- What’s a Guarantor Mortgage?

- What Types of Guarantors Are There?

- Who Is Eligible?

- How Much Can You Borrow on a Guarantor Mortgage?

- Your results

- How Does The Guarantor’s Income Affect Borrowing?

- How Much Does a Guarantor Need to Earn?

- It’s About More Than Just Salary

- How Much Security Is Required?

- What About 100% Guarantor Mortgages?

- Types of 100% Guarantor Mortgages

- Alternatives To Guarantor Mortgages

- The Bottom Line: Getting Expert Guarantor Mortgage Advice

How Much Can I Borrow With a Guarantor Mortgage?

Ever dreamed of owning your OWN home but your income just doesn’t seem to stretch far enough?

A guarantor mortgage could be the solution that gets you on the property ladder. But how much can you actually borrow with this type of mortgage?

Let’s take a look. 🔎

What’s a Guarantor Mortgage?

A guarantor mortgage helps you buy a home even if you struggle to get a regular mortgage on your own.

In this type of mortgage, someone else, typically a close relative like a parent, agrees to be the guarantor.

This means the guarantor takes on some legal responsibility for the mortgage. If you can’t make your repayments, the lender can go after the guarantor to get the money you owe.

By having a guarantor, the lender is more confident they’ll get their money back even if your finances change. This lets you borrow more than you normally could.

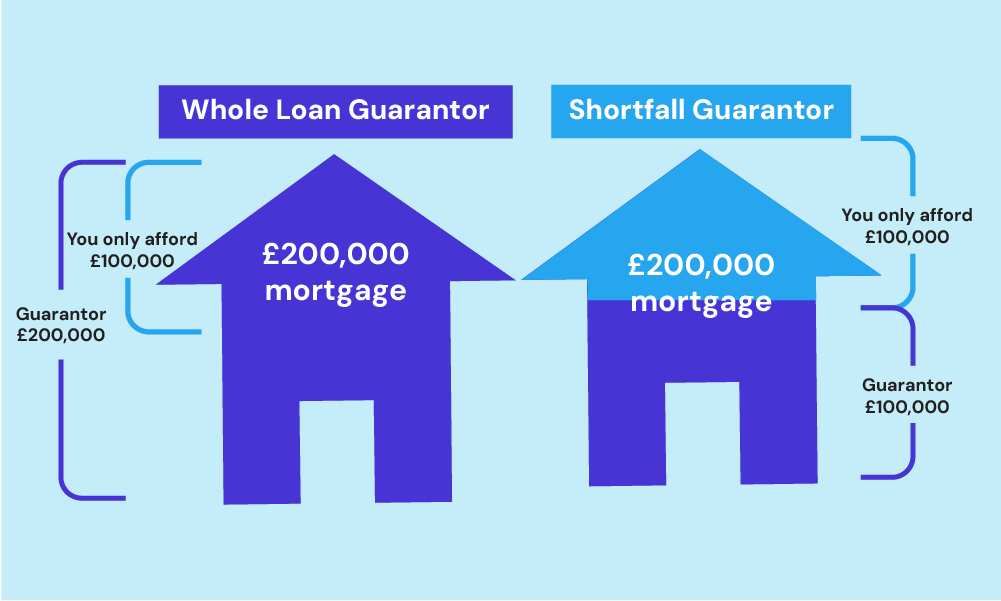

What Types of Guarantors Are There?

There are two main types of guarantors. A ‘whole loan guarantor‘ covers the entire mortgage. This is common if you need more than you can afford on your income alone.

For instance, if you need a £200,000 mortgage but can only afford £100,000, your guarantor still needs to prove they can cover the full £200,000.

A ‘shortfall guarantor‘, less common, only covers the part of the loan you CAN’T afford. So if you can afford £100,000 but need £200,000, the guarantor needs to prove they can afford to cover the £100,000 difference.

Who Is Eligible?

