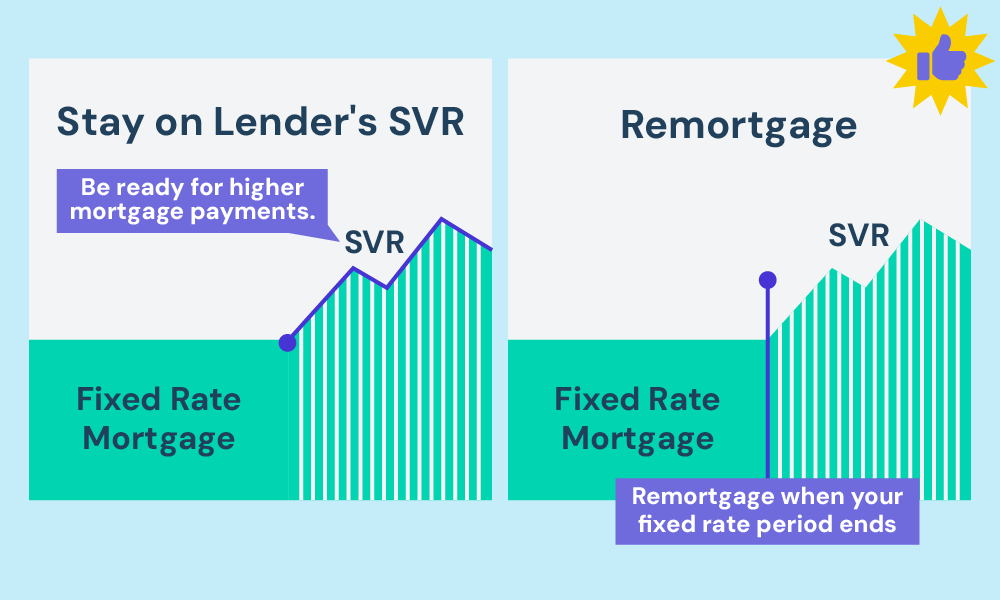

At the end of your fixed-rate period, you face a crucial decision: to stay with your current lender’s SVR or to remortgage.

Doing nothing means you’ll be moved onto the SVR automatically.

This might seem the path of least resistance, but it could lead to more higher payments, especially if the SVR is much higher than your previous fixed rate.

Alternatively, remortgaging offers you a chance to negotiate a new deal, either with your existing lender or a new one.

This could mean securing a lower interest rate, reducing your monthly payments, or adjusting the terms to better suit your current financial situation.

How Do I Change My Mortgage to a New Deal?

OK, so you’ve decided to ditch the SVR and look for a new mortgage product once that fixed period finishes.

What are your options for changing your mortgage to a new deal?

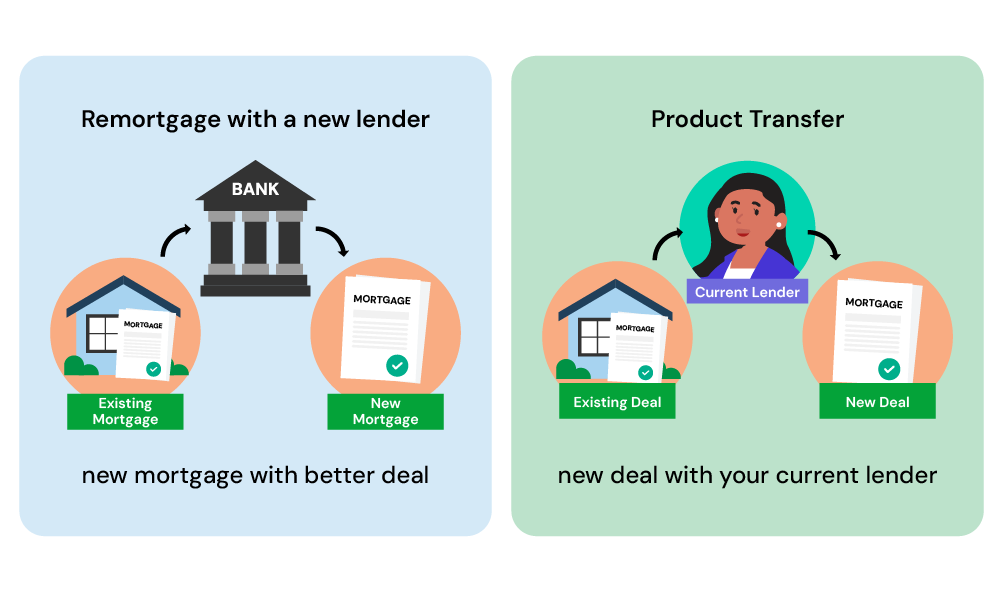

You’ve got two main choices:

- Remortgage with a new lender. This involves taking out a new mortgage with a different bank or building society, using the money to pay off your existing mortgage balance. You get to shop around the whole market for the best available interest rates and mortgage deals.

- Get a new deal with your current lender (Product Transfer). The other path is to simply negotiate a new mortgage product with your existing lender. This avoids the hassle of remortgaging, though their new deals may not be as competitive.

