A Complete Guide To Getting a Mortgage with a Part-Time Job

If you work part-time, you might think only full-time jobs give the financial stability lenders want. But that’s not always true.

You need to know what lenders look at and how a mortgage broker can help you. Managing your money well and showing lenders you’re reliable is important, no matter how many hours you work.

This guide will walk you through getting a mortgage with a part-time job in the UK, giving you all the info you need.

Can You Get a Mortgage with a Part-Time Job?

Yes, you can. Securing a mortgage on a part-time income is possible.

It’s a misconception that the number of hours you work each week directly impacts your mortgage approval. What matters more is your ability to afford the mortgage.

Lenders will evaluate your total income, its consistency, and your capacity to manage the repayments.

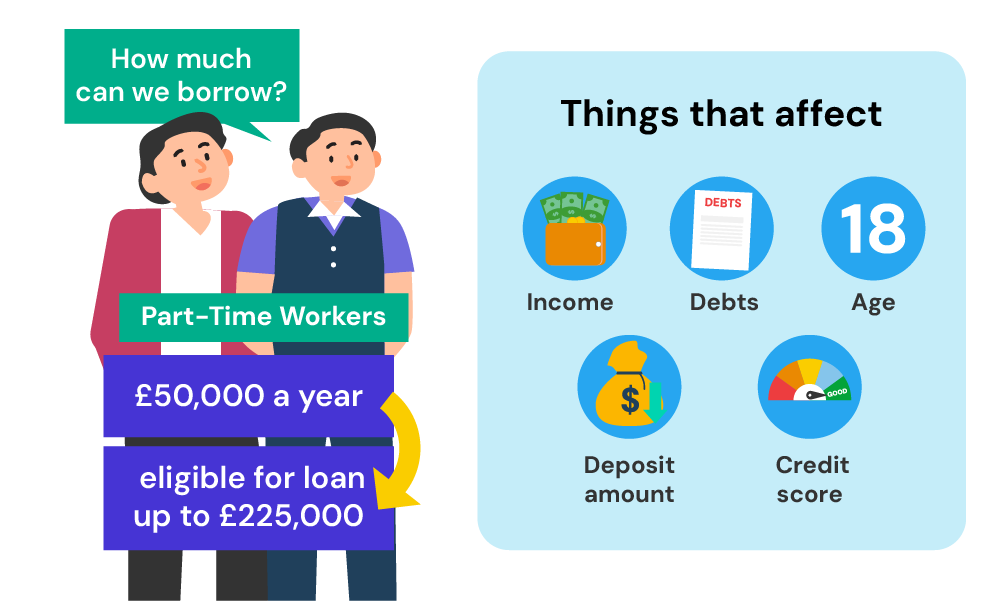

To get specific, here are factors lenders look for when assessing mortgage applications:

- Whether your earnings can comfortably cover mortgage repayments.

- The strength and reliability of your credit history.

- The possibility that, despite working fewer hours, your salary may compare well with or even exceed full-time earnings.

- Your deposit size.

- The long-term security and stability of your employment.

Every mortgage application is considered on its own merits. Your unique financial situation and job stability are critical. Showing you’re a responsible borrower, even with a part-time income, enhances your chances of approval.

Given the complexities involved, consulting with a knowledgeable mortgage broker is advisable. They can guide you towards lenders more inclined to accept your part-time income, ensuring you find a mortgage that suits your needs.

How is it Possible to Gee a Mortgage on a Part-Time Income?

Securing a mortgage with a part-time income is doable.

If you have extra earnings from things like rental properties, trust funds, pensions, or even bonuses, these can boost your application.

Lenders are open to considering all these income sources, as long as you’ve got the paperwork to back them up.

Some lenders are especially welcoming to part-time workers, with realistic income requirements that make mortgages more accessible. Banks like Aldermore, Teachers Building Society, and United Trust Bank are known for their supportive approach.

Applying for a joint mortgage with a partner or a family member who’s earning regularly, also improves your chances. Their income helps show lenders that you can afford the mortgage together.

Eligibility Criteria For Part-Time Workers

When evaluating part-time workers for a mortgage, lenders scrutinise various important factors:

- Deposit Size. A key element is the deposit size. Aiming for a 10-20% deposit not only lowers the lender’s risk but might also get you better mortgage terms. The rule is simple: the higher your deposit, the more favourable your loan conditions might be.