Eligibility criteria for guarantor mortgages are similar to regular mortgages. To qualify, you need to be:

- A UK resident

- Over 18 years old

- Employed, self-employed, or have a stable income

- Able to provide a credit history that meets the lender’s requirements

- Supported by a guarantor who meets the lender’s criteria, which typically includes having a good credit score, stable income, and sufficient equity in their property or savings

Additionally, the guarantor should:

- Be a close family member or someone with a strong financial connection to you

- Typically be under 75 years old at the end of the mortgage term

- Own property in the UK, or have savings they can use as security

Both you and your guarantor will undergo a thorough financial assessment to ensure the repayments are affordable, even if the economic circumstances change.

How Much Can You Borrow on a Guarantor Mortgage?

The amount you can borrow on a guarantor mortgage depends on several factors, but a key one is your own financial situation.

Lenders will look at your income, existing debts, and, of course, your credit history.

On top of that, since we’re talking about a guarantor mortgage, they’ll also consider the finances of your chosen guarantor – often a family member or a really close friend.

The guarantor’s financial security plays a big part here because they’re the ones promising to pick up the tab if you can’t.

For the most part, with a guarantor mortgage, lenders might be willing to offer between 4 to 5 times your annual income, but this isn’t set in stone.

The guarantor’s strength – in terms of their income, assets, and credit score – can boost that number.

For example, if your guarantor has a good income, owns a house, or has some savings, you might be able to borrow more.

Bear in mind, though, that every lender is different. Some are more willing to take on risk than others.

If both you and your guarantor have good finances, some lenders might let you borrow more, but you still need to be able to pay back each month without any trouble.

To get a clearer idea, use the guarantor mortgage calculator below. Just put in your annual income and it will show you an estimate of how much you might be able to borrow.

Guarantor Mortgage Calculator

See how much you could potentially borrow with a guarantor, based on the income multiples used by lenders in the UK.

Mortgage Affordability Calculator

Applicant 1

Your results

Based on the figures you provided, you can expect to borrow between:

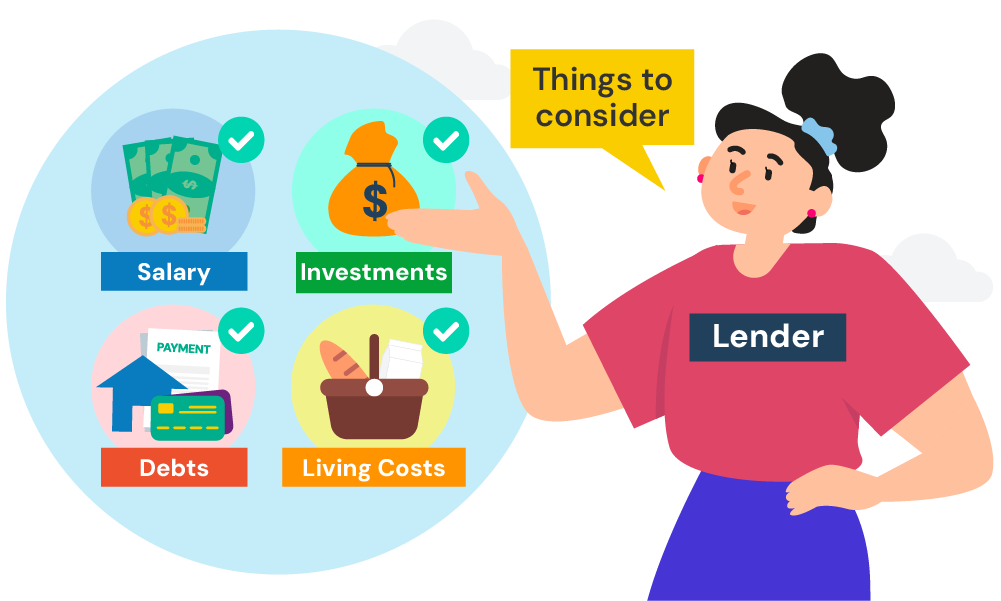

How Does The Guarantor’s Income Affect Borrowing?

Your guarantor’s income directly affects how much you can borrow. Lenders will check their income and expenses just like they would for a regular mortgage application.

This check considers:

- Their salary

- Any other income, like investments

- Existing debts like mortgages, loans, and credit cards

- Their living costs

The lender also wants to see how much extra money your guarantor has each month. The more leftover money they have, the more they can help if you can’t pay.