Using an independent mortgage broker is highly recommended when looking to switch mortgages. They have access to the entire market and can quickly compare thousands of deals to find the most suitable and affordable one for your needs.

Which One Should I Opt For?

Deciding between remortgaging and a product transfer depends on whether you prioritise saving money or a hassle-free experience.

Remortgaging lets you hunt for a much lower interest rate with a new lender, potentially saving you a significant amount each month.

This might be ideal if you want the best possible deal or need to borrow more money. However, it involves more paperwork, fees, and can take longer.

On the other hand, a product transfer with your current lender is quicker, easier, and often involves minimal fees.

It’s a good option if you value convenience, don’t mind your current interest rate, or wouldn’t qualify for the best remortgage deals. The downside is you might not get the absolute best rate on the market.

So, weigh your priorities.

Do you want to save the most money and potentially adjust your loan terms (remortgage), or prioritise a faster, simpler process (product transfer)?

>> More about How To Remortgage

What Are the Costs of Changing My Mortgage?

Before you change mortgage deals, it’s crucial to understand the costs and fees involved. These can potentially wipe out any potential savings, so you need to crunch the numbers carefully.

Common costs when remortgaging include:

- Early repayment charge (if leaving before your fix period ends)

- Exit fee

- Arrangement fee for the new mortgage

- Booking fee (rarely more than £200)

- Property valuation fee (sometimes free for a remortgage)

- Conveyancing fees (also often free when remortgaging)

- Broker fees if using a mortgage advisor

Your broker can calculate if the savings from a new mortgage outweigh these fees over the fixed period. If not, it may be better to stick it out on the SVR for a while.

When Is the Best Time To Remortgage?

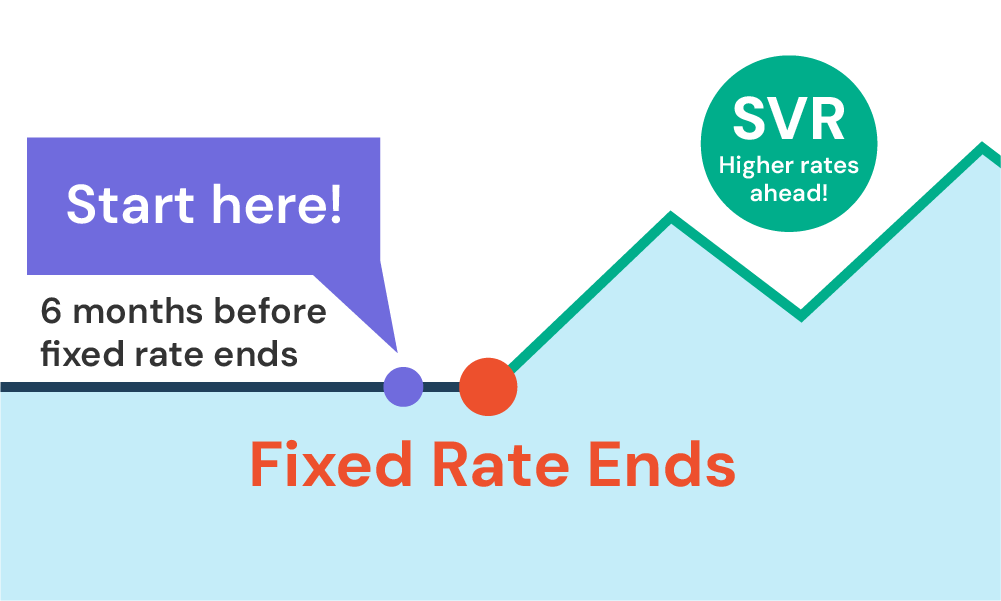

Ideally, you want to start looking at your remortgage options around 6 months before your current fixed rate ends. This allows plenty of time to research the market and apply for a new deal.

Many lenders will let you lock in a new rate around 3 months before your switch date too. Though rates can change, so it’s a bit of a gamble applying too early.

The actual timing may also depend on any early repayment charges attached to your existing fixed rate mortgage.

If these extend beyond the end date, you could face hefty penalties for remortgaging immediately after the fixed period ends.

Should I Always Remortgage After a Fixed Rate?