- Monthly Outgoings. Lenders assess your monthly expenses. Demonstrating that you keep your outgoings low enhances your appeal as a borrower. It’s crucial to show you can handle your finances wisely and afford the mortgage payments on a part-time salary.

- Financial Health. Your overall financial situation is under the lens, not just your earnings. Lenders prefer borrowers who exhibit strong financial health, meaning you’ve consistently managed your money effectively and can sustain mortgage repayments comfortably.

- Income Stability. Beyond the amount, the stability of your income matters. Regular, reliable earnings from part-time work, supplemented by other income sources, can strengthen your application.

- Credit History. A solid credit history signals to lenders that you’re dependable with debt repayments. They’re more likely to favour applicants who’ve maintained good credit over time.

- Age. Your age influences lenders’ decisions. They typically look for borrowers who can repay the mortgage within their working life or have a clear repayment plan for retirement.

- Employment History. A steady employment record, even in part-time roles, reassures lenders of your job security and earning consistency.

- Additional Income. Other reliable income sources, such as rental income, pensions, or investments, are taken into account. These can compensate for the lower income from part-time work.

- Debt-to-Income Ratio. Lenders calculate your debt-to-income ratio to assess if you can manage additional debt. A lower ratio indicates better financial health.

- Future Financial Plans. Some lenders might inquire about your future financial prospects, especially if you’re nearing retirement or planning significant changes.

How Much Can You Borrow?

Figuring out how much you can borrow for a mortgage largely depends on how lenders view your financial situation.

They look at your income, how steady it is, and any other money you have coming in. They also consider your outgoings, like other debts or expenses.

The idea is to see if you can comfortably afford the mortgage payments.

Lenders often use a rule of thumb, multiplying your annual income by a certain number—usually around 4 to 4.5 times. If you have a higher income and a good financial record, some might even offer more.

But, every lender is different. They have their ways of working things out and what they’re willing to offer can vary.

Things like having a larger deposit or a really good credit score can influence how much they’re willing to lend you.

To get a ballpark figure of what you might be able to borrow, a mortgage affordability calculator comes in handy. Pop in your income details, and it’ll give you a rough estimate.

It’s a useful tool for setting your sights on what you can afford, helping you to look for homes within your budget. This way, you start your house hunting knowing what’s within reach.

Rates and Deposit Requirements for Part-Time Workers

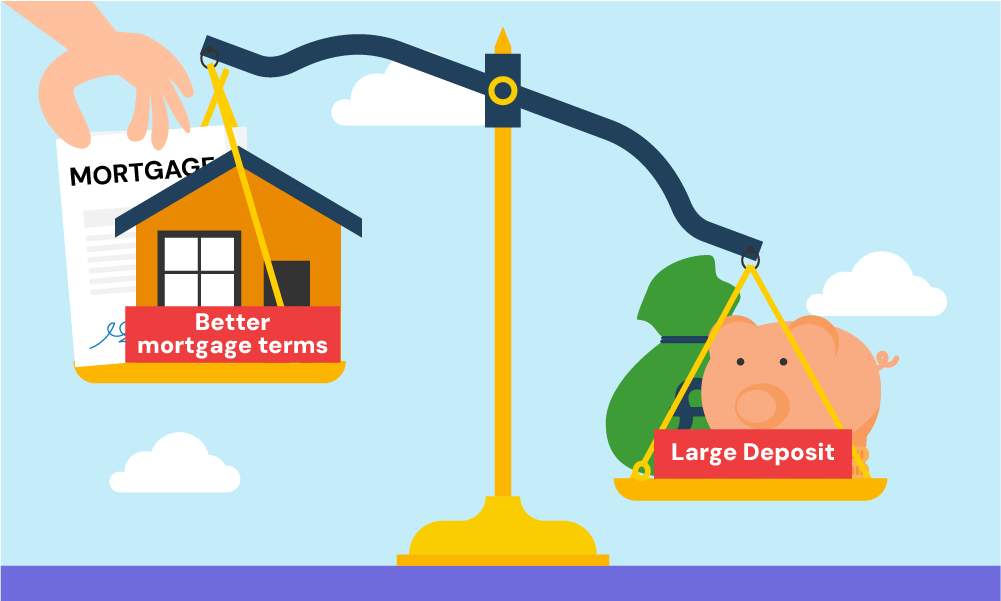

The interest rates and deposit requirements you’ll face as a part-time worker don’t hinge on your working hours or income size. Rather, they’re influenced by the size of your deposit and the lender’s assessment of your borrowing risk.