Simply put, the more your guarantor earns with extra income available, the larger mortgage you might get.

How Much Does a Guarantor Need to Earn?

Lender requirements for guarantor income vary, so there’s no single answer.

The HIGHER your guarantor’s income, the bigger the mortgage you can get.

As a rule of thumb, you’ll commonly be able to borrow around 4 to 4.5 times the guarantor’s income on a guarantor mortgage. Some lenders may stretch to 5 times income for particularly strong applications.

So if your guarantor earns £40,000 per year, you might expect to be able to borrow somewhere between £160,000 to £200,000 with their supporting guarantee.

Of course, this can change depending on their spending habits. If they have lower outgoings, you may be able to borrow slightly more.

It’s About More Than Just Salary

It’s important to know that lenders don’t just consider your guarantor’s total income when deciding how much you can borrow on a guarantor mortgage.

They want the whole picture of your guarantor’s finances. Here’s what they check:

- Their job (employed, self-employed, etc.) and investments

- Age and when they plan to retire

- Any future income changes like bonuses or raises

- Existing debts and regular bills

- Other factors like number of dependents they financially support

You, the borrower, also need good credit history to qualify. So, a high income helps, but the lender will look at everything to see how much you can really borrow.

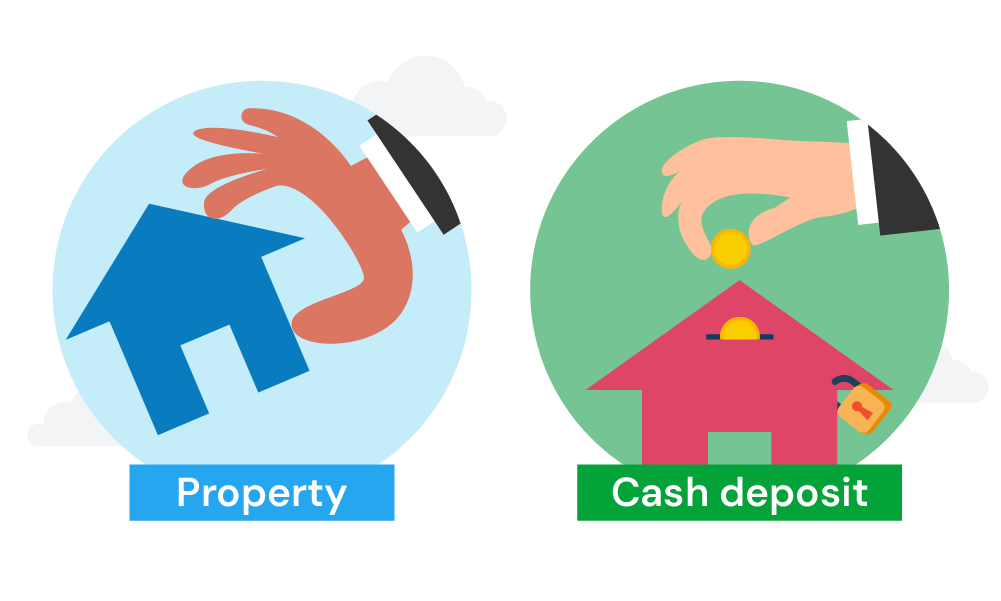

How Much Security Is Required?

Lenders want extra protection since your guarantor is responsible if you can’t pay. They typically require one of these:

- A legal charge on the guarantor’s property. The lender gets a claim on your guarantor’s property if you can’t repay and they have to step in.

- A cash deposit from your guarantor. The guarantor puts a chunk of savings (like 20% of the mortgage) in a locked account for a set time (5-10 years). This acts as a safety net.

The type and amount of security YOU need affects how much you can borrow because the lender considers it when checking how much everyone can afford.

What About 100% Guarantor Mortgages?

Thanks to the guarantor providing additional security, you may even be able to secure a 100% mortgage with no deposit required at all.

With a 100% guarantor mortgage, the lender will stipulate one of the following:

- The guarantor provides a cash lump sum equating to a percentage of the property’s value as security

- The lender takes a charge over the guarantor’s property for the full mortgage amount

- A mix of the above two options

So while possible, a 100% mortgage adds further risk for the guarantor. The bigger the mortgage compared to the property value, the more security the lender will demand from your guarantor.