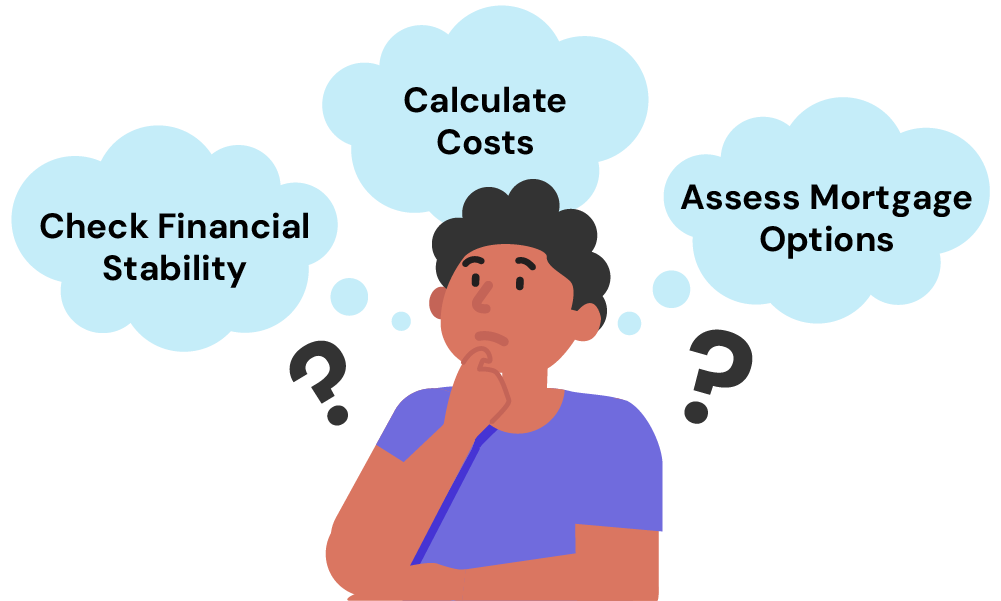

In some situations, switching mortgages after your fixed rate might not actually be the best decision.

While the SVR is usually higher, there are exceptions where it can make sense to stick it out–at least for a little while.

For example, if you have a small mortgage balance under £60,000 remaining, the fees for setting up a NEW mortgage could outweigh any potential interest savings.

Many lenders won’t even take on such small mortgages.

If you can clear a decent chunk of your mortgage by making overpayments, it may also be better doing this interest-free on an SVR rather than remortgaging.

Or if your financial situation has changed for the worse – e.g. you’ve taken on more debts, become self-employed, or your income has dropped – you might struggle to qualify for a competitive remortgage rate. Staying put on the SVR could be simpler.

The takeaway is: don’t just automatically remortgage when your fixed rate ends.

Take some time to assess your financial situation, calculate the costs VS savings, and decide if switching mortgages is worthwhile for you.

Can I Pay Off My Mortgage At The End Of The Fixed Rate?

Yes, you can, but before doing so, it’s important to check the terms of your mortgage agreement closely.

Many fixed-rate deals have Early Repayment Charges (ERCs), especially if you pay it off during the fixed period.

These fees can sometimes apply even at the end of the term, depending on the specific conditions set by your lender.

So, double-check your mortgage agreement before celebrating. 🙂

What Are Early Repayment Charges?

Early repayment charges are fees that lenders might impose if you repay your mortgage early.

The fee is usually a percentage of the loan amount remaining. This varies significantly between mortgages, but usually ranges from 1% to 5% of your mortgage outstanding balance.

Typically, the ERC decreases the closer you get to the end of the fixed rate period.

Key Takeaways

- When your fixed-rate mortgage ends, you’ll usually move to your lender’s Standard Variable Rate (SVR), which can change and is often higher than your fixed rate.

- You can choose to remortgage to a new deal or stay on the SVR; remortgaging often saves money by securing a better rate.

- Remortgaging with a new lender might offer lower rates but involves more paperwork and fees. A product transfer with your current lender is quicker and simpler but may not offer the best rate.

- Start looking for remortgage options around 6 months before your fixed term ends to find the best deal.

- Consider your financial situation before remortgaging; in some cases, staying on the SVR might make sense, especially if your mortgage balance is low or your circumstances have changed.

- You can pay off your mortgage at the end of the fixed rate, but check for any early repayment charges (ERCs) that might apply.

The Bottom Line

In the end, the decision to remortgage or stick with your current standard variable rate (SVR) depends on your own situation, your financial goals and what’s happening in the mortgage market right now.

To make sure you’re making the best choice for the long term, it’s always a good idea to get advice from a qualified mortgage broker.

If you’re in the UK and looking for a whole-of-market broker, just get in touch with us. We can connect you with someone who can help you sort out your mortgage, especially when your fixed deal is coming to an end.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Could I make a big extra payment on my fixed-rate mortgage to pay it off faster?

Yes, you can make extra payments on a fixed-rate mortgage to speed things up. It’s a smart way to save on interest in the long run. But, it’s always a good idea to check with your lender first.

Some fixed-rate mortgages have prepayment penalties (usually 10% of the mortgage amount), so you’ll want to make sure you’re aware of any fees before you go ahead.

Can I extend my fixed rate mortgage?

In most cases, extending your current fixed rate term directly isn’t an option. However, you can achieve a similar outcome by remortgaging.

Remortgaging means taking out a new mortgage deal, which could be another fixed-rate option. This allows you to lock in a new interest rate for another period.

What should I do if there's a mistake about the end date of my fixed rate mortgage?

If you think there might be an error with your fixed-rate mortgage end date, the first step is to contact your lender directly. They can review your loan details and confirm the official end date.

It’s helpful to have your mortgage paperwork on hand when you call. This might include your initial loan agreement or any recent statements that mention the end date.

If the lender confirms a mistake, explain the situation calmly and ask them to clarify the correction process. This might involve updating your paperwork and potentially recalculating any payments made in error.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.