The crucial factor here is the loan-to-value (LTV) ratio—the proportion of your loan to the home’s value.

A lower LTV, meaning you’re borrowing less relative to the property’s price, diminishes the lender’s risk. Consequently, this could secure you more favourable interest rates.

The size of your deposit plays a pivotal role. A substantial deposit not only reduces the LTV but also enhances your profile as a borrower.

While your earnings impact the LTV you can achieve, remember, that a higher LTV typically signifies increased risk for the lender, potentially leading to higher interest rates.

However, amassing a significant deposit and showcasing solid financial health across other aspects of your application can tilt the scales in your favour. This strategy makes you less of a risk in the eyes of lenders, increasing your chances of obtaining lower interest rates.

Essentially, the more you invest upfront in your deposit, the better the terms you might unlock, regardless of your part-time status.

How To Get a Mortgage With a Part-Time Job?

Applying for a mortgage with a part-time job involves a bit more preparation, but with the right steps, it’s entirely feasible.

Get Your Paperwork Ready

Gathering the necessary documents is your first step. You’ll need:

- Recent Payslips: To demonstrate your current earnings.

- Bank Statements: These show your financial stability and outgoings.

- Proof of Additional Income: Any other sources of income need to be documented.

- Part-time Contract Details: This confirms your employment status.

- Proof of ID and Address: Typically a passport or driving licence and recent utility bills.

- Credit History Report: Some brokers or lenders might request this.

- Details of Debts or Loans: Including outstanding amounts and terms.

Having this information ready can significantly speed up your mortgage application process.

Check Your Credit Report

Make sure your credit report is in tip-top shape. You can check your credit score for free with major credit agencies like Experian, Equifax, or TransUnion. If you find any mistakes, get them fixed. A higher credit score improves your chances of getting a good mortgage deal.

Boost Your Deposit

A larger deposit can unlock better mortgage deals, ideally between 10-20% of the property’s value. Here are some strategies to help you save more effectively:

- Open a High-Interest Savings Account. Look for an account with competitive interest rates to maximise your savings growth.

- Supplement Your Income. Consider additional work opportunities. More income can accelerate your savings rate.

- Minimise Unnecessary Spending. Evaluate your spending habits and cut back on non-essential expenses. Redirect these funds into your savings.

- Utilise a Lifetime ISA. If you’re a first-time buyer, this account offers a 25% government bonus on savings up to a certain limit, boosting your deposit fund.

The Bottom Line

Securing a mortgage on a part-time income is certainly feasible with the right strategy. It’s crucial to present your finances well and choose a lender that matches your needs.

A mortgage broker skilled in part-time income cases can be invaluable. They understand which lenders are open to part-time incomes and the most effective ways to apply.

They’ll navigate challenges and unearth deals you might not find alone.

Their know-how ensures you’re matched with lenders who assess your overall ability to repay, not just your hours.

Finding a mortgage suitable for your part-time status is easier with a good broker.

Looking for the perfect mortgage without the hassle? Contact us. We’ll connect you with a reliable broker who specialises in part-time incomes, saving you time and stress, and moving you closer to securing your ideal mortgage.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I apply for a buy-to-let mortgage with a part-time income?

Yes, you can apply for a buy-to-let mortgage on a part-time income. Lenders will want to see that you have enough income to cover the mortgage payments, especially if the property isn’t rented out all the time.

For first-time landlords, some lenders might set a minimum income threshold to ensure you can afford the mortgage.

But, if you’ve been a landlord for a while, some lenders might not need to see your income, focusing instead on the rental income the property could generate.

What's the difference between the criteria for first-time landlords and experienced landlords?

First-time landlords often face stricter criteria because they don’t have a proven track record of managing rental properties. Lenders might ask for a higher income or a larger deposit.

Experienced landlords, on the other hand, might find lenders more flexible. Their experience and history of rental income can make it easier to secure a mortgage, sometimes with more favourable terms.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.