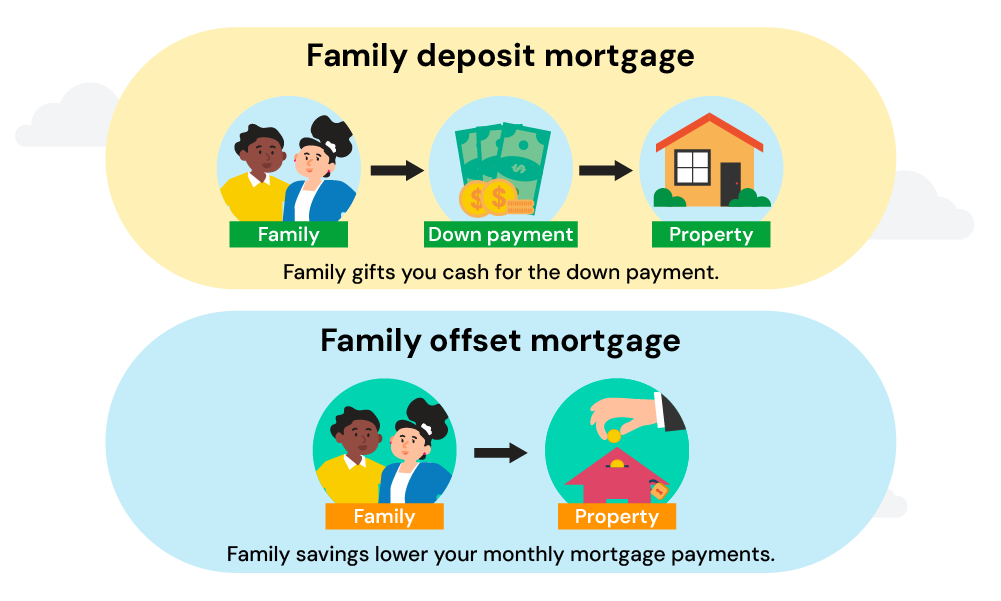

Types of 100% Guarantor Mortgages

There two types:

- Family Deposit Mortgage. This is when the guarantor uses savings as security, not their property. The cash is held in a savings account until a part of the mortgage is repaid, after which the guarantor receives their money back with interest.

- Family Offset Mortgage. This reduces the total loan amount using the guarantor’s savings. It can either shorten the loan term or lower your monthly repayments.

Not all lenders offer 100% guarantor mortgages, so it’s wise to talk with a specialist broker about your options.

Alternatives To Guarantor Mortgages

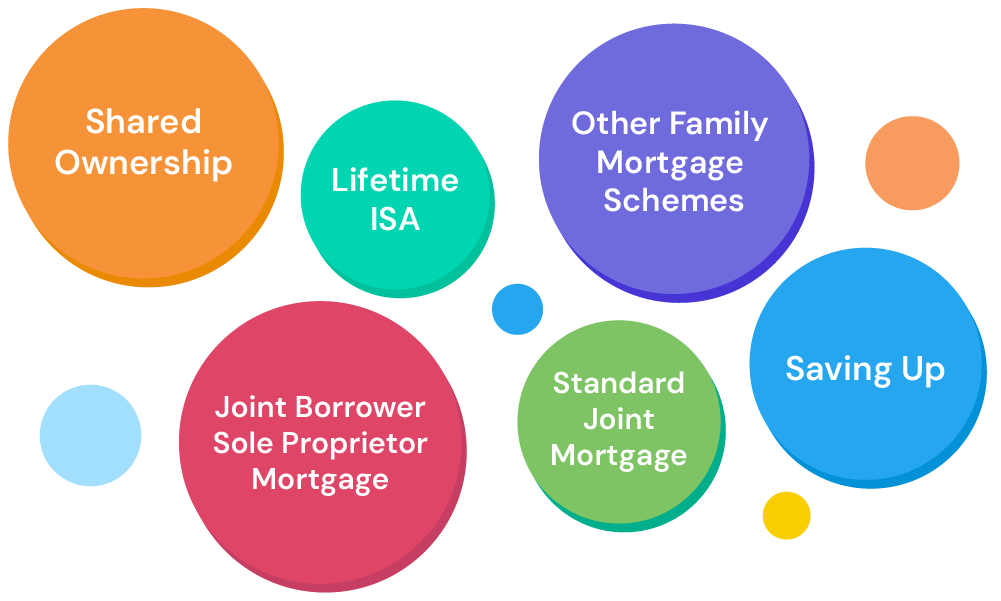

If a guarantor mortgage doesn’t seem like the right fit for you, there are several other options you might consider to help you get onto the property ladder:

- Shared Ownership: This scheme allows you to buy a share of a home (between 25% and 75%) and pay rent on the remaining share. You can buy bigger shares when you can afford to.

- Lifetime ISA: This is a savings account where you can put up to £4,000 each year until you’re 50. The government adds a 25% bonus to your savings, up to a maximum of £1,000 per year. This can be used towards buying your first home.

- Joint Borrower Sole Proprietor Mortgage: This allows you to include the income of a family member or friend in your mortgage without them being co-owners of the property.

- Standard Joint Mortgage: You can buy a property with a partner, friend, or family member where all parties are co-owners and share the mortgage responsibility.

- Other Family Mortgage Schemes: Many lenders offer mortgage products designed to help families support each other in buying a home without the need for a traditional guarantor.

- Saving Up: Sometimes the simplest alternative is to save for a larger deposit. This reduces the need for a mortgage with special terms and can provide more favourable borrowing conditions.

The Bottom Line: Getting Expert Guarantor Mortgage Advice

Guarantor mortgages can be tricky with lots of things to consider. A mortgage broker can help you navigate this by:

- Analysing your situation and your guarantor’s finances.

- Finding the best lenders for your specific circumstances.

- Negotiating to get you the biggest loan you can afford.

A broker’s knowledge is key for a guarantor mortgage. They’ll help you achieve your dream of homeownership while making sure your guarantor isn’t taking on too much risk.

Looking for the right broker in the UK? Reach out to us. We’ll connect you with a qualified mortgage advisor to help you step into the property ladder with a guarantor mortgage.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How many guarantors are required?

You usually only need ONE guarantor for a guarantor mortgage. This person should be financially strong with a good credit history.

Ideally, they’ll also own property or have significant savings the lender can use as backup if needed. Having one good guarantor is enough for most lenders to approve a bigger loan or accept you with a smaller deposit.

Can I borrow more with a guarantor?

Yes, you can borrow more money with a guarantor mortgage than you normally could on your own. This is because the lender considers your guarantor’s income and financial situation on top of yours.

This can be a big help if your income alone isn’t enough for the mortgage you want, or if you don’t have a big deposit saved up.

Do I need insurance as a guarantor?

Yes, consider getting insurance like income protection or life insurance. This protects you financially if the borrower can’t pay due to illness, injury, or job loss, and you have to cover the repayments. You might also suggest the borrower gets similar insurance to protect both of you financially.

How long am I on the hook as a guarantor?

You’ll usually be a guarantor until the borrower is financially stable enough to handle the mortgage alone.

This could be when they have a smaller loan compared to the property value or steady income. The lender decides the terms, and if missed payments happen, they might extend your guarantee.

How can I get removed as a guarantor?

The borrower can usually remove you by refinancing the mortgage or proving they’re more financially stable. The lender may also let you remove them if you have a valid reason, like a financial change or the guarantor passing away.

Depending on the situation, the lender might ask for a replacement guarantor, refinancing, or reject your request.

Can I use a guarantor for a second mortgage?

Yes, but it’s less common. Many lenders only offer guarantor mortgages to first-time buyers. You’ll need to find a lender that allows guarantors for second mortgages.

Will being a guarantor affect my own mortgage chances?

Yes, being a guarantor can affect your ability to get a mortgage because it’s a financial commitment. It usually won’t directly impact your credit score, but if the borrower defaults and you can’t cover it, it will.

Lenders consider these obligations when deciding how much you can borrow, so it might lower your borrowing power.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.